The real difference between an insurance agent and a broker boils down to a simple question: Who do they work for?

An insurance agent works for the insurance company. A broker, on the other hand, works for you, the client. This fundamental difference in who they represent changes everything, from the types of policies they can offer to the advice they give.

Agent vs. Broker: The Fundamental Difference

It's a common mistake to think agents and brokers are the same, but their legal duties and professional responsibilities couldn't be more different. To really get it, you have to understand what it takes to become an insurance agent, because their job is directly tied to the insurers they serve. They are under contract to sell policies for one or maybe a few specific companies.

Brokers, however, have a much wider field of play. Their primary responsibility is to the person or business buying the insurance—that’s you. This isn't a new concept; agents have long been the sales force for insurers, while brokers have acted as independent advisors, scanning the entire market to find the best possible coverage for their clients.

The easiest way to keep it straight is to think about loyalty. An agent's first loyalty is to the insurance company. A broker's loyalty—and their legal duty—is to their client.

This split creates two very different ways to get insurance coverage. One path is centered on the provider, and the other is centered on the client. If you're looking for more guidance on making the right choice, our guide on how to choose an insurance broker can help.

For a quick overview, the table below highlights the main distinctions.

Agent vs Broker Key Differences at a Glance

| Attribute | Insurance Agent | Insurance Broker |

|---|---|---|

| Primary Allegiance | Represents the insurance company | Represents the client (you) |

| Market Access | Limited to the products of the one or few companies they represent | Access to a wide range of products from multiple insurance companies |

| Main Role | To sell insurance policies for their contracted carrier(s) | To advise and find the most suitable coverage from the entire market |

As you can see, the choice isn't just about who you're talking to; it's about the scope of the conversation and whose interests are being prioritized from the start.

Understanding Allegiance: Who Works for You?

When you're trying to figure out the most important difference between an agent and a broker in insurance, it doesn't come down to their title. It comes down to loyalty. This fundamental allegiance dictates the advice you get, the policies you're shown, and what you ultimately pay.

An insurance agent is contractually bound to the insurance company—or companies—they represent. This is true whether they're a "captive" agent working for a single brand or an "independent" agent with a portfolio of several carriers. In both scenarios, their primary duty is to the insurer. Their job is to sell the products their contracted companies have on offer, which means their recommendations are always pulled from a specific menu of options.

The Broker's Fiduciary Duty

An insurance broker, on the other hand, has a fiduciary duty to you, the client. This isn't just a promise; it's a legal and ethical obligation to act in your best interest. Brokers don't work for insurance companies; they work for you. Their entire purpose is to understand your unique needs and then scour the market to find the right coverage.

This distinction is more than just a technicality—it creates an entirely different relationship. A broker is required to put your financial well-being ahead of the interests of any single insurance carrier.

Think of it like this: An insurance agent is like a salesperson at a Ford dealership—they know everything about Fords and can sell you any car on their lot. An insurance broker is like a personal car shopper who can find you the perfect vehicle from any dealership in town—Ford, Toyota, Honda—and negotiate the best price for you.

This client-first commitment ensures the advice you get is unbiased and genuinely focused on your protection. Since brokers aren't tied to any one company, they can offer objective comparisons and act as your advocate if you ever need to file a claim.

How This Affects You in the Real World

This difference in loyalty has a direct impact on your experience. An agent will have deep, expert-level knowledge of their company's products. But if your needs fall outside what their carrier offers, they might not have a solution for you. They are masters of a specific set of products.

A broker's expertise is much broader, centered on risk analysis and a comprehensive understanding of the entire market. For example, if your family goes through major life events, a broker is perfectly positioned to re-evaluate your whole risk profile against what every carrier is offering. You can see a list of common life changes to tell your insurance professional about to understand how these situations can reshape your needs.

Because a broker's allegiance is to you, they are motivated to:

- Find competitive pricing by shopping your policy with dozens of insurers.

- Secure specialized coverage for unique risks that standard policies just don't cover.

- Provide impartial advice on confusing policy language, exclusions, and endorsements.

Ultimately, choosing between an agent and a broker is about deciding who you want in your corner: a representative of the insurance company or a personal advocate dedicated to you.

Comparing Market Access and Policy Options

When you're shopping for insurance, your choice between an agent and a broker fundamentally changes the menu of policies you get to see. It’s a bit like choosing between a brand-specific store and a massive shopping mall—each one has its place, depending on exactly what you’re looking for.

An agent's world is framed by the insurance companies they've signed on with.

A captive agent works for just one insurer. This can be great if you're already set on a specific brand, as their knowledge of that company's products will be second to none. The trade-off, of course, is that their portfolio is strictly limited to what that single carrier sells.

The Agent vs. Broker Spectrum

An independent agent opens things up a bit more. They represent a handpicked group of insurance companies, which means you get more variety than you would with a captive agent. They can shop your needs across that handful of carriers, but their search still stops at the edge of their network.

This is where the starkest difference between an agent and a broker in insurance truly comes to light. A broker has no contractual loyalties to any single insurance company. Their job is to scan the entire market for you, giving them a powerful advantage in finding the perfect policy.

A broker's greatest strength is their unrestricted market access. They can pull quotes from dozens of carriers—including highly specialized ones that most agents can't work with—to make sure your coverage is genuinely built around your needs, not just picked from a short list.

This wide-ranging access is a game-changer for anyone with unique or complicated insurance needs. Think of a business that requires a very specific liability policy or a family with a high-value home in a high-risk area. An agent's limited options just might not cut it. A broker, on the other hand, can hunt down those niche insurers who specialize in covering those exact risks.

Of course, once you have those options, you need to understand what you're looking at. Taking the time to learn how to read an insurance policy is a critical step in making an informed decision.

The sheer economic scale of brokers speaks volumes about their role in the industry. In 2023, the top 10 U.S. insurance brokers pulled in a staggering $49.9 billion in revenue. That figure accounts for 66% of the total revenue for the top 100 brokers combined, a clear indicator of their market influence and their ability to negotiate coverage across the board. You can discover more insights about broker revenue growth on MarshBerry.com.

How Agents and Brokers Get Paid

To really get to the heart of what separates an agent from a broker, you have to follow the money. Both are typically paid a commission by the insurance company, but the way that compensation is structured can fundamentally change their approach and the advice they give you.

For insurance agents, the setup is pretty clear-cut. They earn a commission—a percentage of your premium—that's paid directly by the insurance carrier they work for. This holds true for captive agents tied to a single company and independent agents who represent a handful. At the end of the day, their paycheck is linked to selling policies from their specific lineup of carriers.

The Broker's Compensation Model

An insurance broker also earns a commission that's baked into the premium and paid by the insurer you end up choosing. The critical difference? They have no contractual loyalties to any one company. This frees them up to find the best policy for your unique situation, no matter which carrier it comes from. The commission is really just the mechanism for getting paid for their advisory work.

In some situations, especially with complex commercial insurance or specialized consulting, a broker might charge a client fee instead. This model creates a crystal-clear separation between their income and the insurance company, cementing their role as your advocate.

The key takeaway is that while both are often paid by the insurer, a broker’s compensation is a result of finding the right fit for the client from the entire market. An agent’s compensation is a result of selling a product from their limited menu.

This difference in how they're paid directly reinforces a broker's fiduciary duty to put your interests first. Since they can scan the whole market, their recommendations are driven by what you need, not by which insurer happens to offer a higher commission rate.

Protecting Client Interests

Because brokers are legally your representative, they carry a much higher level of professional responsibility. This is a big reason why they are required to have specialized liability coverage. You can learn more about the importance of Errors and Omissions insurance, which is designed to protect clients from financial loss if a broker makes a mistake.

This professional liability insurance isn't just a technicality; it’s a tangible sign of their commitment to you. When you combine their payment structure with this legal duty, it ensures a broker’s advice is always pointed toward one goal: finding the best, most competitive coverage for you.

When to Choose an Agent or a Broker

Picking between an insurance agent and a broker isn't a toss-up. It's a strategic decision that hinges on your specific needs, how complex your life is, and whether you want a guide for a single path or a navigator for the whole map. Getting this choice right means securing the best possible coverage without paying for things you don't need.

For many people, an agent is the simplest, most direct route to getting insured. They are experts on the products they sell, which makes them incredibly efficient for common insurance needs.

Scenarios Where an Agent Makes Sense

You'll probably find an agent is your best bet if your insurance needs are pretty standard. This is especially true if you already like a particular insurance company and just want to get a policy with them.

Here are a few situations where an agent is a great fit:

- You need standard coverage: If you're shopping for a straightforward auto, home, or renters policy, an agent can get you quotes from the carrier (or carriers) they represent quickly.

- You value brand loyalty: Already a fan of a specific insurer because of great service or rates? A captive agent for that brand is the logical choice.

- You prioritize speed and simplicity: Agents know their products cold. They can cut through the noise and get you signed up fast without drowning you in endless choices.

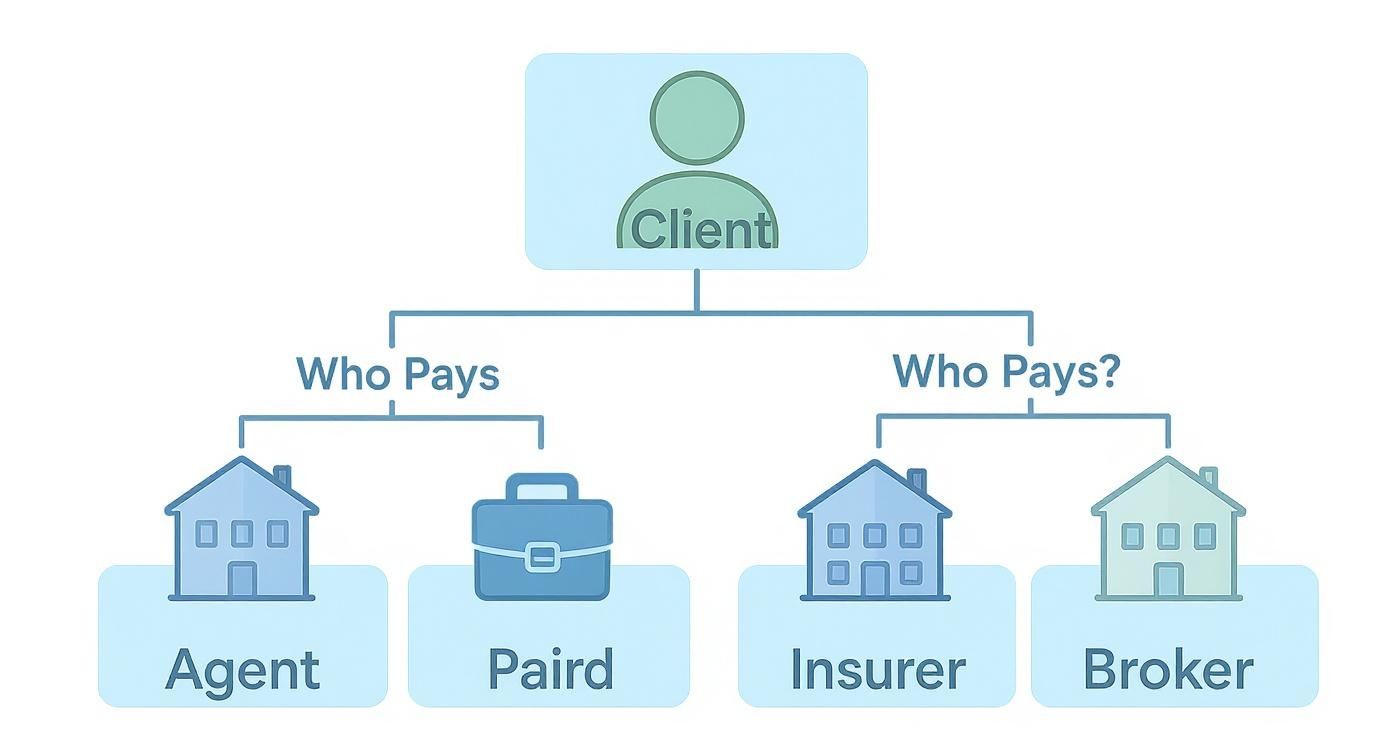

This infographic breaks down how agents and brokers get paid, highlighting the key difference: who they work for. It’s not about you paying extra fees.

As you can see, the insurance carrier pays the commission in both cases. Your decision should be based on the kind of service and breadth of options you need, not on cost.

When a Broker Is the Right Choice

A broker becomes invaluable when your situation gets complicated. Think of them as your personal advocate, tasked with scouring the entire market to find the perfect fit. Their loyalty is to you, not an insurance company.

A broker’s job is to be your personal risk advisor. They dig into your unique situation and find the best protection from a huge pool of insurers, making them essential for anyone with non-standard needs.

Here’s when you should definitely look for a broker:

- You have complex or high-value assets: If you're a high-net-worth individual or own unique property, fine art, or collectibles, you need specialized coverage that a broker is best positioned to find.

- You run a business: Commercial insurance is a minefield of complexities. A good broker can piece together everything from general liability to highly specific professional policies, ensuring there are no dangerous gaps.

- You've been denied coverage: If carriers have turned you down because of your risk profile, a broker knows the niche players in the market who are often willing to write policies others won't touch.

The insurance world is always expanding to meet these diverse needs. In 2022, there were roughly 927,600 licensed insurance agents and brokers in the U.S. Employment in the field is projected to grow by 8% over the next decade. This growth is a direct response to the demand for both simple, direct service from agents and the expert, personalized advice brokers provide. You can dig into more insurance industry trends and statistics on AgentMethods.com.

No matter who you work with, remember that your needs can change. If you feel like your current provider isn't cutting it anymore, both agents and brokers can help you figure out the next step. Our guide on how to switch insurance providers can walk you through making a change without a headache.

Common Questions About Insurance Professionals

Navigating the insurance world can feel like learning a new language, and it's natural to have questions about costs, capabilities, and what to do when things go wrong. Getting clear on the differences between agents and brokers will help you choose the right partner for your needs. Let's tackle some of the most frequent questions head-on.

Is It More Expensive to Use an Insurance Broker?

This is a common myth, but the short answer is no. Brokers and agents are both typically paid a commission by the insurance company whose policy you end up buying. That commission is already baked into the policy's price, so you aren't paying an extra fee for their service.

In many cases, working with a broker can actually save you money. Because they aren't tied to any single company, they can shop your policy across the entire market. This forces carriers to compete for your business, often resulting in better rates or more favorable coverage terms than you'd find with an agent representing only a few companies.

The only exception might be for highly specialized commercial accounts or in-depth consulting, where a broker might charge a fee. If they do, this is always disclosed upfront. For most people and businesses, a broker’s expertise comes at no direct cost.

The core value of a broker is their ability to shop the market on your behalf. This broad access often leads to cost savings and better policy terms, making their service a financial benefit rather than an added expense.

Can an Independent Agent Do the Same Thing as a Broker?

This is a great question, as their roles can look similar from the outside. While they both offer more options than a captive agent, their fundamental loyalties are different. An independent agent can sell policies from several insurance companies, but they still have contractual agreements with that specific group of carriers. Their primary duty is to the insurers they represent.

A broker, on the other hand, represents you. Legally, they have a fiduciary duty to act in your best interest. This is a higher standard of care that obligates them to put your needs first, which is a game-changer when you need an advocate.

A broker's market access is also typically much broader. They can approach dozens—sometimes even hundreds—of insurers, including specialty carriers that most agents can't work with. This makes a broker essential if you have unique risks, high-value property, or a complex business that just won't fit into a standard policy.

How Do I Verify an Agent or Broker's License?

Before you commit, it’s smart to do a quick background check. The best place to start is your state’s Department of Insurance website. Every state has an online tool where you can search for a professional by name or license number. It’s free and only takes a minute.

This search will confirm a few key things:

- That they are properly licensed.

- What types of insurance they are authorized to sell.

- If there are any disciplinary actions or formal complaints on their record.

If you’re not sure where to find your state’s site, the National Association of Insurance Commissioners (NAIC) website is a great resource that links out to every state’s regulatory body.

What if I Have a Problem with My Agent or Broker?

If you run into an issue, the first step is always to try and resolve it directly. Talk to the agent or broker, or if they work for a larger firm, their manager. A simple, honest conversation can clear up most misunderstandings. For more tips on this, check out this guide on improving communication with insurance agents and brokers.

If you can’t get a resolution you’re happy with, your next move is to file a complaint with your state's Department of Insurance. This government agency exists to protect consumers. They will investigate your complaint, mediate the dispute, and can take disciplinary action if the professional has acted illegally or unethically.

At Wexford Insurance Solutions, we operate with the client-first mentality of a broker, leveraging our extensive network of top-rated carriers to find the ideal coverage for your personal and business needs. Our goal is to provide clarity, choice, and dedicated advocacy. Contact us today for a complimentary review of your insurance portfolio.

7 Best Homeowners Insurance New York Providers for 2025

7 Best Homeowners Insurance New York Providers for 2025 A Guide to professional liability insurance for consultants

A Guide to professional liability insurance for consultants