Think of your business insurance less like a monthly bill and more like the most important tool you own. While your wrenches and pipe cutters fix the physical problems, the right business insurance for plumbers is what fixes the financial disasters that can bring a business to its knees.

This guide will break down exactly what you need to protect the business you've worked so hard to build.

Why Insurance Is Your Most Important Tool

Every single plumbing job comes with risk, and it goes way beyond a simple leaky faucet. One mistake, one accident, or one stolen piece of equipment can quickly snowball into a five-figure problem that puts your entire livelihood on the line.

While you're focused on delivering top-notch service, your insurance is working quietly in the background, acting as your financial backstop. It’s also a clear sign of professionalism, telling clients you’re a serious, prepared contractor they can trust.

This isn't just about checking a box or meeting a legal requirement. It's about building a business that can take a punch and keep moving forward. For a look at how insurance fits into the bigger picture, a comprehensive plumbing business guide can show why it's a non-negotiable part of any successful operation.

From Small Leaks to Major Lawsuits

Let’s play out a scenario. A water line you just installed fails overnight, flooding a client’s home and ruining their new hardwood floors and custom kitchen cabinets. The repair bill easily rockets into the tens of thousands. Without general liability insurance, that entire cost lands squarely on your shoulders, potentially draining your savings or even coming after your personal assets.

Or think about something even more common. A client trips over your tool bag in a hallway, breaks their wrist, and sues you for their medical bills and lost wages. These aren't wild, far-fetched stories; they are the real-world risks plumbers navigate every day.

Your insurance policy is the barrier that stands between a manageable problem and a business-ending catastrophe. It turns a potential financial crisis into a predictable, fixed expense.

Building Trust and Winning Bigger Jobs

Having the right insurance doesn't just protect you—it actively helps you land more work. General contractors and commercial clients almost always demand proof of insurance before you can even set foot on their job site. It's a non-starter for bidding on the bigger, more profitable projects.

Homeowners are getting smarter, too. Many now ask to see a certificate of insurance to know they're covered if something goes wrong on their property.

Ultimately, a solid insurance plan shows you're a professional who takes their responsibilities seriously. It gives you and your clients peace of mind, letting you get back to focusing on what you do best. If you want to brush up on the fundamentals, our guide to business insurance basics is a great place to start.

The Core Policies Every Plumber Needs

Think of your business insurance as the financial plumbing for your company. Just like a real plumbing system, you have a few main supply lines that are absolutely essential. These core policies deliver the critical protection you need to keep your business running smoothly, preventing a single leak from turning into a catastrophic flood.

These coverages aren't just good ideas; they're the non-negotiable foundation for any plumbing business. Let's break down the three main lines of defense every single plumber needs.

General Liability Insurance: Your First Line of Defense

General Liability Insurance is the absolute bedrock of your entire protection plan. It’s designed to shield you from claims that your business caused bodily injury or property damage to someone else, like a client, a visitor, or a vendor. It’s what protects you from the slip-ups and accidents that can happen on any job.

Let me paint a picture. You’re in a client's home and you leave a tool bag in the hallway for just a minute. The homeowner rounds the corner, doesn't see it, trips, and fractures their wrist. Just like that, you're on the hook for medical bills, lost wages, and maybe more.

Without a general liability policy, those costs come straight out of your pocket. With it, your insurance carrier steps in to handle the claim, cover legal fees if you get sued, and pay for the damages up to your policy limit.

General Liability isn't just for the big, dramatic mistakes. It's for the everyday, unpredictable accidents that can happen no matter how careful you are. It’s the policy that lets you focus on the job instead of constantly worrying about what could go wrong.

Commercial Auto Insurance: Protecting Your Mobile Office

Your work truck is so much more than a vehicle. It’s your mobile office, your rolling warehouse, and it’s packed with thousands of dollars in tools and equipment. One of the costliest mistakes a plumber can make is thinking their personal auto policy has them covered for work. It absolutely does not.

If you get into an accident on the way to a job, your personal insurance carrier will likely deny the claim the second they find out you were using the truck for business. That leaves you holding the bag for all the repairs, medical bills, and any damage you caused to other people or their property.

That's where Commercial Auto Insurance comes in. It’s built specifically for vehicles used in your plumbing business.

- Liability: This covers you if you’re at fault in an accident that injures someone or damages their property.

- Physical Damage: This takes care of repairs to your own truck or van after a wreck, or if it's stolen or vandalized.

- Specialized Equipment: You can even add coverage for permanently attached equipment, like those custom shelves or that expensive pipe rack.

This policy makes sure your most vital business asset—the truck that gets you and your gear to every job—is properly protected.

Workers’ Compensation: Protecting Your Team and Your Business

If you have employees—even a single part-timer—Workers’ Compensation Insurance isn't just a smart move; it’s legally required in almost every state. It’s designed to be the one and only solution for on-the-job injuries, protecting both your employees and your business from financial disaster.

Let's be honest, plumbing is a tough, physical job with real risks. The U.S. Bureau of Labor Statistics noted over 37,000 nonfatal workplace injuries for plumbing and HVAC contractors in 2021 alone. That number really drives home why workers' comp is such a critical safety net. It covers medical bills and replaces a portion of lost wages for any employee who gets hurt on the job.

Imagine an apprentice slips on a wet basement floor while helping you carry out an old water heater and suffers a serious back injury. Workers' comp is what pays for their hospital stay, physical therapy, and their wages while they recover.

Without it, not only are you breaking the law, but that injured employee could sue you directly for those costs. A lawsuit like that could easily sink a small business. Fulfilling your duty to take care of your team is just good business.

Many plumbing businesses find it makes sense to bundle these core policies into a single package. You can learn more about how this works by checking out our guide on what is a business owners policy.

Specialized Coverage For Total Protection

Once you’ve laid the foundation with essentials like General Liability and Commercial Auto, it’s time to think about the specialized risks that come with the plumbing trade. These add-on policies are designed to plug the specific gaps that standard coverage doesn't touch, protecting your business from some very real, and potentially very expensive, scenarios.

Think of it this way: your core policies are the main water lines running to the house. These specialized coverages are the pressure relief valves and backflow preventers. They stop a single, specific problem from turning into a full-blown catastrophe.

Professional Liability Insurance

This one is a biggie, and it's often called Errors & Omissions (E&O) insurance. It’s built to protect you from claims of professional negligence. While your General Liability policy is great for slip-and-fall accidents, Professional Liability kicks in when a client suffers a financial loss because of a mistake you made in your work or advice.

Let’s say you install a high-end tankless water heater. A few months down the road, it malfunctions, flooding the basement. The manufacturer investigates and determines the failure was due to an installation error that didn't follow their exact specifications. Your General Liability probably won't touch that claim—it wasn't a random accident but an error in your professional service.

That’s the exact moment Professional Liability insurance becomes your best friend. It’s designed to cover your client’s financial damages—and your legal defense fees—that come directly from a professional mistake.

For any plumber taking on complex or high-value jobs, this policy is a non-negotiable part of the business insurance for plumbers toolkit.

Contractors Tools and Equipment Insurance

Your tools are what make you money. It's that simple. When a drain camera gets crushed or a gang box gets cleaned out overnight, your business can grind to a halt. Every plumber knows this risk is all too real.

Imagine leaving your gear secured at a new construction site, only to show up the next morning to a cut lock and thousands of dollars of your best equipment gone. A standard property policy won’t cover tools once they're off your main business premises.

Contractors Tools and Equipment Insurance was created for this exact nightmare. It protects your gear whether it’s:

- At a job site: Covering theft or damage while you're working or overnight.

- In transit: Protecting your equipment while it's in your truck, bouncing between jobs.

- In storage: Providing coverage for tools kept in a temporary storage unit or shed.

This policy is what ensures a major theft is just a bad day, not a business-ending disaster.

Inland Marine Insurance

Don’t let the name fool you—Inland Marine Insurance has absolutely nothing to do with boats or water. It’s another critical policy for protecting property that’s on the move. While Tools and Equipment coverage is perfect for your hand tools and portable items, Inland Marine is typically for bigger-ticket items you transport, like a mini-excavator for digging trenches or sophisticated diagnostic machinery.

Essentially, it's an extension of your property insurance that travels with your most valuable assets. It’s all about protecting property in transit over land. Many plumbers also use personal vehicles for work, which can create its own set of insurance questions. For a deeper dive, our guide on hired and non-owned auto insurance helps clear up some of that confusion.

Finally, while protecting your business is crucial, don’t forget to protect yourself. Personal safeguards like income protection insurance can be a lifesaver, replacing a chunk of your income if you get sick or injured and can't work. By layering these business and personal policies, you build a comprehensive safety net that lets you focus on the job with true peace of mind.

How Plumber Insurance Costs Are Calculated

Ever looked at an insurance premium and wondered where they came up with that number? It’s not just pulled out of a hat. Pricing an insurance policy is a lot like quoting a complex plumbing job—every single detail, from the scope of work to the materials involved, plays a role. Insurance carriers carefully weigh a handful of factors specific to your business to figure out their risk, and that risk level translates directly into your final cost.

On average, plumbing businesses in the United States can expect to pay somewhere between $350 and $2,000 a year for insurance. That breaks down to a more manageable $30 to $165 per month. But that's a wide range. Things like your location, how many people you employ, and your commitment to safety will push your price up or down.

For a clearer picture, here’s a look at what plumbers can typically expect to pay monthly for a few key policies.

Average Monthly Cost of Key Insurance Policies for Plumbers

| Insurance Policy Type | Average Monthly Cost Range | What It Typically Covers |

|---|---|---|

| General Liability | $45 – $90 | Third-party property damage or bodily injury caused by your work. |

| Professional Liability (E&O) | $60 – $85 | Financial losses from mistakes, errors, or faulty advice. |

| Workers' Compensation | $120 – $350+ | Employee medical bills and lost wages from on-the-job injuries. |

| Commercial Auto | $150 – $250 | Accidents, injuries, and damages involving your work vehicles. |

| Contractors' Tools & Equipment | $15 – $30 | Theft, loss, or damage to your essential tools and equipment. |

These figures are just a starting point, of course. Your final premium will be unique to your business, shaped by the specific factors that underwriters focus on.

The Key Factors Driving Your Premiums

At their core, insurance carriers are professional risk managers. Their job is to predict how likely you are to file a claim and price your policy to match. Here are the main ingredients they toss into the pot when calculating your premium.

-

Business Size and Payroll: This is a big one. The more employees you have on your payroll, the higher your exposure to potential workers' compensation claims. More trucks on the road also means a greater chance of a commercial auto incident.

-

Type of Plumbing Work: The risks for a plumber handling simple residential sink repairs are vastly different from those for a contractor working on new commercial high-rises or high-pressure gas lines. If you're doing specialized, higher-risk work like trenching or industrial pipefitting, expect to see that reflected in your premiums.

-

Geographic Location: Where you set up shop really matters. States with a history of high litigation rates or areas prone to natural disasters like floods often have higher insurance costs across the board.

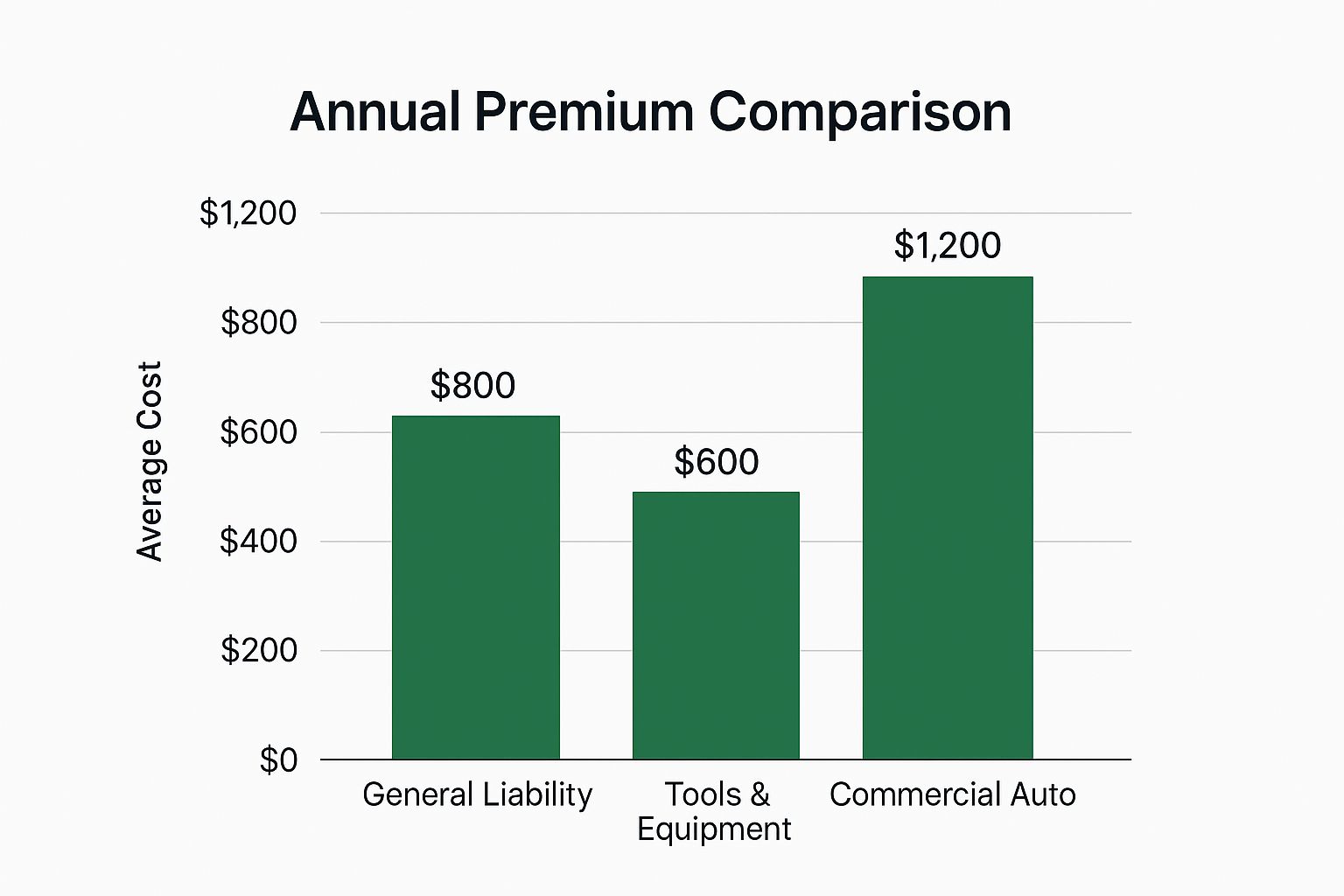

The image below gives a great visual breakdown of how annual premiums for a typical plumber might be distributed across different policies.

It’s interesting to see that insuring the truck that gets you to the job can often cost more than the general liability policy covering the work itself.

Your Claims History and Experience

Your track record speaks volumes to an underwriter. A long, claim-free history shows that you run a tight, safe operation, and carriers will reward that with better rates.

On the flip side, a pattern of frequent or severe claims immediately flags you as a higher risk. This is especially true for workers' comp, where your claims history directly shapes your "experience modification factor," or mod rate. A clean safety record keeps this number low, saving you serious money. You can learn more about workers' comp experience mods in our article and see just how much they affect your bottom line.

Your years in business also matter. An established plumber with a decade of experience is viewed as a much safer bet than a brand-new operation, and pricing will reflect that stability.

How You Can Actively Lower Your Costs

The great news is that you have more control over your insurance costs than you might think. By proactively managing your risk, you can make your plumbing business a much more attractive client to insurers.

Here are a few practical steps you can take:

-

Implement a Formal Safety Program: Don't just talk about safety—document it. Hold regular training sessions, create written safety procedures, and enforce the rules on every single job. This is one of the most powerful ways to cut down on claims.

-

Bundle Your Policies: Most carriers will give you a significant discount for keeping all your policies under one roof. Bundling General Liability, Commercial Auto, and a Business Owner's Policy (BOP) is an easy win.

-

Choose a Higher Deductible: If your cash flow can handle it, opting for a higher deductible is a straightforward way to lower your premium. It just means you agree to cover a larger portion of a claim out-of-pocket before the insurance kicks in.

By focusing on these areas, you can take direct control of your business insurance for plumbers and make sure you’re getting the best possible protection for your money.

Finding The Right Insurance Partner

Picking an insurance provider is a lot like choosing the right brand of PEX or copper pipe for a big job. The wrong choice can lead to leaks and failures down the road, but the right one gives you a secure, lasting connection you can count on. Your insurance partner needs to be more than a salesperson—they should be a strategic advisor who genuinely understands the risks you face every day in the plumbing trade.

This means you’ve got to look past the big names you see on TV commercials. Instead, seek out agents or brokers who specialize in insurance for contractors. A generalist can sell you a policy, sure, but a specialist understands why your completed operations coverage is non-negotiable and why your tool insurance has to cover theft from an open job site, not just from a locked-up warehouse.

The global market for plumbing contractor insurance was recently valued at around USD 7.2 billion. That number tells you just how massive the demand is for specialized policies. With premiums expected to keep climbing, finding a knowledgeable partner who can help you navigate this complex market is more critical than ever.

Vetting Potential Insurance Providers

Before you sign on any dotted line, you need to interview potential insurance partners as thoroughly as you would a new apprentice. You're looking for someone who will be in your corner when things go sideways, not just the person who dangles the cheapest quote in front of you.

Come prepared with a list of specific questions to really gauge their expertise and see how committed they are to your business. Their answers will tell you everything you need to know about whether they're a true specialist or just a general agent.

- How many plumbers or trade contractors do you currently insure? A confident answer here usually points to real-world experience with risks just like yours.

- Can you walk me through the policy's specific exclusions for water damage? This is a great way to test their detailed knowledge of the policy language that matters most to your work.

- What does your claims process look like for a contractor? You need a partner who has a clear, efficient, and supportive process when you need it most.

- How do you help clients adjust coverage as their business grows? A great partner will be proactive, reviewing your needs at least once a year.

Getting this first step right is huge. For a deeper dive, check out our guide on how to choose an insurance broker.

Beware The Fine Print And Policy Exclusions

Here’s a story I hear all too often: a plumber thought his general liability policy had him covered for any mistake he could make on the job. After an incorrectly installed valve caused a slow leak—leading to massive mold damage over several months—he filed a claim. It was immediately denied.

His policy had a specific exclusion for any damages related to mold. It also had another for "your work" if the work itself was deemed faulty. That fine print turned what should have been a covered event into a business-threatening, out-of-pocket nightmare.

This is exactly why your relationship with your insurance partner is so important. A dedicated agent would have walked him through those exclusions, pointed out the gap, and suggested a professional liability policy to fill it.

Never assume a standard policy covers everything. The cheapest premium often comes with the most exclusions, making it the most expensive policy you could possibly buy when a real claim happens. Your provider's job is to make sure you never have to face those kinds of surprises.

Common Questions About Plumber Insurance

Let's be honest, figuring out business insurance can feel like trying to find a leak in a wall—frustrating and confusing. Whether you're a one-person shop or running a crew, you've got questions. This section cuts through the noise to give you straight answers to the things plumbers ask us every day.

We've kept these explanations quick and to the point. No jargon, just the practical info you need to protect your business and get back to work.

I'm a Self-Employed Plumber with No Crew. Do I Really Need Insurance?

Yes, absolutely. Thinking you can skip insurance is one of the most common and costly mistakes a solo plumber can make. When you're a sole proprietor, there’s no legal wall between you and your business. Your personal assets—your house, your truck, your savings account—are all fair game if a client sues you.

Your General Liability policy is the only thing standing between you and a financial nightmare. Imagine you install a new water line that gives way in the middle of the night, flooding a client's newly renovated kitchen. You'd be on the hook for every penny of the repairs, which can easily run into the tens of thousands.

Beyond that, most clients and virtually all general contractors won't even talk to you without seeing proof of insurance. That certificate isn't just a piece of paper; it's your ticket to landing bigger and better-paying jobs.

What's the Difference Between Being Licensed, Bonded, and Insured?

It’s easy to see why people lump these three together, but they cover very different things. Getting them straight is key to showing clients you’re a true professional.

Let’s break it down simply:

- Licensed: This proves you’ve met the government’s standards. You’ve passed the tests and have the training to do plumbing work legally. It’s all about your qualifications.

- Bonded: This is about a surety bond, which is basically a financial guarantee for your client. If you fail to finish a job or don't pay for permits, the bond company steps in to make the client whole. It protects the client’s money.

- Insured: This means you have a policy (like General Liability) to pay for accidents. If you cause property damage or someone gets hurt because of your work, insurance covers the fallout. It protects everyone from the cost of mistakes.

A good way to think about it is: Your license shows you know how to do the job. The bond protects the client if you don't do the job. Your insurance protects everyone if you accidentally cause damage while doing the job. All three together are the foundation of client trust.

How Can I Lower My Insurance Premiums Without Cutting Corners on Coverage?

Everyone wants to save money, but you can't afford to be underinsured. The real goal is to make your business a lower risk in the eyes of an underwriter. The safer you are, the better your rates will be.

First things first, get serious about safety and write it down. A documented safety program isn't just talk. Hold regular safety meetings, insist on PPE, and have clear procedures for tough jobs. A clean claims history is your single best negotiating tool.

Next, look into bundling your policies. You can often get a solid discount by getting your General Liability, Commercial Auto, and a Business Owner's Policy (BOP) from the same company. It’s one of the easiest ways to see immediate savings.

You can also opt for a higher deductible. This is the amount you pay out-of-pocket on a claim before the insurance kicks in. Agreeing to a higher deductible shows the insurer you have some skin in the game, and they'll usually lower your premium in return. Just make sure you can comfortably cover that amount if something happens.

Finally, make it a habit to review your coverage with your agent once a year. Your business doesn't stand still, and your insurance shouldn't either. An annual check-in makes sure you’re not paying for things you don’t need or missing a crucial protection you now do.

My Insurance Covers On-the-Job Accidents, But What About Damage From Faulty Work I Did Months Ago?

Great question, and it gets to the heart of a non-negotiable coverage for plumbers. The short answer is yes, this is usually covered, but only if your General Liability policy includes "completed operations" coverage. This is specifically designed to protect you from claims that pop up long after you've left the job site.

Here's a real-world scenario: You install a new shower valve. Everything looks great. But six months later, a connection you made inside the wall begins a slow, silent leak. By the time the homeowner notices, they have a massive water damage and mold problem on their hands. You can bet they'll be coming to you to pay for it.

This is exactly what completed operations coverage is for. It covers the liability for property damage or injuries that happen because of your work after the job is done. Without it, your business is exposed to ticking time bombs that could go off months or even years down the road. It’s a vital long-term shield for your business.

Navigating the complexities of business insurance for plumbers is a critical part of protecting your livelihood. At Wexford Insurance Solutions, our specialists understand the unique risks you face and are dedicated to finding you the right coverage at a competitive price. To get a clear, no-obligation quote and ensure your business is fully protected, visit us at https://www.wexfordis.com.