At its most basic, builders risk insurance is a special, temporary policy designed to protect a construction project while it's being built. It specifically covers the structure and the materials on-site from all sorts of unexpected trouble. Think of it as a financial backstop against physical damage from things like fire, theft, vandalism, and nasty weather events.

This policy is your project's safety net, active from the moment you break ground until the ribbon-cutting ceremony.

Your Quick Guide to Builders Risk Coverage

A great way to picture builders risk insurance is as a protective bubble wrapped around your entire job site. It shields all the physical assets that are becoming part of the final building—the stacks of lumber, the wiring, the fixtures, and the structure itself—from sudden, accidental loss.

Without it, a single overnight fire or a powerful storm could instantly wipe out months of hard work and invested capital. That kind of event could leave everyone involved in a catastrophic financial hole. This coverage is absolutely essential because your standard commercial property insurance policy won't kick in until the building is actually finished and ready for business. Builders risk is the policy that plugs that critical gap, making sure the project's value is secure when it's most vulnerable.

Who Needs This Coverage?

It's a common misconception that only the general contractor needs builders risk insurance. The reality is that anyone with a significant financial stake in seeing the project through to completion should be covered.

That list includes:

- Property Owners: The person or company footing the bill has the most to lose and is very often the primary policyholder.

- General Contractors: They're on the hook for the day-to-day work and the overall security of the site.

- Subcontractors: Your plumbers, electricians, and other specialized pros can and should be named on the policy.

- Architects and Engineers: Their professional and financial interests are directly tied to the project finishing successfully.

- Lenders: Banks and other financial institutions that provide project loans will almost always require builders risk coverage to protect their investment.

Builders Risk Insurance at a Glance

To make it even clearer, let's break down what a standard builders risk policy typically covers versus what it usually leaves out. Getting this distinction right is the first and most important step to making sure your project is properly protected.

| Component | What It Means | Common Examples |

|---|---|---|

| What's Covered | Direct physical loss or damage to the insured property from a covered event. | Fire, wind damage, theft of materials, vandalism, lightning strikes, hail. |

| What's Excluded | Risks that are either predictable, stem from professional errors, or need their own specialized insurance. | Faulty design, poor workmanship, employee injuries, tools and equipment, earthquakes, floods (unless added on). |

| Who Needs It | Any person or entity with a financial stake ("insurable interest") in the construction project. | Property owners, general contractors, developers, lenders, subcontractors. |

It's no surprise that the demand for this insurance is on the rise, mirroring the growing scale and complexity of modern construction. To put it in perspective, the U.S. builders risk market was valued at around USD 5.36 billion and is forecast to jump to USD 8.75 billion by 2033. You can discover more insights about builders risk market trends to see just how crucial this coverage has become.

What Does Builders Risk Actually Cover?

So, what does a builders risk policy really do for you on the ground? Think of it less like a simple checklist and more like a financial backstop for the physical structure and all the parts that go into it. It’s designed to protect against sudden, accidental physical losses—the kind of events that can turn a manageable setback into a project-ending disaster.

Let's say your crew just spent a week framing a new custom home. Then, a freak windstorm rolls through overnight and collapses a huge section of your work. This is the exact moment a builders risk policy proves its worth. It steps in to cover the cost of the destroyed lumber and, just as importantly, the labor to rebuild that section and get you back on schedule.

But the protection goes well beyond the frame itself. It also covers all the essential components that will eventually become a permanent part of the building.

Your Building Materials are Protected

A job site is basically an open-air warehouse packed with valuable materials. We're talking about everything from copper pipes and wiring to stacks of drywall and high-end flooring. These items are prime targets not just for bad weather, but for thieves. Job site theft is a massive problem, and the true cost isn't just the materials themselves—it's the frustrating delays that follow.

Picture this: you show up on a Monday morning to find that $20,000 worth of copper wiring was stolen over the weekend. A good builders risk policy is built for this exact scenario. It would reimburse you for the cost of the stolen wire, helping you avoid a serious financial hit and letting you reorder materials without digging into your own pocket.

Key Takeaway: Builders risk is often called "course of construction" insurance because it protects the structure and materials as the project is being built. The policy limit should always be set to the total finished value of the project, not just its current value.

This protection isn't always confined to the property lines, either.

Coverage That Extends Beyond the Job Site

Many policies are written to include materials that are in transit to your site or even being stored temporarily at another location. This is a critical detail that adds a much-needed layer of security to your project’s supply chain.

For instance, what if a set of custom kitchen cabinets gets damaged when the delivery truck gets into an accident on the way to your project? With the right policy, the cost to repair or replace them is covered. The same goes for materials stored in an approved warehouse that get damaged in a fire before ever making it to the site.

A solid policy will typically include other core protections as well:

- Fire Damage: This is one of the most common and destructive risks. A single spark from welding equipment can ignite nearby materials and cause catastrophic damage in minutes.

- Vandalism: If someone breaks in and smashes newly installed windows or spray-paints walls, the policy helps cover the cost of repairs.

- Temporary Structures: Coverage can also apply to essential on-site structures that aren't part of the final building, like scaffolding, construction forms, or temporary fencing, if they're damaged by a covered event.

It's also crucial to understand how you get paid after a loss. Most policies are designed to cover the cost to replace what was damaged. To get a better handle on this, it’s worth digging into the specifics of what is replacement cost coverage and how it ensures you have the actual funds needed to rebuild. All these protections work together to create a safety net for your investment, from the moment you break ground until you hand over the keys.

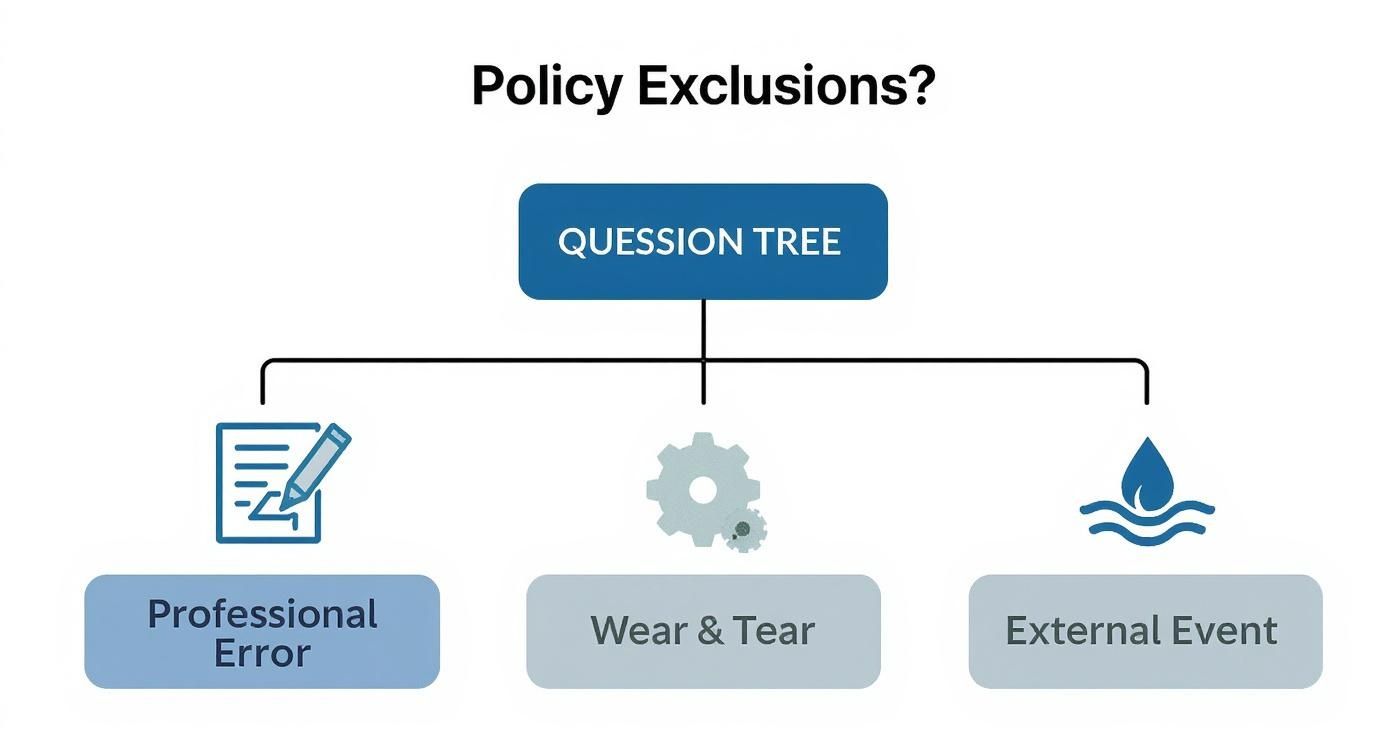

Navigating Common Policy Exclusions

Knowing what a builders risk policy covers is only half the story. To be truly protected, you have to understand what it doesn't cover. Insurance is all about sudden and accidental events, which means some risks just don't fit the bill.

Think of it this way: your policy is like a highly specialized toolkit. It’s got exactly what you need if a fire destroys your framing overnight. But it's not designed to fix a cracked foundation that failed because of a bad concrete mix. One is an unexpected accident; the other is a matter of professional performance.

Getting a handle on these distinctions will save you from major headaches and help you build a complete risk management plan. Let's pull back the curtain on the most common exclusions you'll find buried in the fine print.

Professional Errors and Faulty Workmanship

A builders risk policy is not a warranty for good work. Its job is to protect your project from outside forces—like theft or wind—not from mistakes made by the people building it. This is probably the biggest and most misunderstood exclusion of them all.

So, if a section of the roof gives way because of a design flaw or if the crew used the wrong installation technique, your builders risk policy isn't going to step in. Those kinds of problems fall under professional liability or faulty workmanship.

Here’s a quick rundown of what that means:

- Design Flaws: Mistakes in the blueprints or architectural plans that cause a structural failure.

- Poor Workmanship: Damage caused by shoddy construction practices, like improper welding or bad framing.

- Defective Materials: Losses that happen because the materials themselves were substandard and couldn't hold up.

For these kinds of screw-ups, contractors and design professionals need their own specialized coverage, like professional liability or errors and omissions (E&O) insurance. Builders risk covers what happened to your project, not why it failed due to a professional mistake.

Predictable Wear and Tear

Insurance is for the things you don't see coming, not for the slow, inevitable creep of time and exposure. That's why builders risk policies always exclude damage that happens gradually from normal aging or deterioration.

Key Distinction: A policy will absolutely cover damage from a sudden windstorm that rips the siding clean off a building. But it won't pay to replace rusted pipes or corroded fixtures, as that's considered a maintenance issue that develops over time.

Other things you'll see excluded here are rust, corrosion, rot, and the mechanical breakdown of equipment unless it was zapped by a covered event like a lightning strike. The insurance company sees these as operational risks you can plan for, not accidental losses.

Events Requiring Separate Coverage

Some potential disasters are so massive or location-specific that they are almost always left out of a standard builders risk policy. To get coverage for these catastrophic events, you'll need to purchase a specific add-on, called an endorsement, which will come with an extra premium.

The big ones you'll always see excluded are:

- Earthquakes: Standard policies don't cover "earth movement." If you're building in a seismic zone, you'll need to add a specific earthquake endorsement.

- Floods: This isn't just about overflowing rivers; it also includes storm surges and heavy surface water. Flood coverage has to be bought separately or added as an extension to your policy.

- Employee Injuries: This is a big one. An injury to a worker on your site is never, ever covered by builders risk. That’s what Workers' Compensation insurance is for, and it's legally required.

- Tools and Equipment: Your policy protects the materials that will become a permanent part of the building, but not the contractor’s own tools or mobile equipment like generators and backhoes. That requires a separate Inland Marine or Contractors Equipment policy.

Getting these exclusions straight is the key to building an insurance plan with no surprises. For a deeper dive into making sense of your policy, check out our guide on how to read an insurance policy to get more comfortable with the details.

How to Expand Your Coverage with Endorsements

A standard builders risk policy is a fantastic starting point, but it's really a "one-size-fits-most" solution. To truly protect against the specific risks your project will face, you need to customize that protection. This is where endorsements—sometimes called riders or extensions—make all the difference.

Think of your basic policy as the solid frame of a new house. Endorsements are the custom windows, reinforced doors, and security systems you add to truly fortify it. They’re specific add-ons that plug potential coverage gaps, making sure your policy actually lines up with your project’s real-world needs. Without them, you might find out you're only partially protected right when you need it most.

Tailoring Protection for Indirect Costs

One of the most critical add-ons you can get is soft costs coverage. When a covered event like a fire brings construction to a screeching halt, the direct costs—like replacing lumber and drywall—are just the tip of the iceberg. The delay itself kicks off a cascade of secondary financial damages that can be devastating.

Soft costs are these indirect expenses that keep piling up while your project is stalled. An endorsement for these can be a financial lifesaver, covering things like:

- Additional Interest on Loans: Your construction loan doesn't pause just because the work has. This helps cover the extra interest you’ll be on the hook for because of the delay.

- Lost Rental Income: If you were counting on leasing the property, this helps recoup the income you're losing every single month the project is behind schedule.

- Extra Professional Fees: You may need to pay architects or engineers for more consultations or to revise plans after a loss.

Without this endorsement, you'd be paying these mounting bills right out of your own pocket, all while scrambling to get the project back on track.

Covering the Cleanup and Beyond

After a major loss, the damage isn't just what was destroyed; it’s also the enormous mess left behind. A standard policy might not cover the full cost of hauling away charred debris or dealing with environmental contaminants that were released.

Crucial Insight: An endorsement is a proactive move. It’s always far cheaper to add specific coverage before a loss than it is to pay the full, uncapped cost of that loss yourself after it happens.

This is where a few other specialized endorsements become essential:

- Debris Removal: This extension gives you additional funds specifically for the cost of clearing the site after a covered event. You’d be shocked at how expensive that can be.

- Pollutant Cleanup and Removal: If a fire releases asbestos or other hazardous materials, this helps cover the highly specialized and costly cleanup required by environmental regulations.

- Testing: After something like a water leak, this covers the cost of testing and re-commissioning newly installed systems (like HVAC or electrical) to make sure they're undamaged and working correctly.

The image above does a great job of showing why things like professional errors or predictable wear and tear fall outside standard coverage, while major external events like floods often demand specific endorsements. Builders risk insurance is a vital tool, especially when you consider that global construction spending is hitting heights like $2.15 trillion while natural disasters can cause economic losses of around $380 billion in a single year. These endorsements are what make your project truly resilient. You can explore more findings on global construction risk here.

Finally, when it comes to materials being transported to your site or stored somewhere else, it's also smart to understand how inland marine insurance works. You can learn more about what is inland marine coverage to see how it perfectly complements a strong builders risk policy.

How Project Risks Influence Your Policy and Premiums

https://www.youtube.com/embed/r5ZrPeQW8HQ

Ever gotten a builders risk quote and wondered why it was so different from the last one? It’s not random. The price you pay comes down to a careful calculation of your project’s unique risks. Insurers are in the business of predicting the future, and they do that by digging into every detail of your job site.

Think about it. Insuring a wood-frame apartment complex on the coast is a completely different ballgame than covering a steel office tower in the Midwest. One faces the threat of hurricanes, while the other might be more concerned with different hazards. Every single project has its own risk profile, and that profile is what shapes the cost and terms of your policy.

The Underwriter’s View of Your Project

At the end of the day, securing the right builders risk policy is all about demonstrating effective risk management in project management. The more you can show an underwriter that you've identified and planned for potential hazards, the better your policy and premiums will be.

Underwriters look at a whole host of factors to get a feel for your project. Some of the big ones include:

- Construction Type: Wood-frame buildings are a classic example. They’re more vulnerable to fire and wind, so they're often seen as a higher risk than structures made of steel or reinforced concrete.

- Project Location: Geography is a huge piece of the puzzle. A site in a flood zone, a high-crime area, or a region prone to wildfires will naturally come with a higher premium.

- Project Value and Duration: This one's straightforward. A bigger, longer project means more money and more time on the line for the insurer. That increased exposure is reflected in the cost.

- Site Security: Underwriters love to see proactive security measures. A fenced-in site with good lighting and cameras is far less risky than an open, unsecured one.

When you put all these pieces together, you get a complete picture of your project's risk. That's what allows the insurer to price your policy accurately.

What Factors Drive Up Your Premium?

The cost of builders risk isn't just about your project—it’s also about the market. To give you a clearer idea of what underwriters are looking at, here’s a breakdown of the key factors that can push your premiums up or down.

| Key Factors That Impact Builders Risk Premiums | ||

|---|---|---|

| Factor | Impact on Premium | Why It Matters |

| Project Location | High | Sites in areas prone to natural disasters (hurricanes, floods, wildfires) or high theft rates are considered much riskier. |

| Construction Materials | High | Wood-frame structures are more susceptible to fire and weather damage, often leading to higher premiums than steel or concrete builds. |

| Project Value | Moderate to High | The higher the total project cost, the greater the potential loss for the insurer, which directly influences the premium. |

| Project Duration | Moderate | Longer projects mean a longer period of exposure to risks like theft, vandalism, and weather, which can increase the cost. |

| Site Security | Moderate (can lower) | A well-secured site (fencing, lighting, cameras) demonstrates proactive risk management and can help reduce your premium. |

| Contractor Experience | Moderate (can lower) | A contractor with a proven track record of safety and successful projects may receive more favorable terms from underwriters. |

| Adjacent Properties | Low to Moderate | Proximity to high-risk neighbors, like an old, poorly maintained building or a chemical plant, can slightly increase your risk profile. |

As you can see, a combination of your specific project details and external conditions creates your final premium. While you can't move your job site, you can control things like security and demonstrate a strong safety record.

Market Conditions and External Pressures

Beyond the details of your job site, bigger trends in the insurance world can have a major impact on your premium. The market is always changing, reacting to everything from supply chain issues to the rising number of major storms.

Right now, the builders risk market is getting more selective. Carriers are looking closely at every project, favoring high-quality builds with lower risk profiles. At the same time, they're becoming more cautious about insuring projects in catastrophe-prone areas. This means even as some rates are stabilizing, projects in high-risk zones for natural disasters are still seeing premium increases of 5% to 15%. If your project is exposed to wildfires or major storms, expect tougher underwriting and higher deductibles.

Strategic Takeaway: You can't change your project's location, but you can absolutely influence an underwriter’s decision. Show them you’re serious about risk management. A detailed fire prevention plan, a documented security protocol, and a solid safety record can go a long way in securing better terms.

Proving you’re a responsible, safety-first builder can make a real difference in what you pay. It’s also a perfect example of why having a complete insurance program is so important. When all your policies work together, you create a true safety net. A smart approach always involves looking at your general contractor insurance requirements to make sure every angle of liability and property risk is covered.

Choosing the Right Builders Risk Policy for Your Project

You’ve done the hard work of understanding what builders risk insurance is. Now comes the most critical part: picking the right policy to protect your investment from the moment the first shovel hits the ground. This isn’t about just grabbing any off-the-shelf coverage; it's about tailoring a policy that fits the unique financial and physical realities of your specific project.

The entire process starts with one number: the total completed value of your project. I can't stress this enough—we're not talking about the current value or just the hard construction costs. You need a figure that includes everything: materials, labor, and even the contractor's overhead and profit. Nailing this number is crucial, because getting it wrong could leave you underinsured and facing a massive financial hole if a major disaster strikes.

Determining Your Policy's Scope

Once you know the project's total value, you need to figure out how long you'll need the coverage. A builders risk policy should kick in the second materials are delivered to the job site and stay in force until the project is 100% complete and handed over. Always, always build in a cushion for delays. Extending a policy is simple; trying to get a new one after the old one has expired is a nightmare.

A big question that always comes up is who should actually buy the policy—the property owner or the general contractor? While either can do it, things are often much cleaner when the owner takes the lead. This puts them in the driver's seat, ensuring their interests are the top priority and avoiding any confusion about who’s in control if a claim needs to be filed. That said, some construction contracts will specifically require the contractor to be the one to carry the insurance.

Pro Tip: Settle the "who buys the insurance" question in the construction contract before any work begins. This one simple step can prevent major headaches and make sure you don't accidentally start a project with no coverage.

Preparing for Your Insurance Quote

To get an accurate quote without a lot of back-and-forth, it pays to have your ducks in a row before you even talk to an insurance professional. When you have the right information ready, they can find the best and most competitive options for you much faster.

Here’s a quick checklist of the essentials you'll need:

- A Detailed Project Budget: This is non-negotiable, as it sets the coverage limit.

- The Full Construction Timeline: Insurers need the start and end dates to set the policy term.

- Site Plans and Architectural Renderings: These give the underwriters a clear picture of what they’re insuring.

- Information on the General Contractor: The insurer will want to review the contractor's track record and loss history.

With these documents ready, you're in a great position to secure a policy that truly protects your project. Just remember, this coverage is temporary. Once the ribbon is cut and the keys are handed over, you'll need to transition to a different kind of policy. For a deep dive into what that next step looks like, you can learn more about the fundamentals of commercial property insurance and how it protects your finished building.

Got Questions About Builders Risk? We've Got Answers.

Even after you've got the basics down, a few specific questions always seem to pop up about builders risk insurance. Let's tackle some of the most common ones I hear from clients, so you can fill in the gaps and feel completely confident about your project's coverage.

Think of this as the nitty-gritty. You understand the big picture, but now we'll get into the details to make sure there are no surprises waiting for you down the line.

Does Builders Risk Cover On-Site Injuries?

In a word: no. A builders risk policy is all about the property. Its job is to protect the physical structure and the materials destined to become a permanent part of it. It offers zero coverage for any liability issues, especially bodily injuries.

This is a critical distinction that trips people up all the time. For injuries, you'll need completely separate policies:

- Commercial General Liability (CGL) is your go-to for injuries to third parties, like a visitor or subcontractor who gets hurt on the site.

- Workers' Compensation is legally required in most places. It covers medical bills and lost wages for your own employees if they get injured on the job.

What if My Project Gets Delayed Past the Policy End Date?

Construction delays happen. It's the nature of the business, and insurance companies get it. If your project timeline is stretching out and you're getting close to your policy's expiration date, you absolutely must contact your insurance provider before it expires to request an extension.

Letting that policy lapse, even for a single day, opens up a massive financial risk. Your entire investment is sitting there uninsured. The good news is that most insurers can easily process an extension to keep your coverage seamless until the project is officially wrapped up.

Key Takeaway: Be proactive. Don't wait until the day before the policy expires. As soon as you see a delay on the horizon, get in touch with your insurance agent. It's the best way to keep your project protected without any gaps.

Are My Tools and Equipment Covered?

This is another common point of confusion. A standard builders risk policy does not cover a contractor’s tools or mobile equipment. Things like your generators, forklifts, or excavators are not part of the deal. The policy is designed to protect assets that are being installed and will become a permanent part of the finished building.

To protect your valuable tools and machinery from theft or damage, you'll need a separate policy called Contractors Equipment Insurance. It's a type of inland marine coverage built specifically for the mobile assets you take from job to job.

Can I Get Builders Risk Insurance for a Renovation?

Of course. Builders risk is just as crucial for a major renovation or remodel as it is for brand-new construction. A policy can be structured to cover the full value of the new work you're putting into the building.

Even more importantly, it can also be designed to protect the existing structure from any damage that might happen during the renovation. For those curious about what happens after an incident, it helps to understand the ins and outs of navigating the insurance claim process. Just be sure to clarify with your insurer exactly what parts of the existing property are covered.

At Wexford Insurance Solutions, our specialty is putting together builders risk policies that provide clear, comprehensive protection for projects just like yours. Contact us today to get a quote and build with confidence.