Getting an insurance claim denied feels like a gut punch, but it’s rarely the end of the road. To turn things around, you need a plan. It all starts with understanding exactly why the insurer said "no," then methodically building a case to prove them wrong and submitting a formal appeal. This takes patience and a bit of organization, but when you know the steps, you can challenge the decision with confidence.

So, Why Was Your Claim Actually Denied?

That denial letter isn't a final verdict; it's your starting point. Think of it as the insurer showing their hand. Your first move is to read that letter—every single word of it—to understand their reasoning. This is the blueprint for your entire counter-argument.

Insurance companies deny claims for all sorts of reasons. Sometimes it's a simple clerical error, and other times it's a deep disagreement over what your policy covers. It’s easy to feel overwhelmed, but many denials can be overturned once you get to the heart of the issue.

Expert Insight: Don't view a denial letter as a rejection. See it as an explanation of the insurance company's position. Your mission is to find the holes in their logic and use evidence to show why your claim is valid according to the terms of your own policy.

Getting to the Bottom of Their Decision

Your denial letter will point to specific parts of your policy, usually citing exclusions or provisions. Don't just take their word for it. Pull out your full policy document and read those sections for yourself. Does their interpretation hold up? You'd be surprised how often a denial stems from a simple misunderstanding or a paperwork mix-up that you can fix quickly.

Of course, denials can also be based on more complex issues. Common culprits include:

- Not Enough Proof: They might feel you didn't provide sufficient documentation of your loss or damage.

- Coverage Gaps: The event that caused the damage, like a flood or earthquake, may be explicitly excluded from your standard policy.

- A Lapsed Policy: The incident might have happened during a period when your premiums weren't paid and the policy was inactive.

- Filing Too Late: Every policy has a deadline for submitting a claim, and you might have missed it.

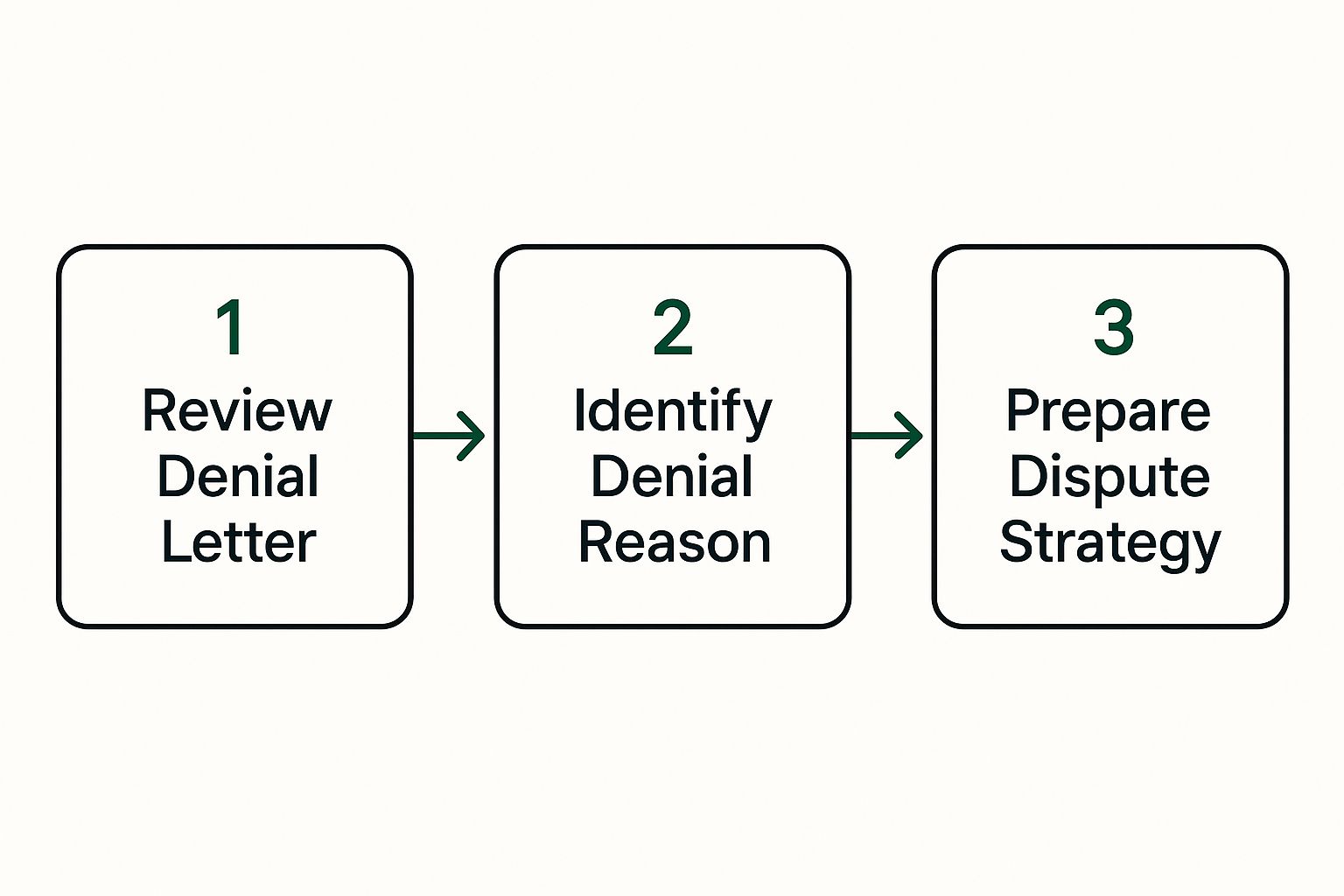

This visual guide lays out the basic path for getting your dispute started.

As you can see, everything hinges on that initial review of the denial letter. It dictates every move you make next. Getting familiar with the various common insurance claim denial reasons can help you quickly classify the insurer's argument and build a laser-focused response.

Once you’ve pinpointed the exact reason for the denial, your mindset can shift from reactive to proactive. You're no longer just dealing with a problem; you're building a case.

To help you stay organized, here's a quick overview of the process.

Quick Guide to the Insurance Dispute Process

This table breaks down the main stages of disputing a claim, helping you focus on the right goal and action at each step of the way.

| Stage | Your Primary Goal | Key Action |

|---|---|---|

| Initial Review | Understand the exact reason for the denial. | Scrutinize the denial letter and cross-reference it with your policy. |

| Evidence Gathering | Collect documents that directly counter the insurer's reason. | Gather photos, receipts, expert reports, and communication records. |

| Formal Appeal | Clearly and professionally state your case in writing. | Write a detailed appeal letter and submit it with all your evidence. |

| Follow-Up | Keep the process moving and hold the insurer accountable. | Call or email to confirm receipt and ask for a timeline. |

| Escalation | Bring in outside help if the appeal is unsuccessful. | Contact a public adjuster, lawyer, or your state's DOI. |

Following these stages provides a structured approach, ensuring you don't miss any critical steps in fighting for the coverage you deserve.

Gathering Evidence to Build Your Case

Once you know why your claim was denied, it’s time to start building your counter-argument. A successful dispute isn't won by complaining louder; it’s won with cold, hard facts.

Think of it this way: you’re not just disagreeing with your insurer, you're constructing an airtight case. Every single document and photo you collect is a building block that strengthens your position and makes it harder to ignore.

Start With Your Core Documentation

Before you go digging for new evidence, the first step is to get organized. Pull together everything you already have into one place. This will be your master file.

- Your Original Claim: Get a complete copy of everything you first sent to the insurance company.

- The Denial Letter: This document is your roadmap. It tells you exactly which arguments you need to dismantle.

- Your Full Insurance Policy: Don't just grab the summary page. You need the entire policy, with all its definitions and exclusions, to find the specific language that supports your claim.

- All Correspondence: Every email, every letter, every note you took during a phone call. Jot down dates, times, and the names of who you spoke with—it all matters.

With these documents organized, you can clearly see the battlefield. If you're dealing with a home insurance claim, for example, your evidence will be very different from that of an auto accident. You can review the standard homeowner insurance claim process to get a better feel for the specific documents you'll need.

Find the Proof That Changes Minds

Now, you can focus on gathering new evidence that directly contradicts the insurer's reason for denial. Your mission is to provide proof so undeniable that it leaves no room for debate.

Let’s say your insurer denied a water damage claim by arguing it was a "long-term leak" caused by poor maintenance. Your job is to prove it was sudden and accidental. An independent plumber’s report stating the pipe burst due to a manufacturing defect, not neglect, completely torpedoes their argument. That one piece of paper can change everything.

Pro Tip: Never rely solely on the insurer's preferred contractor. If their estimate seems low, get two or three of your own from reputable, independent professionals. A significant difference in repair costs is powerful proof that their initial assessment was inadequate.

Here’s a checklist of the kind of compelling evidence that gets results:

- Photos and Videos: Go beyond simple snapshots. Take wide shots to show the context of the damage, then get close-ups of the details. Even better, shoot a video where you walk through the damage and narrate what happened.

- Official Reports: A police report after a car crash or a report from the fire department after a house fire are gold. They provide an unbiased, third-party account of the event.

- Independent Repair Estimates: Don’t just get a total; ask for detailed, itemized estimates that break down labor and material costs.

- Receipts and Invoices: Did you have to pay for a tarp to cover a hole in your roof to prevent more damage? Keep that receipt. You'll also need proof of value for damaged items, like the original receipt for that new TV or a bank statement showing its purchase.

By methodically gathering this proof, you shift the conversation. Your claim is no longer just your word against theirs—it's a well-documented, fact-based argument they have to take seriously.

How to Write a Powerful Dispute Letter

Now that you have all your evidence lined up, it's time to put it all together in the centerpiece of your appeal: the formal dispute letter. This isn't just a quick email—it's a professional, persuasive document that officially challenges the insurance company's decision.

The goal here is to be firm and factual, not emotional. When you're formally disputing a denial, this letter is your appeal. Learning how to write an effective appeal letter is a skill that can dramatically improve your odds by framing your argument for maximum impact. Keep your tone confident and your language crystal clear.

The Essential Components of a Strong Letter

Your letter needs a logical structure that makes your argument impossible to ignore or misunderstand. Think of it as walking the claims manager through your reasoning, one solid point at a time.

Make sure to include these key elements right at the top:

- Your Contact Information: Full name, address, and phone number.

- Insurer’s Information: Address it directly to the claims adjuster or manager handling your file.

- Claim Details: State your full name, policy number, and the claim number so they can find it instantly.

- Date of the Letter: This is non-negotiable for your records.

Getting this foundational information right from the start ensures your letter lands on the right desk and is immediately connected to your claim file, heading off any potential administrative mix-ups.

Crucial Tip: Always—and I mean always—send your dispute letter via certified mail with a return receipt requested. This gives you a legal paper trail, proving exactly when the insurance company got your appeal. It adds a layer of seriousness and accountability they can't ignore.

Crafting Your Rebuttal

The body of your letter is where you systematically take apart the insurer's denial. You need to be direct and back up every single statement with the proof you've collected.

Kick things off with a clear statement of purpose. Something like, "I am writing to formally dispute the denial of my claim (Claim #XXXX) for water damage at my property," sets a professional tone right away.

From there, you need to address their reasoning head-on. Pull out their denial letter and methodically counter each point they made.

- State Their Reason: "Your denial letter dated [Date] stated the claim was denied because the damage was attributed to a long-term leak."

- Present Your Counter-Evidence: "This conclusion is incorrect. As you will see in the enclosed report from ABC Plumbing (Exhibit A), the damage was the direct result of a sudden pipe burst on [Date]."

- Reference Your Policy: Point them to the exact language in your policy that supports your case. This is where knowing https://wexfordis.com/2025/09/06/how-to-read-insurance-policy/ really pays off, as you can quote the specific section covering "sudden and accidental" water damage.

Wrap it up by clearly stating what you expect to happen next. Don't be vague. "I request a full reversal of this denial and prompt payment of $XX,XXX, as detailed in the enclosed independent repair estimate from XYZ Construction (Exhibit B)."

Finally, let them know you expect a response within a reasonable timeframe, like 30 days. This puts the ball firmly in their court.

Talking to Your Insurance Company: How to Handle the Conversations

Once your dispute letter is in the mail, the game changes. You’re no longer just collecting documents; you're actively negotiating. The way you handle conversations with your insurance adjuster from here on out can make or break your case. The secret? Stay calm, be professional, and keep bringing it back to the facts.

It’s completely understandable to feel angry or frustrated, especially when you believe your claim was handled unfairly. But letting those emotions take over won’t get you anywhere. Think of every phone call and email as a business negotiation where your only goal is to present your case clearly and persistently.

Keeping the Conversation on Your Terms

In every interaction, your main job is to protect your own interests. Remember, the adjuster’s goal is to settle the claim while saving the company money. This means anything you say could be used to support their original denial or low offer.

To make sure you’re in control, follow these ground rules for every single conversation:

- Stick to the Facts: Only talk about what you absolutely know and can prove with your documentation.

- Don't Guess: Never speculate about what caused the damage or what might have happened. Stick to what you know for sure.

- Never Say Sorry: Avoid saying "I'm sorry" or anything that sounds like you’re admitting even a little bit of fault. It can be twisted to mean you're accepting blame.

- Document Everything: After a phone call, immediately send a follow-up email. Briefly summarize what was discussed and any agreements made. This creates a paper trail you can rely on.

Learning how to deal with insurance adjusters effectively is a skill, and honing it can seriously improve your chances of a better outcome.

Managing Timelines and Your Own Sanity

A big reason people get so frustrated is the waiting. It can feel like the process is moving at a snail's pace. In fact, a recent Accenture survey showed that 31% of policyholders weren't happy with their claims experience. And for 60% of that unhappy group, slow settlements were the main reason.

Takeaway: Your paper trail is your best friend. Every email, every letter sent via certified mail, and every note from a phone call strengthens your position. This documentation is invaluable if you need to escalate the dispute later.

You have to be the one to push the process forward. In every conversation, ask for a clear timeline for the next steps. "When can I expect to hear back from you?" should be a question you ask every time.

If you’re unsure what a reasonable wait time is, our guide on https://wexfordis.com/2025/08/26/how-long-does-the-insurance-claim-process-take/ can give you a much better idea. By staying organized and politely persistent, you send a clear message: you’re serious about getting a fair resolution.

When to Escalate Your Insurance Dispute

So, you’ve done everything right. You sent the dispute letter, provided all your evidence, and patiently followed up, but the insurance company just won’t see reason. This is exactly where most people get discouraged and walk away, but for you, it’s time to shift gears.

If your direct appeal has hit a brick wall, it doesn't mean the fight is over. It just means you need to bring in someone who speaks the insurer's language a little more forcefully. This is when you escalate.

The numbers don't lie. In the US, a staggering 19% of in-network health insurance claims are denied. Yet, fewer than 1% of those denials are ever formally appealed. That’s a huge gap, especially when you learn that appeal success rates can climb as high as 82%. Persistence really is key. These aren't just abstract figures; you can read the full research on insurance claim payout statistics and see for yourself how often a well-managed appeal wins.

Bringing in the Professionals

When your own efforts aren't enough, it's time to call for backup. You generally have three paths you can take, and knowing which one to choose can make all the difference.

- Public Adjusters: These are state-licensed professionals who work on your behalf, not the insurance company’s. They are pros at spotting overlooked damage, dissecting complex policy language, and negotiating a much better settlement. They typically work on a contingency fee, meaning they only get paid if you do.

- Attorneys: If your claim is large, involves potential bad faith practices by the insurer, or has tangled legal threads, an attorney is your strongest ally. They have the power to file a lawsuit, which gives them serious leverage to compel a fair outcome.

- State Department of Insurance (DOI): Every state has a watchdog agency to oversee insurance companies. Filing a complaint is free and can light a fire under the insurer. No company wants to be on the receiving end of regulatory scrutiny.

If you're so fed up that you're considering a fresh start, it might be time to look for a new carrier. We have a great guide on how to switch insurance companies when you get to that point.

Choosing the Right Path for Your Dispute

Okay, so which professional do you call? The answer really hinges on the nature of your disagreement with the insurer.

Key Takeaway: If the dispute is about the dollar amount of the settlement (like the insurer lowballing your repair estimate), a public adjuster is usually the smartest and most cost-effective first move. But if the insurer has denied your claim entirely or is acting in bad faith, you'll likely need an attorney.

Here’s a quick way to think about it:

| Situation | Best Professional to Call | Why? |

|---|---|---|

| The insurer’s offer is just too low. | Public Adjuster | They’re experts at documenting the true extent of damages and have the negotiation skills to get you more. |

| Your claim was completely denied. | Attorney | A lawyer can legally challenge the insurer's interpretation of your policy and sue if necessary. |

| You suspect bad faith or unfair practices. | Attorney & State DOI | The attorney pursues legal damages for bad faith, while the DOI investigates and can penalize the company. |

Escalating is all about leveling the playing field. Your insurance company has a whole team of experts protecting its bottom line. It's only fair that you have one protecting yours.

So, you’ve received a denial letter. Before you jump to conclusions, it’s crucial to understand what’s happening behind the scenes. Knowing why an insurer denies a claim is your first strategic advantage in building a successful dispute.

Insurers are in a tough spot. They’re businesses that need to remain profitable, which means managing costs and, most importantly, fighting fraud. This isn't personal; it's just the reality of the industry.

The Double-Edged Sword of Fraud Prevention

To combat fraud, insurance companies have rolled out sophisticated, often automated, review systems. Your claim might have been perfectly legitimate, but it could have been flagged by an algorithm for a tiny inconsistency—something as simple as a mismatched date on a receipt.

The system isn't accusing you of anything. It’s simply designed to pause and scrutinize anything that looks even slightly out of the ordinary.

Opportunistic fraud, like padding a claim by exaggerating losses, is a massive headache for the industry. Believe it or not, as many as one in every 30 claims is touched by some type of fraud. That statistic is precisely why insurers have become so strict with their documentation requirements.

You can learn more about the global rise in insurance fraud and see how it affects honest policyholders. When a claim gets flagged, the burden of proof immediately shifts to you to prove every single detail.

Here’s the key takeaway: A denial isn't always a final judgment on your character or your claim. More often than not, it’s an automated response to a red flag. Your job is to step in and provide the human context the system missed, backing it up with solid proof.

Once you start seeing things from their perspective—a constant balancing act between paying valid claims and stopping fraud—you can get ahead of their arguments. You’ll know exactly what kind of documentation they need to see to feel confident in approving your claim.

Frequently Asked Questions About Disputing a Claim

When your insurance company denies a claim, it's natural to have a lot of questions running through your mind. It can feel overwhelming, but knowing what to expect is the first step toward getting the payout you deserve. Let's walk through some of the most common concerns I hear from policyholders.

How Much Will It Cost to Fight a Denial?

This is usually the first thing people ask. The good news is, you have options, and some of them are completely free.

Filing a formal complaint with your state's Department of Insurance won't cost you a dime. It's a powerful first step and can often get an insurer to take a second look at your file.

If you decide to bring in professional help, like a public adjuster or an attorney, they typically work on a contingency fee. This means they don't get paid unless you do. Their fee is a percentage of the settlement they secure for you, which usually ranges from 10% to 20%.

How Long Does This Whole Process Take?

Patience is key here, but there are rules in place to keep things moving.

State regulations generally require insurers to acknowledge your appeal and give you a final decision within a set period, often somewhere between 30 and 60 days.

Of course, a straightforward dispute might resolve within that window. But if your case is particularly complex and requires multiple rounds of negotiation or escalation, it could stretch out for several months.

Will Disputing My Claim Make My Rates Go Up?

This is a valid fear, but it's mostly unfounded. Filing a claim in the first place can sometimes affect your future premiums, depending on the type and frequency of claims.

However, simply disputing the outcome of that claim doesn't typically impact your rates. You're not being penalized for holding the insurance company to their end of the bargain—you're just advocating for your rights under the policy you've been paying for.

Key Takeaway: Remember, no one will fight for your claim as hard as you will. Don't hesitate to ask tough questions, demand clear answers, and be persistent. More often than not, simply refusing to take "no" for an answer is what turns a denial into a paid claim.

Navigating the claims process can feel like a full-time job, but you don't have to go it alone. The experts at Wexford Insurance Solutions offer intelligent claims advocacy to ensure you get a fair outcome. Discover how our personalized service can protect you at https://www.wexfordis.com.