Think of plumbing company insurance as the most important tool in your truck. It's a specific bundle of policies built to shield your business from the financial fallout of accidents, injuries, and property damage. Without it, one bad day—a burst pipe, a slip-and-fall, a vehicle accident—could trigger a lawsuit that sinks your entire company. This isn't just about ticking a box for compliance; it's your financial backstop.

Why Your Business Needs Plumbing Company Insurance

Let's paint a picture. You and your crew just finished a huge repiping job on a high-end home. A few weeks go by, and you get a frantic call. One of the fittings failed, and water has been pouring into the house for hours, destroying hardwood floors, custom kitchen cabinets, and expensive electronics. The homeowner is suing you for negligence, and the bill is climbing into the six-figure range.

Without the right insurance, you’d be on the hook for every penny of the legal fees and the final settlement. It's a nightmare scenario that could wipe out your business savings and even put your personal assets at risk. This isn't just a scare tactic; it's a real-world risk plumbers face every single day. Insurance is the foundation of your financial stability and your reputation. It shows clients you're a serious professional who stands by your work.

For a closer look at the foundational policies that all businesses should have, check out our in-depth guide on business insurance basics.

The Core Pillars of Protection

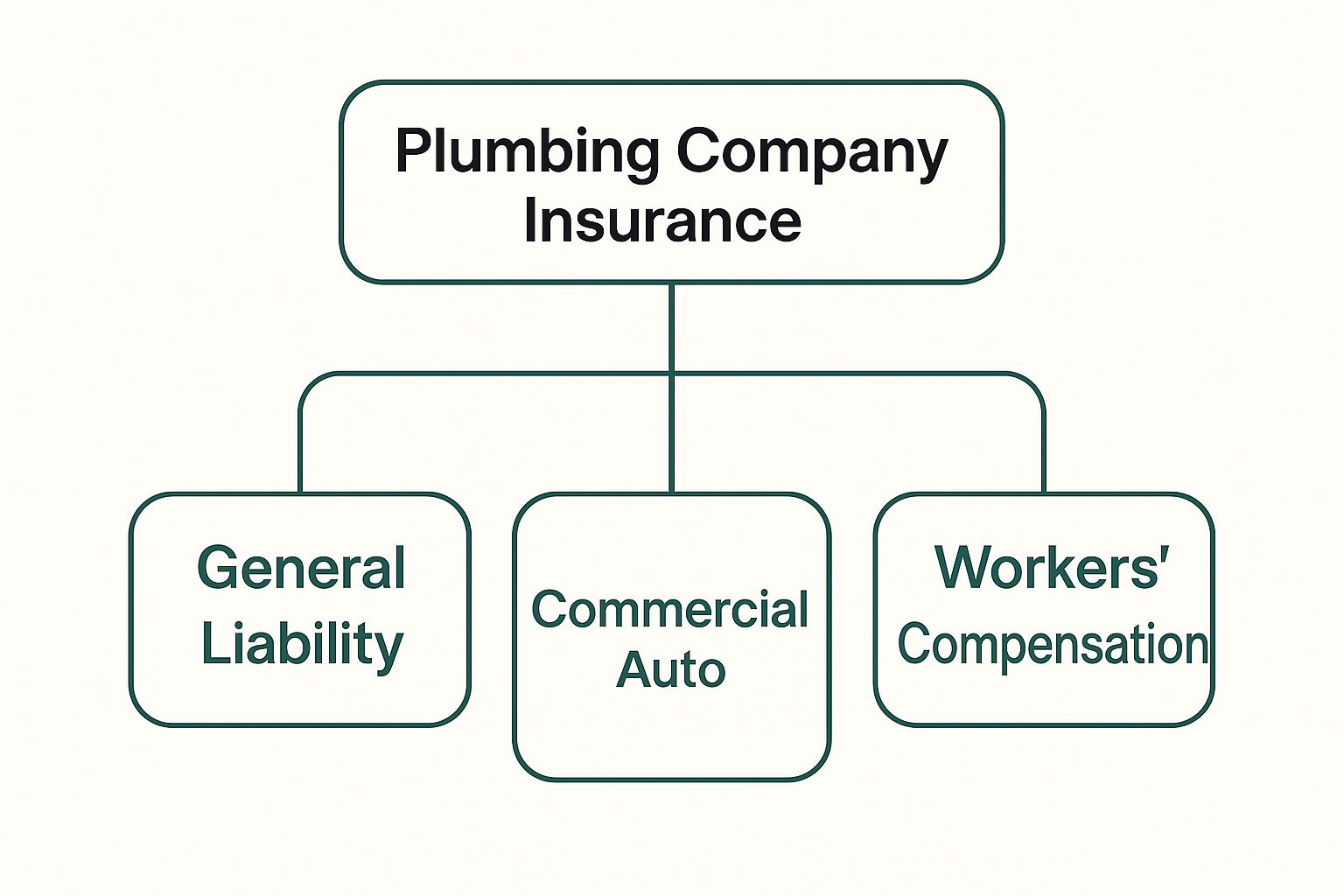

At its core, plumbing insurance is all about managing risk so you can get back to what you do best. A solid insurance plan is built on a few key policies that work together to create a comprehensive safety net.

-

Protecting Against Third-Party Claims: General Liability is your first line of defense. It covers you if your work causes property damage or bodily injury to a client or another third party.

-

Covering Your Mobile Workforce: Your work vans and trucks are the lifeblood of your business. Commercial Auto insurance is non-negotiable for protecting these critical assets.

-

Caring for Your Team: Workers' Compensation is a must-have. It covers medical bills and lost wages for employees injured on the job, and it's legally required in almost every state.

This infographic gives a great visual breakdown of how these policies stack up.

As you can see, these three policies form the bedrock of any solid insurance plan for a plumbing company. Getting a handle on how they work together is the first real step toward protecting your business for the long haul.

Essential Insurance Policies for Plumbing Companies at a Glance

To make things clearer, here’s a quick summary of the core insurance types every plumbing business owner needs to understand.

| Policy Type | What It Covers | Why It's Critical |

|---|---|---|

| General Liability | Property damage and bodily injury claims from third parties (e.g., clients, visitors). | Protects against common job-site accidents, like a tool damaging flooring or a client tripping over equipment. |

| Commercial Auto | Liability and physical damage for vehicles used for business purposes. | A personal auto policy will not cover accidents that occur while driving for work-related tasks. |

| Workers' Compensation | Employee medical expenses and lost wages from work-related injuries or illnesses. | It's legally mandated in most states and protects your most valuable asset—your employees. |

These policies are the absolute essentials. Think of them as the non-negotiable starting point for building a truly resilient plumbing business.

Getting to Grips with Your Core Insurance Policies

Trying to understand plumbing company insurance can feel like deciphering a complex schematic for the first time. The best approach is to break it down into the essential components. Think of your insurance package like a specialized toolkit—each policy is a different tool designed to handle a specific risk.

Three tools are absolutely essential for any plumber: General Liability, Commercial Auto, and Workers' Compensation. Each one protects a critical part of your business, and when used together, they create a strong defense against the most common and financially draining risks you'll encounter.

Let's open up the toolkit and see what each one really does.

General Liability: Your Financial Shield on the Job

General Liability insurance is the foundation of any solid protection plan. Its job is to cover claims from third parties—like clients or vendors—who allege your business operations caused them bodily injury or damaged their property. This is the policy that stands between a simple mistake and a business-ending expense.

Here’s a real-world scenario: one of your plumbers is soldering a pipe in a client's basement. A stray spark lands on some stored materials, starting a small fire. It doesn't burn the house down, but it causes significant smoke damage and ruins a wall. The client sues your company for $40,000 to cover the repairs, professional smoke remediation, and their hotel stay.

Without General Liability, that $40,000 comes straight out of your business account. With it, the policy is there to handle the legal defense and settlement costs.

This coverage is crucial for two different stages of your work:

- Ongoing Operations: This protects you while your crew is physically on the job site. It’s for things like a dropped wrench cracking a high-end tile floor or a customer tripping over your tool bag and breaking their wrist.

- Completed Operations: This is an absolute must-have for plumbers. It covers damage or injury that happens after you’ve packed up and left, but was caused by your work. A classic example is a new pipe fitting that fails weeks later, causing a slow leak that results in catastrophic water damage.

Key Takeaway: General Liability isn’t optional; it’s a non-negotiable cost of doing business. Most states and nearly every commercial client will require proof of coverage before you can even set foot on their property. It’s your front-line defense against the everyday mishaps that are bound to happen.

Commercial Auto Insurance: Protecting Your Workshop on Wheels

Your work vans aren't just a way to get from A to B. They're mobile workshops, loaded with thousands of dollars in tools, parts, and equipment. A standard personal auto policy simply won't cover a vehicle used for business, leaving a massive, dangerous gap in your coverage.

That's where Commercial Auto insurance steps in.

This policy provides both liability and physical damage coverage for all your company vehicles. If your van rear-ends someone on the way to a call, Commercial Auto pays for the other driver's medical bills and car repairs. If you opt for collision coverage, it will also pay to fix your van.

But it goes beyond just accidents. Imagine a work truck, packed with PEX and expensive fittings, is stolen from a job site overnight. The comprehensive portion of a good Commercial Auto policy would help replace the vehicle and, depending on the specifics, can even cover the stolen equipment. This coverage is what keeps a theft from crippling your ability to work. You can explore more options in our deep dive into commercial insurance types.

Workers' Compensation: The Bedrock of Employee Protection

The moment you hire your first employee—even a part-timer—Workers' Compensation becomes a legal necessity in almost every state. This policy is designed to do two things simultaneously: protect your most valuable asset (your team) and shield your business from lawsuits related to on-the-job injuries.

If a technician throws out their back lifting a heavy water heater, Workers' Comp kicks in to cover their medical bills, from the ER visit to ongoing physical therapy. It also provides wage replacement benefits, so they can still pay their bills while they recover.

In exchange for providing these no-questions-asked benefits, the employee generally gives up the right to sue you for negligence. This no-fault system is a lifesaver for business owners, replacing unpredictable, expensive lawsuits with a clear and manageable process for handling workplace injuries. It makes sure your people are taken care of without putting your entire business on the line.

Securing Specialized Coverage for Unique Risks

While the core policies like General Liability give you a solid foundation, the world of plumbing is messy and unpredictable. It's full of unique risks that demand more than just basic protection.

Standard insurance might cover a customer slipping on a wet floor, but what happens when the problem isn't a physical accident but faulty advice? Or when your most expensive gear gets stolen right off a job site? This is exactly why specialized coverage exists. These policies are designed to plug the specific gaps left by your primary insurance, tackling the real-world challenges plumbers face every day.

Think of them as the precision instruments in your risk-management toolkit—each one built for a very specific job.

Defending Against Faulty Advice with Professional Liability

You do a lot more than just turn wrenches. You’re an advisor. You might recommend a specific type of water heater, design a complex drainage system, or consult with a client on the best pipe material for their home's water pressure. But what happens if that expert advice turns out to be wrong and costs your client money?

This is where Professional Liability insurance, often called Errors & Omissions (E&O), is absolutely critical. It’s built to protect your business from claims of negligence or bad advice that lead to a financial loss for a customer, even if no property was actually damaged.

Here’s a real-world example: You recommend a new, high-efficiency tankless water heater for a large family. After you install it, they realize it can't keep up with their needs, leaving them with lukewarm showers. They sue you, claiming your professional recommendation was flawed and demanding you cover the cost of ripping out the unit and installing a larger, more expensive one.

General Liability won't touch this. Why? Because there’s no property damage—just a financial loss stemming from your professional expertise.

Key Insight: Professional Liability is your shield against claims of faulty work or incorrect advice. It covers legal defense costs and potential settlements when a client argues your professional services failed them and cost them money.

Protecting Your Mobile Assets with Tools and Equipment Coverage

Your tools are the engine of your business, and they represent a massive investment. From pricey pipe threaders and drain cameras to your everyday power tools, their value can easily climb into the tens of thousands of dollars. The big problem is that these assets are always on the move and often left on job sites, making them a prime target for theft or damage.

Unfortunately, your standard Commercial Auto or General Liability policy offers very little, if any, coverage for the contents of your van. That’s why Contractors' Tools and Equipment Insurance is so vital. It's a policy specifically designed to protect your gear.

This coverage is usually a form of inland marine insurance, which is a fancy way of saying it protects property in transit over land. To get a better handle on how it all works, you can read our detailed guide explaining what inland marine coverage is.

Bottom line: If your van is broken into and your tools are stolen, or if a piece of equipment is ruined in a fire on-site, this policy provides the funds to replace everything quickly. You can get back to work without a massive out-of-pocket expense.

Adding an Extra Layer of Armor with Umbrella Insurance

Even with solid foundational policies, a single catastrophic event can blow right past your coverage limits. Imagine a multi-vehicle accident involving one of your work trucks or a severe water damage incident in a high-rise commercial building. Either one could easily trigger a lawsuit that exceeds the $1 million or $2 million limit on your General Liability or Commercial Auto policy.

When that happens, Commercial Umbrella Insurance acts as your ultimate safety net.

Think of it as an extra layer of financial armor. It sits on top of your existing liability policies (like General Liability and Commercial Auto) and only kicks in after those primary policies have paid out their maximum limit. An umbrella policy can add an extra $1 million, $5 million, or more in liability protection for a surprisingly low cost.

For instance, say you have a $1 million General Liability limit and are found liable for a $1.5 million claim. Your primary policy pays out the first million. Without an umbrella policy, that remaining $500,000 would come straight from your business assets. With an umbrella, it covers that excess amount, protecting your company from a potentially devastating financial hit. It's an affordable way to buy peace of mind for the worst-case scenarios.

How Your Plumbing Insurance Costs Are Calculated

Figuring out what you'll actually pay for plumbing company insurance can feel a bit like a guessing game. But it’s not random. The final price tag—your premium—is really a reflection of your business's unique risk profile.

Think of it like a "risk score." The lower your perceived risk in the eyes of an insurer, the lower your premiums will be.

Insurers look at a handful of specific factors to build this picture of your business. Understanding what they're looking at gives you the power to make smart changes that can genuinely lower your insurance bill over time. A great first step is folding your insurance estimates into the process of creating a comprehensive business budget.

Core Factors That Drive Your Premiums

At the end of the day, your insurance premium is tied directly to the scale of your operation and how much risk you're exposed to every day. Insurers look at concrete numbers to get a sense of how much work you do, how many people are on your team, and what a potential accident could cost.

Here are the big-ticket items they're looking at:

- Number of Employees: More people on the payroll means a higher chance of a workplace injury. This is the single biggest factor for your workers' compensation premium.

- Annual Revenue and Payroll: These numbers give insurers a quick snapshot of your business volume. More revenue usually means more jobs, more customers, and more exposure to potential liability claims.

- Business Location: Where you set up shop matters. Insurance costs and regulations can be wildly different from one state to another. A plumbing company in a big city with a reputation for lawsuits will likely pay more than a similar business in a quiet rural town.

- Services Offered: Not all plumbing is created equal. A plumber who sticks to simple residential faucet repairs is a much lower risk than a company that takes on complex commercial sewer line installations or works with high-pressure gas lines.

Your History and Operations Matter

Beyond just the raw numbers, insurers want to know about your track record and how you run your business day-to-day. If you can show them you have a solid history of safety and professionalism, you'll always get a better look—and better rates.

Your claims history is probably the most important part of this. A business with a long list of claims, even small ones, screams "high risk" to an underwriter. On the flip side, having a clean record for several years can earn you some serious discounts.

The kinds of vehicles you drive also make a big difference. Those big, heavy-duty trucks will cost more to insure than a fleet of small service vans. Our guide on commercial vehicle insurance costs dives deeper into how your vehicle choices affect your premiums.

Key Insight: Your insurance premium is a direct reflection of your operational risk. Proactively managing safety, maintaining a clean claims record, and documenting your procedures are the most powerful ways to take control of your costs.

Budgeting for Your Insurance Needs

Having a ballpark idea of what to expect is crucial for planning your finances. For 2025, the average cost for a plumbing business in the U.S. lands somewhere between $350 and $2,000 per year, which breaks down to about $30 to $165 per month. Of course, this number can swing quite a bit depending on all the factors we just covered.

To help you get a clearer picture for your own budget, here’s a breakdown of what a small plumbing business might expect to pay each month for the essential policies.

Average Monthly Cost for Common Plumbing Insurance Policies

| Insurance Type | Average Monthly Premium Range | Key Cost Factors |

|---|---|---|

| General Liability | $50 – $150 | Revenue, services offered, claims history |

| Workers' Compensation | $75 – $250+ | Payroll, state regulations, job risk |

| Commercial Auto | $125 – $300 per vehicle | Vehicle type, driving records, coverage limits |

Keep in mind that these are just averages. Your final costs will come down to your specific operations, history, and the coverage limits you choose.

Choosing the Right Insurance Partner for Your Business

Picking the right plumbing company insurance isn’t just about hunting for the lowest price. It’s about finding a strategic partner who genuinely gets your trade. Think of your insurance provider as a critical line of defense—a decision that deserves as much thought as hiring a key employee. The right partner can mean the difference between a claim being a manageable hiccup or a full-blown business disaster.

A great insurance partner is like a specialist doctor for your company’s financial health. You wouldn't see a general family doctor for a complex surgery, right? The same logic applies here. An agent who lives and breathes contractor insurance will grasp the unique risks of plumbing in a way a generalist simply can't.

Evaluating Potential Insurance Providers

When you start comparing providers, it's easy to drown in a sea of quotes and policy jargon. The best way to cut through the noise is to zero in on three core criteria that truly signal an insurer's quality and reliability. These are the things that show you who will actually have your back when things go wrong.

Here's what you should be looking for in any potential partner:

- Financial Stability: Check for a high rating from an independent agency like A.M. Best. An "A" rating or better is a good sign that the company has the cash reserves to pay out claims, even the big, catastrophic ones.

- Experience with Trade Contractors: Does the agent or company actually work with a lot of plumbers and other trades? An experienced partner has seen it all before—claims involving completed operations, stolen tools, you name it. They'll know how to set up your policy correctly from day one.

- Claims Handling Reputation: A policy is just a piece of paper until you need to file a claim. Dig into reviews and ask for references to see how they treat their clients. A slow, combative claims process can be almost as damaging as having no coverage at all.

Partnering with a Specialist Agent

One of the smartest moves you can make is to work with an independent insurance agent who specializes in the construction trades. They aren't tied to one company; they're your advocate. They'll shop your business around to multiple carriers to find the best fit for your specific operation.

Expert Insight: A specialist agent knows to look for dangerous policy exclusions—the fine print that can sink you. They’ll spot language that excludes damage from subcontractor work or certain types of water damage, which is a common trap in generic, one-size-fits-all policies.

This kind of expertise is priceless. A specialist can anticipate your needs, like making sure your policy has a blanket additional insured endorsement. That one feature can save you a ton of time and headaches every time a client asks for a certificate of insurance.

Preparing for an Accurate Quote

To get quotes that are both accurate and competitive, you need to come to the table prepared. Before you even start shopping, pull together a clear and detailed risk profile of your business.

Your profile should include:

- A detailed description of your services, breaking down the percentage of residential versus commercial work.

- Your total annual payroll and revenue figures, as these are major factors in how premiums are calculated.

- A complete list of your vehicles, including their value and who primarily drives them.

- Your claims history for the past three to five years, even if you have a perfect record.

Finally, don’t be afraid to ask tough questions. Ask them directly about exclusions for mold, repeated leakage, or work done by your subs. Knowing what isn't covered is every bit as important as knowing what is. A good partner will be transparent and walk you through every detail, making sure there are no costly surprises waiting for you down the road.

Lowering Your Premiums with Proactive Risk Management

It’s easy to look at plumbing company insurance as just another bill to pay—a necessary evil. But that’s a huge missed opportunity. A smarter way to see it is as a mirror reflecting your company's commitment to safety and professionalism.

When you stop just reacting to problems and start proactively managing risk, you can actually gain control over your annual premiums. Insurance carriers love to see businesses that actively try to prevent losses, and they’ll reward you for it with better rates. Every safety meeting you run or detailed service record you keep is a direct investment in a lower insurance bill.

Build a Culture of Safety

The single most effective way to cut down on risk is to make safety a core part of your company's DNA. This isn't about just telling your crew to "be careful." It's about building documented systems and providing consistent training that turns safety from an idea into a daily habit.

To really move the needle on your premiums, you need a solid strategy. A great starting point is understanding the 5 stages of risk management.

A strong safety culture is built on a few key pillars:

- A Documented Safety Program: Don't just talk about safety—write it down. A formal safety manual outlining everything from proper tool use to emergency protocols shows you're serious.

- Regular Employee Training: Hold weekly or monthly "toolbox talks." These short, focused sessions keep safety at the forefront of everyone's mind and reinforce your standards.

- Meticulous Record-Keeping: Document every single job with detailed notes, photos, and customer sign-offs. If a bogus faulty workmanship claim comes your way, this paper trail will be your best defense.

Key Takeaway: A documented safety program isn't just bureaucratic fluff. It's a powerful signal to insurers that you run a professional, low-risk operation, which can directly translate into a lower premium.

Protect Your Physical Assets

Your team’s safety is paramount, but don't forget about your physical assets. Your tools, equipment, and vehicles are the lifeblood of your business, and protecting them is a direct path to fewer claims.

Think about it—a dedicated contractors' tools and equipment policy can cost as little as $20 per month to protect thousands of dollars worth of vital gear from theft or damage. It's a no-brainer. Simple habits, like mandatory vehicle lock checks at the end of the day and secure overnight storage for expensive equipment, can prevent some of the most common and frustrating claims.

These small, consistent actions are all part of a bigger picture. To get a better handle on the strategies that work, check out our guide to risk management best practices.

Answering Your Top Plumbing Insurance Questions

Let's be honest, insurance can get confusing. When you're trying to run a plumbing business, you just want straight answers so you can make sure you're covered and get back to work.

Here are the questions we hear most often from plumbers just like you.

I'm a One-Person Shop. Do I Really Need Insurance?

Yes, without a doubt. Whether you're a solo operator or a subcontractor, you're on the hook for the same risks—property damage, client injuries, you name it.

Think about it this way: most general contractors won't even let you on a job site without seeing a certificate of insurance. The same goes for many homeowners. And don't ever make the mistake of assuming the GC's policy will cover you. That's a huge gamble, as their insurance is there to protect them, not to cover mistakes they claim are your fault.

What’s the Deal with “Per Occurrence” and “Aggregate” Limits?

This is one of the most important parts of your policy to understand. These limits define how much your insurance will actually pay out when something goes wrong.

- Per Occurrence Limit: This is the absolute maximum your insurer will pay for a single claim. If a pipe bursts and causes $200,000 in water damage, this is the number that matters.

- Aggregate Limit: This is the total, overall cap on what your insurer will pay out for all claims during your policy term (usually one year).

The key is to make sure these limits are high enough to cover a true worst-case scenario. If a claim exceeds your limits, you could be forced to pay the rest out of pocket, putting your entire business on the line.

How Do I Prove I Have Insurance?

That's where a Certificate of Insurance (COI) comes in. It's a simple, one-page document from your insurance provider that serves as official proof of your coverage.

Getting one is easy—just call up your agent and ask. You'll need it constantly to bid on jobs, sign contracts, and partner with other contractors. It’s the standard way everyone in the industry verifies you're properly insured.

At Wexford Insurance Solutions, we know the plumbing trade inside and out. Our job is to cut through the jargon and get you the right coverage, so you can work with total peace of mind. Get a quote and protect your business today.

Does Homeowners Insurance Cover Foundation Problems?

Does Homeowners Insurance Cover Foundation Problems? How to Change Car Insurance Provider Seamlessly

How to Change Car Insurance Provider Seamlessly