When you're looking for insurance, the first major choice you'll make isn't about coverage or premiums—it's about who you work with. The difference between an agent and a broker in insurance seems subtle, but it all comes down to one critical question: who do they really work for? An agent is tied to the insurance company, while a broker works for you. This single distinction changes everything.

Agent vs. Broker: It's All About Allegiance

Both agents and brokers are licensed professionals who can get you the coverage you need, but their loyalties and the way they operate are worlds apart. Grasping this is the key to finding the right partner for your insurance journey.

An insurance agent is appointed by one or more insurance companies to sell their products. Think of them as a direct representative. Their primary responsibility is to the carrier they work for, meaning they're focused on selling that company's specific policies.

On the other hand, an insurance broker represents you, the client. They aren't tied to any particular insurer. Instead, they have a legal fiduciary duty to put your best interests first, which means they shop the entire market to find coverage that truly fits your needs.

The easiest way to think about it is this: An agent's loyalty lies with the insurance carrier, while a broker's loyalty lies with you. This simple fact shapes their market access, the advice they give, and their legal obligations.

The Core Differences at a Glance

To really see how these roles differ, let's break it down. Understanding these distinctions is just as important as knowing how to read an insurance policy, because it determines the options and advice you receive from the start.

| Feature | Insurance Agent | Insurance Broker |

|---|---|---|

| Who They Represent | The insurance company (the carrier). | You, the client. |

| Legal Obligation | A duty to the insurer they represent. | A fiduciary duty to act in your best interest. |

| Product Access | Limited to the policies of one or a few carriers. | Access to a wide range of insurers and products. |

| Primary Goal | To sell the insurer's policies. | To find the best possible coverage for your needs. |

With this foundation, we can dig deeper. You'll soon see how these differences play out in the real world, whether you're buying a simple car insurance policy or navigating the complexities of commercial coverage.

How Insurance Agents Work for the Carrier

Think of an insurance agent as a direct representative of an insurance company, also known as the "carrier." At the core, their legal and professional loyalty is to the insurer, not you, the policyholder. This fundamental relationship shapes everything about how they operate and the advice they give.

When you sit down with an agent, you’re essentially talking to the carrier’s sales team. Their job is to know their company's products inside and out and sell them. They’ll handle your quotes, issue the policy, and often serve as your first point of contact for claims—all while working within the rules set by their carrier.

Captive vs. Independent Agents

Not all agents are the same, and it’s helpful to know the difference between the two main types. While both ultimately work for the carrier, they offer different paths to getting coverage.

- Captive Agents: These agents work exclusively for one insurance company. Think of your local State Farm or Allstate agent. They have an incredibly deep knowledge of their carrier's specific offerings, from a simple auto policy to the most intricate life insurance products.

- Independent Agents: An independent agent partners with several different insurance companies. This allows them to shop around for you and present multiple quotes and policy options, but their loyalty is still contractually tied to the specific carriers they represent.

The crucial takeaway is this: whether an agent is captive or independent, their binding legal duty is to the insurance company. Their goal is to find the best fit for you from the menu of products they are authorized to sell.

The Agent Experience in Practice

Let’s imagine a young couple buying their first house. They need to bundle home and auto insurance to get the best deal. They decide to visit a local captive agent who has been with a major, well-known insurer for 20 years.

The agent immediately gets what they need. Because she knows her company's policies so well, she can instantly identify the best bundling discounts and first-time homebuyer programs. She provides a competitive quote and walks them through the policy features with confidence. The whole thing is incredibly efficient because she’s an expert in a single, familiar system. For a lot of people with straightforward insurance needs, this direct and expert approach is perfect.

In this scenario, the agent’s specialized knowledge of one company’s products is a huge plus. She guides the couple, answers their specific questions about that carrier's claims process, and gets the policies finalized without a hitch. This is the real value of an agent—providing deep expertise and direct access to the products they are paid to represent. Today, top agencies use powerful insurance policy management systems to make this process even more seamless for their clients.

Why a Broker's Allegiance Is to You

Unlike an agent who represents an insurance carrier, a broker's primary loyalty is to you. This isn't just a marketing slogan; it’s a legal reality. Brokers have what’s called a fiduciary duty, which legally obligates them to act in your best interests. This simple fact changes everything, turning them from a salesperson into a personal risk advisor.

This fundamental distinction drives their entire approach. A good broker doesn't start by showing you a list of products. They start by getting to know you or your business, digging into your unique circumstances and potential risks. They are carrier-neutral and legally bound to put your financial security first, so the advice you get is built around your needs, not a sales quota.

Your Advocate in the Insurance Market

Because brokers aren’t captive to a single insurance company, they have the freedom to shop the entire market on your behalf. This gives them the power to find, compare, and negotiate the best possible coverage from a massive pool of insurers. They don't just hand you a few quotes; they dissect the policy language and fight for terms that actually protect you.

Let's look at a real-world example. Imagine a growing tech startup that needs very specific cyber liability insurance. A captive agent might only be able to offer a standard business policy with a generic cyber add-on from their one company. That might cover a simple data breach, but what about the real risks—software errors, intellectual property claims, or complex international privacy laws? It would likely leave dangerous gaps.

A broker, on the other hand, would start by analyzing the startup’s specific vulnerabilities. They'd look at the code, the client data, and where the company operates. With that deep understanding, the broker can then go to multiple specialized insurers to find a policy that precisely covers those unique risks, often getting better pricing and terms in the process.

A broker's greatest strength is their independence. Their ability to scan the entire market, combined with their legal duty to you, means their goal is to find the most complete and cost-effective solution—not just the easiest policy to sell.

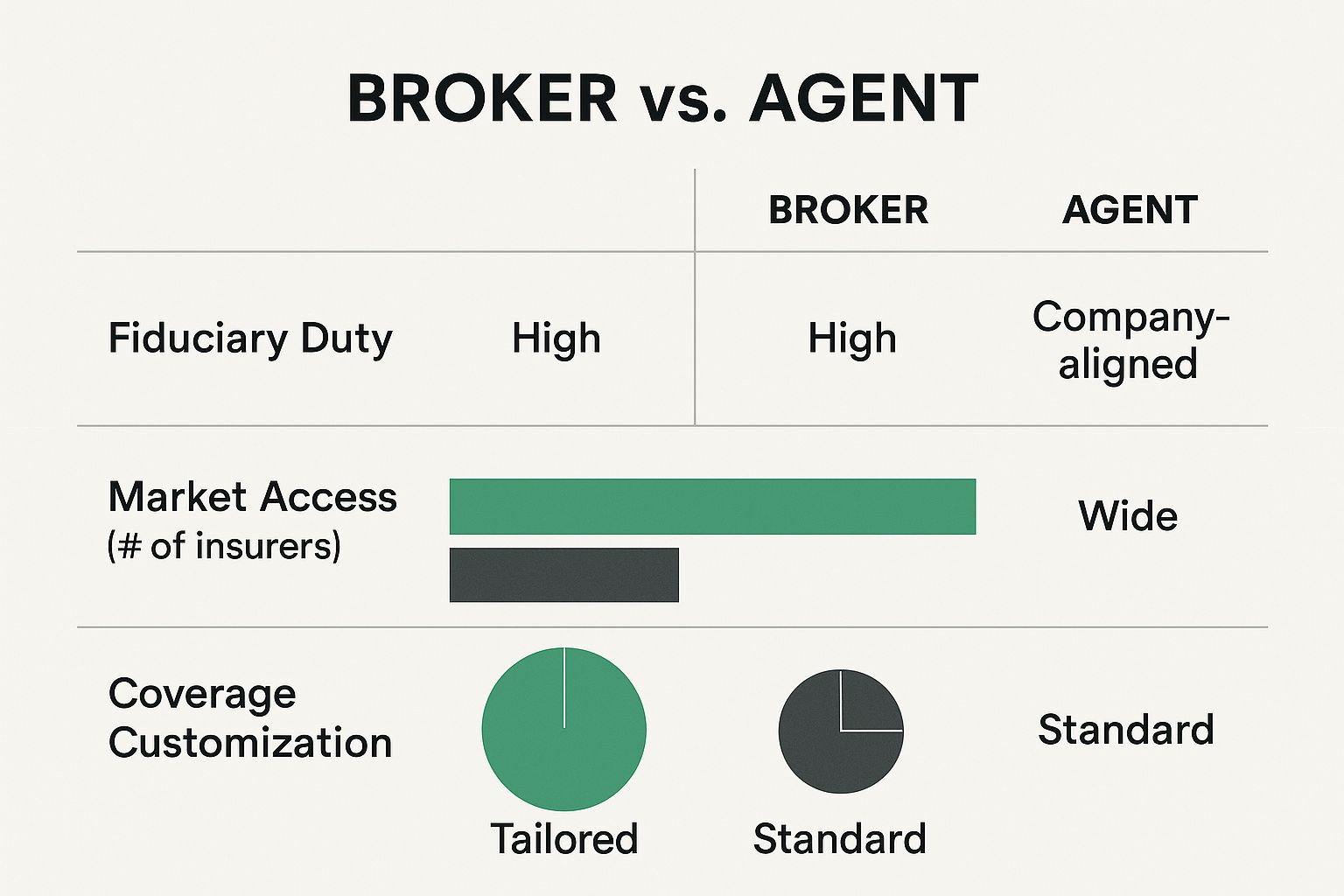

This chart helps break down the key differences in loyalty, market access, and the level of customization you can expect from a broker versus an agent.

As you can see, a broker’s role is built on a high level of fiduciary responsibility and broad market access, which naturally leads to more personalized coverage. If you want to dive deeper into what makes them a powerful advocate, this resource on understanding the role of insurance brokers offers some great professional insights.

Ultimately, when you hire a broker, you’re bringing a dedicated risk management expert onto your team. If you're ready to find the right partner, our guide on how to choose an insurance broker has practical tips to help you make the best choice.

Comparing How Agents and Brokers Operate

While the fundamental difference between an agent and a broker comes down to who they represent, that single distinction creates a ripple effect across their entire operation. How they navigate the market, how they get paid, and how they approach their work all stem from that core allegiance. Understanding these operational nuances is crucial because they directly shape your experience, from the policy options you see to the quality of advice you receive.

Market Access and Available Choices

The first and most obvious difference you'll encounter is in market access. An agent, whether captive or independent, works from a pre-set menu. A captive agent is a specialist in one company's offerings, while an independent agent can present policies from a small, curated group of carriers they have appointments with.

A broker, on the other hand, isn’t tied down by carrier appointments. Their entire business model is built around having broad, open access to the insurance marketplace. They can shop your needs across dozens of insurers, including highly specialized carriers that many agents simply don't have access to. For anyone with a complex or unusual risk profile, this wide-open access is a broker's superpower.

Compensation Models and Transparency

The way agents and brokers are paid also highlights a key operational split. In most cases, both earn a commission from the insurer that's baked into your premium. You don't typically see a separate bill for their services.

However, the dynamics can be different. An agent’s commission is a straightforward percentage for selling their carrier's policy. A broker also earns a commission, but because they have a legal duty to you, there's often greater transparency. For more complex commercial accounts, some brokers might also charge a disclosed flat fee for their advisory work, separating their compensation from the policy itself.

Scope of Service and Client Relationship

This is where the rubber really meets the road. An agent's primary role is to sell and service an insurance policy. They are experts at explaining their carrier’s products, answering questions, and helping you through the purchasing and claims process for that specific brand.

A broker’s role, by contrast, is much broader, often extending into holistic risk management. Their process usually starts with a deep dive into your unique exposures. For a business, this could mean conducting a thorough insurance gap analysis to find vulnerabilities before they even start shopping for policies. This advisory-first model makes the broker a long-term risk partner, not just a salesperson.

A simple way to view the difference in scope is this: an agent helps you buy an insurance product, while a broker helps you build a risk management strategy. One is product-focused; the other is client-focused.

To make these differences crystal clear, the table below provides a direct, side-by-side comparison of how agents and brokers function in practice.

Agent vs Broker: A Head-to-Head Comparison

This table breaks down the fundamental operational and legal differences between insurance agents and brokers across key decision-making criteria.

| Attribute | Insurance Agent | Insurance Broker |

|---|---|---|

| Market Access | Limited to the products of one or several appointed carriers. | Access to a wide range of insurers across the entire market. |

| Primary Service | Policy sales and carrier-specific service. | Risk analysis, market shopping, and client advocacy. |

| Legal Allegiance | Contractually bound to the insurance company. | Fiduciary duty to act in the client's best interest. |

| Compensation | Earns commissions from the carriers they represent. | Earns commissions from carriers and may charge disclosed fees. |

Ultimately, seeing these distinctions laid out helps clarify which professional is better suited to your specific needs and expectations.

Deciding Between an Agent or a Broker

Knowing the technical difference between an agent and a broker is one thing, but figuring out which one is right for you is what really matters. There’s no single correct answer here. The choice hinges entirely on your specific insurance needs, how complex your risks are, and the kind of guidance you're looking for. What works perfectly for your neighbor might be a terrible fit for your family or business.

To get it right, you have to take a hard look at your own situation. Are you searching for a standard, no-fuss policy, or are you trying to protect unique assets and liabilities that don’t fit into a neat little box? The answer to that question will tell you which direction to go.

When to Choose an Insurance Agent

An insurance agent is often the perfect fit for people and families whose insurance needs are pretty common and straightforward. Because they have a deep understanding of one specific carrier's products, they can offer a direct and efficient way to get the coverage you need.

You should probably work with an agent if:

- Your needs are simple. Think standard personal policies, like auto, renters, or a basic homeowners policy.

- You're loyal to a specific brand. If you already know you like a particular insurance company, it makes sense to work directly with their representative.

- You just want to get it done. An agent can give you a quote and bind your policy quickly, without you having to sort through a dozen different market options.

Take a recent college grad who needs their first auto insurance policy. An agent is a great choice here. They can walk the grad through the options from their carrier, point out relevant discounts, and get the policy started in one sitting. In this case, the agent’s specialized knowledge of one company’s offerings is a huge plus.

To find the right fit, ask yourself this key question: "Do my insurance needs fit a standard, 'off-the-shelf' solution, or do I have unique circumstances that require a custom-built strategy?" Your answer is the strongest indicator of whether an agent or a broker is better for you.

When a Broker Is the Right Choice

An insurance broker becomes indispensable when your situation gets more complicated or when you need a true advocate to search the entire market for you. Their legal duty is to you, the client, which makes them a powerful ally for anyone with risks that aren't standard.

A broker is likely the better option if:

- You own a business. Commercial insurance is a different beast entirely. It involves complex coverages like general liability, workers' compensation, and cyber liability that require an expert with broad market knowledge.

- You have high-value or unique assets. Things like classic cars, fine art collections, or custom-built homes often need policies from specialty insurers that only a broker can access.

- You face unique liability risks. Professionals such as doctors, architects, or consultants require specialized liability coverage that protects them from the specific hazards of their jobs.

- You want to shop the entire market. If your goal is to have a professional compare your needs across dozens of carriers to find the absolute best terms and price, a broker is the way to go.

Picture a small manufacturing business. Their risks are all over the map—property damage, equipment failure, employee injuries, and product liability, just to name a few. A broker would start by performing a deep risk analysis, then take that information to multiple commercial insurance companies to piece together a comprehensive and competitively priced program. That kind of advocacy and market access is exactly where a broker shines.

And if you discover your needs have evolved and you now require this level of service, our guide on how to switch insurance providers can help you make the change smoothly.

Common Questions About Agents and Brokers

When you're trying to figure out the agent vs. broker puzzle, a few key questions always seem to pop up. Let's clear the air on these common points so you can make your decision with confidence.

Does Using a Broker Cost More Than an Agent?

This is probably the biggest myth out there. In almost all cases, you do not pay a broker any extra fees for their service. It's a common misconception that their broader access comes at a direct cost to you, but that's rarely how it works.

Both agents and brokers earn their living from commissions paid by the insurance company, and this commission is already baked into your premium. So, while a broker technically works for you, the insurer pays them when you buy a policy. Because brokers can shop the entire market, they can often find you a better deal that saves you money, making their service a net positive for your wallet.

On rare occasions, for very complex commercial insurance needs that require deep risk management work, a broker might charge a separate advisory fee. This is always discussed and agreed upon upfront—no surprises.

Can an Independent Agent Find the Same Policies as a Broker?

Not really. While independent agents have a leg up on captive agents by offering policies from several companies, they're still limited. They can only sell policies from the specific insurance carriers they have appointments (contracts) with. It’s like a restaurant with a set menu.

A broker, on the other hand, isn't tied down by appointments. They have the freedom to approach almost any carrier in the market, including highly specialized insurers that agents simply can't access. This is a massive advantage if you have unique or hard-to-place risks.

The core operational distinction lies in market reach. An independent agent represents a handful of pre-selected companies, whereas a broker represents you to the entire marketplace, unlocking a much broader range of potential solutions.

How Are Agents and Brokers Licensed and Regulated?

Both are licensed professionals who have to jump through some serious hoops. They need to complete specific coursework, pass a state exam, and keep up with continuing education credits to stay licensed.

The crucial difference is who they legally answer to. An agent's primary legal duty is to the insurance company they represent. A broker, however, has a fiduciary duty to you. That's a much higher legal standard. It legally obligates them to act in your best interests, putting your financial security first in every recommendation they make. This is perhaps the single most important difference between them.

At Wexford Insurance Solutions, we bring together the personal touch of a dedicated guide with the market-wide access you need to find truly fitting coverage. Whether it’s for your family or your business, our team is here to be your trusted advisor. See how we can protect what matters most to you by visiting us at https://www.wexfordis.com.