So, you're wondering if your homeowners insurance will cover your fence. It’s a great question, and the short answer is yes, it usually does. But—and this is a big but—it all boils down to what caused the damage.

Think of your insurance policy as a safety net for unexpected disasters, not a maintenance plan. If a sudden storm knocks your fence down or a neighbor’s tree falls on it, you’re likely covered. If it simply rots away over time, that's a different story.

How Your Policy Actually Sees Your Fence

When we talk about fence coverage, we're not talking about the main part of your policy that covers your house. Instead, we're looking at a specific section called Coverage B, often labeled "Other Structures."

This part of your policy is designed to protect things on your property that aren't physically attached to your main house. This includes your fence, but also things like a detached garage, a shed, or even a gazebo. The coverage limit for these structures is typically 10% of your home's total insured value.

Covered Perils: What Insurance Likes to See

For your fence damage claim to be approved, the cause must be what the insurance world calls a "covered peril." These are specific, sudden, and accidental events listed right there in your policy documents. To get a deeper dive into these terms, our comprehensive guide to homeowners insurance is a great resource.

Here are the most common perils that lead to a successful fence claim:

- Weather Damage: Heavy windstorms, hail, or the sheer weight of snow and ice.

- Falling Objects: A tree or a large branch crashing down onto your fence.

- Impact: A car veering off the road and hitting your fence is a classic example.

- Fire & Vandalism: If your fence is damaged by fire or intentionally destroyed by someone else.

The golden rule is this: insurance is for the unexpected. If an event was sudden, accidental, and completely out of your control, you have a solid foundation for a claim.

Common Exclusions: What Insurance Won't Cover

Now for the flip side. Insurance companies expect homeowners to maintain their property. They will almost always deny claims for damage that happens slowly over time or could have been prevented.

You'll find that standard policies typically exclude:

- General Wear and Tear: This includes wood rot, rust on a metal fence, or warping from age.

- Pest Infestations: Damage from termites, carpenter ants, or other critters is considered a maintenance issue.

- Earth Movement: Things like earthquakes, sinkholes, or landslides require separate, specialized coverage.

- Flooding: Standard homeowners policies do not cover flood damage; you need a separate flood insurance policy for that.

Basically, if the damage is a result of neglect or gradual decay, the repair bill will be on you.

To make it simple, here’s a quick breakdown of what you can generally expect.

Fence Coverage At a Glance

| Typically Covered Scenarios | Typically Excluded Scenarios |

|---|---|

| A strong windstorm blows over a section | The wood posts have rotted at the base |

| A healthy tree falls on it during a storm | Termites have eaten through the panels |

| A neighbor backs their car into it | The fence has rusted and fallen apart over time |

| It's damaged by hail or fire | Damage from a flood or an earthquake |

| Vandalism or malicious mischief | Mold or fungus growth from lack of upkeep |

This table is a great starting point, but always remember to check your specific policy documents. That's where the real answers are.

How Your Policy Protects Your Fence

When your fence gets damaged, trying to figure out where it fits into your insurance policy can feel a bit like a puzzle. The answer is almost always found in a section called Coverage B, also known as "Other Structures" coverage. This is the part of your policy that protects things on your property that aren't physically attached to your house.

Think of it this way: your main house is protected under Coverage A (Dwelling Coverage). Everything else—your fence, a detached garage, a tool shed, even a gazebo—falls under the separate umbrella of Coverage B. This distinction is key because how much coverage your fence gets is directly linked to how much your home is insured for.

Calculating Your Coverage Limits

Typically, the coverage for "other structures" is set at 10% of your home's dwelling coverage. So, if your house is insured for $400,000 (Coverage A), your policy automatically sets aside $40,000 to cover all your other structures, including your fence.

However, that's not always a hard and fast rule. While that 10% is standard, some insurance companies give you the option to increase it. It's possible to find policies that let you bump up your Coverage B to as much as 30% of your dwelling coverage. On that same $400,000 home, a 30% limit would give you a much beefier $120,000 in protection for your fence and other structures. If you're curious about these options, it's worth taking a look at how different insurers explore policy structures.

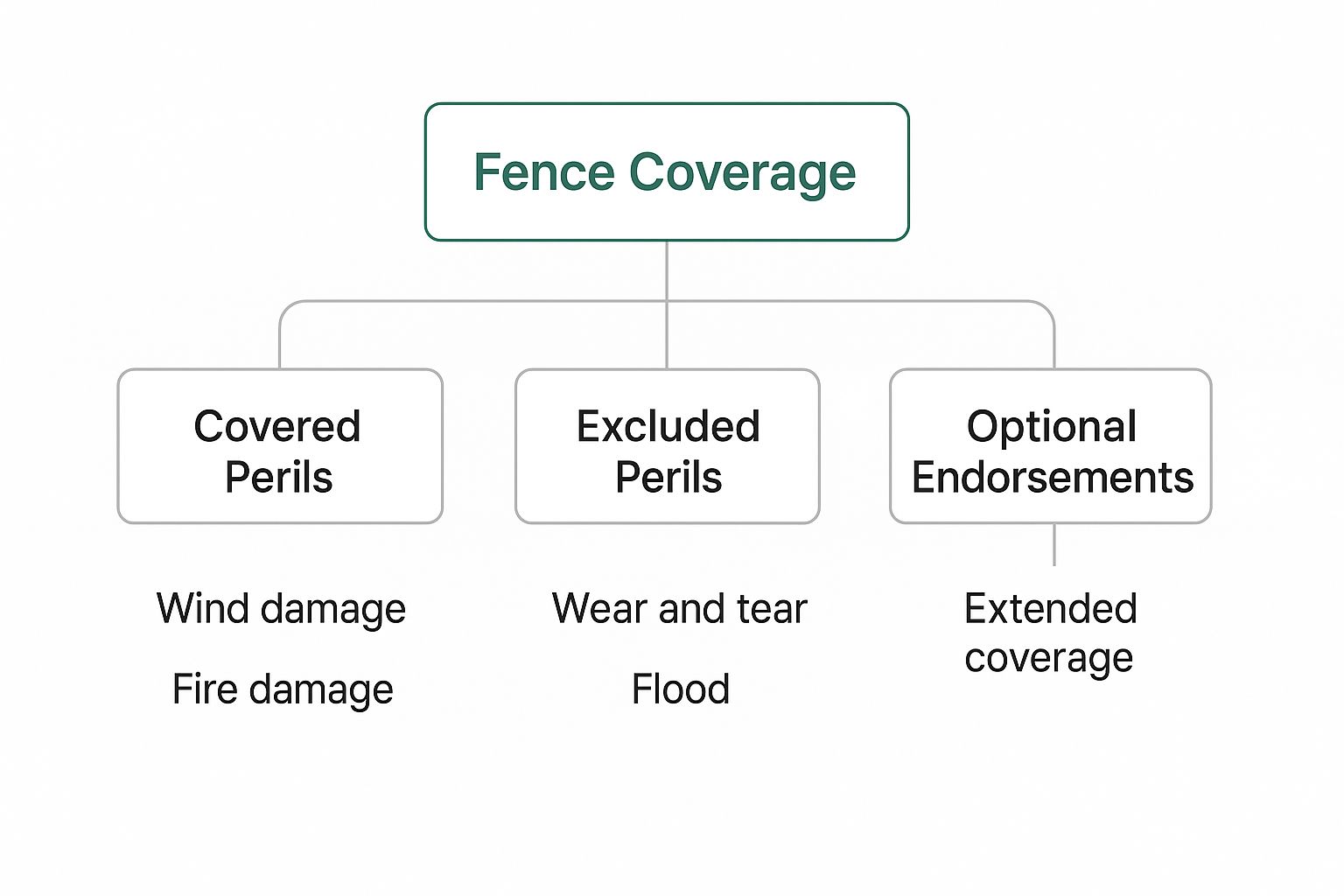

This infographic gives a great visual breakdown of what's usually covered and what's not when it comes to your fence.

As you can see, standard policies are really designed to handle sudden, accidental events like storms or a tree falling. Slow, gradual problems like rot or pest damage? That's generally considered part of regular homeowner maintenance.

The Role of Your Deductible

Before your insurance company cuts a check for a fence repair, you have to meet your deductible. This is simply the amount of money you've agreed to pay out of your own pocket for any claim. Deductibles commonly range from $500 to $2,500 or even more.

Let's walk through an example. Imagine a heavy windstorm knocks over a few sections of your vinyl fence, and the repair quote is $1,800. If you have a $1,000 deductible, you'll pay that first, and your insurance provider will cover the remaining $800.

Because you always have to pay the deductible first, it often doesn't make financial sense to file a claim for minor fence damage. Filing a small claim might only get you a few hundred dollars, but it could lead to higher insurance premiums down the road—costing you more in the long run.

This is a crucial calculation every homeowner needs to make. It’s usually best to save your insurance for major, expensive damage that goes well beyond your deductible. This way, you get real value from your policy without risking a rate hike over a small repair you could have handled yourself.

Real-World Scenarios Where Your Fence Is Covered

Insurance policies can feel a bit theoretical, full of jargon that doesn't always click until something actually happens. So, let's bring it down to earth and walk through a few real-world examples of when your homeowners insurance will likely cover fence damage.

The guiding principle here is that the damage needs to be from a sudden and accidental event—not the result of slow-burn issues like rot or neglect. These scenarios showcase the "covered perils" that trigger your policy's protection.

Example 1: The Surprise Blizzard

Imagine a freak blizzard rolls in, dumping two feet of heavy, wet snow. The weight is too much for a large, otherwise healthy oak tree in your neighbor's yard. A massive branch snaps off, completely crushing a 20-foot section of your vinyl fence.

This is a textbook covered claim. The damage was caused by the weight of snow and ice, a standard peril in most policies. Since the tree wasn't dead or rotting (which would be a maintenance issue), this is considered an "act of God," and you'd file a claim under your own policy to fix your fence.

Example 2: The Powerful Windstorm

A nasty thunderstorm barrels through your neighborhood with wind gusts topping 60 mph. When you check the next morning, you find several panels of your wooden fence have been ripped clean off their posts, leaving a huge gap.

This is another straightforward situation where your insurance should step in. Wind is one of the most common reasons people file fence claims. The damage was sudden and direct, fitting the criteria perfectly for a covered event.

Keep in mind that insurers typically cover only the damaged sections. They usually won't pay to replace the entire fence just for a perfect match, unless the storm compromised the whole structure.

Example 3: The Distracted Driver

You're inside when you hear a sudden, loud crash. A distracted driver looking at their phone has swerved off the road and plowed right through the corner of your chain-link fence, mangling the gate and a few posts.

Damage from vehicles is an explicitly covered peril. In this case, you'd file a claim with your own insurance company. Your insurer would then likely go after the driver's auto insurance to get reimbursed for the payout—a process called subrogation.

It’s worth noting that while a car hitting your fence is covered, damage from rising water is not. To understand why, you can learn more by comparing flood insurance vs homeowners insurance and see what each policy is designed for.

Example 4: An Act of Vandalism

You wake up one morning to find your new fence has been defaced with spray-painted graffiti. This is considered vandalism, or "malicious mischief" in insurance terms.

Vandalism is a covered peril. Your policy should cover the cost to clean, repaint, or even replace the damaged sections of your fence, after you pay your deductible. In any of these situations, your very first step should always be to pull out your phone and take plenty of pictures to document the damage.

Common Reasons a Fence Claim Is Denied

Knowing what your insurance doesn't cover is just as critical as knowing what it does. Think of your policy as protection against sudden, accidental disasters—not a long-term maintenance plan for issues that creep up over the years.

Let's say a big storm rolls through and knocks over a section of your fence. If that fence was already leaning and rotting, the insurance company might deny your claim. Their logic is pretty straightforward: they're there to cover the damage from the storm, not the pre-existing neglect.

Gradual Damage and Lack of Upkeep

By far, the most common reason for a denied fence claim is gradual damage. Insurers expect homeowners to keep their property in good shape, and if they see that you haven't, it can spell trouble for your claim.

Here are a few classic examples of gradual damage that insurance won't touch:

- Slow Rot and Rust: Wooden posts rotting away at the ground level or a chain-link fence rusting out over several seasons are considered maintenance problems, not insurable events.

- Wear and Tear: Every fence gets old. Fading paint, warped boards, and general aging from being out in the elements simply aren't covered.

- Pest Infestations: Damage from termites, carpenter ants, or other critters is almost universally excluded because it's seen as a preventable maintenance issue.

An adjuster might deny a claim for wind damage if they show up and find the fence posts were already crumbling from rot. They'll argue that the storm was just the final push for a structure that was already failing.

Excluded Perils and Structural Type

Beyond basic maintenance, some disasters just aren't covered by a standard homeowners policy. Damage from flooding is a perfect example; you need a completely separate flood insurance policy for that. The same goes for damage caused by earthquakes or other earth movements.

You also have to consider the type of fence. Your policy is designed for the permanent fence around your yard, not temporary structures. For example, a claim for damage to temporary fencing used for construction would almost certainly be denied because it’s not a permanent part of your property.

It's also important to remember how you'll get paid if your claim is approved. Most policies pay out based on Actual Cash Value (ACV), which factors in depreciation. So, if your 15-year-old fence gets destroyed, you won’t get the money for a brand-new one; you'll get what the 15-year-old fence was worth right before it was damaged. For a deeper dive, check out our guide on common insurance claim denial reasons.

Actual Cash Value vs. Replacement Cost

When it comes to a fence claim, how your insurance company calculates the check they cut you is everything. It boils down to two very different approaches: Actual Cash Value (ACV) and Replacement Cost Value (RCV). The one you have in your policy can mean a difference of thousands of dollars.

Think of it like this: Actual Cash Value is the "used" value of your fence. It doesn't give you what you need for a brand new one; it pays you what your specific fence was worth right before it was damaged. It’s the sticker price minus years of wear, tear, and weather.

Replacement Cost Value, on the other hand, is the real-deal. This coverage gives you the full amount it would take to build a brand new, similar fence today, based on current material and labor prices. It's designed to make you whole again without you having to foot a huge portion of the bill.

How Depreciation Changes Everything

Depreciation is the secret ingredient that makes these two coverages so different. With an ACV policy, the insurance adjuster will calculate how much value your fence has lost over time and subtract that from your payout.

Let's walk through a real-world example to see the impact.

- Original Fence Cost: You built a nice wood fence 10 years ago for $5,000.

- Fence Lifespan: A wood fence like yours is expected to last about 20 years.

- Cost to Replace Today: With prices for lumber and labor way up, an identical new fence now costs $8,000.

The ACV Math: Since your fence is halfway through its 20-year lifespan, it has depreciated by 50%. The insurance company takes the current replacement cost ($8,000) and subtracts that 50% depreciation ($4,000). You’d get a check for just $4,000, leaving you to come up with the other $4,000 yourself.

If you had an RCV policy, you'd be in a much better spot. You would receive the full $8,000 needed to replace the fence (after you pay your deductible, of course).

So, Which Coverage Do You Have?

Here's the thing: most standard homeowners policies automatically cover structures like fences at Actual Cash Value. It's the default because it keeps the premium a bit lower. But the tradeoff is a much smaller payout when you actually need it.

The good news is you can usually upgrade to Replacement Cost Value coverage. It's a smart move, especially if your fence is newer or was a significant investment. For a deeper dive into how this works, check out our guide on what is replacement cost coverage.

Pull out your policy's declaration page or give your agent a call to see what you have. Making that small upgrade now can save you from a massive headache and an even bigger out-of-pocket expense down the road.

Filing a Successful Fence Damage Claim: A Step-by-Step Guide

The sound of a cracking tree limb or the screech of tires is often the first sign of trouble. When you look outside and see your fence in pieces, it's easy to feel overwhelmed. But take a deep breath. Getting your fence fixed and paid for by insurance isn't about luck; it's about having a clear, simple plan.

The very first thing you need to do—before you call anyone or move a single splinter—is to grab your phone and play detective. Document absolutely everything. Walk around the damaged area and take photos and videos from every possible angle. Get close-ups of the snapped posts, wide shots showing the entire section that's down, and if you can, capture the cause of the damage, like the tree branch still lying on the fence. This visual evidence is your single most powerful tool.

Once you have a solid record of the scene, your next job is to make sure the problem doesn't get any worse.

Taking the Right First Steps

Your insurance company expects you to take reasonable steps to prevent further damage. This could be as simple as propping up a wobbly section so it doesn't topple over completely or clearing away the debris. But, and this is important, do not start any permanent repairs. If you rebuild a section before the insurance adjuster has a chance to see it, you could seriously complicate or even void your claim.

With the immediate situation stabilized, it’s time to get the ball rolling.

- Contact Your Insurer Right Away: Don't put this off. The sooner you report the damage to your agent or insurance company, the better. Have your policy number handy to make the call go smoothly.

- Get a Few Repair Quotes: Call at least two or three local, reputable fence contractors and ask them for detailed written estimates. Make sure they separate the costs for materials and labor. This shows your insurer that you're being proactive and fair.

- Keep a Detailed Log: This is a pro tip. Start a simple journal or a note on your phone. Every time you talk to someone from the insurance company, jot down the date, time, their name, and a quick summary of what you discussed. Keep all your emails in one folder, too.

This kind of careful record-keeping will be your best friend as you move through the homeowner insurance claim process and helps ensure no detail gets missed.

How to Prove Your Case and Get Paid

Want to know a secret that makes claims almost foolproof? "Before" pictures. Every year or so, on a nice sunny day, take a few pictures of your fence. Having a clear photo of your sturdy, well-maintained fence from before the incident happened is the best way to counter any suggestion that the damage was just old age or poor upkeep.

When the adjuster comes to your property, imagine handing them a folder with clear "before" and "after" photos, three competitive repair bids, and a neat log of all your communications. You're not just a homeowner with a problem; you're an organized, responsible partner in the process. This makes their job easier and gets your claim approved much faster.

By following these steps, you take control of the situation. A well-organized, well-documented claim is almost always a successful one.

Your Top Questions About Fence Coverage, Answered

Even after you've read your policy front to back, real-life situations can throw you a curveball. Let's walk through some of the most common questions and sticky situations homeowners run into with fence damage.

What Happens if My Neighbor's Tree Smashes My Fence?

This is a classic, and the answer surprises a lot of people. In nearly every case, you file the claim with your own insurance company. The damage happened on your property, so it's your policy that kicks in first. It's as simple as that.

Now, your insurer might decide to go after your neighbor's insurance to get their money back. This is called subrogation, and it only really works if they can prove your neighbor was negligent—for instance, if they knew the tree was dead or rotting and did nothing about it. But that's their battle to fight. Your first and only call should be to your own agent.

Is a Fence I Share With My Neighbor Covered?

Boundary fences are a bit of a gray area, and the answer often comes down to local property laws. Generally, the most straightforward path is for both you and your neighbor to file separate claims with your own insurance providers.

Think of it as a 50/50 split. Each insurance company will likely cover its policyholder's share of the repair or replacement costs for that shared fence. The key is communication. Chat with your neighbor first, get on the same page, and then both of you can contact your insurance agents to get the ball rolling together.

Should I File a Claim for Just a Few Broken Boards?

Honestly, probably not. Before you do anything, you have to consider your deductible. That's the amount you have to pay out-of-pocket before your insurance kicks in a single dollar.

Let's say a section of your fence will cost $1,200 to fix, but your deductible is $1,000. If you file a claim, the insurance company is only going to cut you a check for $200. For that small amount, you risk seeing your premiums go up at your next renewal. It's often much smarter in the long run to handle those smaller repairs yourself.

And for those with more complex setups, like automated gates, the stakes are even higher. Getting familiar with how they work is a good idea; a practical guide to driveway gates is a great resource for understanding their value and maintenance.

Figuring all this out on your own can be a headache. At Wexford Insurance Solutions, we make it our job to help you understand what your policy actually says before you need it. Reach out to us for a policy review today at https://www.wexfordis.com and get the clarity you deserve.

Business Insurance for Plumbers | Protect Your Plumbing Business

Business Insurance for Plumbers | Protect Your Plumbing Business What Is Fiduciary Liability Insurance? Key Facts You Need to Know

What Is Fiduciary Liability Insurance? Key Facts You Need to Know