So, your pipe burst. The big question on your mind is probably, "Am I covered?"

In most cases, the answer is yes. A standard homeowners insurance policy is designed to step in when you have water damage from a pipe that bursts. But—and this is a big but—it has to be a sudden and accidental event.

Think of a pipe that freezes and cracks during an unexpected cold snap. That’s a classic example of a covered problem. On the other hand, if a tiny leak under your sink has been dripping for months and you just ignored it, your claim for the resulting rot and mold will almost certainly be denied.

Understanding Your Burst Pipe Coverage

At its core, insurance is there for the unexpected catastrophe, not for issues that pop up because of poor maintenance. This "sudden and accidental" rule is the single most important factor.

Here’s an easy way to think about it: your policy will cover a kitchen fire that flares up from a grease spill, but it won’t cover the mold that’s been slowly growing under a leaky faucet for a year. It's all about the emergency versus the deferred maintenance. This distinction is what separates an approved claim from a denied one.

Key Coverage Principles

Let's break down what this really means for you and your home.

-

Sudden Damage: The problem has to happen out of the blue. A pipe that bursts without warning is a perfect fit.

-

Accidental Damage: The incident can’t be something you caused on purpose or through neglect. It needs to be a true, unforeseen accident.

-

Resulting Damage vs. The Pipe Itself: This is a crucial detail many homeowners miss. Your policy will pay to fix the water-logged drywall, ruined carpets, and damaged furniture. However, it typically will not pay for the cost of repairing the broken pipe itself.

Burst Pipe Coverage At a Glance

Insurance policies can be tricky, so here’s a simple table to help visualize what’s usually covered and what isn’t when a pipe bursts.

| Scenario | Typically Covered? | Reason |

|---|---|---|

| A pipe freezes and bursts during a sudden winter storm. | Yes | The event was sudden, accidental, and unforeseen. |

| A water heater supply line suddenly splits and floods the basement. | Yes | This is considered an unexpected failure of a plumbing system. |

| A slow leak from a corroded pipe you knew about causes mold. | No | The damage resulted from a lack of maintenance, not a sudden event. |

| You drill into a wall and accidentally hit a water pipe. | Yes | While caused by you, it was a genuine accident, not intentional neglect. |

| An outdoor sprinkler pipe cracks from ground-settling. | No | Damage from earth movement is often excluded. Maintenance is also a factor. |

This table gives you a general idea, but every policy is different. It’s always best to review your own documents or speak with your agent to be certain.

As long as you’ve taken reasonable steps to keep your home in good shape, your policy should have your back. To get a better handle on the ins and outs of your coverage, our complete home insurance explained guide is a great place to start.

Understanding Sudden and Accidental Damage

When your insurance company looks at a water damage claim, one phrase matters more than any other: "sudden and accidental." This is the key that unlocks your coverage, and understanding it is crucial.

Think of it like this: a lightning strike is sudden and accidental. A slow-growing vine that eventually pulls down a fence is not. Insurance is there for the lightning strike—the disaster you couldn't see coming. A pipe that freezes and bursts overnight or a water heater that ruptures without warning are classic examples. They happen in an instant, and the damage is immediate.

On the flip side, that tiny drip under the sink you've been meaning to fix? That's a different story. If it slowly rots the cabinet over six months, the damage is considered a result of poor maintenance, not a sudden event.

Seeing Through an Adjuster's Eyes

When an insurance adjuster shows up, their first job is to play detective and find the origin of the water. Was it a catastrophic failure or a slow, predictable leak?

Let's look at two real-world examples to see how this plays out.

-

Covered Scenario: Your washing machine's supply hose suddenly splits, sending water gushing across your laundry room. The damage to your floors and drywall is covered because the failure was sudden and accidental.

-

Excluded Scenario: You’ve been watching a small water stain grow on your ceiling for months, caused by a leaky roof flashing. When the drywall finally gets soggy and collapses, the claim will almost certainly be denied. Why? The problem was a gradual, long-term issue that needed maintenance.

Your policy is a shield against unforeseen accidents, not a warranty for parts of your home that degrade over time. The "sudden and accidental" clause ensures coverage is reserved for true emergencies.

This distinction is the bedrock of your policy. Taking the time to learn how to read your insurance policy can save you a world of headaches later on.

Of course, even a covered event can leave you with a mess. For smaller repairs, like figuring out how to remove water spots from wood furniture, there are some great DIY guides available.

What Your Policy Actually Pays For

When your burst pipe claim gets the green light, the next big question is: what exactly will the insurance check cover? It’s a common misconception that everything is included, but there’s a critical distinction to understand.

Your policy is built to pay for the resulting damage—that is, all the chaos the water caused after it escaped the pipe. This means covering the costs to rip out and replace waterlogged drywall, salvage soaked carpets, and repair or replace ruined floors.

What it almost never covers is the cost to fix the broken pipe itself. Think of it this way: your insurance pays for the mess the pipe made, not for the pipe's own failure. This detail catches a lot of homeowners by surprise right when they’re most stressed.

Covered Damage Versus Excluded Repairs

The whole point of your policy is to get your home back to the way it was before the disaster. It’s designed to handle the collateral damage that disrupts your life and wrecks your stuff. Water damage is a huge deal in the insurance world; from 2018 to 2022, roughly 25% of all claims were for water or freezing incidents, second only to wind and hail damage.

So, what does that look like in practice? Here’s how the money breaks down:

- Dwelling Coverage (Coverage A): This is the part of your policy that pays to repair your home's structure. We're talking about the walls, ceilings, floors, and built-in cabinets that got soaked.

- Personal Property Coverage (Coverage C): This covers your possessions. If the water ruined your couch, fried your TV, or destroyed your favorite rug, this is the coverage that kicks in. Knowing what is personal property coverage can make a massive difference in how well you recover.

A great way to think about it is like a car accident. If your brakes fail and you crash into your neighbor's fence, your auto insurance will pay to fix the fence (the resulting damage), but it won't pay to replace your faulty brakes (the part that failed).

Common Exclusions To Be Aware Of

Beyond the pipe itself, standard policies have a few other water-related blind spots. Getting familiar with these exclusions now can save you from a major financial headache later.

For example, damage from a sewer backup or a failed sump pump is typically not covered unless you've purchased a specific add-on, or "endorsement," for your policy.

Similarly, any damage from groundwater seeping up into your basement or floodwaters rushing in from outside is a completely different story. That requires a separate flood insurance policy, as a standard homeowners policy only deals with water that comes from inside your own plumbing system.

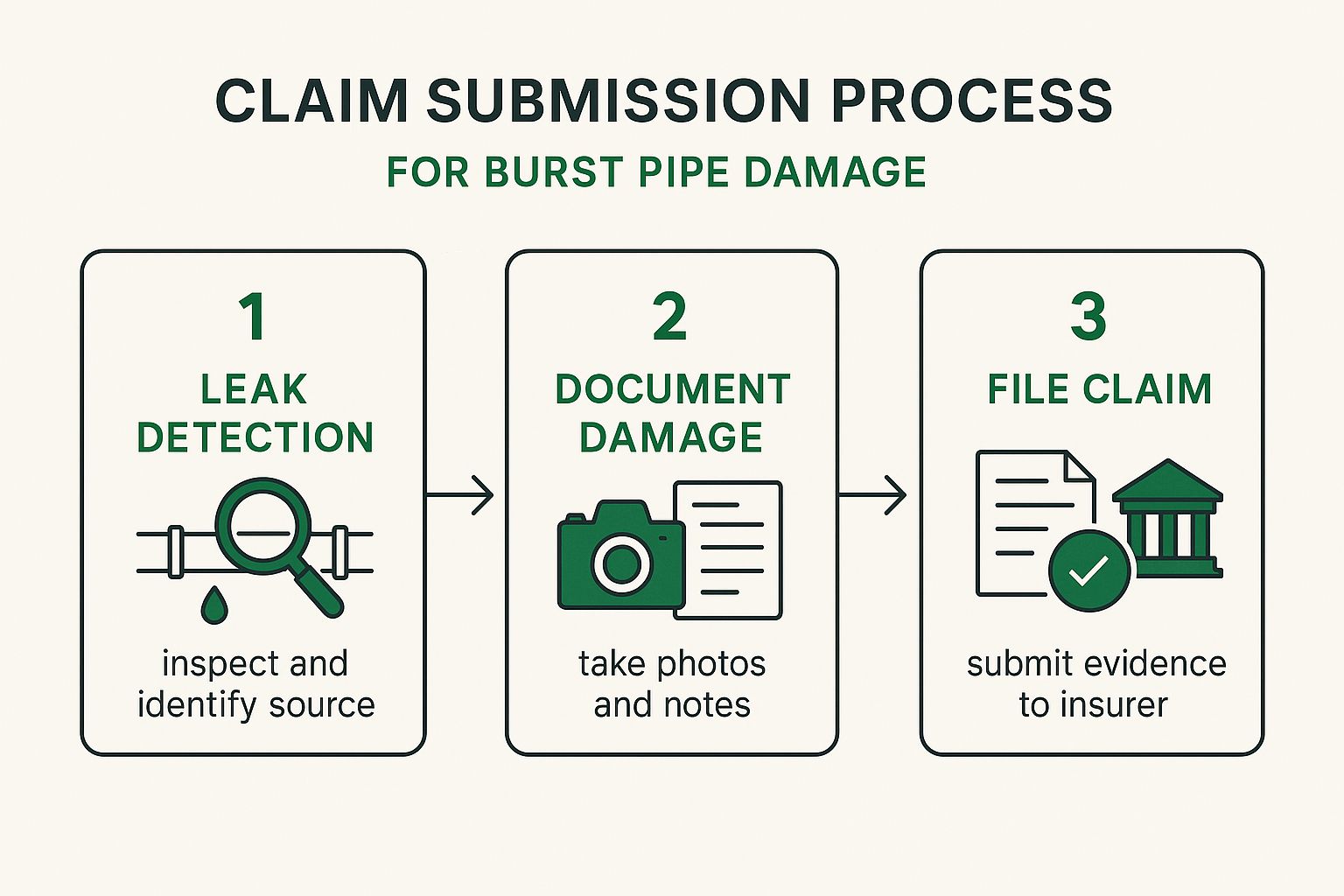

How to File a Successful Claim

That sinking feeling you get when you discover a burst pipe is overwhelming. In that moment of panic, it's tough to think clearly, but what you do in those first few hours is absolutely critical for both your safety and the success of your insurance claim.

The number one priority? Mitigate further damage. This isn't just a suggestion; it's a core responsibility outlined in most homeowners insurance policies. Your insurer needs to see that you acted quickly to stop the problem from spiraling out of control.

Your Immediate Action Plan

Before you even pick up the phone to call your agent, you need to get the situation under control. Taking these steps immediately shows your insurer you’re a responsible homeowner and, more importantly, protects your home from even more devastation.

- Shut Off the Water Main: First thing's first. Find your home's main water shutoff valve and turn it clockwise until it's completely closed. This cuts off the source of the flood and is the most important step you can take.

- Turn Off the Electricity: Water and electricity are a lethal combination. If water is anywhere near outlets, appliances, or your breaker box, kill the power to those areas immediately. Don't take any chances.

- Move Your Belongings: Get your stuff out of harm's way. Haul furniture, electronics, rugs, and anything else of value to a dry, safe spot.

The Power of Documentation

Okay, the water has stopped flowing and the power is off. Your instinct might be to start cleaning up the mess. Resist that urge. Right now, your job is to be a detective, and solid proof is your best friend.

Grab your phone and start taking pictures and videos of everything. Don't just take one or two shots—go overboard. Get wide-angle views of the entire scene, then get close-ups of the soaked drywall, warped floorboards, and every single damaged item. The more visual evidence you have, the stronger your claim will be.

Notifying Your Insurance Company

With your initial evidence in hand, it’s time to make the call. Contact your insurance company or agent to get the claims process started. From here on out, document every single interaction. Keep a running log of who you spoke to, the date and time of the call, and what was discussed.

The insurance company will assign an adjuster to your case. They'll schedule a time to come out and inspect the damage, so be ready with your photos, videos, and an inventory of everything that was ruined. Make sure to save receipts for any emergency expenses you have, like paying for a plumber to make temporary repairs or a water mitigation company to start drying things out.

For a more in-depth look at what comes next, our guide on the homeowner insurance claim process breaks it all down for you.

Preventing Burst Pipes in Your Home

Let's be honest: the best insurance claim is the one you never have to file. Taking a few steps to protect your home from a burst pipe will save you an unbelievable amount of stress. It also shows your insurance company you’re a responsible homeowner, which can be a surprisingly helpful detail if you ever do need to make a claim.

Water damage is no small thing. Between 2016 and 2020, about 1 in 60 insured homes filed a claim for water damage, often from burst pipes. The average payout? A hefty $11,650. That’s a serious financial hit for something that’s often preventable.

Winterization and Year-Round Maintenance

The good news is that most preventative measures are simple and don't cost much, especially when you stack them up against the cost of a major repair. A little bit of effort now can save you a world of trouble later.

-

Insulate Vulnerable Pipes: Your first line of defense is wrapping pipes in unheated spots—think basements, crawl spaces, attics, and garages. Simple foam insulation sleeves from the hardware store work wonders.

-

Keep Cabinets Open: When you know a serious cold snap is coming, open the cabinet doors under your kitchen and bathroom sinks. This little trick lets the warm air from your house circulate around the plumbing and keep it from freezing.

-

Let Faucets Drip: On the coldest nights, let a slow, steady drip run from any faucets connected to exposed pipes. This relieves pressure in the system, and moving water is far less likely to freeze solid than water that's just sitting still.

Think of prevention as your home's immune system. A few small, healthy habits—like insulating pipes and keeping air circulating—can help your home fight off the "sickness" of a winter freeze and a subsequent burst pipe.

Of course, knowing your insurance policy is only half the battle. Proactive steps, like following these essential home maintenance tips, are what really keep you ahead of the game. These simple actions add up to a powerful strategy for keeping your home safe and dry, no matter what the weather throws at you.

Answering Your Top Questions

Even when you know the basics, the reality of a burst pipe claim can bring up some tricky, real-world questions. Let's walk through some of the most common things homeowners worry about, so you can face these situations with more confidence.

Will My Insurance Rates Go Up After a Burst Pipe Claim?

It's a valid concern, and honestly, it’s a possibility. Any claim can flag your property as a higher risk to an insurer, and water damage is a big one. This could lead to a higher premium when it's time to renew your policy.

Two things really drive this decision: the size of the claim and your past claim history. A single, major water damage claim is more likely to trigger a rate hike than a small one. If the total repair bill is just a hair over your deductible, it’s a smart move to talk with your agent about the long-term cost before you file.

What If the Burst Pipe Was Hidden Inside a Wall?

This happens all the time, and it’s usually a clear-cut case for coverage. Because the pipe was hidden from view, the damage it caused is almost always considered “sudden and accidental.”

The story can change, however, if there were obvious warning signs that were ignored—think of a growing water stain on the drywall or a musty odor that just wouldn't go away. In that situation, an insurance company might argue the damage resulted from a lack of maintenance, not a sudden accident. The moment you even suspect a leak, document it and report it. Quick action is your best ally.

An unseen pipe that suddenly lets go is the textbook definition of an accidental loss. Insurers know this happens. What they push back on is when a homeowner ignores clear signs of trouble, letting a small leak turn into a huge disaster.

Does Insurance Cover Mold Damage From a Burst Pipe?

Mold is a notoriously tricky subject in insurance. Most standard homeowner policies specifically exclude coverage for general mold removal.

But there’s a critical exception. If the mold grew as a direct result of a covered event—like your burst pipe—the policy might provide a limited amount of coverage for remediation. This is usually capped, often somewhere between $5,000 and $10,000. The key here is speed. Your insurer expects you to start drying everything out immediately to stop mold in its tracks. If mold appears because you waited weeks to report the damage, the claim will almost certainly be denied.

Am I Covered if a Pipe Bursts While I'm on Vacation?

For the most part, yes—but only if you took reasonable steps to keep your home safe before you left. Insurers call this "due diligence."

For example, leaving your heat set to a sensible temperature (say, 55°F or 13°C) in the winter is a responsible step. If you shut the heat off completely before a trip during a cold snap and a pipe freezes and bursts, your insurer could deny the claim on the grounds of negligence. This is one of the top insurance claim denial reasons we see. Before any long trip, it's always wise to double-check your policy for any specific rules about leaving your home unoccupied.

At Wexford Insurance Solutions, we believe a clear understanding of your policy is the best tool you have to protect your home. Whether you're dealing with the aftermath of a burst pipe or just want to feel more prepared, our team is here to help. Contact us today for a personalized review at https://www.wexfordis.com.