Negotiating an insurance settlement isn't a battle of wills; it's a battle of preparation. The secret to getting a fair outcome is to build an unshakeable, evidence-backed case before you even pick up the phone to talk to an adjuster. When you do the legwork upfront, you shift the entire conversation. You're no longer just asking for money—you're presenting a documented, fact-based valuation of your claim that they simply can't ignore.

Building Your Case Before You Negotiate

Honestly, the most important work happens long before that first conversation with the insurance company. A thoroughly prepared case leaves very little room for an adjuster to poke holes in your story or try to undervalue your losses. I tell my clients to think of it like building a fortress of evidence. The stronger your foundation of proof, the more protected you are from the inevitable lowball offers.

Gathering Your Core Evidence

First things first, you need to become a collector of every single document related to what happened. This isn't just about proving the incident occurred; it's about weaving together an undeniable narrative that forces the insurance company to take your claim seriously.

Your starting point should be a file that includes:

- The Official Police Report: This is your unbiased, third-party account of the incident. It often includes crucial details, like an initial assessment of who was at fault.

- Photographs and Videos: Don't hold back. Snap pictures of everything—the property damage, the wider accident scene, and any visible injuries. If you can, make sure they're timestamped. It adds a layer of credibility.

- Witness Information: Get the name, phone number, and a quick summary from anyone who saw what happened. Their perspective can be incredibly valuable.

This initial evidence sets the scene, but it's the next layer of documentation that truly builds the financial value of your claim.

Documenting Your Financial and Personal Losses

This is where you draw a direct line from the incident to its real-world consequences. It's time to get granular and record every single loss, no matter how minor it might feel at the moment. This detailed accounting makes it much harder for an adjuster to brush off your settlement figure.

Make sure you're tracking these key areas:

- Medical Records and Bills: Create a comprehensive file of every single diagnosis, treatment plan, prescription, and therapy session. This is the backbone of any injury claim.

- Proof of Lost Income: Don't just estimate. Get an official letter from your employer detailing your regular pay rate, the exact hours you missed, and the total wages you lost.

- Repair Estimates: For any property damage, always get multiple, itemized estimates from reputable shops. This shows you've done your due diligence.

Pro Tip: One of the biggest mistakes people make is forgetting about non-economic damages. Start a simple journal and jot down notes about your pain levels, your emotional state, and all the ways the injuries are messing with your daily life. This is the evidence you'll need to justify compensation for pain and suffering.

Of course, knowing what to claim starts with understanding your coverage. For a deep dive into this, our guide on how to read an insurance policy can help you make sure you aren't leaving any money on the table.

To help you stay organized, I've put together a checklist of the essential documents you'll want to have in your file before you start negotiating.

Essential Documentation Checklist for Your Claim

| Document Type | Why It's Important | Where to Get It |

|---|---|---|

| Police/Incident Report | Provides an official, objective account of the event and often notes preliminary fault. | The responding law enforcement agency. |

| Photos & Videos | Creates a visual record of damage, injuries, and the scene before anything is altered. | Your own phone; ask witnesses for their photos too. |

| Medical Bills & Records | Documents the full extent of your injuries, treatments, and associated costs. | Your doctor's office, hospital, and other healthcare providers. |

| Proof of Lost Wages | Quantifies the income you lost due to being unable to work. | A formal letter from your employer's HR department. |

| Repair Estimates | Establishes the cost to repair or replace damaged property (e.g., your vehicle). | Reputable auto body shops or contractors. |

| Personal Journal | Captures the non-economic impact, like pain, suffering, and loss of enjoyment of life. | A simple notebook or a document on your computer. |

Having this documentation ready to go puts you in a position of strength.

The bottom line is that the strength of your evidence is directly tied to your settlement outcome. It’s not just a theory; historical data shows a clear pattern. Well-supported claims demonstrating obvious negligence settled up to 95% of the time. In contrast, cases built on weaker evidence settled far less often. When you build an airtight case, you give the insurer a very compelling reason to offer a fair settlement instead of risking a much more expensive court battle. You can read more on these findings in a study from Cornell Law School about how claim strength impacts settlement outcomes.

How to Calculate the True Value of Your Claim

Heading into a negotiation without a solid number in mind is a huge mistake. It’s like trying to sell a house without getting it appraised first—you're almost guaranteed to leave money on the table. Insurers have their own complex software and formulas, but you need to arrive at your own valuation.

The first step is to break down your losses into two main buckets. This helps you make sure you're accounting for everything, not just the most obvious costs.

- Economic Damages: These are the straightforward, tangible financial hits you've taken. We're talking about things with a clear paper trail: medical bills, pharmacy receipts, lost wages from time off work, and repair estimates for your property.

- Non-Economic Damages: This is where things get a bit more abstract, but these losses are just as real. This covers your pain and suffering, emotional distress, and the loss of enjoyment you've experienced since the incident.

Putting a Number on Your Losses

For economic damages, it’s mostly simple addition. Meticulously gather every single receipt, bill, and pay stub related to your claim and add them all up. This total becomes the concrete foundation of your settlement demand.

Figuring out non-economic damages is more of an art than a science. A common approach that even industry pros use is the multiplier method. Here, you take your total economic damages and multiply them by a number, usually between 1.5 and 5.

Where you land on that scale depends entirely on the severity of your situation. A minor injury that healed quickly might only justify a 1.5 multiplier. But a permanent, life-altering injury? That could easily push the multiplier to a 4 or 5. This gives you a logical, defensible starting point for putting a price on your pain and suffering.

Combining your hard economic numbers with your calculated non-economic damages gives you a well-supported settlement range. It’s not just a number you pulled out of thin air; it’s a valuation backed by evidence and a recognized methodology. This gives you a powerful position to negotiate from.

Accounting for External Market Factors

Remember, the value of your claim isn't set in stone. Outside factors can have a massive impact, especially with property damage.

For instance, we've all seen how supply chain issues and chip shortages have made used cars way more expensive. If you're negotiating a total loss on your vehicle, this trend is your friend. Insurers have to pay what it costs to replace your car in the current market. Knowing this gives you the leverage to argue for a settlement that reflects today's prices, not what the car was worth a year ago. You can find more details about how market conditions affect insurance payouts on TotalLossAppraisals.com.

This same principle applies to knowing the lingo in your policy. Adjusters love to throw around terms like "actual cash value" (ACV), which can be pretty confusing. To make sure you’re getting a fair shake, it pays to understand exactly what that means. We have a great guide that explains what is actual cash value in plain English.

Writing a Demand Letter That Gets Attention

Think of your demand letter as your opening argument. It’s much more than just a formal request for payment; it’s the document that sets the stage for the entire negotiation. A well-written letter immediately signals to the insurance adjuster that you're organized, serious, and can back up every single dollar you’re demanding. It's really the first impression of the case you've so carefully built.

A powerful letter isn't about being aggressive or trying to sound like a lawyer. Its real strength lies in its clarity, logical structure, and the solid evidence you've gathered. You're essentially telling a clear story, supported by undeniable facts, that leads the adjuster to one simple conclusion: your settlement demand is both fair and well-founded.

What Goes Into a Compelling Demand Letter

To make your letter effective, you need to structure it in a way that’s impossible to dismiss. Each section should logically build on the one before it, creating a clear path from the incident itself to your final settlement number. This kind of organization shows you mean business and makes it easy for the adjuster to follow your reasoning.

Make sure your letter hits these key points:

- A Clear Factual Summary: Start with the basics—date, location, and a straightforward account of what happened. Stick to the facts here; leave emotion out of it for now.

- A Detailed List of Your Damages: This is the heart of your letter. List out every economic cost, like medical bills and lost income. Then, you'll need to explain the reasoning behind your figure for non-economic damages, such as pain and suffering.

- The Math Behind Your Demand: Don't just throw out a number. Show the adjuster exactly how you got there. Tally up your economic damages and explain the multiplier or method you used to calculate the pain and suffering component.

- Proof to Back It Up: State clearly that you've included copies of all the necessary documents—medical records, bills, receipts, and proof of any lost wages.

This systematic approach is worlds away from just demanding a lump sum with no explanation. For property damage, the logic is very similar to what's described in the typical homeowner insurance claim process, where thorough documentation is absolutely crucial.

Getting the Tone Just Right

The tone you strike in your letter matters. A lot. You want to be firm and professional, but not hostile. Remember, you're presenting a business case, not declaring war. A simple phrase like, "This letter is our formal attempt to resolve this matter amicably," can go a long way in setting a cooperative tone.

A mistake I see all the time is people writing angry, emotional letters. Adjusters see these every day and have become immune to them. A calm, fact-driven, and resolute letter will always earn more respect and lead to a better starting offer.

It's also a good idea to avoid issuing ultimatums or threatening to sue right out of the gate. That kind of talk often just puts the adjuster on the defensive and shuts down the possibility of a productive negotiation. Instead, let your well-organized evidence and clear calculations speak for themselves. A strong demand letter can dramatically improve the adjuster's first counter-offer, which saves you a ton of time and frustration down the road.

Mastering the Art of the Counter-Offer

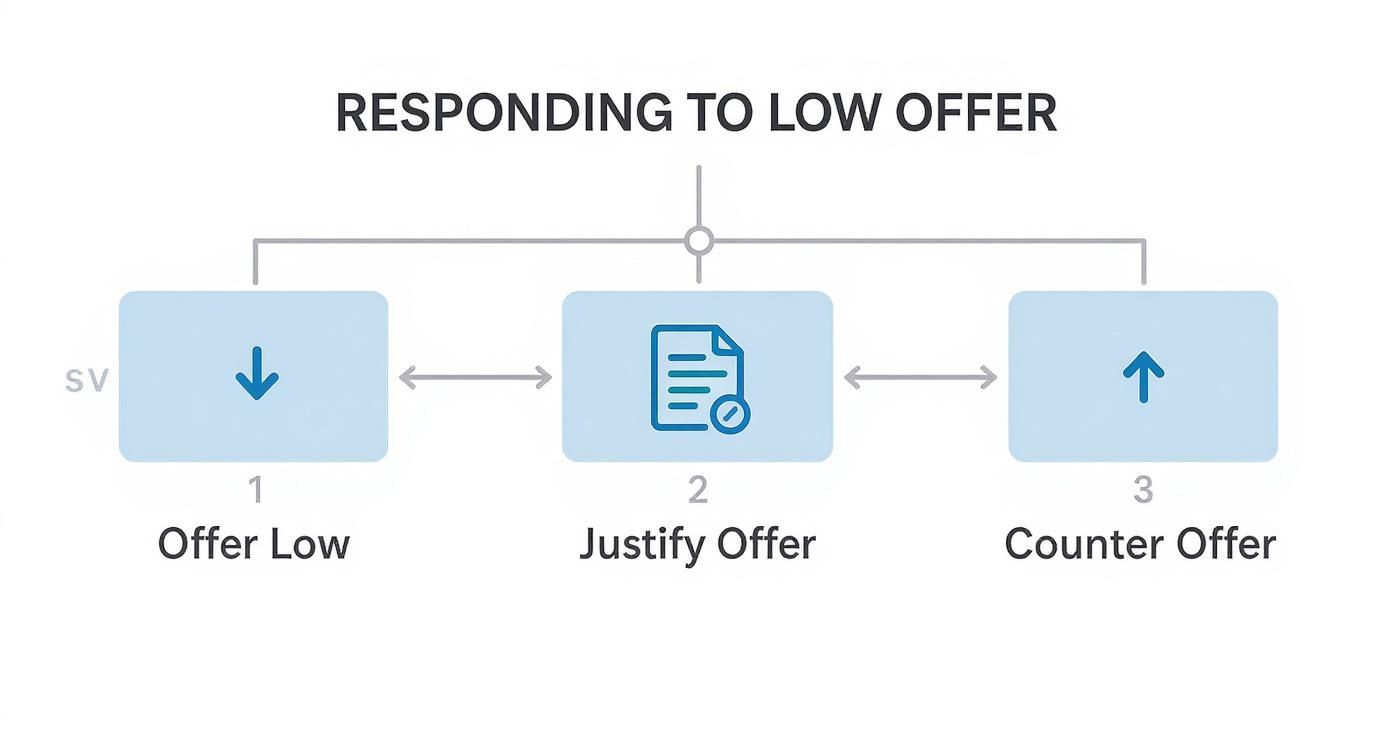

Don't be surprised when the insurance adjuster's first offer comes in low. It’s almost a tradition. This is a standard opening move, a test to see if you're desperate enough to take a quick, cheap payout and walk away. How you respond right here, at this very moment, sets the stage for everything that follows.

Resist the urge to get angry. A calm, evidence-based response is infinitely more effective. Your first move should be to politely ask the adjuster to walk you through their math. Request a detailed, written breakdown that explains exactly how they arrived at that number.

Deconstructing Their Lowball Offer

Once you have their justification in hand, it's time to take it apart, piece by piece. This is where all that documentation you painstakingly gathered becomes your secret weapon.

Hold their valuation up directly against the one you carefully calculated. You're not just arguing; you're auditing their work.

- Did they conveniently overlook a medical bill? Point it out directly.

- Did they undervalue your lost wages? Show them the letter from your HR department again.

- Are they applying a low multiplier for your pain and suffering? Talk them through your personal journal, reiterating the real, ongoing impact on your daily life.

By doing this, you shift the entire conversation. It's no longer a vague squabble over a dollar amount. It becomes a focused, fact-based discussion. You’re not just saying, "That’s not enough." You're showing them, with proof, exactly where their assessment falls short.

How to Talk and When to Write

The way you communicate is just as crucial as the facts you present. A smart approach is to use different methods for different reasons. After any phone call, immediately send a brief follow-up email. Summarize the key points of your conversation and any agreements you reached. This simple step creates an essential paper trail and eliminates any "he said, she said" confusion down the line.

Never, ever rely on an adjuster's verbal promise. If it's not in writing, it doesn't exist. Your paper trail is everything.

This back-and-forth can feel like a slow dance, and it demands patience. The adjuster will likely only bump up the offer in small increments. That's part of the game. Stick to your minimum settlement amount and only make a small concession if they give you a solid, evidence-backed reason to do so. Be aware that some adjusters might use unfair tactics that could lead to a full denial. Knowing the most common insurance claim denial reasons can help you spot and shut down these strategies.

It's also worth noting that the willingness to settle can vary around the world. In the U.S., for example, settlement rates often fall between 20% to over 50%. You can learn more about these global settlement rate variations and see how geography can influence an insurer's motivation to negotiate.

Knowing When to Escalate or Hire a Lawyer

https://www.youtube.com/embed/1WWeEGg5PG0

Sometimes, no matter how well you've prepared, the negotiation just grinds to a halt. The adjuster might start using delay tactics, hold firm on a ridiculously low offer, or worse, just go silent. It’s critical to recognize these red flags so you can protect your right to a fair settlement.

When the conversation breaks down or you get the sense the insurer is acting in bad faith, it’s time to think about escalating. You're not out of moves yet.

Escalation Options Before a Lawsuit

Before you jump straight to hiring a lawyer, there are a couple of other paths you can take. These steps can often break the deadlock without the time and expense of a full-blown legal battle.

Here are two effective intermediate steps:

- Mediation: Think of this as a structured conversation with a neutral third party. A mediator's job isn't to take sides but to help you and the insurer find some common ground. It's far less formal than court and can be a surprisingly effective way to get things resolved.

- State Department of Insurance: Every state has a regulatory body that oversees insurance companies. Filing a formal complaint here can put some serious heat on the insurer. They will investigate to see if your claim is being handled improperly, which can be a powerful motivator for the company to start playing fair.

If an insurer keeps "losing" your paperwork, your claim gets passed from adjuster to adjuster, or they threaten to just close your file, these aren't just frustrating little hiccups. They are potential signs of bad faith and a clear signal that you need to take things to the next level.

This decision tree gives you a visual on how to approach a lowball offer strategically.

The main point here is that a low offer calls for a calm, evidence-based response, not an emotional one.

Making the Call to Hire an Attorney

If those other measures don't get you anywhere, or if your case involves serious injuries and a lot of money from the get-go, it’s probably time to hire an attorney. A lawyer brings more than just negotiating skills to the table. Their involvement alone sends a clear message to the insurance company: you're serious and ready to go to court if needed. That's powerful leverage.

Many people worry about the cost, but most personal injury lawyers work on a contingency fee basis. This means they don't get paid unless you do—they take a percentage of the final settlement. You don't pay anything upfront. Research has shown that even after deducting the attorney's fees, people with legal help often walk away with significantly more than those who try to handle it themselves. When the stakes are high, you may need to learn more about how to dispute an insurance claim with professional guidance.

For tricky property damage issues, you might find yourself wondering if you need a diminished value claim lawyer to argue your case effectively. At the end of the day, if the insurer simply won't be reasonable, a lawyer is your best bet for a fair fight.

Frequently Asked Questions About Insurance Negotiations

Going head-to-head with an insurance company can feel daunting, and it's natural to have a lot of questions. Getting clear on the answers beforehand will give you a major confidence boost and help you sidestep some of the most common pitfalls people run into. Let's break down a few of the questions I hear most often.

Should I Give the Other Insurer a Recorded Statement?

My advice is almost always the same: politely decline the request for a recorded statement from the at-fault driver's insurance company. You have no legal obligation to give them one.

Keep in mind, their adjusters are trained professionals. They know how to ask leading questions that might trip you up or get you to say something that could be twisted later to pin some of the blame on you. Instead, just provide the basic, factual information needed to get the claim started. It's much smarter to keep your communication in writing, like email, so you have a clear paper trail.

How Long Does an Insurance Settlement Negotiation Take?

Honestly, there's no magic number. A straightforward property damage claim for your car might be settled in just a few weeks. But if you're dealing with a personal injury claim, you need to be prepared for a much longer haul—it could take several months or even over a year.

The real negotiation can't even start until you've finished all your medical treatments. Why? Because you can't know the full extent of your damages—both what you've already paid and what you might need in the future—until you've reached what doctors call "maximum medical improvement."

Patience is your biggest ally in a negotiation. If you rush to settle before you have a complete picture of your medical costs and lost income, you will almost certainly leave money on the table.

What if the Insurance Company Says I Was Partially at Fault?

This is a classic move. It's a tactic called comparative negligence, and the adjuster's goal is simple: to lower the amount of money they have to pay you. If they bring this up, the absolute worst thing you can do is get defensive or start arguing.

The best way to handle this is to calmly ask the adjuster to put their reasoning in writing. Have them send you the specific evidence they're using to claim you were partially responsible. Once you have that, you can push back with your own documentation:

- The official police report from the accident.

- Statements from any witnesses who saw what really happened.

- Photos from the scene that back up your side of the story.

If the insurance company insists on assigning a high percentage of fault to you without solid proof, that's a huge red flag. It might be time to bring in a professional to fight for you.

Is the Final Settlement Amount Taxable?

For the most part, you can breathe easy on this one. The IRS generally does not consider settlements for personal physical injuries or sickness to be taxable income. That includes the money you receive for medical bills and your pain and suffering.

However, there are exceptions. If a portion of your settlement is specifically for lost wages, that part is treated as regular income and is taxable. Punitive damages, which are awarded to punish the other party and are pretty rare, are also taxable. Since the rules can get complicated, it's always a good idea to run the final agreement by a tax professional before you sign.

Trying to make sense of insurance claims and negotiations can be a lot to handle on your own, but you don't have to. The experts at Wexford Insurance Solutions are here to offer the guidance and advocacy you need to get a fair result. We make the process easier and ensure your rights are protected from start to finish. Learn how our intelligent claims advocacy can work for you.

What is retroactive date in insurance? Key insights

What is retroactive date in insurance? Key insights Excess Liability vs Umbrella Insurance Decoded

Excess Liability vs Umbrella Insurance Decoded