If your latest home insurance bill made you do a double-take, you're not alone. Finding ways to lower that cost often comes down to a mix of smart policy tweaks, practical home improvements, and simply knowing what to ask for. The good news is that you can often find savings by increasing your deductible, bundling your home and auto policies, and asking your agent about discounts you might not even know exist.

Why Is My Home Insurance So Expensive All of a Sudden?

It’s not just you. Rates are on the rise everywhere, and it’s not some random price jump from your carrier. To get a handle on how to lower your premium, it helps to first understand the big-picture forces driving costs up.

Right now, two major culprits are at play: persistent inflation and a dramatic increase in severe weather events.

The Real Price of a Rebuild

When an insurance company calculates your premium, they aren't looking at your home's Zillow estimate. They're focused on its replacement cost—the actual dollar amount it would take to rebuild your home from scratch at today's prices.

Think about it. The cost of lumber, roofing, and skilled labor has shot up over the last few years. Lingering supply chain hiccups and high demand mean that what it cost to fix a roof five years ago is a fraction of what it costs now. Insurers have to price policies to cover that new, much higher reality.

The bottom line: Your premium isn't based on what you paid for your house. It's directly tied to the sky-high cost of construction materials and labor, which inflation has sent soaring.

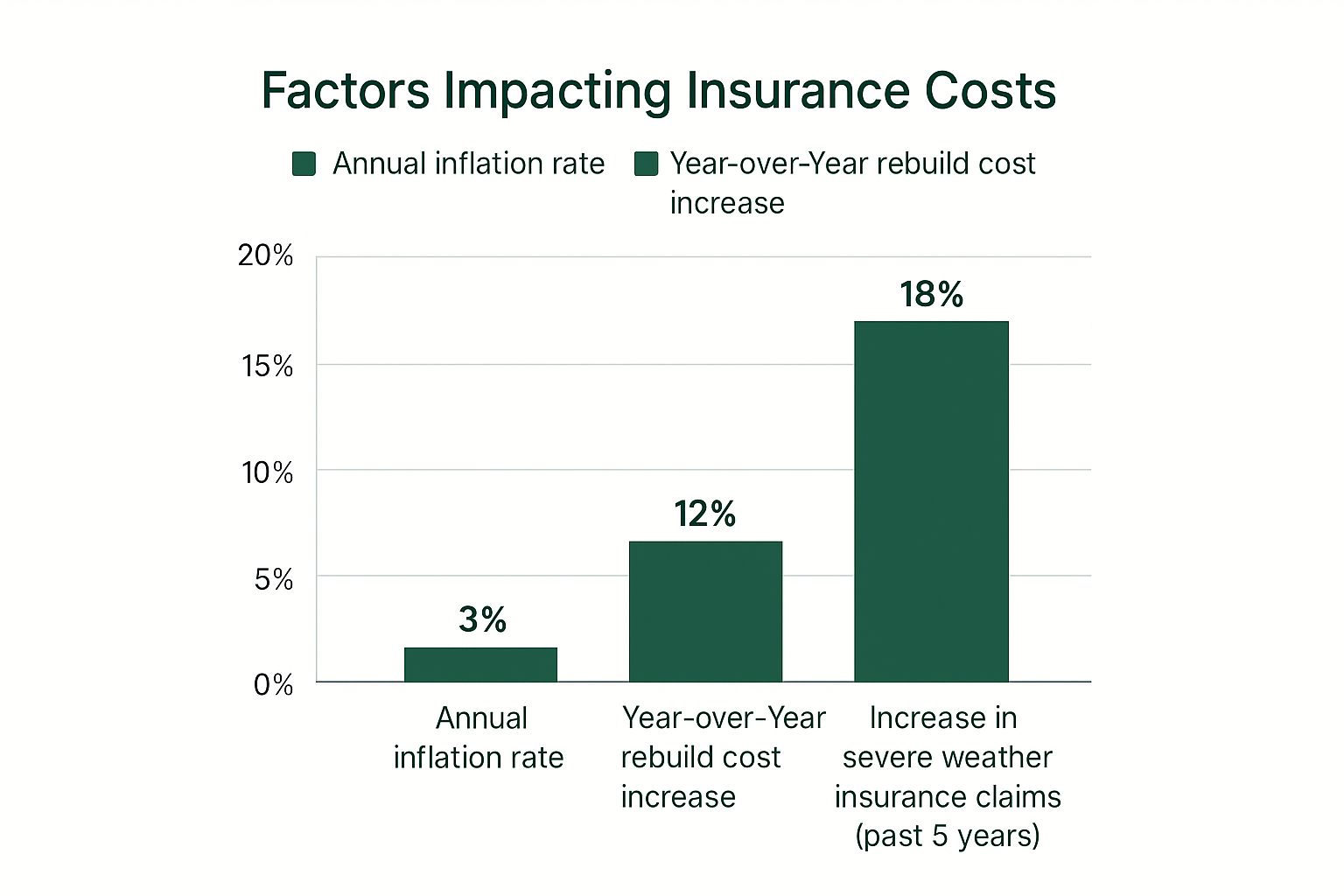

This visual breaks down how all these factors connect.

As you can see, general inflation is just one piece of the puzzle. The specific costs to rebuild a home and the sheer number of claims are climbing even faster, which puts a lot of pressure on insurance rates across the board.

Weathering the Financial Storm

On top of inflation, insurance carriers are dealing with a staggering number of claims from natural disasters. Hurricanes, wildfires, hailstorms, and tornadoes are becoming more frequent and more destructive, leading to billions of dollars in losses each year.

This isn't a small-scale problem. Between 2021 and 2024, average homeowners insurance premiums jumped by roughly 24%. For the typical homeowner, that's an extra $648 tacked onto their annual budget. The Consumer Federation of America’s recent report dives deep into this trend if you want to see more of the data.

Because the losses are so widespread, insurers have to spread that risk out by adjusting premiums for everyone—even for homeowners who live in areas that seem perfectly safe. If you want to better understand all the moving parts of your policy, check out our guide offering a complete home insurance explanation.

Fine-Tuning Your Policy for Quick Savings

If you're looking for the fastest way to dial down your home insurance premium, the first place to look is your policy's deductible. This is simply the amount you agree to pay yourself on a claim before your insurance kicks in. It’s a classic risk-reward trade-off.

By shouldering a bit more of the initial financial risk, you can achieve a pretty significant drop in your yearly cost. Insurers love this because it filters out the smaller, nuisance claims that are costly for them to process.

A recent analysis showed that bumping your deductible from $1,000 to $2,500 could lower your annual premium by about 12%. It’s a straightforward adjustment that signals to your insurer that you'll handle the minor stuff, which makes you a lower-risk client in their eyes.

The golden rule here is to make sure you have the higher deductible amount—say, $2,500—tucked away in an emergency fund. You never want to choose a deductible you can't comfortably cover at a moment's notice.

The Power of Increasing Your Deductible

Raising your deductible is one of the most reliable ways to lower your premium. The table below gives you a general idea of what to expect, though your actual savings will vary based on your insurer, location, and claims history.

Potential Savings from Deductible Increases

| Deductible Increase | Average Annual Premium Savings (Percentage) | Average Annual Premium Savings (Dollar Amount) |

|---|---|---|

| $500 to $1,000 | Up to 10% | $100 – $250 |

| $1,000 to $2,500 | 10% – 15% | $250 – $400 |

| $2,500 to $5,000 | 15% – 25% | $400 – $600 |

As you can see, the savings become more substantial with larger increases. Just remember to balance the potential savings against what you can realistically afford to pay out-of-pocket if something goes wrong.

Trimming the Fat: Are You Over-Insured?

Beyond the deductible, it’s also smart to take a hard look at the extra coverages, often called riders or endorsements, tacked onto your policy. Life changes, and the insurance you needed five years ago might be overkill today.

Do you still need that expensive jewelry rider for a piece that now lives in a safe deposit box? Or what about that extra coverage for a high-tech home office you’ve since dismantled? These are real-life examples of how people end up paying for protection they no longer need.

Pruning these outdated riders can result in instant savings without touching your core protection for the house itself. To spot these opportunities, you first have to know what you're looking at. Taking the time to learn how to read an insurance policy is an invaluable skill for any homeowner.

I always recommend an annual policy review with your agent. Sit down and go through it line by line. Make them explain each rider and ask yourself, "Does this still apply to my life right now?" This simple habit keeps your coverage lean, effective, and affordable.

Uncovering Hidden Home Insurance Discounts

So many homeowners pay more than they need to simply because they're unaware of all the discounts available. It’s easy to miss them. Think of it less like a chore and more like a scavenger hunt where the prize is real money back in your pocket.

The one you’ve probably heard of is the multi-policy or "bundle" discount. There's a good reason it's so popular: it works. Insurers reward loyalty, and keeping your policies under one roof is the easiest way to show it. Combining your home and auto insurance is often the single biggest move you can make, frequently slashing your premium by 15% or more.

Bundling is a great start, but it's just that—a start. Don't stop there. Your best strategy is to be proactive. Make it a point to ask your agent for a full discount review on your account every single year.

Your Go-To Discount Checklist

Beyond the bundle, a whole world of savings opportunities opens up, most of which are tied to home safety upgrades or your personal history. Use this list to start a conversation with your insurance agent. They won't always know about the changes you've made unless you tell them.

Ask about credits for recent home improvements, such as:

- Protective Devices: This is a big one. Think professionally monitored security systems, smart smoke detectors that alert your phone, and even centrally-monitored fire alarms. From an insurer's perspective, these are clear signs you’re serious about protecting your property.

- Water Leak Detectors: Automatic water shut-off systems are a game-changer. Water damage is one of the most common and costly claims, so preventing it gets you a serious nod from your insurance company.

- A New Roof or Updated Systems: Did you recently replace your roof or overhaul the plumbing or electrical? Let your agent know. A newer, more resilient home is less risky, and your rate should reflect that.

And don’t forget about personal discounts that reward you for being a responsible homeowner.

- Claims-Free History: Haven't filed a claim in the last three to five years? You should absolutely be getting a discount for that.

- Loyalty: Many carriers offer a credit just for sticking with them for several years. It pays to stay put sometimes.

- Mortgage-Free: Paying off your home is a massive milestone. Some insurers will celebrate with you by offering a lower premium.

By actively asking about these credits, you're not just a customer; you're taking control of your insurance costs. If you want to dig into the specifics of combining policies, our guide to bundling home and auto insurance breaks down everything you need to know.

Making Home Upgrades That Reduce Your Premium

Sometimes, the best offense is a good defense. When it comes to your home, making smart, strategic improvements can be one of the most powerful long-term plays for lowering your insurance bill.

Insurers are all about managing risk. When they see a homeowner proactively making their property safer and more resilient, they see a lower chance of having to pay out a large claim. That risk reduction often gets passed back to you in the form of a lower premium.

Think about it from their perspective. An old roof with curling shingles is just one bad hailstorm away from a major claim. But a brand-new roof built with impact-resistant materials? That’s a much safer bet for everyone.

High-Impact Improvements Insurers Reward

Not all home projects catch an underwriter's attention. While a gorgeous kitchen remodel adds plenty of personal and resale value, it doesn't do much to reduce your risk profile. The key is to focus on upgrades that directly protect your home against common disasters like fire, wind, and water damage.

Here are a few of the upgrades that give you the most bang for your buck:

-

Upgrade Your Roof: This is the big one. A new roof is often the single most effective way to earn a discount. If you live in a storm-prone area, installing a Class 4 hail-resistant roof can make a huge difference. A sturdy roof makes it less likely you'll ever have to file a hail damage roof insurance claim, which is a win for both you and your insurer.

-

Modernize Electrical and Plumbing: Old, outdated systems are a ticking time bomb. Things like knob-and-tube wiring or old galvanized pipes are major red flags for fire and water damage. Bringing them up to modern code not only prevents a catastrophe but can also unlock a nice premium reduction.

-

Install Storm Shutters or Impact-Resistant Windows: For anyone living in a coastal or hurricane-prone state, this is a must. These installations drastically lower the odds of catastrophic wind and debris damage during a major storm, and insurers reward that foresight.

Investing in upgrades that boost energy efficiency can often lead to lower premiums; consider how you can implement practical home energy efficiency tips to not only save on utilities but also potentially on your insurance.

Just remember one crucial step: tell your insurance agent! The savings don't just appear out of thin air. Once the work is done, send your agent the receipts and contractor invoices as proof. Proactively managing your home’s weak points is a surefire way to keep your insurance costs in check for years to come.

Why You Should Shop for New Quotes Regularly

https://www.youtube.com/embed/E_oaQdG8QsY

When it comes to home insurance, loyalty rarely gets you the best deal. It’s easy to stick with the same company year after year, but that comfort could be costing you a small fortune.

The truth is, every insurance carrier uses its own secret sauce—a complex algorithm—to figure out what you should pay. One might hike rates for everyone in a zip code that had a few hail claims last spring, while another is more focused on older plumbing or wildfire zones. This is why the best deal for your neighbor might be a terrible one for you.

Your Location Is a Major Factor

Where your house is located plays a massive role in your premium. Insurance costs can swing wildly from one state to another, and even from one town to the next, all based on local risks. Think hurricanes in Florida, tornadoes in Oklahoma, or wildfires in California.

These regional risks, along with state-specific regulations, are a huge driver of what you pay. To get a better sense of how your area is affected, you can see the premium differences across the country in this home insurance cost map.

A word of caution: Don't just look at the final number. When you get multiple quotes, you absolutely have to compare them apples-to-apples. Make sure the coverage limits, deductibles, and endorsements are identical across the board.

Only then can you be sure you’re actually getting a better deal, not just less coverage for a lower price.

How to Shop Smart

Being prepared is the key to shopping for insurance effectively. The goal isn't just to find a cheaper price, but to find the right coverage at the best possible price.

Before you start calling around or filling out online forms, grab your current policy's declarations page. This one document is your cheat sheet—it lists all your current coverage amounts, from your dwelling coverage down to liability.

Give this information to every agent or company you contact. This ensures that every quote you receive is for the exact same level of protection you have now. Once you have that in hand, you’re ready to compare home insurance quotes and find the savings you deserve.

Your Top Insurance Savings Questions, Answered

Even after mapping out a plan, a few questions always pop up. It’s completely normal. Let's dig into some of the most common things homeowners ask when they’re trying to trim their insurance costs.

How Often Should I Actually Shop Around for New Insurance?

Think of it as an annual financial health check. You don't necessarily have to switch carriers every year, but getting fresh quotes every two to three years is a genuinely smart move.

Insurance companies are constantly updating how they calculate risk and price their policies. The carrier that offered the best deal a few years back might not be the most competitive for you today. This is especially true if your own situation has changed for the better, like an improved credit score or a clean claims history.

Will Filing a Small Claim Really Hurt My Rates?

In short, yes. Filing a claim of almost any size can trigger a rate increase when your policy renews. Just as importantly, it can knock you out of a valuable claims-free discount. Many insurers reward homeowners with discounts of 10% or more for staying claim-free for three to five years.

Before you call your insurance company for minor damage, always run the numbers. If the cost to fix the issue is just a bit more than your deductible, paying for it yourself is almost always the smarter long-term play.

Imagine you have a $1,000 deductible and a repair bill for $1,300. Filing that claim only puts $300 back in your pocket. That tiny payout is rarely worth the higher premium you'll likely face for the next several years.

How Much Does My Credit Score Matter for My Premium?

It matters a lot. In most states, insurers rely on a special credit-based insurance score to help set your rates. The data shows a clear link between how a person manages their credit and the odds they'll need to file an insurance claim.

Simply put, a better credit score often leads to a lower premium. Working to improve your score—by paying bills on time and keeping your credit card balances in check—is one of the most effective and overlooked strategies for lowering your home insurance costs over time.

At Wexford Insurance Solutions, we live and breathe these details so you don't have to. Our experts can give you a complimentary policy review to find every saving you deserve. Ready to see if you're getting the best price? Get your personalized quote by visiting us at https://www.wexfordis.com.

Difference Between Agent and Broker Insurance: Key Insights

Difference Between Agent and Broker Insurance: Key Insights How to Prevent House Fires A Practical Guide

How to Prevent House Fires A Practical Guide