So, you've found a crack in your foundation and your first thought is, "Will my homeowners insurance cover this?" The honest answer? It's a solid maybe.

When it comes to foundation problems, your insurance policy is less concerned with the damage itself and more focused on what caused it. This is the single most important thing to understand. Insurers are looking for a specific, sudden, and accidental event—not a problem that’s been slowly developing for years.

Think of your policy as a safety net for unexpected disasters, not a warranty for your house. A pipe that bursts and washes away the soil supporting your foundation? That's a sudden event, and you've got a good chance of being covered. But those hairline cracks that have slowly widened as the house has settled over the past decade? Your insurer will almost certainly view that as a maintenance issue, which is your responsibility.

What's a "Covered Peril" and What's an "Exclusion"?

Every standard homeowners policy has a list of what it will and won't cover. The things it does cover are called "perils." Think of things like fire, lightning, explosions, or windstorms.

Interestingly, severe weather is a huge driver of foundation-related claims. In fact, wind and hail alone were responsible for a staggering 42% of all homeowners insurance losses between 2018 and 2022. You can dig deeper into insurance claim statistics and their financial impact over at Guardian Service.

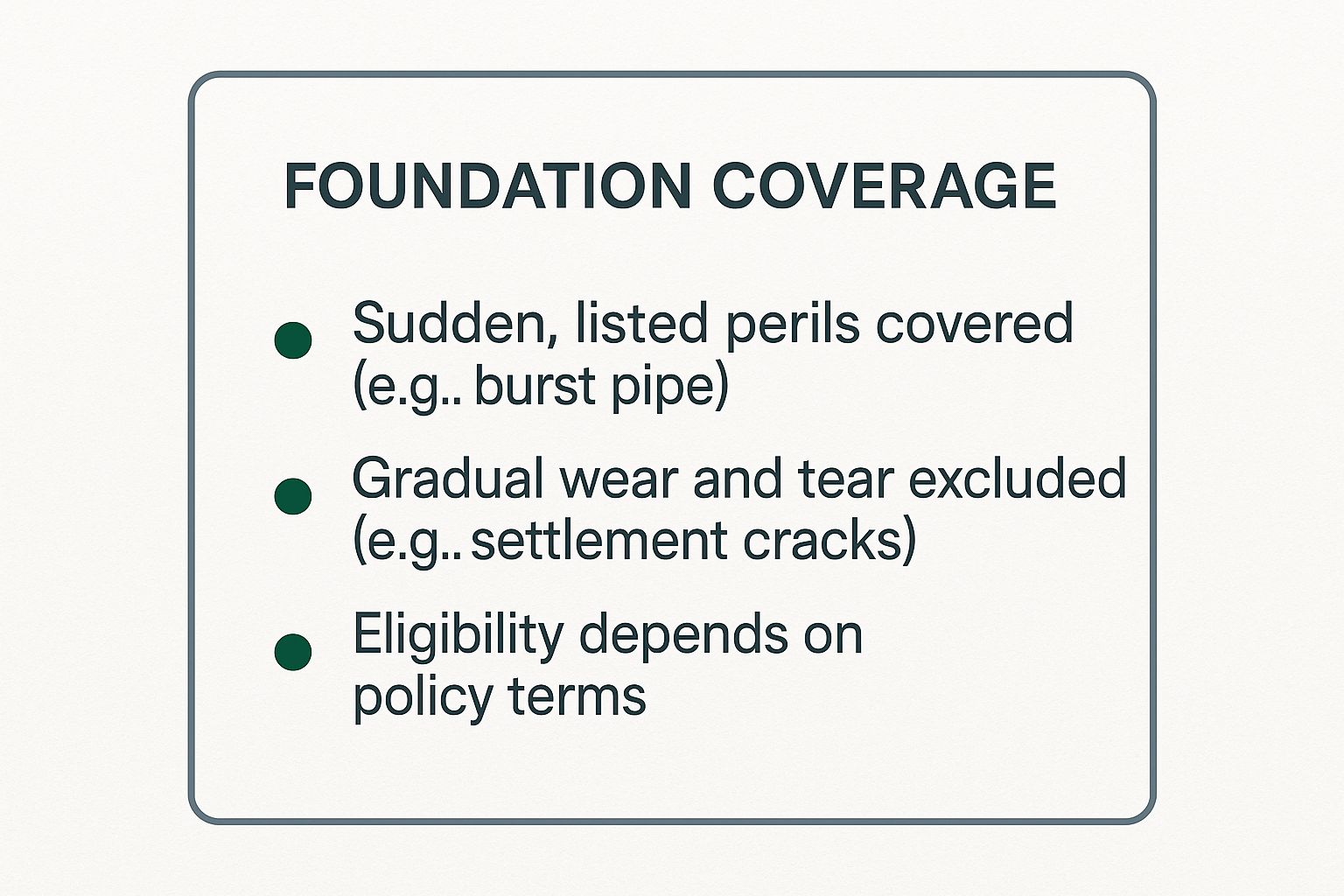

The infographic below gives you a great visual breakdown of what's typically covered versus what's left out.

As you can see, the theme is consistent: coverage is tied to those sudden, named events. Gradual damage, on the other hand, almost always falls under the umbrella of routine home maintenance.

To make this crystal clear, here’s a quick summary of how different causes of foundation damage usually stack up against a standard policy.

Foundation Damage Coverage at a Glance

| Cause of Damage | Typically Covered? | Key Consideration |

|---|---|---|

| Sudden Water Damage (e.g., burst pipe) | Yes | The damage must be from an accidental and sudden event, not a slow leak. |

| Fire or Explosion | Yes | These are standard named perils in almost all homeowners policies. |

| Tornadoes & Windstorms | Yes | Damage from severe wind is a classic covered peril. |

| Vandalism | Yes | Malicious mischief that damages your foundation is generally covered. |

| Earthquakes & Earth Movement | No | Requires a separate earthquake insurance policy or endorsement. |

| Flooding (from outside sources) | No | Requires a separate flood insurance policy. |

| Poor Construction or Faulty Materials | No | This is considered the responsibility of the builder or a pre-existing issue. |

| Normal Settling & Shifting | No | This is viewed as natural wear and tear, a homeowner maintenance issue. |

| Tree Root Damage | No | Insurers typically see this as a preventable, gradual maintenance problem. |

| Pest Infestations (e.g., termites) | No | Considered preventable through regular pest control and maintenance. |

This table shows just how critical the cause is. Now, let's take a closer look at the specific perils your policy is most likely to cover when it comes to your home's foundation.

Cracking the Code: What Does "Covered Peril" Actually Mean for Your Foundation?

Before we can figure out if your foundation damage is covered, we have to talk about a key insurance term: "covered peril." Don't let the jargon intimidate you. A peril is just the insurance world’s word for a specific event or disaster that your policy protects you against.

Think of it this way: your policy is an agreement. The covered perils are the specific events—like fire, windstorms, or burst pipes—that trigger your insurer’s side of the bargain.

The type of policy you have makes all the difference here. They generally come in two flavors, and knowing which one you bought is the first step. For a really detailed walkthrough, our guide on how to read an insurance policy is a great resource to help you make sense of the fine print.

Named Perils vs. Open Perils: The Two Types of Coverage

A "named perils" policy is a lot like a grocery list. It covers only the specific events written down on that list, like "fire" or "lightning." If the cause of your foundation damage isn't explicitly named, you're out of luck. It's a very defined, and often limited, form of coverage.

Then you have an "open perils" policy, sometimes called "all-risk." This one works in reverse. Instead of listing what is covered, it lists what isn't. It basically covers damage from any and every cause, unless it’s on the specific exclusion list. This is the more comprehensive of the two, because the list of exclusions is usually much shorter than the list of included events in a named perils policy.

Here's the bottom line: With a named perils policy, it’s up to you to prove the damage was from a listed event. With an open perils policy, the insurance company has to prove the damage was caused by a specific exclusion.

So, What Kinds of Events Actually Get Covered?

Now for the real question: which specific perils might actually lead to a covered foundation claim? While policies vary, the common thread is that the event must be sudden and accidental. The slow, creeping problems that happen over years are almost never covered.

Here are a few real-world examples of covered perils that could wreck a foundation:

- Explosions: A sudden gas line explosion that shakes your home to its core and compromises its structural integrity.

- Falling Objects: A massive oak tree getting knocked over in a storm and crashing down on your house, cracking the foundation.

- Sudden Water Damage: Not a slow leak, but a major pipe bursting under your house, suddenly washing away the soil and causing the foundation to shift.

- Fire: An intense house fire that heats the concrete and rebar to the point where they lose strength, leading to structural failure.

Notice the pattern? All of these are unexpected, one-time events. That's the key. Gradual problems, like the soil under your home slowly settling over a decade, just won't make the cut.

Common Exclusions That Void Foundation Claims

Knowing what your homeowners insurance won't cover is just as important as knowing what it will. Time and time again, I've seen homeowners get a devastating "claim denied" notice simply because the cause of their foundation trouble falls under a standard policy exclusion.

These exclusions are the fine print, the lines in your policy that draw a hard boundary around your coverage. They’re the specific events your insurer has decided not to pay for. Understanding them is the key to figuring out why the answer to "does homeowners insurance cover foundation problems?" is so often a complicated "it depends."

Earth Movement: The Ground-Shifting Exclusion

Let's start with the big one: "earth movement." This is a catch-all term insurers use for any damage caused by the ground itself shifting, sinking, or sliding. Unfortunately, this single exclusion is responsible for knocking out a huge number of foundation claims.

Think of it this way—if the problem starts with the ground, you're likely out of luck.

This exclusion typically applies to damage from:

- Earthquakes: The violent shaking from seismic activity is a classic example of earth movement. It’s never covered by a standard policy.

- Landslides or Mudslides: If a slope gives way and the sliding soil damages your home's foundation, it's considered earth movement.

- Sinkholes: That sudden, terrifying collapse of the ground? It also falls under this exclusion in a base policy.

- Natural Settling: This is a tricky one. The slow, gradual shifting, sinking, or expanding of the soil under your home that happens over years is also considered earth movement. Your insurer sees this as a maintenance issue, not a sudden event.

Water Damage: The Critical Difference

Water is another frequent culprit behind foundation damage, but where the water comes from is everything. Coverage hinges entirely on its source. A sudden pipe burst inside your house that floods the basement and cracks the slab? That’s often covered. Water from the outside world, however, is a completely different story.

Standard homeowners policies almost universally exclude damage from flooding. This means water from overflowing rivers, heavy rainfall that saturates the ground, or storm surges is not covered.

This distinction is absolutely crucial. Let's say your foundation cracks under immense pressure from soil that’s been waterlogged after a week of torrential rain. That's a flood-related event, and the claim will almost certainly be denied. The lines between these policies can be blurry, so it helps to understand the full breakdown in our guide to flood insurance vs. homeowners insurance.

Other Common Claim Killers

Beyond shifting earth and rising water, a few other exclusions regularly trip up homeowners. These are usually tied to problems that your insurer believes are either predictable or could have been prevented.

Here are a few more common reasons for a denied claim:

- Wear and Tear: Just like anything else, a house ages. Concrete gets old and cracks. Your insurer sees this gradual decay as normal wear and tear, not something a policy is meant to cover.

- Poor Construction or Faulty Workmanship: If your foundation fails because the original builder cut corners, used bad materials, or made a mistake, your insurance policy isn't going to pay for it. The liability lies with the builder, not your insurer.

- Pest Infestations: Damage from termites chewing through supports or rodents burrowing under the slab is seen as a preventable maintenance problem, not a sudden and accidental loss.

How to Navigate the Foundation Damage Claims Process

That sinking feeling you get when you spot a crack in your foundation is a tough one. The good news is that the insurance claim process that follows doesn't have to be a nightmare. A clear, step-by-step approach is your best defense and the surest way to get the coverage you've been paying for.

Think of it like you're building a case. Your job is to show your insurance company a clear, well-documented story that connects the foundation damage directly to an event your policy actually covers. The more buttoned-up you are from the start, the less painful this will be.

The second you notice something wrong, your first job is to document everything. Don't put this off.

Step 1: Document Everything Immediately

Before you even pick up the phone to call your agent, grab your camera. This is the single most important thing you can do right away.

- Take Detailed Photos: Snap pictures of every crack and any other damage you see. Get up close, then take wider shots for context. Stick a ruler or measuring tape next to the cracks so there’s a clear sense of scale.

- Record Videos: A slow walk-through video can be even better than photos. It shows how everything fits together and captures the full scope of the problem. Talk while you're recording, pointing out what you see.

- Create a Timeline: Jot down the date you first saw the damage. Make a note of any recent events that might be connected—a wicked thunderstorm, a water main break down the street, or even nearby construction blasting.

This initial evidence is gold. It creates a "before" picture before the damage gets worse or any work begins.

Step 2: Prevent Further Damage

Your insurance policy includes a clause that requires you to take reasonable steps to stop the problem from getting worse. It’s often called your “duty to mitigate damages.”

For instance, if a busted pipe is washing away the soil under your foundation, your first call isn't to the insurer—it's to a plumber to shut off the water. If a tree fell and cracked the slab, you might need to throw a tarp over the area to keep rain out. Hang on to the receipts for any temporary fixes; these costs are often reimbursable.

Keep in mind, "preventing further damage" does not mean starting permanent repairs. It simply means taking temporary, protective measures until an adjuster can assess the situation.

Step 3: Hire a Structural Engineer

This might be the best money you spend in the entire process. Before you let the insurance company’s adjuster in, think about hiring an independent structural engineer.

Yes, your insurer will send their own person, but that adjuster works for the insurance company. An engineer works for you.

An engineer’s report gives you an unbiased, expert opinion on what caused the damage and how bad it really is. This report is your secret weapon, especially if the insurance company tries to blame the damage on an exclusion like "gradual settling." Having a professional assessment in your corner adds serious credibility to your claim. For a complete overview of what to expect, check out our guide on the general homeowner insurance claim process.

Proactive Maintenance to Protect Your Foundation

While it’s smart to know what your insurance policy says, the absolute best defense against foundation damage is preventing it in the first place. Think of it this way: proactive maintenance is your first and strongest line of defense, saving you from enormous repair bills and the headache of filing a claim. It all comes down to controlling the environment around your home—especially water—to keep your foundation solid.

Your foundation is constantly fighting a battle against the soil surrounding it. When that soil gets soaked, the pressure it exerts can multiply, pushing against your foundation walls with incredible force. A little consistent upkeep can stop a catastrophe before it starts.

This is why staying ahead of water issues is the single most important thing you can do for your foundation's health. It also means keeping an eye out for hidden problems. Learning about identifying slab leak symptoms is a perfect example of how spotting a small plumbing issue can stop it from turning into a foundation nightmare.

Manage Water and Drainage

Your number one job is to get water away from your foundation and keep it away. Soil that stays damp is a foundation’s worst enemy, causing it to swell and shrink, which puts immense hydrostatic pressure on your home’s structure.

Here are the non-negotiables for keeping your foundation high and dry:

- Clean Your Gutters Regularly: When gutters get clogged with leaves and debris, rainwater has nowhere to go but over the edge, pooling right next to your foundation. Make sure they’re clear, especially after fall and spring.

- Use Downspout Extenders: Your downspouts need to carry water far from the house. Aim for them to discharge runoff at least five to ten feet away. This simple step prevents thousands of gallons of water from soaking the soil right where it can do the most damage.

- Maintain Proper Yard Grading: The ground should visibly slope away from your house. The gold standard is a drop of at least six inches over the first ten feet, which helps gravity do the work of pulling water away naturally.

Monitor Landscaping and Soil

Believe it or not, what you plant near your home can have a massive impact. The wrong tree in the wrong spot can go from a beautiful addition to a serious structural threat over the years.

An ounce of prevention is worth a pound of cure. A weekend spent on gutter cleaning or adjusting a downspout can prevent a repair bill that easily climbs into the tens of thousands of dollars.

Be particularly careful with large trees. Their roots are incredibly powerful and will travel far to find moisture, sometimes pushing right through concrete. They can also suck so much water out of the soil that it shrinks, causing your foundation to settle and crack.

It's not just water and roots, either. Pests can cause just as much trouble. Our guide on whether homeowners insurance covers termites dives into why that kind of damage is also typically viewed as a preventable maintenance issue. Taking these simple steps protects your home and makes it far less likely you’ll ever have to wonder, "does homeowners insurance cover foundation problems?"

What to Do When Your Foundation Claim Is Denied

Getting a denial letter for your foundation claim can feel like a gut punch. But don't let that initial shock be the end of the story. Think of it less as a final "no" and more as an opening bid in a negotiation. You absolutely have the right to push back.

The first thing you need to do is dissect that denial letter. It’s not just bad news; it's your road map. The insurance company is required to tell you exactly why they denied the claim, usually by pointing to a specific exclusion in your policy. That’s the very argument you need to dismantle.

Building Your Case for an Appeal

Once you know their reasoning, it’s time to build your counter-argument. Just telling them you disagree won't get you anywhere. You need to come back with fresh, compelling evidence that undermines their position.

Here’s where you start:

- Get a Second Opinion: This is non-negotiable. Hire your own independent structural engineer to inspect the damage. Their professional report is your single most powerful tool, offering an unbiased assessment that can directly challenge the insurer's verdict—especially if they tried to blame it on vague terms like "settling."

- Document Everything: Pull together every scrap of paper and every digital file related to your claim. This means your original photos, contractor estimates, emails, and notes from phone calls. Organize it all chronologically.

- Re-Read Your Policy: Now that you have the denial in hand, go back to your policy one more time. Read the sections they cited. Look for gray areas or ambiguous wording that could be interpreted differently.

Escalating Your Claim Effectively

With your engineer's report and a full set of documents, you’re ready to officially appeal. You'll write a formal letter that directly addresses and refutes each point in their denial, using your new evidence to back up your position. For a complete walkthrough, our guide on how to dispute an insurance claim breaks down the entire process.

Key Takeaway: An insurer’s initial denial is based on their assessment. When you introduce new, expert evidence, you change the entire conversation and force them to re-evaluate the claim based on a much stronger set of facts.

If your formal appeal still doesn't work, it's time to bring in the pros. A public adjuster is a licensed professional who works on your behalf to negotiate with the insurance company. For more complicated or high-stakes denials, hiring an attorney who specializes in insurance law is your next logical step.

Your Top Foundation Coverage Questions, Answered

Alright, we've covered the policy language and the typical exclusions. But what about those specific, real-world situations that keep homeowners up at night? Let's dive into some of the most common questions people have about foundation damage and their insurance.

Think of this as your practical field guide—clearing up the gray areas so you know exactly where you stand.

Are Small Hairline Cracks in My Foundation Covered?

This is probably the number one question we hear, and the answer almost always circles back to one thing: what caused the crack?

If you're seeing tiny, hairline cracks that have developed over the years, your insurance company will almost certainly see this as the house settling naturally. That's considered routine wear and tear—a maintenance issue for you to handle, not a covered insurance event.

But what if those cracks showed up overnight after a specific incident? Say, a car smashes into your home, or an explosion happens down the street. Now we're talking. In that scenario, the cracks are direct damage from a covered peril, and you have a strong basis for a claim. The critical difference is proving the damage was sudden and tied to a single event, not a gradual process.

The Bottom Line: To get a crack covered, you have to connect it directly to a specific, named peril in your policy. Slow-forming cracks from a settling house are always considered your responsibility.

What if a Plumbing Leak Caused the Foundation Damage?

This is a classic "it depends" situation, and the details matter—a lot.

Imagine a pipe bursts under your foundation slab. If that sudden gush of water rapidly washes away the soil and causes the foundation to shift or crack, the resulting damage is often covered. Most policies include protection for "sudden and accidental discharge of water."

On the flip side, a slow, dripping leak that you didn't notice for months (or even years) is a different story. If that gradual saturation causes the soil to expand and damage the foundation, your claim will almost certainly be denied. The insurer will view it as a maintenance failure, which is a standard exclusion. This is where being vigilant about your plumbing really pays off.

Will a Foundation Claim Make My Insurance Premium Go Up?

It's a definite possibility. Filing any major claim, especially one as expensive as foundation repair, signals to your insurer that your property carries a higher risk. They often respond by increasing your premium when it's time to renew your policy.

Here's a smart strategy: before you even think about filing, get a professional estimate for the repair costs. If the total is just a bit more than your deductible, it might make more financial sense to pay for it yourself. You'll avoid a potential rate hike and keep a serious claim off your record, which can save you money in the long run.

Trying to make sense of your homeowners policy can feel like a full-time job. You don't have to go it alone. The team at Wexford Insurance Solutions can look over your current coverage, spot any gaps, and make sure your home is truly protected. Contact us today for a personalized consultation.

Difference Between Insurance Agent and Insurance Broker | Key Insights

Difference Between Insurance Agent and Insurance Broker | Key Insights Plumbing Company Insurance A Complete Guide

Plumbing Company Insurance A Complete Guide