When you're looking for insurance, the first question is often: should I use an agent or a broker? While they might seem similar, the most important difference comes down to a simple question: who do they work for?

An insurance agent represents the insurance company. In contrast, an insurance broker represents you, the client. This single distinction changes everything about the process, from the advice you receive to the policies you can choose from.

Defining the Agent vs Broker Relationship

Let's break this down with a real-world parallel. An agent is like a salesperson at a specific car dealership—say, Toyota. They know every Toyota model inside and out and are there to sell you a Toyota. A broker, on the other hand, is like an independent auto consultant you hire to survey the entire market and find the best car for you, whether it's a Toyota, a Ford, or a Honda.

This simple analogy gets to the heart of the matter. An agent's primary loyalty is to the insurer they're contracted with. A broker’s loyalty is legally bound to you. They have a fiduciary duty to act in your best interest, a legal standard that puts your financial needs first.

Allegiance and Options

Since an agent works for a specific company (or a few select ones), the policies they can offer are limited to that company's product line. A broker isn't tied down by these contracts. They have the freedom to shop the entire market, sourcing policies from a vast network of carriers.

This access to a wider market is a game-changer, especially if you have unique or hard-to-place risks.

Here’s a quick breakdown of this core difference:

| Criterion | Insurance Agent | Insurance Broker |

|---|---|---|

| Represents | The insurance company | The client (you) |

| Primary Duty | To sell the insurer's policies | To find the best coverage for the client |

| Policy Options | Limited to their affiliated company(s) | Access to the entire market |

The most significant distinction lies in their legal obligation. A broker has a fiduciary duty to the client, a higher standard of care that legally requires them to act in the client's best interest.

Ultimately, who you choose to work with impacts the variety of quotes you'll see and the advice you'll get. This all leads up to securing your coverage, which is often confirmed with a temporary document before the final policy is issued. You can learn more about this in our guide explaining what is an insurance binder.

Understanding Their Distinct Professional Roles

While it’s easy to think of agents and brokers as interchangeable, their day-to-day functions and legal duties are worlds apart. The key difference lies in who they work for, and understanding this split is the first step in figuring out who can best help you.

An insurance agent’s primary loyalty is to the insurance carrier they represent. This relationship dictates everything from their professional obligations to the specific products they can put in front of you.

The Two Types of Insurance Agents

Not all agents are cut from the same cloth. The way they're set up directly affects the range of policies you'll see.

- Captive Agents: These professionals work exclusively for a single insurance company. Think of them as specialists who know their company's products inside and out, but they can only sell you policies from that one carrier.

- Independent Agents: An independent agent represents several different insurance companies. This gives you more variety than a captive agent, but their contractual obligation is still to the insurers they’ve partnered with, not directly to you.

The Broker's Role as Your Advocate

On the other side of the table, an insurance broker’s professional and legal duty is to you, the client. This isn't just a promise; it's a fiduciary duty, a high legal standard that requires them to always act in your best financial interest.

A broker’s process is naturally more in-depth and client-focused.

- Risk Analysis: It all starts with a deep dive into your personal or business risks to figure out exactly what kind of coverage you need.

- Market Research: Armed with that knowledge, they scour the entire insurance market, gathering quotes from a wide range of carriers to find the best fits and most competitive prices.

- Negotiation: Finally, a broker goes to bat for you, negotiating the policy's terms and pricing to make sure the final contract truly serves your needs.

This distinction is what really matters. In the U.S., the roles of over 457,510 insurance sales agents are all about connecting customers with policies, fueling a massive market. In fact, the insurance brokerage and agency sector is on track to hit $261.7 billion by 2025, a testament to the demand for both direct sales and specialized advice.

To keep up, both agents and brokers need to be incredibly efficient. Mastering effective time management strategies, a skill crucial in any client-focused industry, can make all the difference.

A Practical Comparison of Agents and Brokers

To really get a feel for the difference between an insurance agent and a broker, it helps to put them side-by-side and see how they actually operate. Their loyalties lie in different places, and that single fact creates a ripple effect that touches every part of the insurance-buying process for you.

This direct comparison will show you exactly how their roles diverge. We’re talking about everything from the advice you get to the fine print in your final contract. Knowing these differences is critical before you even think about getting a quote.

Allegiance and Your Best Interests

Here’s the most important distinction: who are they legally bound to serve? An agent’s primary duty is to the insurance carrier they work for. This is true whether they're a captive agent for one company or an independent agent representing a handful of them.

On the other hand, a broker’s primary duty is to you, the client. They operate under a fiduciary responsibility, which is a much higher legal standard. This obligates them to act in your best financial interest, not the insurer's. Essentially, this legal framework ensures their recommendations are genuinely aligned with protecting you.

This fiduciary duty is the key differentiator. It legally requires a broker to prioritize your needs above all else, including their own compensation or the insurer’s preferences, giving you a powerful advocate.

Comparing Key Operational Differences

Let’s dig into how this core difference in loyalty actually plays out in the real world. The table below gives you a clear, side-by-side look at their day-to-day functions, helping you see where their paths split and how it directly affects your experience.

Key Differences Insurance Agent vs Insurance Broker

This table highlights the fundamental differences between an agent and a broker, making it easier to see whose interests they serve.

| Criterion | Insurance Agent | Insurance Broker |

|---|---|---|

| Primary Loyalty | To the insurance company | To the client (you) |

| Policy Options | Limited to affiliated insurer(s) | Access to the broad market |

| Compensation | Commission from the insurer | Commission from insurer/fees |

| Legal Duty | Suitability standard | Fiduciary standard |

As you can see, the contrast is stark. An agent works from a limited menu of products, guided by their contractual obligations to their carriers. Their job is to find a suitable policy for you from within that portfolio.

A broker, however, has the freedom to search the entire marketplace to find the optimal coverage for your unique risk profile. While they are often still paid a commission by the carrier, their business model is built around being an impartial advisor. This structure allows them to recommend any policy from any carrier without a conflict of interest.

No matter who you work with, fully understanding your options is the first step, and learning how to read an insurance policy is an essential skill every policyholder should have.

Understanding the Money: How Agents and Brokers Fit into the Financial World

To really grasp the difference between an agent and a broker, you have to look at the money and market power involved. The sheer economic scale of the top brokerage firms tells a story about their influence, which often translates into better leverage and more options for their clients.

Take the top 10 U.S. insurance brokers, for example. In 2023, they pulled in a staggering $49.9 billion in revenue. That single figure accounts for 66% of the total revenue for the top 100 brokers combined. This isn't just trivia; it's a clear indicator of concentrated market power. This financial muscle is precisely why businesses with complex risks often lean on brokers for their expertise and negotiating clout. You can find more data on broker revenue trends over at MarshBerry.com.

How Does This Affect Your Choice?

This isn't just an abstract industry statistic; it has a direct impact on the insurance options available to you. A large, well-funded brokerage has built deep relationships with countless carriers. That network can unlock more competitive rates and specialized coverage that you might never see through other channels.

The massive financial footprint of major brokerage firms isn't just about revenue—it signals their indispensable role in the insurance ecosystem. For a client, this often means access to deeper markets and more sophisticated risk advice than a single agency can typically offer.

This advantage really comes into play year after year. A well-established broker acts as your advocate during the insurance policy renewal process, making sure your coverage evolves with your needs without breaking the bank.

How to Choose the Right Insurance Professional for You

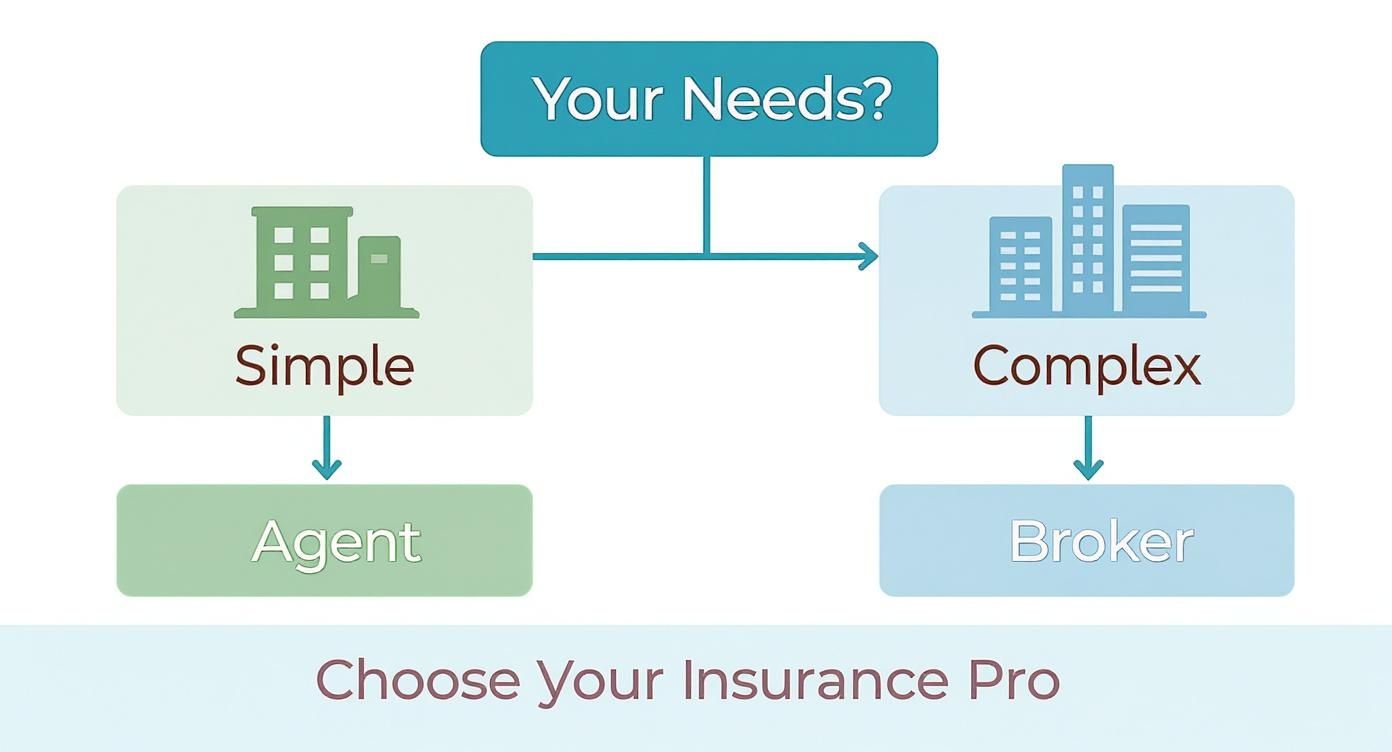

So, should you go with an agent or a broker? The answer really boils down to how complex your insurance needs are. You're either looking for a straightforward policy from a brand you trust, or you need a custom-built strategy that pulls from the best options across the market. That single decision sets the stage for your entire experience.

Let's ground this in reality. Imagine a family looking to bundle their home and auto insurance. A captive agent from a big-name company is often a perfect fit. They know their company's products inside and out and can get you set up efficiently. It’s a direct, simple path.

Now, picture a small business with a mix of risks—they need general liability, professional liability (E&O), and maybe even cyber insurance. In this case, a broker is almost always the smarter choice. A single insurer might not even offer all those coverages, let alone offer the best terms for each. A broker’s ability to shop the market and negotiate on your behalf is invaluable here.

This decision tree infographic can help you see where you fall.

As you can see, agents are great for common, everyday insurance needs. But once your situation gets a little more unique or complicated, a broker's wider access becomes a huge advantage.

Key Questions to Ask Yourself

Before you start making calls, take a minute to think about what you're actually looking for. Answering these questions honestly will point you in the right direction. For a more detailed walkthrough, check out our guide on https://wexfordis.com/2025/09/29/how-to-choose-an-insurance-broker/.

Here are a few questions to get the ball rolling:

- How complex are my needs? Is this for a standard car policy, or am I insuring a business with a lot of moving parts and specific risks?

- Do I value brand loyalty over market choice? Am I happy sticking with one major carrier, or would I rather see what multiple insurers can offer?

- How much time can I dedicate to research? Do I want an expert to do the comparison shopping for me, or am I okay exploring the options within one company’s system?

Your answers create a clear path forward. If your needs are simple, an agent’s focused expertise is often the best route. If they’re complex, a broker’s market reach and client advocacy are what you need.

The world of insurance distribution is enormous and still expanding. The U.S. insurance brokers and agencies market hit roughly $260.1 billion in 2024, which just goes to show how critical both roles are in the economy. As you make your choice, it's also worth thinking about how an AI-driven customer experience in insurance might influence the quality of service you get down the line.

Common Questions About Insurance Agents and Brokers

Even after you get the basic differences down, a few practical questions always seem to pop up. Let's tackle some of the most common ones to clear up any lingering confusion.

When it comes to insurance, money is always top of mind. It’s natural to wonder if a broker's wider access and personalized service will end up costing you more.

Does It Cost More to Use an Insurance Broker?

Typically, no. Brokers are usually paid a commission by the insurance company you choose, so you don't pay them directly. While some might charge a separate fee for very complex cases or specialized consulting, this is the exception, not the rule.

In fact, a good broker often saves you money. By shopping the entire market, they can uncover policies with better coverage or a lower premium than you might find on your own. Their goal is to find you the best possible value.

The real value of a broker is their ability to scan the whole market for you. This often leads to savings that more than justify their commission. An agent is working with a set menu; a broker can order from any restaurant in town.

Is an Independent Agent the Same as a Broker?

This is a common point of confusion. They seem similar because both work with multiple insurance companies, but there's a crucial legal difference in who they work for. An independent agent has a contract with the insurance companies they represent, meaning their primary duty is to them.

A broker, on the other hand, has a legal and fiduciary duty to you, the client. That means they are legally required to act in your best interest when recommending a policy. It’s a subtle but powerful distinction when your financial security is at stake.

Who Helps Me If I Need to File a Claim?

Both should be your first call. An agent will help you get the claim started with their company, but a broker often takes on a much bigger role as your advocate.

Since their loyalty is to you, a dedicated broker will leverage their expertise and relationships to make sure your claim is processed fairly and promptly. They're in your corner from beginning to end. Keeping your insurance professional in the loop is key, so make sure you review these life changes to tell your insurance agent about to ensure your coverage keeps up with your life.