The insurance renewal cycle usually kicks off 60-90 days before your current policy expires. Think of this as your annual check-up for your financial protection—a chance to make sure your coverage still fits your life and that you're getting the best possible value. It's so much more than just another bill to pay.

Your Pre-Renewal Game Plan

Simply waiting for the renewal notice to land in your inbox is a huge missed opportunity. If you get ahead of the process, you're the one in the driver's seat, which helps avoid last-minute surprises or discovering you're underinsured when it's too late. The secret is starting early—at least one to three months before that expiration date looms.

Giving yourself this head start means you can gather everything you need without the pressure of a deadline. It's also a good time to brush up on practical strategies for managing risk, which can give you a clearer perspective on what you truly need from your insurance.

Gather Your Essential Documents

First things first, let's get your paperwork in order. Having everything ready before you talk to your agent makes the conversation incredibly efficient and simplifies the process of comparing quotes if you decide to shop around.

Here’s a quick checklist of what to pull together:

- Current Policy Declarations Page: This is your cheat sheet. It lays out all your current coverages, limits, deductibles, and what you’re paying.

- Recent Billing Statements: These confirm your payment history and will show any changes made mid-year.

- Claims History or Loss Run Report: Insurers will be looking closely at any claims you've filed, as this directly impacts your renewal premium.

- Inventory of Valuables: If you have homeowners or renters insurance, make sure your list of high-value items (think jewelry, electronics, or collectibles) is up to date.

Expert Tip: Walking into the renewal conversation with all your documents ready is a power move. It instantly shifts the dynamic, putting you in a proactive position to lead the discussion based on your actual needs and data.

Assess Life Changes from the Past Year

Insurance isn't a "set it and forget it" product. Your life changes, and your coverage needs to change right along with it. A policy that was perfect last year could leave you exposed now. Take a few minutes to think about what's happened in the last 12 months.

Did any of these life events occur?

- Home Renovations: That new kitchen, finished basement, or backyard deck adds value to your home, and your coverage needs to reflect that.

- New Drivers or Vehicles: Adding a teenager to your auto policy or buying a different car will significantly alter your premium and risk.

- Starting a Home-Based Business: This is a big one. Your standard homeowner's policy offers almost no coverage for business-related liability or equipment.

Forgetting to mention these changes to your insurer could lead to a claim being denied down the road. Once you've identified what's new, the next step is to see how it impacts your current policy. This often reveals surprising gaps in your protection.

A great way to do this is with a proper insurance gap analysis to pinpoint exactly where you might be vulnerable. Getting this homework done sets you up for a much more productive and meaningful conversation with your insurance advisor.

Decoding Your Renewal Notice

When that renewal notice lands in your mailbox or inbox, it’s tempting to just check the new price, sigh, and file it away. I've seen it a hundred times. But treating this document like any other bill is a mistake that could leave you seriously underprotected.

The real story isn't just the final number; it's buried in the details of your policy summary. Taking a few minutes to really understand what’s changing is a crucial part of the insurance policy renewal process. It’s not just about what you pay, but what you get for your money.

Look Beyond the Premium Amount

Your eyes will naturally jump right to the total cost. That's normal. But the most important information is in the "why" behind that number. Insurance companies adjust their rates for all sorts of reasons, and many of them have nothing to do with you personally.

For instance, maybe your area was hit with a bad hailstorm season last year. That means local auto and home repair costs probably skyrocketed for insurers. When they have to pay out more in claims, they often raise premiums for everyone in that region—even if your own car or home was perfectly fine.

Pinpoint Key Policy Changes

Your renewal packet will always include a declarations page. Think of it as the "cheat sheet" for your entire policy. The best thing you can do is pull out last year’s version and compare the two, side-by-side.

I always tell my clients to focus on three specific areas:

- Deductibles: Did your deductible go up? Sometimes, an insurer will bump a $1,000 deductible to $2,500 to stop your premium from jumping too much. It looks good on paper, but it means you're on the hook for a lot more out-of-pocket if you need to file a claim.

- Coverage Limits: Check the main coverage limits, like for your home's structure (often called Coverage A) or your liability protection. If you’ve done any renovations or your net worth has increased, your old limits might not be enough anymore.

- New Endorsements or Exclusions: This is where things get tricky. Insurers can add new endorsements that change your coverage, sometimes in subtle ways. You might find a brand-new exclusion for a certain type of water damage or a lower payout limit for your expensive electronics.

Real-World Scenario: A client in Florida got their renewal notice and was shocked by a 20% premium hike. When we dug into the fine print, we found the real issue: their hurricane deductible had been changed from a flat dollar amount to a 5% named storm deductible. For their home's value, this was a massive shift in their financial risk.

If the policy language feels like a foreign language, don’t worry. Our guide on how to read an insurance policy can help you cut through the jargon.

This level of detail is more important than ever. The entire insurance industry is constantly shifting based on global trends. A recent report, for example, noted that the global insurance market grew by 8.6% in 2024. Those big-picture changes eventually trickle down and affect the renewal offer you receive. You can actually read the full report about these global insurance trends to get a better sense of the economic forces at play.

When you take the time to decode your renewal, you shift from being a passive bill-payer to an informed consumer—one who can ask the right questions and make sure their coverage is actually doing its job.

How to Get a Better Deal on Your Policy

Alright, you've got your renewal offer in hand. Now comes the part where you can actually make a difference. Don't just glance at the premium and accept it as-is. This is your chance to move from simply reviewing paperwork to actively negotiating the best possible terms for your insurance policy renewal process. The secret? It's all about creating leverage by knowing what else is out there.

Your first move, without question, should be to shop around. I tell every client this. Even if you've been with your insurer for a decade and love them, you need to get quotes from at least two or three competitors. It's the only real way to know if the offer you're holding is fair or inflated. Honestly, this one step can often save you hundreds of dollars right off the bat.

Start the Conversation with Your Agent

Once you have a couple of competing quotes, it's time to call your current agent. Remember, this isn't a confrontation. It's a business conversation, and now you have data on your side. You’re simply an informed consumer looking for the best value.

Go into that conversation prepared with a few specific questions. This shows you've done your homework. Try framing it like this:

- For Discounts: "I was hoping we could do a full review of my policy. I just want to make sure I’m getting every discount I qualify for. For instance, I installed a new home security system last month."

- For Deductibles: "Out of curiosity, how much would my premium change if I raised my car's collision deductible from $500 to $1,000?"

- For Bundling: "My home is insured with you, but my auto policy is with another company. Could you run the numbers to see what I'd save by bundling them together?"

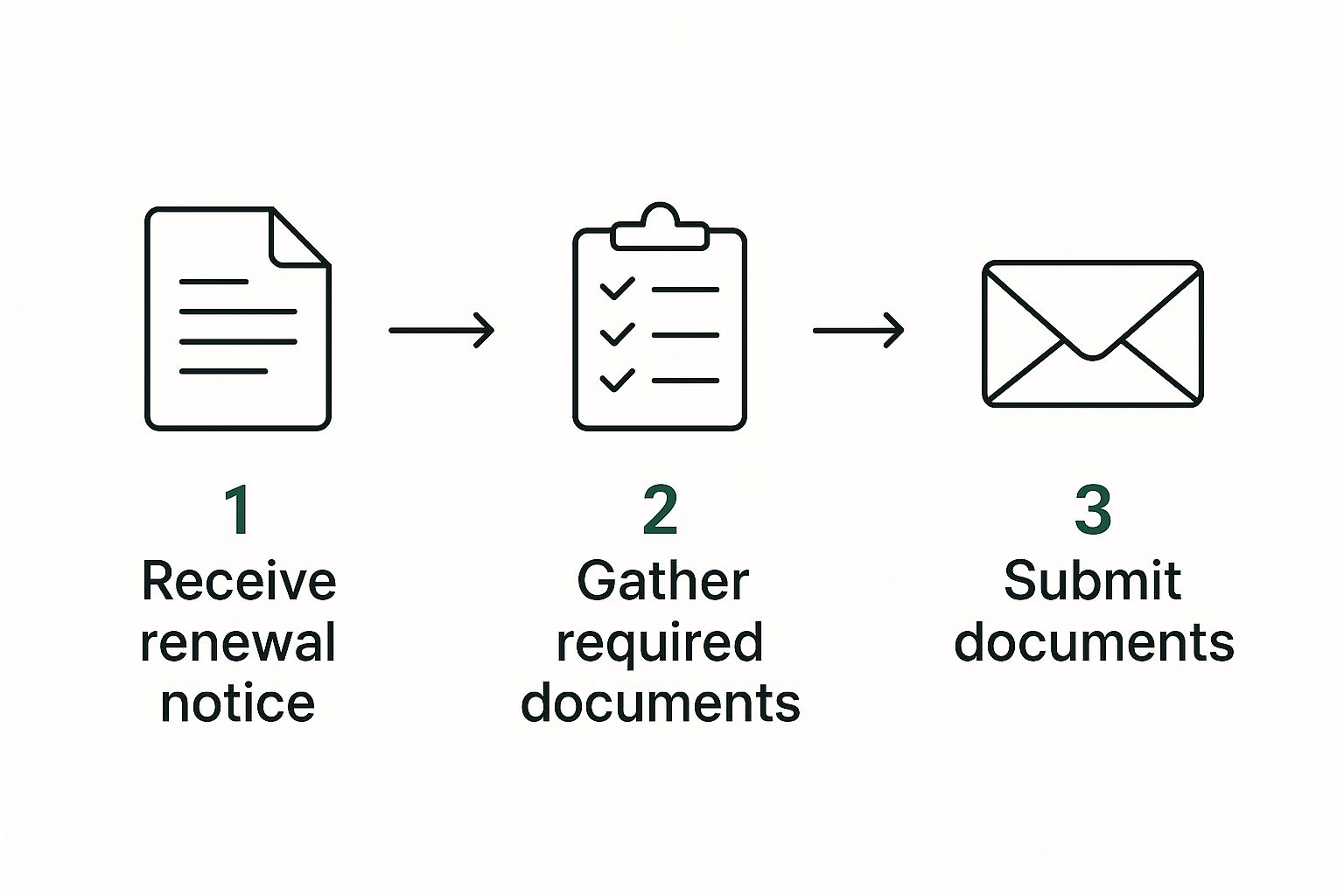

This whole process—from receiving the notice to finalizing your policy—involves several key stages.

As you can see, your best window to negotiate is right after you get that initial offer but before you're locked in.

Understanding the Factors That Drive Your Premium

Knowing what makes your premium go up or down is half the battle. Certain things are within your control, while others are market-driven.

Here’s a quick breakdown of the key elements that underwriters look at when pricing your renewal.

Key Factors Influencing Your Renewal Premium

| Influencing Factor | Description | Potential Impact on Premium |

|---|---|---|

| Claims History | Your record of past claims. A clean history indicates lower risk. | Fewer claims can lead to a lower premium or a "claims-free" discount. |

| Credit Score | In many states, insurers use a credit-based insurance score to predict risk. | A higher score generally results in a lower premium. |

| Coverage Changes | Any adjustments you make to your policy limits or deductibles. | Increasing your deductible usually lowers your premium. |

| Location & Risk | Factors specific to your area, like weather events, crime rates, or repair costs. | Higher local risks can drive premiums up for everyone in that area. |

| Market Conditions | Broader insurance market trends, including inflation and reinsurance costs. | A "hard" market can cause rates to rise, even with no changes on your end. |

Understanding these drivers helps you focus your negotiation on the areas you can actually influence, like your deductibles and applicable discounts.

Using Data to Your Advantage

Solid data is your best friend in any negotiation. A clean driving record or a long, claim-free history makes you a very desirable customer. For a business policy, this is where knowing what is a loss-run-report becomes absolutely critical. That report is the detailed history insurers use to price your risk, and having a good one gives you serious negotiating power.

Market trends can also work in your favor. Increased competition among insurers is creating a more favorable environment for buyers. Some projections even show that reinsurance capital—the insurance for insurance companies—could grow by 6% in 2025. This gives your insurer more flexibility to offer better rates, especially if you have a solid history.

My Pro Tip: Never, ever assume you're getting all the discounts you deserve. Many aren't applied automatically. The single most effective thing you can do is politely ask your agent, "Are there any other ways we can lower this premium?" You'd be surprised how often they find something.

By doing your homework and asking smart questions, you turn a routine renewal into a real opportunity to save money. If you want to explore even more strategies, there are some great expert tips on how to lower insurance premiums out there. Taking this proactive approach is how you ensure you're getting the best coverage at the best price.

Navigating Different Renewal Scenarios

Ideally, your insurance renewal is a non-event. You get the paperwork, the terms look right, you pay the premium, and your coverage rolls over for another year. Simple. But let's be honest, it doesn't always go that smoothly.

Sometimes the offer isn't what you expected, or worse, there's no offer at all. Understanding how to handle these bumps in the road is what separates a stressful scramble from a managed transition.

When Your Insurer Says No

Getting a non-renewal notice in the mail can feel like a punch to the gut. It’s unsettling, but the first thing to remember is this is not a cancellation. A non-renewal just means the insurance company has decided not to offer you a new policy when your current one expires.

Why does this happen? Usually, it's a business decision on their end. Maybe they're reducing their exposure in certain areas. For example, a homeowner living on the coast might get non-renewed after new flood maps suddenly place their property in a high-risk zone. The insurer isn't saying you're a bad client; they're saying your property no longer fits their risk appetite.

By law, they have to give you a heads-up—typically 30 to 60 days' notice. This gives you a window to find a new policy without a gap in coverage.

If you get a non-renewal notice, here’s what you do:

- Call your agent immediately. Find out the specific reason this happened.

- Ask for your loss run report. This is your claims history, and you'll need it when you shop for new quotes.

- Start getting quotes right away. Don't wait. The clock is ticking, and you want to avoid being uninsured, even for a day.

Making the Switch to a New Provider

Whether you're forced to switch by a non-renewal or you’ve just found a better deal somewhere else, changing carriers requires careful planning. A lapse in coverage is a big deal, and the goal is to make the transition absolutely seamless.

I can't tell you how many times I've seen people make this mistake: they cancel their old policy before the new one is officially locked in. Always, always have the new policy's effective date confirmed in writing before you tell your old insurer you're leaving. It's a simple step that prevents a world of hurt.

Coordinating a smooth handover is more critical than ever given today's market. We're seeing some price softness in most parts of the world—one recent report from Marsh noted a 4% dip in global insurance rates.

But that trend isn't hitting everywhere. In the U.S., rates stayed flat overall, and casualty insurance prices are still climbing. This is exactly why shopping around is so important; you never know what the market is doing until you look.

Switching carriers might seem daunting, but it’s manageable if you follow a clear process. Our guide on how to change insurance companies breaks it down with a simple checklist to make sure you get it right and keep your protection continuous.

Finalizing Your Policy the Right Way

You’ve done the hard work of researching quotes and comparing your options. Now it’s time to cross the finish line and make it official. This final stage of the insurance policy renewal process is all about locking in your coverage and getting everything squared away for the year ahead.

First things first, you need to formally accept the offer. Whether you're sticking with your current carrier or making a switch, you’ll have to sign the renewal offer or a new application. Thankfully, most insurers now use e-signatures, so this part is usually quick and painless.

Next up is making that initial payment. This is the action that truly activates your policy. It’s absolutely crucial to confirm that your new policy's effective date lines up perfectly with your old policy's expiration. You do not want to find yourself with a dangerous, even if brief, gap in your protection.

Post-Renewal Organization

Once your policy is officially in force, don't just shove the documents in a drawer and forget about them. Taking a few minutes to get organized now can save you a world of frustration later. I like to think of this as future-proofing my peace of mind.

Here’s what I always recommend clients do immediately:

- Create a Digital Folder: Get all your policy documents—the declarations page, any endorsements, and your new ID cards—scanned or downloaded. Pop them into a secure cloud folder (like Google Drive or Dropbox) so you can pull them up on your phone anytime, anywhere.

- Verify Your Contact Information: Log into your insurer’s online portal and give your contact details a quick once-over. Is your email, phone number, and mailing address all up to date? This ensures you won't miss any critical alerts or billing notices.

- Set a Calendar Reminder: Seriously, do this right now. Open your calendar and set a reminder for 90 days before your new policy is set to expire. This one simple action automates the start of your renewal process for next year.

After you've accepted the renewal, your insurance company will send over the official policy documents and your proof of insurance. If you're in a situation where you need immediate proof of coverage—say, for a car loan or vehicle registration—and are still waiting on the final paperwork, you can ask for temporary documentation. You can learn more about what is an insurance binder and how it fills this exact need.

Confirming Everything Is in Place

Before you can truly call it a day, do one last sweep to tie up any loose ends. Double-check that your new auto-pay is scheduled correctly and confirm you’ve received your new auto ID cards in the mail or have them saved to your phone.

If you’re a homeowner and your mortgage company handles your insurance payments through an escrow account, it’s a smart move to send them a copy of your new declarations page.

These small administrative tasks might seem tedious, but they form the foundation of a well-managed policy. By getting them handled proactively, you’re ensuring your coverage will be there to protect you exactly as intended when you need it most.

Answering Your Top Questions About Insurance Renewals

Even when you've done this a dozen times, the insurance renewal process can throw a few curveballs your way. It's completely normal to have questions, especially when you see a price jump or start digging into the policy details. Let's walk through some of the most common questions I get from clients.

Getting clear, straightforward answers is the best way to feel confident about the choices you're making for your coverage.

Why Did My Premium Go Up? I Didn't Even Have a Claim.

This is probably the most frustrating part of insurance renewals. You did everything right—no claims, no accidents—and yet your premium still increased. What gives? More often than not, it has very little to do with you personally.

The real culprits are usually broader economic trends. For instance, inflation drives up the cost of everything. The price of lumber for home repairs and the cost of sophisticated sensors in a new car bumper have all skyrocketed. When it costs an insurer more to pay out claims for everyone, they have to adjust their rates across the board.

On top of that, regional risk plays a huge role. If your area has recently been hit with more severe weather—like hailstorms or flooding—or has seen a spike in auto thefts, the overall risk for that entire zone goes up. Unfortunately, that means higher premiums for everyone living there, regardless of their individual claim history.

What's the Difference Between Non-Renewal and Cancellation?

These two terms sound alike, but they mean very different things in the insurance world. It's really important to know which is which.

-

Non-Renewal: This happens at the end of your policy term. It’s simply the insurance company deciding not to offer you a new contract. Maybe they're no longer insuring certain types of homes or have changed their business strategy. They are legally required to give you advance notice, usually 30 to 60 days, which gives you time to find a new provider.

-

Cancellation: This is when your policy is terminated in the middle of its term. It's almost always for a specific reason, like failing to pay your premiums, committing fraud on an application, or a major change in your risk profile (like getting a DUI). A cancellation is a much bigger red flag on your insurance record than a non-renewal.

The key difference is the timing. A non-renewal is a conscious parting of ways at the end of a contract. A cancellation is a sudden termination for cause.

Can I Switch Insurance Companies Before My Renewal Date?

Yes, you absolutely can! You're never locked into a policy for the full term. If you find a better rate or coverage that fits your life better, you can make a switch at any time.

Just follow this one golden rule: Make sure your new policy is officially active before you cancel your old one. A gap in coverage, even for a single day, can lead to serious legal and financial headaches. Once you have confirmation that the new policy is in effect, go ahead and cancel the old one. You should even get a prorated refund for any unused premium you've already paid.

How Far in Advance Should I Start Shopping for New Insurance?

I always tell my clients to mark their calendars for 45 to 60 days before their current policy expires. This is the strategic sweet spot.

Starting this early gives you a huge advantage. You’ll have plenty of time to get the renewal offer from your current insurer, which serves as a great baseline. From there, you can gather several competing quotes without feeling rushed, really dig into the details, and handle all the paperwork for a new policy if you decide to switch. It puts you in the driver's seat.

Navigating the insurance renewal process can feel like a lot, but you don't have to do it alone. The experts at Wexford Insurance Solutions are here to help you review your coverage, compare options, and secure the best protection for your needs. Contact us today for a personalized consultation.

8 Crucial Risk Management Best Practices for 2025

8 Crucial Risk Management Best Practices for 2025 Decoding Commercial Vehicle Insurance Requirements

Decoding Commercial Vehicle Insurance Requirements