Think of your business like a ship on the open sea. You've got a sturdy vessel (your company), a capable crew (your team), and a clear destination (your goals). But what happens if you lose your captain—the one person with the vision, experience, and leadership to navigate the stormiest waters?

That's where key person insurance comes in. It's a life or disability insurance policy that your company takes out on its most indispensable people. The business pays the premiums, and if that key person were to pass away or become disabled, the company itself receives the payout.

It’s not a personal benefit for the employee; it's a strategic safety net for the business.

The Financial Parachute Your Business Can't Afford to Skip

Let's be honest, some people are just irreplaceable—or at least, incredibly difficult and expensive to replace. This could be a founder with the original vision, a star salesperson who brings in 80% of your revenue, or a lead developer with deep institutional knowledge.

Key person insurance is the financial parachute that deploys when one of these critical individuals is suddenly gone. The policy is owned by the company, the premiums are paid by the company, and the benefit is paid directly to the company. This structure is designed to give your business the resources to weather the storm and keep moving forward.

This is a specific type of coverage, but it fits within the broader world of protecting your company's assets. For more context on how this fits into a larger strategy, you can explore some general business insurance basics.

What Does This Insurance Actually Do?

When the worst happens, the last thing you want to worry about is money. The insurance payout provides an immediate, and typically tax-free, cash infusion that the business can use to stay afloat.

This capital is a lifeline that can be used for several critical purposes:

- Hiring and Training: Finding and onboarding a replacement of the same caliber is a costly and time-consuming process. The payout can cover recruitment fees, high-level salaries, and training expenses.

- Offsetting Lost Revenue: The policy helps compensate for the sales dips, project delays, or loss of client confidence that often follows the departure of a key leader.

- Reassuring Stakeholders: It shows investors, lenders, and major clients that you have a solid contingency plan, which helps maintain stability and trust in your business.

- Managing Debt: The funds can be used to pay off loans, buy back stock from the key person's estate, or handle other financial obligations that might otherwise cripple the company.

A business often depends on one or two individuals for the majority of its success. Key person insurance is the mechanism that protects the company's value from being tied too closely to the health and longevity of those individuals.

Key Person Insurance At a Glance

To simplify, let's break down who does what in a key person policy. This table outlines the main components for a quick overview.

| Component | Who It Is | What They Do |

|---|---|---|

| Policy Owner | The business or company | Purchases the policy, pays the premiums, and holds all ownership rights. |

| Insured Person | The "key" employee, founder, or executive | Their life or disability is the subject of the insurance policy. |

| Beneficiary | The business or company | Receives the tax-free death or disability benefit if a claim is made. |

| Insurer | The insurance company | Underwrites the policy and pays the benefit upon a valid claim. |

Ultimately, this coverage transforms a potential catastrophe into a manageable business challenge. It buys you the most valuable asset in a crisis: time. It gives you the breathing room and the resources you need to navigate a difficult transition, ensuring the company you’ve built can survive—and even thrive—long after losing a vital team member.

Identifying the Key People in Your Business

When you start thinking about who is truly indispensable to your company, you have to look past the org chart. Sure, the CEO or a founder is an obvious choice, but the person whose absence would cause the most chaos might be someone you least expect.

A key person is anyone whose specific skills, deep knowledge, or critical relationships are the bedrock of your company’s stability and financial success. It’s about pinpointing the real engines of the business, regardless of their official title. Losing them could mean derailing projects, losing major clients, or watching years of institutional memory walk out the door.

Moving Beyond the Obvious Roles

So, how do you find these people? Think about the roles that are so specialized that finding a replacement would be a massive undertaking, costing you precious time and a whole lot of money.

Here are a few examples of who might qualify for key person insurance in your business:

- The Top Sales Executive: This isn't just any salesperson. This is the one who holds the relationships with your three largest clients—the ones responsible for more than half of your annual revenue.

- The Lead Developer: You know the one. They’re the only engineer who truly understands the old, complex code that your main product is built on. Without them, good luck pushing out updates or fixing critical bugs.

- The Creative Visionary: This might be your lead designer or creative director whose unique style is your brand. They’re the reason customers recognize you in a crowded market.

- The Operations Genius: This is that manager who has your entire supply chain or production line running like a well-oiled machine. They’ve built efficiencies that nobody else even knows how to replicate.

A Practical Checklist for Your Internal Audit

Figuring this out requires a serious, honest look at where your business is vulnerable. You need to ask some tough questions. This whole process is a core part of building a solid defense, much like you would when creating a business continuity plan checklist for other threats.

Use these questions to kickstart the conversation with your leadership team:

- Revenue Impact: Whose absence would immediately cause a major dip in sales?

- Project Paralysis: Is there one person whose departure would bring a critical project to a dead stop?

- Specialized Knowledge: Who holds irreplaceable skills, trade secrets, or knowledge that isn't written down anywhere?

- Client and Investor Confidence: Who do your most important clients, partners, and investors see as the face of the company?

Answering these questions honestly shows you exactly where your biggest risks are. The conversation shifts from "who is important?" to "whose loss would we financially struggle to recover from?"

By identifying these people, you’re doing more than just making a list of valuable employees. You’re mapping out the potential fault lines in your business. Key person insurance is the strategic move you make to reinforce those weak spots, protecting the real assets that drive your success: your people.

How a Key Person Policy Actually Works

So, how does this all work in practice? It’s far more straightforward than you might imagine. A key person policy is essentially a financial contingency plan you set up before a crisis hits, ensuring your business has a lifeline when it needs one the most.

Think of it this way: you wouldn't wait for a fire to start before installing smoke detectors and fire extinguishers. This is the same logic. You're proactively putting a plan in place to handle the sudden loss of a critical team member.

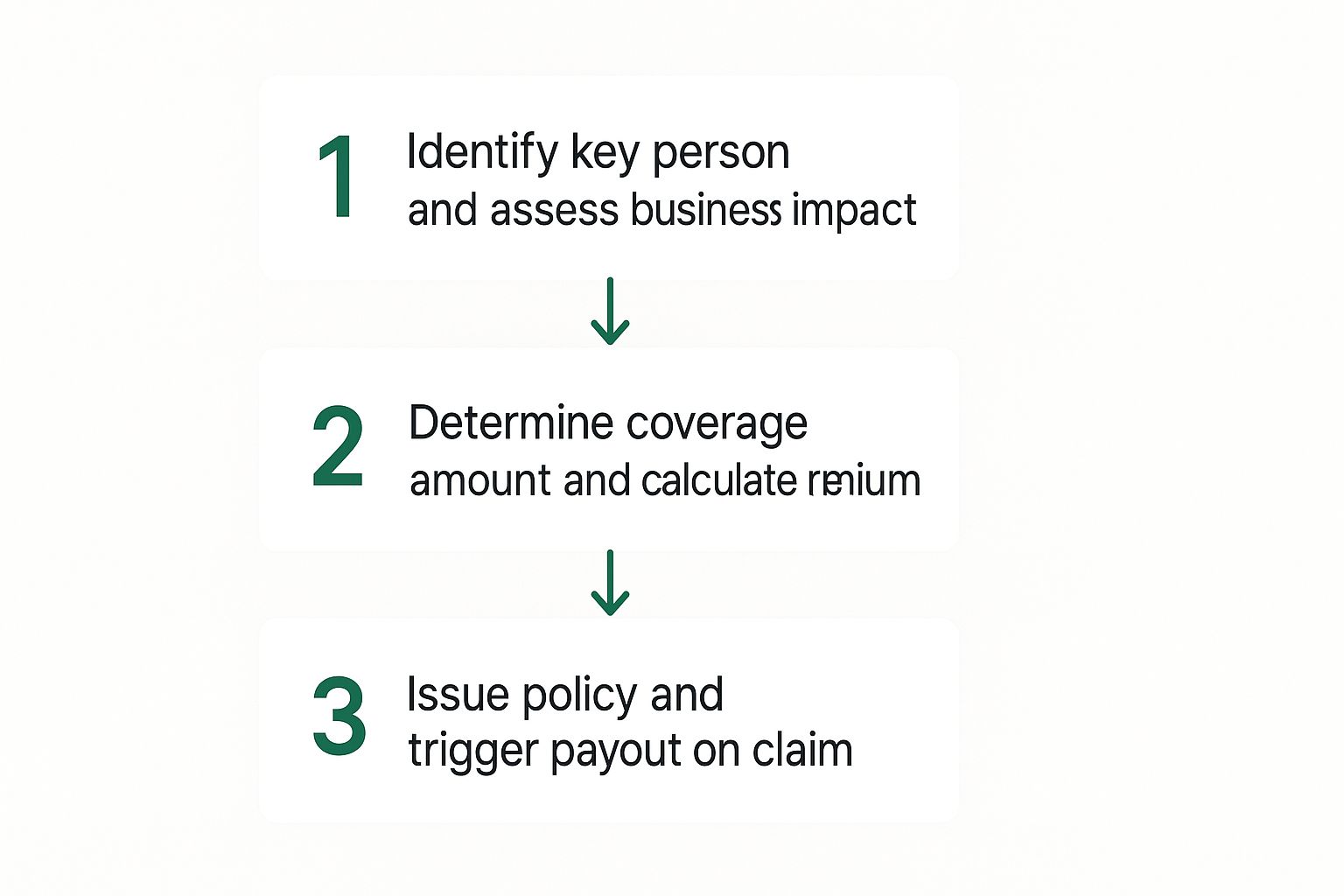

The entire journey, from identifying who to cover to receiving the funds, follows a clear path. This visual breaks it down nicely.

As you can see, it’s a logical flow: you spot the risk, figure out the financial impact of that risk, and then get the right policy to cover it.

The Step-by-Step Policy Lifecycle

The process kicks off long before you’d ever need to make a claim. First, you have to pinpoint the individual whose absence would leave a gaping hole in your operations or finances. Once you've identified that person, you need to calculate a coverage amount—a realistic figure that would offset the expected losses and cover the costs of finding and training a replacement.

With those decisions made, the business formally applies for a policy on that individual. That person will need to give their consent and usually go through a medical exam. From there, the company pays the premiums to keep the policy in force. It’s absolutely essential to get familiar with the policy's fine print at this stage. If you're unsure where to start, our guide on how to read an insurance policy is a great resource.

Choosing the Right Policy Type

One of the big decisions you'll make is what kind of life insurance to use. It generally boils down to two main options:

- Term Life Insurance: This covers a specific period, like 10, 20, or 30 years. It's the more affordable choice and makes a lot of sense if the key employee is critical for a set project timeline or until they reach retirement.

- Permanent Life Insurance: This type of policy lasts for the insured’s entire life and often builds up a cash value that the company can borrow against. While it costs more, it can function as a long-term asset on the company's books.

The right choice really hangs on your company’s unique situation and financial goals. A lean startup might lean toward a term policy for its lower cost, whereas a long-standing family business might see the lasting value in a permanent policy.

A Real-World Payout Scenario

Let's paint a picture. Imagine a fast-growing tech firm whose brilliant lead software architect, Sarah, suddenly passes away. She was the mastermind behind the company's core algorithm—the secret sauce. Her loss throws clients and investors into a panic.

Luckily, the company had a $2 million key person policy on Sarah. The payout, which is typically tax-free, was immediately put to work to:

- Hire a top-tier executive search firm to find someone of Sarah's caliber.

- Fund a competitive signing bonus and salary to attract the best talent.

- Reassure nervous investors that the company had a solid plan.

- Cover operating costs and project delays without draining cash reserves.

The insurance payout gave the company breathing room. It provided the cash and the time they needed to navigate the crisis, turning a potential company-ending disaster into a manageable challenge.

This kind of planning is critical. Studies show that the success of about 70% of companies is tied to just one or two key people, yet only around 22% of businesses have this protection in place.

How Much Key Person Insurance Do You Actually Need?

Figuring out the right coverage amount for a key person policy can feel a bit like guessing, but it’s actually a very deliberate process. The goal is to land on a number that truly represents the financial gap your business would face if that individual were suddenly gone.

This isn’t about pulling a number out of thin air. It’s about doing a clear-eyed financial assessment of what that person is worth to your bottom line. The right amount gives you the breathing room and capital to manage the transition without putting your entire operation at risk.

There are a few standard ways businesses and insurers tackle this calculation. Each one offers a different lens for viewing a key person's value.

Common Ways to Calculate Value

Getting familiar with these methods will make your conversation with an insurance advisor far more productive. They provide a solid framework for putting a number on something that can feel intangible.

-

Income Multiple: This is the most straightforward approach. You take the key employee's annual salary and multiply it by a factor, usually somewhere between 5 and 10. So, an executive earning $200,000 a year might be insured for $1 million to $2 million. Simple and effective.

-

Cost to Replace: This method gets a lot more granular. It adds up all the real-world costs of finding, hiring, and training a suitable replacement. Think about it: executive search firm fees, onboarding costs, lost productivity while the new person gets up to speed, and the premium salary you might have to offer to lure top talent away from a competitor.

-

Contribution to Earnings: This one is perfect for people whose work is directly tied to revenue, like a superstar salesperson or a founder who brings in all the big deals. You figure out the percentage of company profits that person is directly responsible for, then insure against the loss of that income for a set number of years, often three to five.

The best method really hinges on the person's role. A CEO's value is often captured well by a simple income multiple, but a top rainmaker's value is better measured by their direct contribution to your profits.

Comparing the Approaches

Each valuation method gives you a different angle on an employee's worth. Seeing how they stack up can make it much clearer which one fits your specific situation.

Below is a quick breakdown of these methods. Looking at them side-by-side helps clarify their strengths and when to use them.

Methods for Calculating Coverage Amount

| Valuation Method | How It Works | Best Suited For |

|---|---|---|

| Multiples of Income | Coverage is 5-10 times the person's annual salary. | General leadership and executive roles where direct profit contribution is hard to measure. |

| Cost to Replace | Sum of all expenses to find, hire, and train a successor. | Highly specialized technical or operational roles that require a unique skillset. |

| Contribution to Earnings | Based on the profits directly generated by the individual. | Sales-driven positions or founders who are the primary drivers of revenue. |

For a really precise look at your potential losses, it helps to map out the numbers. A detailed worksheet can be a great tool for this. You can find a useful template by checking out this business income worksheet to guide your own calculations.

In the end, arriving at the right coverage amount is a strategic decision, not just an accounting exercise. By using these established methods, you can turn a vague worry into a solid financial plan that protects your business with a number that makes real-world sense.

Financial Benefits and Tax Considerations

Key person insurance is, first and foremost, a safety net. But its value goes far beyond just covering a worst-case scenario. It's a strategic financial tool that can seriously strengthen your company's balance sheet and open up new opportunities.

While the death benefit is the main event, the policy offers other advantages for long-term planning and financial health. A common point of confusion for many business owners is how the IRS treats these policies, but the rules are actually quite favorable. Getting this right is a key part of smart financial planning for business owners.

Tax Treatment of Premiums and Payouts

Let's break down the two most important tax questions people ask about key person insurance. It's simpler than you might expect.

First off, the premiums you pay are generally not tax-deductible. The IRS doesn't see this as a regular operating expense. Instead, they view it as an investment in a capital asset—similar to how you'd treat buying a new piece of machinery for the business.

The real win comes when a claim is filed. The death benefit your business receives is typically 100% income tax-free. That’s a huge deal. If you have a $2 million policy, your company gets the full $2 million. No tax bill to worry about, just the full amount of cash available right when you need it most.

This tax-free payout is what makes key person insurance so powerful. It guarantees the funds meant to stabilize your company aren't chipped away by taxes, so every dollar can be put to work on recovery.

Using the Policy as a Financial Tool

A key person policy isn't just about waiting for a disaster. It can be a proactive part of your financial strategy, especially if you choose a permanent life policy that builds cash value. Over time, this cash value grows into a real, tangible asset on your company's books.

This asset can be put to work in a couple of smart ways:

-

Securing Business Loans: Lenders love to see this kind of planning. The policy's cash value can often be used as collateral, which might make it easier to get a loan or even help you lock in better interest rates.

-

A Source of Liquidity: Need cash for a sudden opportunity or an unexpected expense? The business can borrow against the policy's cash value, giving you quick access to capital without the red tape of a traditional bank loan.

This dual purpose turns what seems like a simple expense into a flexible financial asset. It protects you from the worst while also giving you options to grow, making it an essential piece of any solid business plan.

Why This Coverage Is More Important Than Ever

In a world where specialized knowledge and unique leadership drive success, your people are easily your most valuable asset. We’re used to insuring buildings and equipment, but protecting your human capital is just as vital. Losing one indispensable person can throw your entire operation into chaos, spook investors, and stop growth dead in its tracks.

This isn't just a hypothetical problem. More and more businesses are waking up to this reality, and the market reflects it. The global key person insurance market is expected to jump from USD 32.1 billion in 2025 to a staggering USD 45 billion by 2035. This isn't just a small trend; it shows a fundamental shift in how smart companies think about risk.

A Strategic Move for Business Resilience

Think of key person coverage as more than just a financial safety net. It's a proactive move that signals strength and stability. For savvy business owners, this policy does far more than just cut a check when things go wrong.

It sends a powerful message and delivers tangible benefits:

- Boosts Investor Confidence: Lenders and investors love to see it. It tells them you have a solid plan for managing worst-case scenarios and protecting their investment.

- Ensures Business Continuity: It gives you the immediate cash you need to find and train a replacement, manage cash flow, and keep the doors open during a tough transition.

- Strengthens Overall Strategy: This isn't just an insurance policy; it's a mark of sophisticated planning. It shows everyone you're serious about long-term survival.

To really understand its value, you have to see this policy as a core piece of your comprehensive small business risk management strategies, all designed to keep your company thriving for years to come.

Frequently Asked Questions

Even after you get the basic concept down, a lot of practical questions pop up when you're considering key person insurance. Let's tackle some of the most common ones business owners ask.

What Happens If the Key Employee Leaves the Company?

This is a great question and something that happens all the time. If your insured key person quits or is let go, the company still holds all the cards because it owns the policy. You’ve got a few choices.

- Cash It Out: You can simply surrender the policy. If it’s a permanent life policy with cash value, the insurance company will send you a check for its accumulated value.

- Let Them Take It: You could offer to sell or transfer the policy to the departing employee. This can sometimes be a nice parting gesture, especially if they want to continue the coverage for themselves.

- Assign It to Someone New: The company can often reassign the policy to a different key employee. This usually means the new person has to go through medical underwriting, as the premium will need to be adjusted for their age and health.

The right move really depends on your specific situation and the kind of policy you have.

Is This the Same As a Buy-Sell Agreement?

No, but they often work hand-in-hand. Think of them as two different tools for two different jobs.

Key person insurance is all about protecting the business operations. The payout is designed to give the company breathing room and working capital to survive the loss of a vital team member.

A buy-sell agreement, on the other hand, is about protecting the business ownership. It’s a legal contract that lays out exactly how a departing owner's shares will be bought out. Life insurance is often used to fund these agreements, but its purpose is to ensure a clean ownership transfer, not to cover day-to-day operational costs.

How Much Does Key Person Insurance Cost?

There’s no simple price tag. The cost of key person insurance can vary quite a bit because it's tailored to the specific person you're insuring.

A few key things drive the final premium:

- The Person's Profile: The employee's age, overall health, and lifestyle habits (like smoking) are the biggest factors.

- The Coverage Amount: It's a simple truth—a $5 million policy will have a higher premium than a $500,000 one.

- The Policy Type: Basic term life insurance is typically the most budget-friendly option, while permanent life policies that build cash value cost more upfront.

To get a real number, you need a quote that’s calculated based on your specific employee and the amount of coverage your business needs.

Figuring out the details is the most important part of putting the right protection in place for your business. The experts at Wexford Insurance Solutions can give you a clear, no-obligation quote and help you build a policy that truly protects your most valuable assets. Secure your business continuity plan today.

Does Homeowners Insurance Cover Theft

Does Homeowners Insurance Cover Theft What Is Aggregate Insurance Coverage and How It Works

What Is Aggregate Insurance Coverage and How It Works