When you buy a homeowners insurance policy, you’re obviously thinking about protecting the house itself. But what about everything inside it? That’s where personal property coverage comes in.

Think of it as the part of your insurance policy that has your back if something happens to your stuff—your furniture, your electronics, your clothes, even the blender on your kitchen counter. If a disaster like a fire or a break-in strikes, this coverage is what helps you pick up the pieces by paying to repair or replace what you lost.

A Financial Safety Net for Your Stuff

Picture your home and everything you own in it. It’s more than just a collection of items; it's the fabric of your daily life. Personal property coverage, which you’ll often see listed as Coverage C on your policy documents, is designed specifically to protect all of it. It’s a standard, essential part of nearly every homeowners, condo, or renters insurance policy for a reason.

And it doesn't just stop at your front door. One of the best features of this coverage is that it often follows your belongings. So, if your laptop gets snatched from a coffee shop or your suitcase is stolen while you’re on vacation, your policy can still step in to help.

How Much Coverage Do You Get?

So, how do insurance companies decide how much your stuff is worth? For homeowners, it’s usually straightforward. The amount of personal property coverage is typically calculated as a percentage of your home's insured value (the dwelling coverage).

For example, if your house is insured for $400,000, your policy might automatically set your personal property coverage at 50% of that value—giving you $200,000 to protect your belongings. You can learn more about how insurers calculate these coverage amounts from industry experts.

At its core, personal property coverage is designed to help with the cost of repairing or replacing a wide variety of belongings, up to the limits in your specific policy, after a covered loss.

To get a clearer picture, let's break down the key components of this coverage.

Personal Property Coverage at a Glance

Here’s a quick summary to give you an at-a-glance understanding of what personal property coverage is all about.

| Aspect | Brief Explanation |

|---|---|

| What It Is | Insurance that protects your personal belongings (furniture, electronics, clothing). |

| Who Needs It | Homeowners, condo owners, and renters. |

| What It Protects | Items damaged or destroyed by covered events like fire, theft, or windstorms. |

This table covers the basics, but understanding the fine print is what really matters when it comes to making sure you're properly protected.

What Your Policy Actually Protects

When we talk about personal property coverage, what are we really talking about? Forget the insurance jargon for a moment. Think about everything in your home that isn’t bolted down.

This coverage is designed to protect the stuff that makes your house a home. It's the big things, like your sofa and television, but it’s also the smaller things you use every day—your clothes, your dishes, your books, and even the kids' toys. If you were to turn your house upside down and shake it, almost everything that falls out is considered your personal property.

It All Comes Down to "Covered Perils"

Now, here’s a crucial detail: your policy doesn't pay for damage from just any event. Your stuff is only protected against specific situations listed in your policy, which the insurance world calls covered perils.

Think of a peril as a specific type of disaster. Your policy is essentially a rulebook that says, "If one of these things happens, we've got your back."

In the simplest terms, a peril is just an event that causes a loss. A fire is a peril. Theft is a peril. Your insurance policy clearly outlines which perils it covers and, just as importantly, which ones it doesn't.

So, what kind of events are usually on the list? While policies vary, most standard homeowners insurance will cover you for these common disasters:

- Fire and smoke: If a fire damages your furniture, electronics, and other belongings, this coverage helps you replace them.

- Theft and vandalism: Got broken into? This is the part of your policy that helps reimburse you for stolen items. You can find out more about how this works in this guide on how homeowners insurance covers theft.

- Windstorms and hail: When a nasty storm rolls through and causes damage, your personal property is protected.

- Certain water damage: This is a tricky one. It typically covers sudden and accidental damage, like from a burst pipe, but usually excludes damage from floods.

At the end of the day, if a kitchen fire chars your appliances or a thief steals your laptop, this is the coverage that steps in. It’s the heart of your policy, helping you get back on your feet by replacing the things you lost.

What Isn't Covered? A Look at Exclusions and Limits

Knowing what your policy covers is only half the story. To really get a handle on your protection, you need to understand what it doesn't cover. Your personal property coverage is comprehensive, but it's not a magic wand that fixes everything. Every policy has a list of exclusions—specific situations or types of damage your insurance company won't pay for.

Think of it this way: your policy is designed to protect you from sudden, accidental events. Things like floods, earthquakes, and sewer backups are usually considered separate, high-risk events that require their own dedicated insurance policies. The same goes for damage that happens over time due to neglect or poor maintenance.

So, if a heavy rainstorm causes a river to overflow and flood your living room, your standard homeowners policy probably won’t cover the ruined sofa and electronics. You'd need a separate flood insurance policy for that.

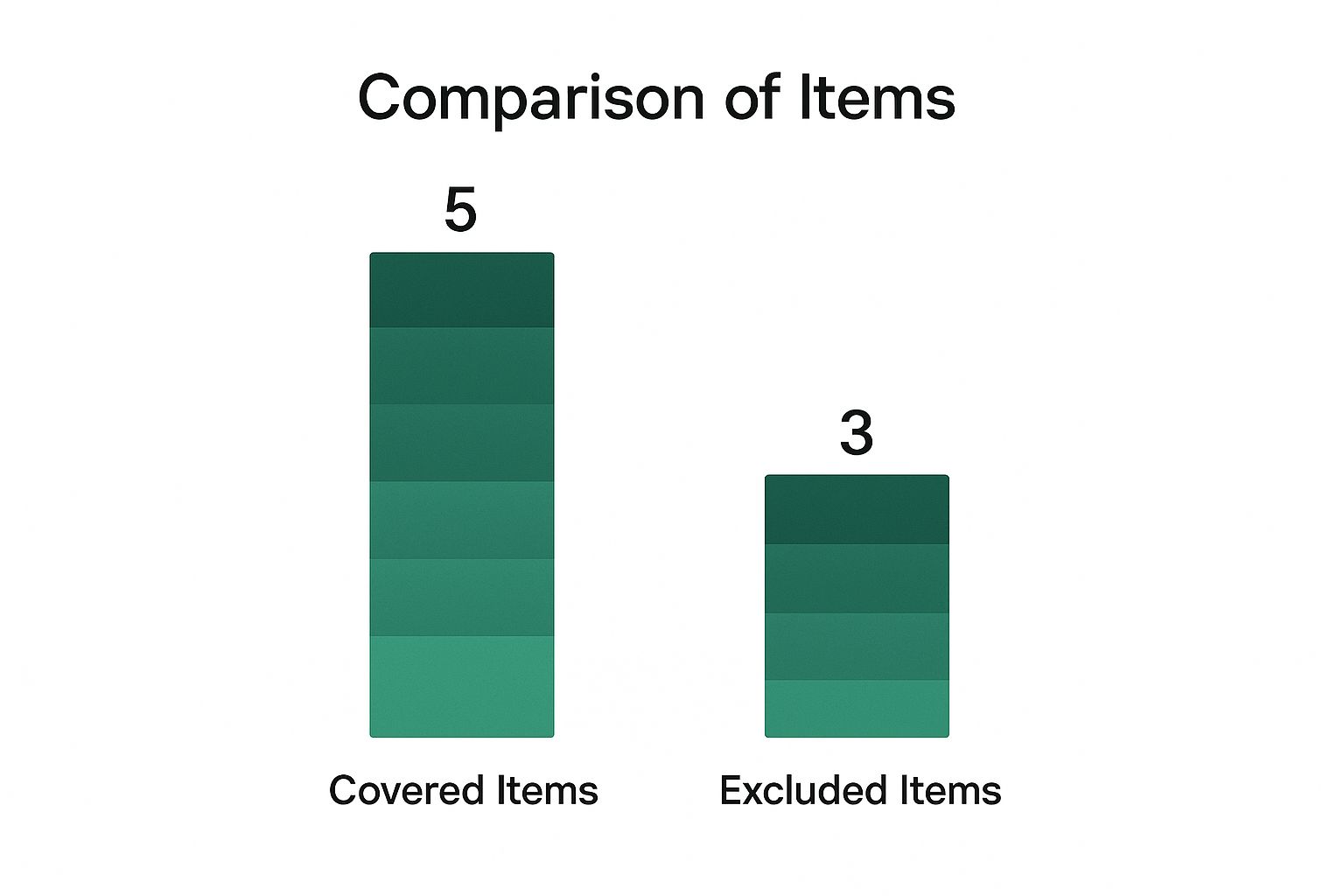

This visual gives you a great at-a-glance idea of how this works. Everyday belongings are generally protected from common perils like fire and theft, but major catastrophes and certain valuable items fall into a different category.

Demystifying Special Coverage Limits

Now, let's talk about something that trips up a lot of homeowners: special limits. These are also known as sub-limits, and they're one of the most misunderstood parts of an insurance policy. Just because your policy says you have $200,000 in personal property coverage doesn't mean every single item you own is covered up to that amount.

Insurance companies put caps on how much they’ll pay for certain categories of high-value items. It's their way of managing risk on things that are easily stolen or have a high price tag.

Here’s a real-world example. Let's say your policy provides $100,000 of total personal property coverage, but it has a special limit of $1,500 for stolen jewelry. If a burglar breaks in and steals your $5,000 engagement ring, the insurance company will only pay out $1,500. You'd be left to cover the remaining $3,500 out of pocket unless you have extra protection.

To help clarify this, the table below breaks down items that usually fall under your general coverage versus those that often have special, lower limits.

Commonly Covered Items vs. Special Limit Items

| Category | Standard Coverage Items | Items Often Subject to Special Limits |

|---|---|---|

| Electronics | TVs, kitchen appliances, standard computers | High-end audio/visual equipment, business-use computers |

| Valuables | Standard furniture, clothing, kitchenware | Jewelry, watches, furs, fine art, silverware |

| Collectibles | Books, movies, hobby supplies | Stamp or coin collections, rare memorabilia |

| Cash & Documents | Most personal documents (cost to replace) | Cash, securities, banknotes, manuscripts |

| Equipment | Lawn mowers, basic tools, sports gear | Firearms, watercraft, trailers, business property |

As you can see, the items with special limits are typically smaller, more valuable, or more susceptible to theft. If you own anything on the right side of that table, it’s a good idea to talk to your agent about additional coverage.

To make sure there are no surprises when you file a claim, it's crucial to understand these maximum payouts. Getting comfortable with these details is much easier once you know https://wexfordis.com/2025/09/06/how-to-read-insurance-policy/ from cover to cover. For a more detailed breakdown, there are some excellent guides on Understanding Insurance Policy Limits.

Replacement Cost vs. Actual Cash Value

When you file a claim for damaged or stolen belongings, how your insurance company cuts the check is a huge deal. It all comes down to two little acronyms: RCV and ACV. Understanding the difference between them can mean getting back on your feet quickly or facing a major financial shortfall.

Let's use a real-world example. Imagine a burglar makes off with your five-year-old laptop. It was a top-of-the-line model when you bought it, but it's definitely seen some wear and tear since then.

Actual Cash Value (ACV)

If your policy uses Actual Cash Value (ACV), you’ll get paid for what that five-year-old laptop is worth today. An adjuster will look at the price of a similar new model and then subtract for depreciation—basically, the value it lost due to age and use.

The formula is simple:

- Replacement Cost – Depreciation = Actual Cash Value

What you're left with is the "garage sale" price. It's something, but it's probably not enough to walk into a store and buy a brand-new replacement.

Replacement Cost Value (RCV)

Now, a Replacement Cost Value (RCV) policy is a different story entirely. It’s designed to put you back in the same position you were in before the loss.

With RCV, you get the full amount needed to buy a new laptop of similar quality at current market prices. There’s no deduction for depreciation.

Replacement Cost Value gives you the money to replace what you lost with a brand-new, equivalent item. It truly helps you recover without dipping into your own savings.

RCV coverage does cost a little more in premiums, but that extra investment pays for itself after a significant loss. It provides the peace of mind that you can actually afford to replace your things. To get a more detailed look, you can explore our guide on what is replacement cost coverage.

How to Calculate Your Coverage Needs

Trying to figure out the right amount of personal property coverage can feel like pulling a number out of thin air. How can you possibly know what all your stuff is worth? Thankfully, there’s a straightforward method that cuts through the guesswork.

The most effective tool you have is a home inventory—a complete catalog of your belongings.

Creating a list of everything you own might sound like a massive project, but it's more manageable than you think. You don't need any fancy software; your smartphone is the only tool you really need. By walking through your home and documenting your possessions, you’re creating concrete proof of what you own and what it's worth.

This inventory is vital for two reasons. First, it helps you land on a coverage limit that actually covers your stuff, so you don't find yourself underinsured after a disaster. Second, if you ever need to file a claim, this list will be your best friend, making the entire process faster and far less stressful.

Creating Your Home Inventory Step-by-Step

A detailed home inventory is your number one defense against being underinsured. Spending a few hours on this now can save you an incredible amount of money and frustration down the road.

Here's how to get it done:

-

Go Room by Room: Don't try to tackle the whole house at once. Start in one room—like the living room or your bedroom—and finish it before moving on. This keeps the project from feeling overwhelming.

-

Use Your Phone: Walk through each room and take videos. Open up every closet, cabinet, and drawer. Then, go back and take individual photos of more valuable items like electronics, furniture, art, and jewelry.

-

List and Describe: For your big-ticket items, jot down a quick description. Note the brand, model, and serial number if you can find it. If you have receipts for major purchases, snap a photo of those, too.

-

Store It Safely: Don't just leave these files on your phone or computer! Upload everything to a secure cloud service like Google Drive or Dropbox. That way, if your devices are destroyed, your inventory is still safe and accessible from anywhere.

An accurate inventory doesn't just help you pick the right coverage amount; it gives the insurance adjuster the exact proof they need to process your claim quickly.

Once you’ve got your inventory, you can take the next step: conducting a personal insurance gap analysis to see if your current policy is truly enough. After all, it's impossible to protect what you haven't accounted for.

What About Your Most Valuable Possessions?

Your standard personal property coverage does a great job protecting your everyday stuff, but what about the really special items? Things like your engagement ring, that antique watch from your grandfather, or your collection of rare baseball cards often have values far higher than the special limits built into a typical policy.

This is where you need to look at an endorsement, also known as a floater or a rider.

Think of it like a VIP pass for your most prized possessions. It’s a separate, add-on policy that attaches to your main homeowners insurance, giving a specific high-value item its own dedicated coverage. This not only covers it for its full value but often protects it against a wider range of potential accidents.

How to "Schedule" Your Valuables

Getting an endorsement is a pretty simple process called "scheduling." You're essentially listing, or scheduling, a specific item on your policy so it’s covered for its full appraised worth.

Here’s how it usually works:

- Get a Professional Appraisal: First, you’ll need an expert to officially determine the item's current market value. This document is the proof your insurance company needs.

- Gather Your Documents: Send the appraisal, along with any photos or original receipts, over to your insurance agent.

- Add it to Your Policy: Your agent will then add the endorsement, officially listing the item and its insured value.

An endorsement doesn't just bump up the dollar amount. It often expands your protection to cover things a standard policy won't, like accidentally losing your wedding ring down the drain—a classic "mysterious disappearance" scenario.

For your most treasured belongings—fine art, jewelry, collectibles, or expensive musical instruments—taking this extra step is non-negotiable. It bridges the gap between your standard coverage and the true value of your items. To dive deeper, you can learn more about the specifics of valuable personal property insurance. It’s a small step that provides huge peace of mind.

Got Questions? We've Got Answers

When you start digging into the details of personal property coverage, a few common questions always seem to pop up. Let's tackle them head-on with some straight answers.

What if My Laptop Gets Stolen from My Car or a Coffee Shop?

Good news—you're most likely covered. One of the best features of personal property coverage is that it’s not just confined to the four walls of your home. It travels with you.

So, whether you're working remotely at a café or on vacation, your policy helps protect your stuff from theft or damage. Just remember, your standard policy limits and deductibles still apply, no matter where the incident happens.

Are My Roommate's Things Covered Under My Policy?

This is a big one, and the answer is no. Your homeowners or renters insurance policy is designed to protect your personal belongings and those of relatives living with you.

Your roommate is considered a separate household, so they’ll need to get their own renters insurance policy to make sure their computer, clothes, and furniture are protected.

It’s a crucial point to remember: insurance coverage doesn't automatically extend to tenants, guests, or roommates. It's tied specifically to the policyholder and their resident family members.

Deductibles vs. Limits: What's the Difference?

It’s easy to mix these two up, but they play very different roles in your policy. Let's break it down simply.

- Your limit is the maximum amount your insurance company will pay out for a single claim. If your personal property limit is $50,000, that’s the absolute ceiling for reimbursement.

- Your deductible is the amount you pay first before your insurance coverage starts paying. Think of it as your share of the cost for a claim. If your deductible is $1,000, you’ll handle that portion of the loss yourself.

Imagine a fire causes $5,000 worth of damage to your electronics. With a $1,000 deductible, you would pay the first $1,000, and your insurer would cover the remaining $4,000. Getting these two numbers straight is fundamental to understanding how your policy really works when you need it most.

Figuring out the ins and outs of personal property coverage is a lot easier when you have an expert in your corner. At Wexford Insurance Solutions, our job is to provide clear, simple guidance and build a policy that actually fits your life. Let us help you make sure everything you value is properly protected.

Contact Wexford Insurance Solutions today for a personalized consultation.

Hired and Non Owned Auto Insurance: Essential Coverage for Your Business

Hired and Non Owned Auto Insurance: Essential Coverage for Your Business What Is Additional Living Expense Coverage?

What Is Additional Living Expense Coverage?