So, what's this actually going to cost? Let's cut right to the chase.

When you're budgeting for engagement ring insurance, a really solid rule of thumb is to expect an annual premium of 1% to 2% of the ring's total appraised value. It's a surprisingly straightforward formula.

What does that look like in real dollars? A beautiful $5,000 ring would likely cost you about $50 to $100 a year to protect. If you have a $15,000 stunner, you’re looking at something in the $150 to $300 range annually. It's a small price for some serious peace of mind.

Breaking Down Your Potential Insurance Cost

The 1% to 2% guideline is the perfect starting point, but keep in mind that your final quote will be influenced by a few other factors, which we’ll get into a bit later. Think of your premium as a small annual investment to safeguard one of your most precious assets—both emotionally and financially.

The single most important document in this whole process is the official appraisal. This is the number an insurer uses to determine exactly how much your ring is worth and, therefore, how much coverage you need. A higher value means a higher premium, but it also means you’re fully protected if something happens.

Estimated Annual Engagement Ring Insurance Cost

To give you a clearer picture, I've put together a simple table. It shows the typical annual cost based on that 1% to 2% industry standard. This should help you visualize what you might budget for this essential protection.

| Ring Appraised Value | Estimated Annual Premium (1%) | Estimated Annual Premium (2%) |

|---|---|---|

| $2,500 | $25 | $50 |

| $5,000 | $50 | $100 |

| $10,000 | $100 | $200 |

| $15,000 | $150 | $300 |

| $20,000 | $200 | $400 |

As you can see, the cost is pretty manageable when you consider what you're protecting. It’s an easy-to-understand trade-off for knowing your investment is safe.

This kind of protection is typically handled in one of two ways: either as an add-on to your existing homeowner's or renter's policy (often called a "rider" or "floater") or as a completely separate, standalone policy from a specialized jewelry insurer.

If your ring is just one of several high-value items you own, you might want to explore broader coverage options. You can learn more about how valuable personal property insurance works to see if it’s a better fit for your needs.

What Goes Into Your Insurance Premium?

While the 1% to 2% rule is a fantastic ballpark estimate for your engagement ring insurance cost, it’s just the beginning of the conversation. Think of it like a car insurance quote. The price starts with the car's sticker price, but your driving record and where you park it at night will definitely change the final number. Insurers look at a whole host of factors to tailor a premium specifically for you and your ring.

Unsurprisingly, the biggest piece of the puzzle is the ring's appraised value. A more expensive ring represents a bigger financial risk for the insurance company to cover, and that will always mean a higher premium. This is exactly why getting a professional, certified appraisal is the essential first step before you can even think about getting coverage.

But the appraisal is just one part of the story. Let's dig into the other details that will shape your final quote.

Where You Live Matters

Your home address plays a much bigger role than you might think. Insurers are experts at using geographical data, and they know the theft and crime rates for every zip code. If you happen to live in an area with a high rate of property crime, the insurer sees a greater risk of a claim, and your premium will reflect that.

On the flip side, living in a quiet neighborhood with very low crime rates can absolutely work in your favor and help bring that annual cost down. It’s a simple, data-driven calculation that every single insurance provider uses.

Key Takeaway: Your premium isn't just about you. It’s also about the environment where your ring lives. Insurers are looking at the big picture of risk, and that includes your local crime statistics.

Your Past Claims History

Just like with your car or home insurance, your personal track record is important. Have you filed several claims in the past? It doesn't even have to be for jewelry. A history of frequent claims can flag you as a higher-risk client in the eyes of an underwriter.

From their perspective, a person who has filed claims before is statistically more likely to file one again. To balance that risk, they might add a "loading fee" to your premium, which could increase your rate by 10% or more, depending on the company and the specifics of your claims history.

How You Can Earn Discounts

The good news is you're not powerless in this process. You can actually take concrete steps to lower your premium, and insurers are happy to reward you for it. Why? Because you’re making their job easier by reducing the chance of a theft.

You could be eligible for some nice discounts if you have:

- A Home Security System: A monitored alarm is a massive deterrent to burglars.

- A Secure Home Safe: Keeping the ring in a heavy, bolted-down safe when it's not on your finger is a huge plus.

- Bank Vault Storage: For ultimate peace of mind and the biggest potential discount, storing your ring in a bank's safe deposit box is the gold standard.

Taking these steps shows the insurance company you’re a responsible owner, which can directly lower your annual engagement ring insurance cost. Many of these same proactive ideas can help with your other policies, too. In fact, you can learn more about finding these kinds of savings by reading up on how to lower your home insurance premiums. When you understand what the insurers are looking for, you can get ahead of the game and find ways to save.

So, What Does Your Policy Actually Cover?

When an insurance company says your ring is "covered," what does that really mean? The devil is always in the details, so let's break down the jargon to see what kind of protection you're actually getting.

The biggest difference you'll find is between broad all-risk plans and the more restrictive named perils policies. It's a crucial distinction.

An all-risk policy is pretty much what it sounds like. It covers you for almost everything—theft, loss, accidental damage, and even that frustrating "mysterious disappearance." So if you look down and your center stone is just… gone, you're likely protected.

On the other hand, a named perils policy only covers the specific events listed in your contract, like fire or theft. If it's not on the list, it's not covered. That means if your ring slips off your finger and falls down the drain, you could be out of luck and paying for a replacement yourself.

Here’s a quick rundown of the terms that matter most:

- All-Risk Policies: These cover your ring against almost any kind of harm, unless it's a specifically listed exclusion. Think of it as "innocent until proven guilty."

- Named Perils Policies: These only cover the events explicitly named in your policy. If a peril isn't on the list, you have no coverage for it.

- Replacement Value: This is the good stuff. It pays the full amount needed to buy a brand-new, identical ring today.

- Actual Cash Value: This pays you what your ring is worth at the time of the claim, which means its original cost minus depreciation.

How This Plays Out in Real Life

Let's imagine you accidentally chip your diamond on a granite countertop while cooking. With a solid all-risk plan, you can take it straight to your jeweler for repair or replacement without a second thought. The policy is designed for exactly these kinds of real-life mishaps.

Now, picture that same scenario with a basic named perils policy. Since "chipping a stone while cooking" probably isn't a listed peril, your claim would likely be denied. You'd be on the hook for the entire repair bill.

Theft is another area where the fine print makes all the difference. Some policies cover straightforward theft but exclude what they call "mysterious disappearance"—when the ring vanishes without any evidence of a crime. That one little clause can be the difference between a paid claim and a total loss.

"Choosing a plan that pays replacement value is key. It ensures you won't be stuck with a depreciated payout that can't actually replace what you lost."

A policy with replacement value lets you work directly with your trusted jeweler to have your ring remade or repaired to its original glory. With an actual cash value plan, you just get a check—and it's almost always for less than what you’d need to buy an identical replacement.

Putting This Knowledge to Work

Understanding these terms helps you spot a great policy and avoid the bad ones. Before you sign anything, read the fine print to confirm exactly what's covered and how you'll be paid if you ever need to file a claim.

Make sure you're clear on whether your policy offers replacement value or actual cash value, if you can use your own jeweler, and what exclusions are buried in the contract.

| Coverage Type | Payout Basis | Preferred Jeweler Option |

|---|---|---|

| Replacement Value | Full cost of a new ring | Yes, use your jeweler |

| Actual Cash Value | Cost minus depreciation | Often no, cash only |

A lot of people assume their homeowners policy will cover their ring, but that's rarely the full picture. For a deep dive, check out our guide on how homeowners insurance covers theft.

When insuring something as sentimental as an engagement ring, you should always push for full replacement coverage. It’s the only way to guarantee you can restore or replace it exactly as you remember it.

Before you commit, ask your agent for a clear, written summary of covered perils and payout methods. Don't be afraid to ask direct questions about limits on mysterious disappearance or accidental damage.

- Compare quotes that specify both replacement and actual cash value options to see the real-world cost difference.

- Confirm if a claim settlement allows you to get repairs done at your own jeweler or if you're limited to a cash payout.

- Review the list of exclusions carefully. This is where you'll find the surprises you want to avoid.

- Keep your appraisal and original receipts in a safe place. Having them ready will make any future claim process much smoother.

With this insight, you can confidently choose an engagement ring insurance plan that actually protects your investment. Understanding the fine print is the best way to avoid a policy that looks good on paper but leaves you exposed when it matters most.

Comparing Standalone vs. Homeowners Insurance

When it comes to insuring an engagement ring, you really have two main paths to choose from. You can either get a standalone policy from a company that specializes in jewelry, or you can add a "rider" to your existing homeowners or renters insurance policy.

At first glance, tacking it onto your home insurance seems like the easiest option. But these two choices offer vastly different levels of protection and, frankly, peace of mind.

Think of it this way: a homeowners rider is like your family doctor—great for a lot of things, but not a specialist. A standalone jewelry policy is the heart surgeon—an expert focused entirely on protecting one very specific, very valuable asset.

The Homeowners Insurance Rider

Adding a rider to your home or renters policy is definitely convenient. You’re dealing with the same company and agent you already know, and it just gets added to a bill you’re already paying. This is a necessary step because most standard policies have shockingly low limits for jewelry theft, often capping out around $1,500. A rider raises that limit to cover your ring's full appraised value.

But here’s the big catch: filing a claim for your ring means you’re filing a claim against your primary property insurance. This can easily cause your overall homeowners premium to spike when it’s time to renew. Worse, if you’ve had other claims, this one could even put you at risk of being dropped by your insurer altogether.

The Specialized Standalone Policy

A standalone policy, on the other hand, is built from the ground up just for jewelry. These plans almost always offer broader, more comprehensive coverage. For instance, they're far more likely to cover "mysterious disappearance"—that heart-stopping moment you realize your ring is just gone, with no clear signs of theft. Many homeowners riders specifically exclude this scenario.

The claims process is also a world apart. You’re not dealing with a general claims adjuster; you’re working with an expert who understands the true value and intricacies of fine jewelry. They know how to handle repairs and replacements properly. Best of all, a claim on your jewelry policy has absolutely no impact on your homeowners insurance. The two are completely separate.

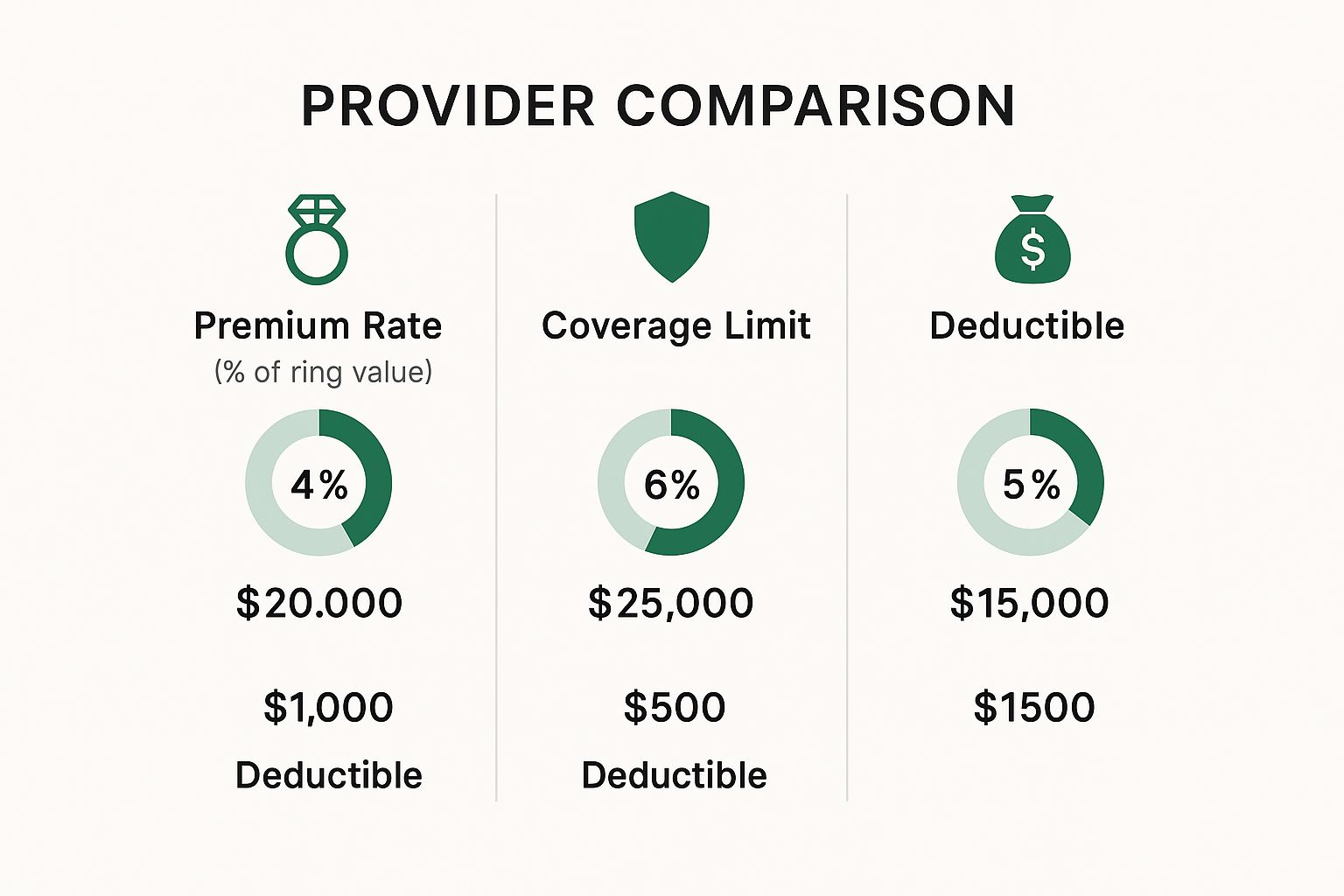

This chart breaks down how different insurance options stack up when it comes to premiums, coverage limits, and deductibles.

As you can see, the costs and coverage can vary quite a bit, which is why getting quotes from a few different places is always a smart move.

Deciding between these two isn't just about cost—it's about understanding the fine print and potential consequences. Let's put them side-by-side to make the differences crystal clear.

Standalone Jewelry Insurance vs. Homeowners Rider

| Feature | Standalone Jewelry Policy | Homeowners/Renters Rider |

|---|---|---|

| Coverage Scope | Broader; often includes mysterious disappearance, worldwide travel, and accidental damage. | Narrower; may exclude mysterious disappearance and have more restrictions on what's covered. |

| Claims Impact | No effect on your homeowners or renters insurance premiums or eligibility. | A claim can raise your overall home insurance premium and may lead to non-renewal. |

| Deductible | Often offers a $0 deductible option. | Usually subject to your homeowners policy deductible, which can be $1,000 or more. |

| Claims Process | Handled by jewelry experts who facilitate repair or replacement with a jeweler of your choice. | Managed by general adjusters; you may be required to use a specific replacement company. |

| Simplicity | Requires a separate policy and bill. | Conveniently bundled with an existing policy. |

While a rider on your home insurance is a workable solution, a standalone policy almost always provides superior, worry-free coverage. The peace of mind that comes from knowing a lost ring won't put your entire home's insurance at risk is invaluable.

The real advantage of a standalone policy is keeping a jewelry claim from ever touching your homeowners coverage. This separation is especially critical for high-net-worth individuals whose assets require more sophisticated protection strategies.

For those with a portfolio of valuable assets, keeping policies separate is just smart risk management. You can dive deeper into this dedicated approach by exploring the benefits of private client insurance, which is designed to protect unique, high-value items far beyond what a standard policy can offer.

Why an Official Appraisal Is So Important

When you get your ring insured, an official appraisal isn't just a suggestion from your jeweler—it's the very foundation of your entire policy. This document is the single most critical factor that shapes your insurance cost because it gives the insurer a detailed, professional valuation of exactly what they’re protecting.

Think of it this way: an appraisal is to your ring what a deed is to a house. It’s the official proof of your ring's specific characteristics and replacement value. This ensures you're not overpaying for coverage you don’t need, but more importantly, it prevents you from being underinsured if the unthinkable happens.

Insurance companies use this valuation to calculate your premium, usually based on that 1-2% rule of thumb. It also sets the official, agreed-upon amount they will pay out if you ever have to file a claim for a total loss.

What a Professional Appraisal Includes

A legitimate appraisal is far more than just a price tag. It's a comprehensive report from a certified gemologist who documents every last detail about your ring. To really dive into what this involves, our guide on a jewelry appraisal for insurance is a fantastic resource.

A thorough appraisal will meticulously describe:

- The 4Cs of the Diamond: A full breakdown of the Cut, Color, Clarity, and Carat weight, which are the main drivers of the diamond's value.

- Setting Details: It will specify the precious metal used (like platinum or 18k gold), its weight, and any unique design elements or craftsmanship.

- Side Stones: It also includes a detailed description and valuation of any smaller diamonds or other gemstones in the setting.

- Identifying Marks: Any inscriptions, serial numbers from the diamond's certificate, or other unique identifiers that prove the ring is yours are noted.

This level of detail is absolutely crucial. It's what allows a jeweler to create a true replacement if your original ring is lost or stolen.

An appraisal provides an indisputable, third-party valuation of your ring. This detailed document removes all guesswork, ensuring your insurance policy is based on fact, not sentiment, and that you can replace exactly what you lost.

Of course, this professional service comes at a cost. If you're looking to budget for it, learning more about understanding the cost of an antique appraisal can give you a solid idea of what to expect, as many of the pricing principles are similar.

Why You Need to Re-Appraise Your Ring

Finally, don't just get an appraisal and forget about it. The value of precious metals and gemstones changes over time, often increasing significantly. It’s a smart move to get your ring re-appraised every two to three years.

This simple step ensures your coverage keeps up with current market values. After all, the average cost of an engagement ring in the United States was approximately $6,504 in 2025, a number that is always shifting with economic trends. An updated appraisal guarantees your policy reflects today's replacement cost, not the price you paid several years ago.

Common Questions About Ring Insurance (And Straight Answers)

When you start looking into jewelry insurance, a lot of questions pop up. It’s totally normal. Getting clear, straightforward answers is the key to feeling confident about your decision. Let's walk through some of the most common things people ask when it's time to protect an engagement ring.

We'll cover everything from the best time to get your policy started to what happens if you're traveling overseas. Getting this right isn't just about protecting a valuable item—it's about genuine peace of mind.

When Is the Right Time to Insure My Ring?

The short answer? Immediately after you purchase it. Don't wait until after the proposal or for a special occasion to pop up. The moment that ring leaves the jeweler, it's a significant financial asset, and it's vulnerable to being lost, stolen, or damaged.

A lot of people are surprised to find out they can get a policy rolling even before the ring is physically in their hands. Most insurers will let you start the process with a detailed receipt or purchase agreement. You can then lock in the policy once you have the official appraisal. Acting fast means you're never left with a gap in coverage.

Is My Ring Covered if I Travel Internationally?

This is a fantastic and super important question. The answer really hinges on the type of policy you have.

One of the biggest perks of a standalone jewelry insurance policy is that it almost always includes worldwide coverage. That means your ring is just as protected on your honeymoon in Italy as it is when you're running errands back home.

On the other hand, a standard homeowners insurance rider often has frustrating limitations. Some policies only cover you within the United States and Canada, or they might have specific exclusions for international travel. Before you pack your bags, you absolutely have to confirm the geographic limits of your policy with your agent.

Think of a specialized policy as being built for a modern, mobile lifestyle. It gets that valuable jewelry travels with you, offering seamless protection that follows you wherever you go. That's a level of security a standard homeowners rider often can't match.

What Happens if I Lose Just the Diamond?

It's a nightmare scenario, but losing the main stone from its setting is a surprisingly common and heartbreaking event. A good "all-risk" or comprehensive policy will cover the loss of a center stone. This is usually classified as accidental damage or, in some policies, "mysterious disappearance."

When you file a claim, the insurance company will pull out your appraisal and use it to find a replacement diamond of the exact same size, cut, color, and clarity. This is precisely why having a detailed appraisal is so critical—it’s the blueprint they need to make your ring whole again.

How Does the Claims Process Actually Work?

Filing a claim is usually much less of a headache than people imagine, especially if you're with a specialized insurer. It typically breaks down into a few simple steps:

- Contact Your Insurer: Let them know what happened as soon as you can.

- File a Police Report: If the ring was stolen, this is a must-do. It provides the official documentation your insurer will need for the claim.

- Provide Your Documents: You'll need to send over your original appraisal, receipts, and the police report (if you filed one).

- Work on the Replacement or Repair: Your insurer will then guide you through the next steps, which usually involves working with a trusted jeweler to either repair or replace your ring.

If you're looking for a broader overview on this topic, this guide on how to insure jewelry the right way offers some great context and helpful tips.

It's clear that more and more people are recognizing these risks. The global market for engagement ring insurance has hit a valuation of $500 million in 2025 and is expected to grow at 8% each year through 2033. This isn't just a niche product anymore; it's becoming a standard step for protecting precious items. You can dive deeper into these market trends by reading the full research on engagement ring insurance.

At Wexford Insurance Solutions, our whole focus is on providing clear, comprehensive coverage that protects what matters most. Our experts are here to help you find the perfect policy for your engagement ring, making sure it’s protected from day one. Get the peace of mind you deserve by visiting us at https://www.wexfordis.com to get a personalized quote today.

What is Professional Indemnity Insurance? Essential Guide

What is Professional Indemnity Insurance? Essential Guide A Guide to Business Continuity Risk Assessment

A Guide to Business Continuity Risk Assessment