When a fire, storm, or theft hits your business, the damage to your physical assets can be devastating. Commercial property insurance is the financial backstop that helps you repair or replace your building, equipment, and inventory. Think of it as a recovery plan for your physical operations, making sure a disaster doesn't become a permanent shutdown.

Protecting the Foundation of Your Business

Picture your business as a complex machine. You have liability insurance for lawsuits and workers' comp for your team, but commercial property insurance is what protects the actual machine. Without it, the physical heart of your company—from the roof over your head to the tools you use every day—is left vulnerable.

This coverage is designed to absorb the financial blow from unexpected physical damage, giving you the resources to rebuild and reopen. A major fire or a severe storm can easily run up repair bills in the tens or even hundreds of thousands of dollars. For most businesses, paying that out-of-pocket just isn't an option and could easily lead to closing for good.

What Physical Assets Are Covered?

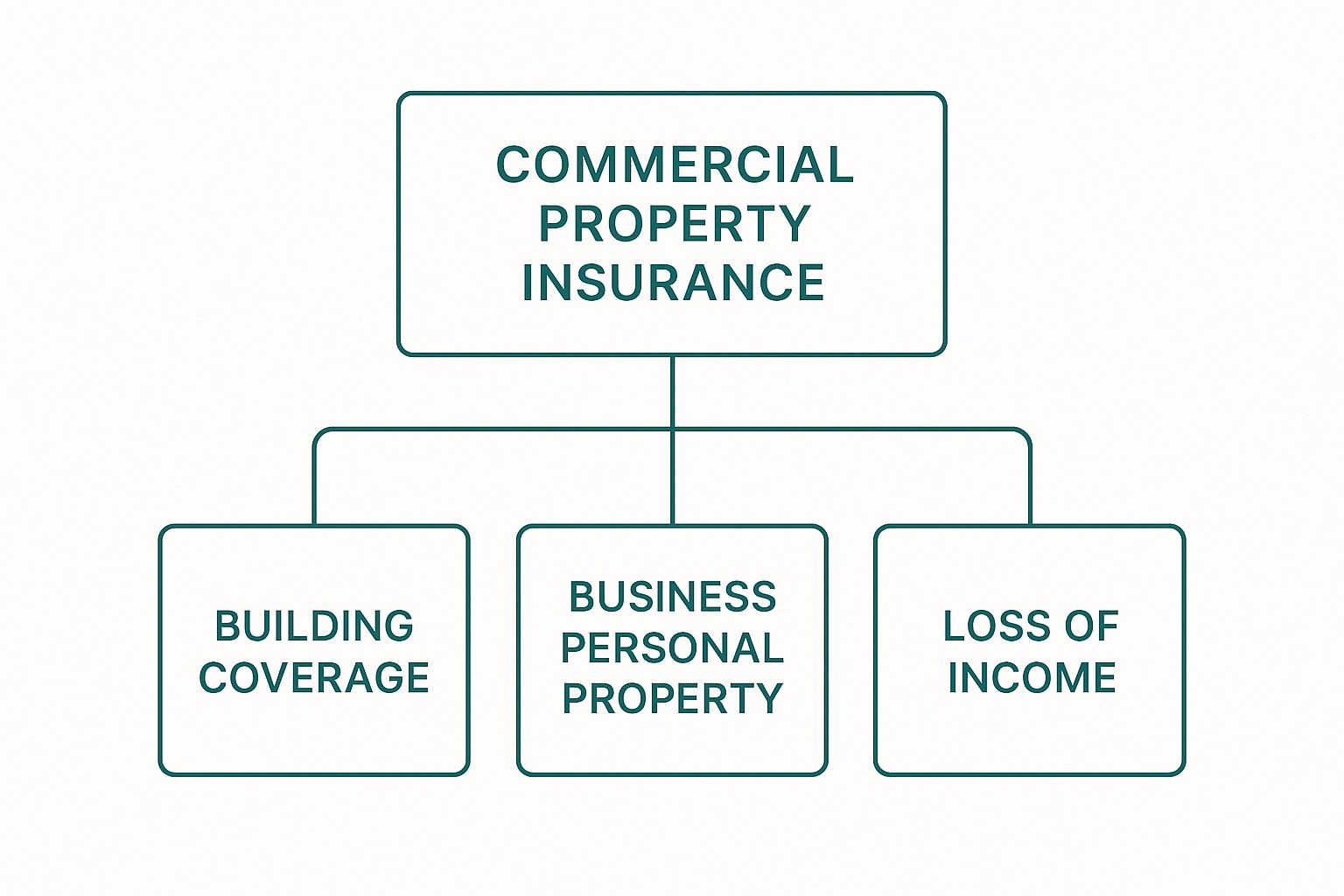

At its core, commercial property insurance protects the tangible items your business relies on. The protection is usually broken down into a few key categories to make sure you have broad financial security.

- The Building Itself: This covers the physical structure, whether you own the property or your lease makes you responsible for insuring it. It also includes permanently installed fixtures like plumbing, lighting, and critical infrastructure like commercial HVAC systems.

- Business Personal Property (BPP): This is a catch-all for pretty much everything inside your building. We're talking about desks, computers, specialized machinery, manufacturing equipment, and all the inventory you have sitting on your shelves.

- Property of Others: Do you hold onto your customers' property for any reason? A computer repair shop or a dry cleaner are great examples. This part of the policy can cover those items if they get damaged while in your care.

This type of insurance is a fundamental piece of any solid risk management plan. It’s about more than just protecting a building; it’s about ensuring you can stay in business and preserving the value you’ve worked so hard to create.

Getting a handle on this coverage is the first step toward building a more resilient business. While it's a specific policy, it's crucial to understand how it fits into your larger protection strategy. To see the full picture, it helps to learn more about the broader scope of what is commercial insurance and how different policies work together to protect your entire operation.

Decoding What Your Policy Actually Covers

To really understand your commercial property insurance, you need to look beyond the policy's title. Think of it less like a single safety net and more like a bundle of specific protections, each designed to shield a different part of your business from the physical and financial fallout of a disaster.

At its core, the policy protects the building or structure you operate from. This isn't just the walls and roof, but also the guts of the building—things like the plumbing, electrical systems, and any permanently installed fixtures. If a fire rips through your office, this is the coverage that foots the bill for repairs.

But a business is so much more than the building it's in.

Protecting Your Assets Inside And Out

That brings us to the next critical layer: Business Personal Property (BPP). This is a broad term for basically everything inside your building that isn't part of the structure itself. Without it, you’d have a repaired building with nothing in it.

BPP is designed to cover the tangible assets that keep your business running day-to-day.

- Equipment and Machinery: This could be the laptops and servers in an office or the heavy-duty manufacturing equipment on a factory floor.

- Furniture and Fixtures: We're talking desks, chairs, retail display cases, and shelving—all the essentials that furnish your space.

- Inventory and Stock: For a retailer, this is your lifeblood—the products on your shelves. For a restaurant, it's all the food and supplies in your walk-in cooler.

- Property of Others: This is crucial if you take temporary possession of customer property. Think of a computer repair shop or a dry cleaner; this covers your customers' items if they're damaged while in your care.

This visual helps put into perspective how these key pieces fit together to form a comprehensive policy.

As you can see, a strong policy is built on these distinct pillars. Each one protects a vital component of your physical operation, ensuring you can get back on your feet after a loss.

Named Perils vs. All-Risk Policies

Now, not all policies are built the same. The real difference comes down to what kinds of disasters—or "perils"—are actually covered. You'll typically encounter two main flavors: Named Perils and All-Risk (sometimes called Open Perils).

A Named Perils policy is like a strict, pre-written grocery list. It only covers the specific events explicitly listed in the policy, such as fire, theft, windstorms, or vandalism. If a disaster isn't on that list (like a burst pipe, for instance), you're out of luck.

An All-Risk policy flips that logic on its head. It covers you against damage from any cause unless it is specifically excluded in the fine print. This approach offers far broader protection because it can cover unexpected or freak accidents that you'd never think to list. The burden is on the insurance company to prove why a claim isn't covered.

A quick comparison can make the distinction crystal clear.

Named Perils vs All-Risk Coverage Comparison

| Feature | Named Perils Policy | All-Risk (Open Perils) Policy |

|---|---|---|

| Coverage Scope | Only covers perils explicitly listed (e.g., fire, theft). | Covers all perils unless they are explicitly excluded. |

| Burden of Proof | You must prove the loss was caused by a listed peril. | The insurer must prove the loss was caused by an excluded peril. |

| Protection Level | Basic, limited protection. | Comprehensive, broader protection. |

| Common Gaps | Vulnerable to unlisted, unusual, or new types of risks. | Gaps only exist where specific exclusions are named. |

| Best For | Businesses with predictable risks and tighter budgets. | Businesses wanting the most robust protection available. |

Ultimately, an All-Risk policy is generally the safer bet for most businesses. It provides peace of mind by covering a wider range of unforeseen events, whereas a Named Perils policy can leave you exposed to anything not explicitly mentioned.

Don't Overlook Business Interruption Coverage

So, your property is damaged, and your insurance is covering the repairs. Great. But what happens to your revenue while your doors are closed for months? How do you pay your key employees or your rent?

This is where Business Interruption coverage saves the day.

Often called Business Income coverage, this is an absolutely essential add-on. It’s designed to replace lost income and cover ongoing expenses while you're recovering from a disaster. It helps you keep the lights on by covering:

- Lost Net Income: Steps in to replace the profits you would have earned had the incident never happened.

- Continuing Operating Expenses: Takes care of fixed costs that don't stop, like rent, loan payments, and payroll.

- Temporary Relocation Costs: If you need to set up shop in a temporary location, this helps cover the moving and rental costs.

While commercial property insurance is a crucial standalone product, it doesn't exist in a vacuum. To see how it fits with other protections like liability or workers' comp, you can read our overview of commercial insurance types.

Finally, your lease can have a big impact on your insurance needs. When you’re figuring out coverage, you have to consider how lease structures like triple net lease agreements define who is responsible for insuring the building. Getting this wrong can create dangerous gaps between your policy and your landlord’s.

The Key Factors That Drive Your Premiums

When an insurance underwriter sits down to calculate your premium, they aren't just pulling a number from a hat. The price you pay is the direct result of a deep and detailed risk assessment. For decades, insurers have relied on a proven framework known as COPE to figure out the odds of you filing a claim and how much it might cost.

COPE is an acronym for the four pillars of this assessment: Construction, Occupancy, Protection, and Exposure. Once you understand how an underwriter looks at your property through this lens, you gain a powerful advantage. You can see your business through their eyes, which helps you understand your pricing and even find smart ways to lower it.

C is for Construction

First things first, the underwriter wants to know about the physical building itself. What's it made of? How old is it? What's the condition of its critical systems, like the electrical and plumbing? The materials used to build your property are a massive indicator of how well it will hold up to potential disasters, especially fire.

It’s pretty logical when you think about it. A modern building with a steel frame is far more resistant to fire and will almost always get a better rate than an older structure made of wood. The less likely your building is to burn to the ground or suffer catastrophic damage, the lower the risk for the insurance company.

Here’s what they’re looking at:

- Building Materials: Is your property built with wood, masonry, or steel? Steel offers the best fire resistance, while a classic wood frame is the most vulnerable.

- Age of the Building: An older property might hide outdated wiring or aging pipes, which increases the risk of fire or major water damage.

- Recent Upgrades: Have you put on a new roof or updated the HVAC and electrical systems? These improvements show that you're reducing the chances of a system failure, which can lead to better rates.

O is for Occupancy

Next, they look at what you do inside the building. Occupancy is all about the nature of your business and the specific risks your operations bring to the table. A quiet accounting firm, for example, is a completely different risk profile than a bustling restaurant with open flames and deep fryers, or a woodworking shop kicking up flammable sawdust all day.

The risk here is tied directly to your daily activities. A warehouse storing something non-combustible like stone tiles is seen as a much safer bet than one holding barrels of hazardous chemicals. It all boils down to how your specific operations could start or contribute to a potential loss.

P is for Protection

This part of the equation is all about the proactive steps you’ve taken to prevent or minimize damage. Protection covers both the public services available to you (like the fire department) and the private systems you've installed on-site. Getting this part right can have a huge, direct impact on your premium.

By investing in solid protective systems, you're sending a clear signal to the insurer: you are actively managing your own risk. This proactive approach is almost always rewarded with a lower insurance bill.

Insurers focus on a few key protective features:

- Fire Alarms: Do you just have local alarms, or is your system professionally monitored 24/7?

- Sprinkler Systems: A full, well-maintained sprinkler system is one of the single most effective ways to slash your fire risk and, in turn, your premium.

- Security Systems: Professionally monitored burglar alarms and visible security cameras can be a major deterrent for theft and vandalism.

- Fire Department Proximity: Being located just a few blocks from a well-equipped, full-time fire department will earn you a much better rate than if your property is out in a rural area served by a volunteer station.

These elements prove that if something does go wrong, the damage can be contained quickly, which limits the size of a potential claim. You can get more ideas for managing these costs in our guide on commercial property insurance cost.

E is for Exposure

Finally, the underwriter looks at the risks outside your four walls. Your business doesn't operate in a vacuum, and nearby threats can have a serious impact. This is Exposure, and it covers everything from the risk of natural disasters to the kinds of businesses that are your neighbors.

If your property sits in a known flood zone, a region prone to wildfires, or a high-crime area, your premium will have to account for that elevated risk. The same is true for your neighbors. Being located next to a quiet office park is one thing; being next to a fireworks factory is something else entirely.

External market conditions also play a role. The commercial property market, for instance, saw a noticeable softening trend in early 2025. Healthier insurer profits and lower reinsurance costs led to more competitive pricing for many business owners. By understanding the COPE framework, you're in a much better position to navigate these market shifts and secure the best possible terms for your policy.

How Global Market Conditions Affect Your Policy

Ever wonder why your insurance premium goes up even if you’ve never filed a claim? It’s because your policy isn’t priced in a vacuum. It's tied to massive economic forces, global events, and the financial health of the entire insurance industry. Knowing how these big-picture dynamics work puts you in a much stronger position when it's time to renew.

The insurance world ebbs and flows in cycles, swinging between what we call a "hard market" and a "soft market." Think of it like a pendulum. A hard market usually kicks in after a period of major losses for insurers, like a series of devastating hurricanes or widespread wildfires that lead to billions in payouts.

When the market hardens, you'll start to see a few things:

- Higher Premiums: Insurers need to recoup their losses and build back their cash reserves, so prices go up across the board.

- Tighter Underwriting: Getting coverage becomes tougher, especially if your property has any "risky" characteristics.

- Less Capacity: Insurers become more cautious and may limit the amount of coverage they’re willing to sell.

The Shift to a Softer Market

On the flip side, a soft market is a great time to be an insurance buyer. This happens when insurance companies are financially healthy, profitable, and hungry for new business. That intense competition is good for you, often leading to lower premiums, better coverage terms, and more wiggle room from underwriters.

We're actually seeing a shift in that direction right now. According to Marsh’s Global Insurance Market Index for Q2 2025, commercial insurance rates dropped by 4%. This was the fourth consecutive quarterly decrease, signaling a welcome change after a tough hard market that stretched on for nearly seven years. You can dig into the numbers yourself in the full global insurance market report.

It's a perfect example of how conditions on the other side of the world can directly affect what a local business pays for its policy.

The Role of Reinsurance in Your Premiums

So, what’s pulling the strings on these market cycles? A huge piece of the puzzle is reinsurance.

The simplest way to think about reinsurance is as "insurance for insurance companies." When your carrier agrees to cover your property, they don't hold onto all that risk themselves. They offload a portion of it to massive, global reinsurance companies.

This is the financial backstop that keeps your local insurer solvent after a catastrophic event, allowing them to pay out millions—or even billions—in claims without going under. We break this down further in our guide explaining what reinsurance is in insurance.

The cost of that reinsurance has a direct impact on your premium. If reinsurers take a massive hit from global disasters one year, they raise their prices for the next. In turn, your insurance company has to pass that cost increase on to you.

The price you are quoted is not just a reflection of your building's risk; it's also a reflection of an insurer's global financial stability and their outlook on future catastrophic events.

Once you understand that your policy is connected to these much larger forces, you can approach your renewals more strategically. If you know the market is softening, you have more leverage to negotiate for better terms. And if you see signs of it hardening, you can budget for an increase and double down on your risk management efforts to make your property a more attractive risk. It changes the game, turning you from a passive buyer into an informed partner in the process.

How Climate Change Is Shaking Up Property Insurance

It's impossible to talk about commercial property insurance today without talking about the weather. But we're not talking about small talk—we're talking about a fundamental shift in how insurance carriers view risk. Climate change isn't a future problem; it's here, and it's actively redrawing the map for insurers and business owners alike.

The simple fact is that severe weather events are becoming more common and more destructive. We're seeing more intense wildfires, more powerful hurricanes, and flooding in places that never had to worry before. Because of this, insurance companies are in a constant state of recalibrating their risk models. For business owners, especially those in high-risk areas, this often translates directly into higher premiums. In the most extreme situations, some insurers are even pulling out of certain markets entirely, deciding the risk is just too high to cover.

The Growing "Protection Gap" You Need to Know About

This new reality has created a dangerous financial hole known as the "protection gap." It’s a simple but scary concept: the gap is the difference between the total financial losses from a disaster and the portion of those losses that insurance actually covers. Everything left over is an uninsured loss that businesses and property owners have to absorb themselves.

The numbers here are pretty sobering. Between 2014 and 2023, natural disasters caused an estimated US$2.35 trillion in economic losses across the globe. Insurers only covered about US$944 billion of that, leaving a staggering 60% protection gap. As more people and businesses are located in climate-vulnerable areas, this gap is becoming a major threat to financial stability. For a deeper dive into these global trends, EY offers some excellent insights into the insurance outlook.

The protection gap isn't just an industry buzzword. It's the very real, out-of-pocket cost a business owner has to pay to rebuild after a catastrophe—a cost that can easily put a company out of business for good.

Why You Can't Afford to Wait: The Case for Risk Mitigation

With insurance costs on the rise and coverage becoming harder to find in some places, just sitting back and hoping for the best is no longer a viable strategy. The single best way to keep your insurance affordable and available is to prove to underwriters that you're serious about protecting your property. Investing in risk mitigation has become a core business necessity.

This is all about taking tangible steps to make your building tougher and more resilient against the specific threats you face. These actions can have a real impact on your premiums because they show insurers you're a less risky partner.

Here are a few practical examples:

- Strengthen Your Structure: Simple upgrades can make a world of difference. Think about installing a hail-resistant roof or reinforcing your building's frame to handle high winds. You can find out more about what that entails in our guide to handling a hail damage roof insurance claim.

- Clear a "Defensible Space": If your property is in a wildfire zone, one of the most effective things you can do is clear away flammable brush and vegetation to create a buffer around your buildings.

- Manage Water Flow: For businesses in flood-prone areas, improving on-site drainage, grading the landscape properly, or even installing flood barriers can prevent a minor water issue from becoming a total disaster.

- Have a Plan: A well-documented disaster preparedness and recovery plan demonstrates to an insurer that you've thought through the risks and are prepared to act quickly to minimize damage and business interruption.

By taking these kinds of proactive steps, you're not just protecting your building. You're making a strong case to your insurer that you're a responsible owner, which can help you secure better coverage and more favorable pricing.

Common Exclusions and Gaps in Coverage

One of the biggest mistakes I see business owners make is assuming their commercial property policy covers absolutely everything. It’s a dangerous assumption. The reality is that every single policy has a list of exclusions—specific events and damages that just aren't covered.

Knowing what isn't covered is just as important as knowing what is. It’s how you find the gaps in your financial safety net before you fall through them.

Insurers have to exclude certain massive, high-risk events. Why? Because if they had to cover widespread catastrophic damage for every client under a standard policy, the premiums would be astronomical. No one could afford it.

By carving out these major perils, insurance companies keep the core policies affordable. This lets you start with a solid foundation and then layer on extra coverage for the specific risks your business and location actually face.

Catastrophic Events Are Almost Always Excluded

Most standard policies, whether it's a basic Named Peril or a broader All-Risk form, will draw the line at large-scale natural disasters. These are considered specialized risks that need their own dedicated insurance.

Here are the big ones you’ll almost always see excluded:

- Floods and Water Damage: This is a huge one. Standard policies do not cover damage from rising water—think storm surges, overflowing rivers, or even heavy rain pooling and seeping in from the outside. You’ll need a separate flood insurance policy for that, which you can often get through the National Flood Insurance Program (NFIP) or a private carrier.

- Earthquakes: Shakes, tremors, and any other "earth movement" are another classic exclusion. If your business is in a seismically active area, you absolutely must purchase a separate earthquake policy.

- War and Terrorism: Any losses that come from acts of war, military action, or terrorism are also typically excluded. Specialized coverage is available for businesses that might be exposed to these risks.

Maintenance and Wear-and-Tear Issues

Your property insurance is there for the sudden and unexpected—not for problems that creep up over time due to neglect or simple aging. The insurance company expects you to be a responsible property owner and keep up with routine maintenance.

An insurance policy is a partnership in risk management. It protects you from the unexpected, but it relies on you to manage the expected, like routine maintenance and addressing wear and tear before they become disasters.

This means you’re generally on your own for damages that result from:

- General Wear and Tear: The slow, gradual breakdown of your building and equipment over the years is just a cost of doing business. It’s not an insurable loss.

- Lack of Maintenance: If your roof has been leaking for a year because you never replaced the bad shingles, an insurer will likely deny the claim for water damage. That's a maintenance failure, not a sudden accident.

- Mold and Fungus: Most policies won't cover mold cleanup unless it was the direct result of a covered event, like a burst pipe that you dealt with immediately. Slow-growing mold from a damp basement is your problem to solve.

- Pest Infestations: Damage from termites, rodents, or other pests is viewed as a maintenance issue, not an insurable peril.

Ignoring these exclusions leaves dangerous holes in your protection. The only way to be sure is to sit down, read your policy's exclusion list carefully, and talk with your insurance agent. They can help you spot the gaps and find the right endorsements or separate policies to make sure you’re truly covered.

Frequently Asked Questions

It's completely normal to have questions when you're digging into commercial property insurance. It's a detailed topic, but getting straight answers is the best way to feel confident you're making the right call for your business. Let's tackle some of the most common questions we hear from business owners.

I Rent My Space—Do I Really Need This Insurance?

Yes, absolutely. This is probably the biggest misconception out there. Many tenants think their landlord's policy has them covered, but that's a risky assumption.

The landlord's insurance covers the building itself—the walls, the roof, the foundation. It does absolutely nothing for what’s inside your rented space. Your inventory, computers, equipment, furniture, and any improvements you've paid for are all on you. If a fire or a break-in happens, you’d be starting from scratch without your own policy.

What’s The Difference Between Replacement Cost And Actual Cash Value?

Understanding this difference is critical because it directly affects how much money you get after a claim. These are the two ways an insurance company can value your damaged property.

- Replacement Cost (RC): This is the good stuff. It pays to repair or replace your damaged items with brand-new property of similar quality. No haggling over age or wear and tear. It’s designed to get you back on your feet quickly.

- Actual Cash Value (ACV): This option pays you for what your property was worth the second before it was damaged. It’s the replacement cost minus depreciation. So, that five-year-old laptop might only be valued at a fraction of what a new one costs, leaving you to pay the difference.

Choosing a Replacement Cost policy might mean a slightly higher premium, but the financial protection it offers is far superior. For nearly every business, it's the smarter choice to avoid a massive, unexpected expense when you're already dealing with a disaster.

Opting for ACV might save you a few bucks now, but it can leave a serious gap in your finances when you need the money most.

How Can I Get A Better Deal On My Premiums?

The great news is you're not just a passive buyer here. You have a lot of influence over what you pay. Insurers love to see proactive business owners who take risk management seriously, and they reward them with lower rates.

Here are a few practical ways to lower your costs:

- Beef Up Your Security. Installing monitored fire and security alarms is a huge step. A well-maintained fire sprinkler system is often the single best way to earn a major discount.

- Raise Your Deductible. If you agree to cover a larger portion of a loss yourself (your deductible), the insurance company will lower your premium. Just make sure it’s an amount your business can comfortably handle.

- Stay on Top of Maintenance. Keeping your electrical, plumbing, and HVAC systems in good shape prevents some of the most common—and costly—claims. A well-cared-for building is simply less risky.

- Keep Your Claims History Clean. The fewer claims you file, the better your rates will be. It can be tempting to file a claim for a small issue, but sometimes it pays to handle minor things out-of-pocket to protect your long-term insurability.

At Wexford Insurance Solutions, we believe a protected client is an educated one. If you have more questions or want a professional to look over your current policy, our team is here to give you the clear, straightforward advice your business deserves. Let's build a solid foundation together. Find out more at https://www.wexfordis.com.

How to Choose an Insurance Broker You Can Trust

How to Choose an Insurance Broker You Can Trust Business Insurance for Plumbers | Protect Your Plumbing Business

Business Insurance for Plumbers | Protect Your Plumbing Business