So, you’re thinking about switching your car insurance. Good. It’s one of the smartest financial check-ups you can do. But when is the right time to actually pull the trigger?

The best time to start looking is about a month before your current policy is up for renewal. This gives you plenty of breathing room to shop around, compare quotes, and get everything sorted out without any last-minute panic or, even worse, a gap in your coverage.

Knowing When to Switch Your Auto Insurance

Most people wait until they get that renewal notice in the mail, but there are plenty of other moments that should have you thinking about a switch. These are prime opportunities to see if you can get a better deal or find a company that actually fits your life now.

A big life change is almost always a signal to shop for new insurance. Your rates are based on your personal situation, and when that changes, your premium should too.

Think about it—have you recently:

- Moved? Even just moving to a new zip code can dramatically change your rates.

- Bought a new car? The make, model, and safety features of your vehicle are huge factors.

- Tied the knot? Getting married can often lead to some nice discounts from insurers.

- Boosted your credit score? Many carriers use your credit score to determine rates, so an improvement could mean real savings.

Policy Renewals and Bad Service

Of course, your policy renewal is the most obvious time to do a little comparison shopping. If that renewal letter comes with a surprise rate hike, that’s your cue. Don't just accept it as the new normal; see what other companies are offering.

And let's not forget about the human element. If you’ve had a bad experience with a claim or can never seem to get a hold of your agent, that’s a perfectly valid reason to walk. Your insurance is supposed to provide peace of mind, not add to your stress.

Proactive drivers almost always save more. It's no surprise that industry data reveals around 60% of people start shopping for a new policy about a month before their current one ends. This timing is the sweet spot for avoiding fees or an accidental lapse in coverage. You can dig into more vehicle insurance market trends on coherentmarketinsights.com.

To make it even clearer, here are some of the most common reasons people decide it's time for a change.

Key Triggers for Switching Your Auto Insurance

| Trigger Event | Why It's a Good Time to Switch | Potential Savings or Benefit |

|---|---|---|

| Policy Renewal | Your current rate is likely to change, and competitors may offer better deals. | Lock in a lower premium for the next 6-12 months. |

| Buying a New Car | The cost to insure your new vehicle can vary significantly between carriers. | Find an insurer that offers better rates for your specific make and model. |

| Moving to a New Address | Rates are heavily influenced by location, theft rates, and traffic data. | Your new location might qualify you for a much lower premium. |

| Getting Married | Insurers often view married drivers as lower risk. | Access multi-policy and marital status discounts. |

| Adding a Teen Driver | This is one of the biggest rate increases you'll ever see. | Some companies specialize in or offer better rates for families with young drivers. |

| Credit Score Improvement | A better credit history can unlock significantly lower insurance rates. | Capitalize on your improved financial standing for immediate savings. |

| Poor Customer Service | A bad claims experience or unresponsive agent is a huge red flag. | Find a company with a better reputation for customer support and claims handling. |

Looking at this list, you can see that waiting for renewal isn't always the best strategy. Life happens, and when it does, your insurance needs to keep up.

How to Compare Insurance Quotes The Right Way

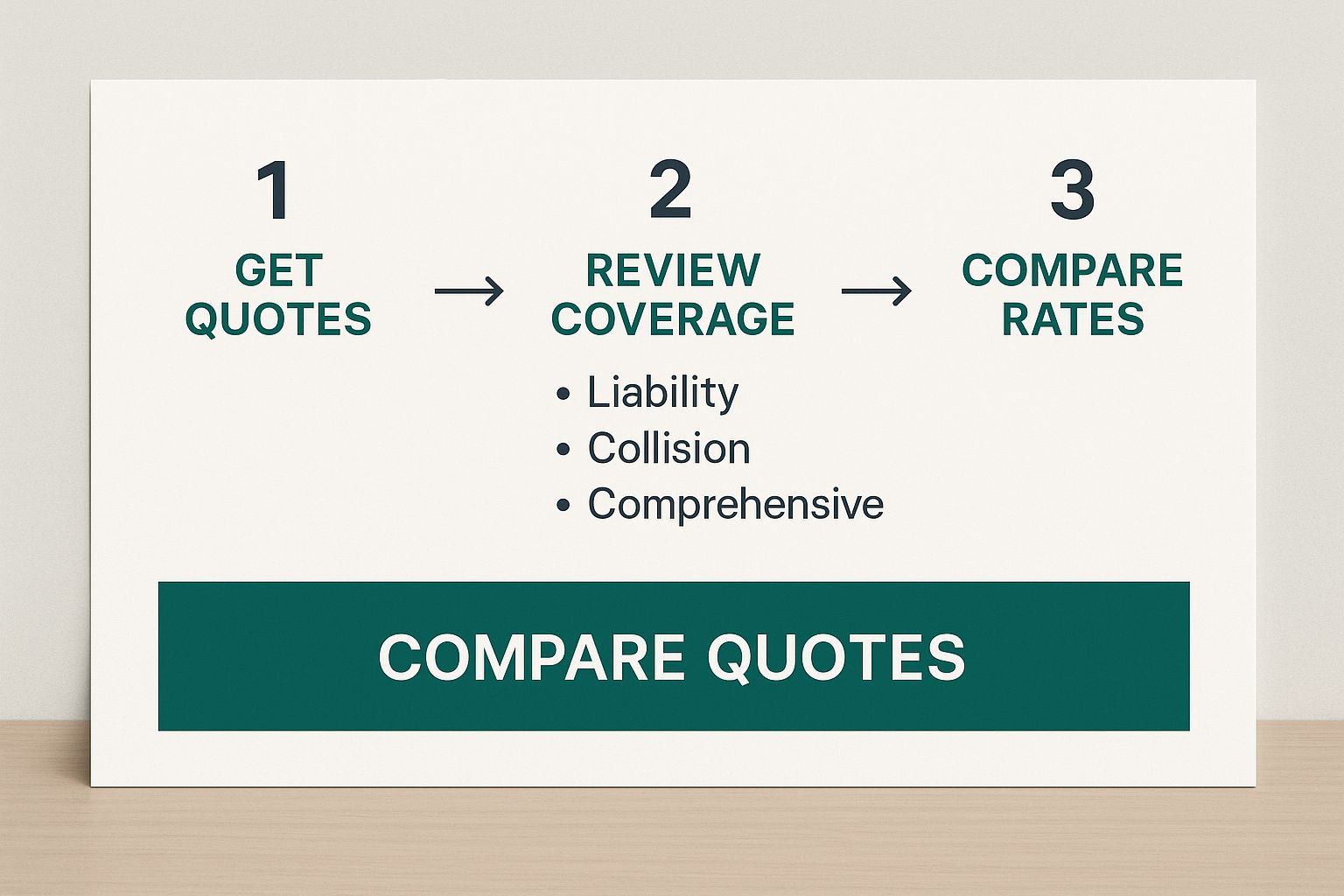

So you've decided it’s time to shop around. Getting a stack of quotes is the easy part. The real work—and where you can save a ton of money—is in understanding what they actually mean. The goal isn't just to find the lowest price, but to conduct a true apples-to-apples comparison of what you’re actually getting for your money.

It’s no secret that price is a huge driver for switching insurers. Consumer surveys consistently show that up to 85% of drivers point to cost as their main motivation for making a change. But here's the catch: a cheap policy with flimsy coverage can end up costing you thousands more down the road if you have an accident.

Look Past the Premium

The biggest mistake I see people make is getting tunnel vision on the monthly premium. A quote might look incredibly cheap on the surface, but it could be hiding sky-high deductibles or dangerously low liability limits. A smart comparison means lining up the core components of each policy to see what’s really going on.

The best way to do this is to grab your current policy's declaration page. Think of this document as your cheat sheet; it breaks down all your current coverage levels. Use it as your baseline to make sure any new quote meets—or, ideally, exceeds—what you have now.

Make sure you’re matching these key numbers across every quote you get:

- Liability Limits: This is your financial shield if you’re at fault in an accident. You need to compare the limits for bodily injury (both per person and per accident) and property damage.

- Deductibles: This is what you’ll pay out-of-pocket before the insurance company starts paying. A lower premium often comes with a higher deductible, so make sure it's an amount you could comfortably pay tomorrow if you had to.

- Collision and Comprehensive: If you want protection for your own car from crashes, theft, or weather damage, make sure these coverages are included and that the deductibles are the same.

Key Takeaway: A quote that saves you $20 a month isn't a bargain if it doubles your collision deductible from $500 to $1,000. That "savings" gets wiped out instantly with a single claim, leaving you to foot a much bigger bill.

Don't Forget the Extras and Discounts

Once you've aligned the core coverages, it's time to dig into the extras that can make a real difference. Does one policy offer rental car reimbursement or roadside assistance as a standard feature, while another tacks on an extra fee for it? These perks add genuine value.

You also need to be proactive about discounts. Never assume they’ve been automatically applied. Ask about everything you might qualify for, from good student discounts to savings for bundling your home and auto policies.

Remember, every vehicle is different. If you have a specialty car, for instance, you'll need to understand the nuances of things like classic car insurance requirements. This is exactly why a detailed review is so crucial. A thorough comparison is a cornerstone of learning https://wexfordis.com/2025/09/09/how-to-change-car-insurance-providers/ successfully. When you dig into the details, you can switch with confidence, knowing you’ve secured both a great price and the solid protection you need.

Avoiding the Coverage Gap When You Switch

When you're switching car insurance, timing is everything. Seriously, this is one of the most expensive mistakes you can make. A gap in your coverage, even for a single day, can cause a world of financial and legal headaches. This happens when your old policy gets canceled before your new one is officially locked in and active.

The golden rule is simple but non-negotiable: secure your new policy before you even think about canceling the old one. This doesn't mean just getting a quote. It means you have absolute confirmation—in writing—that your new coverage is active and in force.

How to Nail the Timing

To make sure you've got a seamless transition with no gaps, you need to follow a specific order. I've seen people mess this up, and it's never pretty.

Here's the right way to do it:

- First, get the official start date for your new insurance policy confirmed.

- Next, make that first premium payment. This is what actually activates the policy.

- Finally, make sure you have your new insurance ID cards in hand (or on your phone). This is your proof of insurance.

Only after you've checked all three of those boxes should you pick up the phone and cancel your old policy.

The Real Cost of a Coverage Lapse

Going without car insurance is a huge gamble. The immediate consequences are stiff penalties from the state, which can include massive fines and even the suspension of your driver's license and vehicle registration.

The biggest long-term damage, though, is how insurers see you afterward. They'll label you a high-risk driver, and that label can stick around for years. It pretty much guarantees you’ll be paying way more for your premiums down the road.

Think of switching as a careful handoff, not a risky leap of faith. The goal is a smooth, continuous line of protection.

This process really starts with doing your homework. Before you make any final moves, you need to gather and compare quotes to find the right fit. A detailed insurance gap analysis is also a smart move to make sure you aren't accidentally leaving yourself exposed during the switch.

Making a Clean Break: How to Cancel Your Old Policy

Alright, you’ve got your new insurance policy locked in and ready to go. Now, it’s time to officially part ways with your old provider. This is a step where a lot of people make a critical mistake, so listen up.

Whatever you do, do not just stop paying the bill. Letting your old policy lapse for non-payment is a huge red flag. It can get reported to collections, ding your credit score, and make it harder (and more expensive) to get insurance down the road. You need to end things the right way.

Put Your Cancellation in Writing

The best way to handle this is to be direct and create a paper trail. Give your old insurance company a call, but follow it up with a written request. An email works perfectly for this.

Your cancellation notice doesn't need to be complicated. Just be sure to include:

- Your full name and address

- Your policy number

- The exact date you want the policy to end (which should be the same day or after your new policy starts, to avoid any gaps in coverage)

A simple, clear statement that you've found new coverage and wish to terminate your policy is all you need. Taking this formal step is a non-negotiable part of learning how to switch insurance providers without creating a mess for yourself later.

A Quick Word of Advice: Some agents might suggest you can just let the policy "lapse" on its own. Don't do it. A formal cancellation protects you; a lapse for non-payment is a black mark on your insurance history.

Tie Up the Loose Ends

Once you’ve sent your request, you have a couple of final tasks to ensure a smooth transition. Don't skip these—they'll save you from potential headaches.

First, get written confirmation of the cancellation. Ask them to send an email or a letter showing the policy has been officially terminated. File this away. It’s your proof if any billing disputes pop up later.

Next, talk about your refund. If you paid your premium in full for a six-month or year-long term, you're almost certainly owed some money back. Ask them for the prorated refund amount and find out when you should expect to receive the check or direct deposit.

Wrapping Things Up: The Final Steps After You Switch

You've done the hard part, but don't close the book just yet. Once your new policy is officially active, a few quick housekeeping tasks will make sure your transition is completely seamless and keeps you on the right side of the law.

First thing's first: grab those new insurance ID cards. Go out to every vehicle you own and swap out the old cards for the new ones. It’s a simple, two-minute job that can save you a major headache if you get pulled over.

Don't Forget to Tell Your Lender

This next one is critical if you have a car loan or lease. You absolutely must notify your lender or leasing company that you've changed insurance providers. They have a financial stake in your vehicle—they're the lienholder—and your contract requires you to keep them in the loop.

Thankfully, this is usually pretty straightforward. A quick phone call or an email is often all it takes. Just be ready to provide them with a few key details:

- The name of your new insurance company

- Your new policy number

- The effective date (the day your new coverage started)

Your lender will almost certainly want to see the "declarations page" of your new policy as proof. The path of least resistance here? Just ask your new insurance agent to send proof of insurance directly to the lender. They do this all the time and know exactly what's needed.

Skipping this step can have serious consequences. If a lender thinks the car is uninsured, they can buy their own expensive policy (called force-placed insurance) and tack the cost onto your loan balance. A quick notification prevents all that drama.

For a complete rundown of the entire switching process from start to finish, be sure to check out our detailed guide on how to change insurance companies.

Common Questions About Switching Car Insurance

https://www.youtube.com/embed/6Lq44nJjl-w

Even when you know the steps, a few nagging questions can make you pump the brakes on switching car insurance. It’s completely normal to feel a bit hesitant. Let's tackle some of the most common worries so you can move forward with confidence.

Probably the biggest concern I hear is about credit scores. People worry that shopping for insurance will ding their credit. The good news? It won't. When insurers pull your credit information for a quote, it's a soft inquiry, which has no impact on your score. The only way your credit could ever be involved is if you left an unpaid final bill from your old insurer that ended up in collections.

What About Timing And Open Claims?

"Can I really switch in the middle of my policy?" Absolutely, yes. While many people wait until their renewal date because it feels like a natural breaking point, you are never locked in. Your policy is yours to cancel at any time.

If you've paid for your policy in full or are ahead on payments, your old insurer is required to send you a prorated refund for the unused portion of your premium. Just make sure your new policy is active before your old one ends to avoid any gaps.

Another thing that holds people back is having an open claim. What happens then? It's actually much simpler than you might think.

Your old insurance company is legally on the hook for handling any claims that happened while their policy was active. Moving to a new provider doesn't change that. You’ll just continue working with your original claims adjuster until everything is settled.

A smooth transition is a huge part of learning how to switch insurance providers without any headaches. Once you understand these details, you can make a change that helps your budget without creating extra stress or risk.

Navigating the insurance market can be complex, but you don't have to do it alone. The experts at Wexford Insurance Solutions are here to help you compare options and find the perfect policy for your needs. Get a personalized quote today!

What Is Replacement Cost Coverage for Your Home

What Is Replacement Cost Coverage for Your Home Hail Damage Roof Insurance Claim Tips | Get Your Claim Approved

Hail Damage Roof Insurance Claim Tips | Get Your Claim Approved