When you're dealing with significant wealth, standard financial planning advice just doesn't cut it. Forget basic budgeting and retirement savings accounts. We're talking about a much more sophisticated discipline designed to not only grow your assets but also protect them from complex challenges like tax optimization, risk management, and building a generational legacy.

The New Realities of High Net Worth Financial Planning

What does it really mean to be a high-net-worth individual (HNWI) today? It’s far more than just a number on a spreadsheet. It’s the point where incredible opportunity meets significant complexity. As your wealth grows, so do the stakes, and the off-the-shelf financial advice you see everywhere quickly becomes inadequate for your unique situation.

This is especially true as the number of affluent individuals continues to climb. The global HNWI population recently jumped by 2.6%, with the United States alone welcoming about 562,000 new millionaires. This surge, highlighted in recent industry reports, underscores a growing demand for genuinely specialized guidance.

Core Concerns for Modern Wealth

Navigating this new landscape requires a total shift in thinking. Simply managing a portfolio isn't enough. HNWIs are grappling with a much wider array of concerns that truly define modern wealth:

- Market Volatility: How do you shield your assets from inevitable economic storms while still capturing opportunities for growth?

- Complex Tax Laws: It's not about what you make, but what you keep. This means using advanced strategies to legally minimize what you owe on income, investments, and your estate.

- Generational Transfer: How can you pass your wealth to your heirs or to causes you care about smoothly and with minimal tax impact?

A holistic financial plan is not merely a collection of investments. It is a strategic blueprint for your entire financial life, designed to build a resilient, multi-generational legacy.

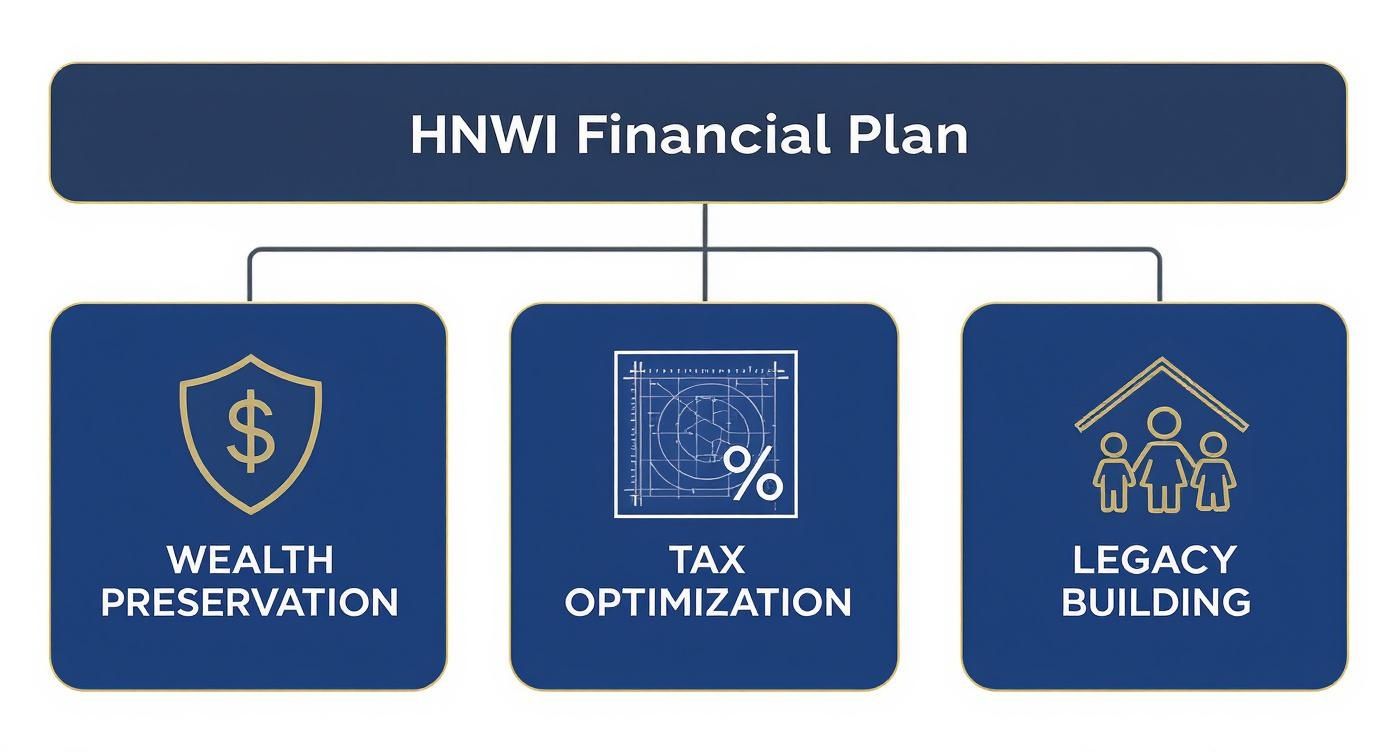

This blueprint needs to weave every thread of your financial world into one cohesive strategy. The infographic below breaks down the three core pillars of this approach.

As you can see, a central, unified plan is the foundation. From there, it branches out into the critical areas of preserving what you have, optimizing for taxes, and planning the legacy you'll leave behind.

To bring this all together, a comprehensive plan for an HNWI rests on a few essential pillars. Each pillar addresses a specific area of your financial life, but they all work in concert to support your overarching goals.

The table below outlines these core components.

Table: Core Pillars of HNWI Financial Planning

| Pillar | Objective | Key Strategies |

|---|---|---|

| Wealth Preservation | Protect assets from market volatility, inflation, and unforeseen risks. | Diversified portfolios, alternative investments, sophisticated insurance solutions. |

| Tax Optimization | Legally minimize tax liabilities across all areas of your financial life. | Tax-advantaged accounts, trust structures, strategic charitable giving. |

| Risk Management | Mitigate threats from litigation, health crises, and other personal liabilities. | Asset protection trusts, umbrella insurance policies, captive insurance companies. |

| Estate & Legacy Planning | Ensure the seamless and tax-efficient transfer of wealth to future generations. | Wills, trusts, family foundations, gifting strategies. |

Thinking in terms of these pillars helps organize the complex moving parts of a high-net-worth financial picture into a clear, actionable framework.

Building a Resilient Financial Future

Achieving true financial security at this level is about being proactive. It requires a deep dive into sophisticated insurance products, intricate legal structures, and specialized investment vehicles that go far beyond stocks and bonds.

How you structure your assets is one of your strongest lines of defense. For a closer look, our guide on risk management best practices offers some critical insights into asset protection.

To really get a handle on this world, you need to explore the specifics within each pillar. For instance, digging into resources on estate planning specifically for high net worth individuals can give you targeted knowledge for crafting your legacy. This guide will walk you through these foundational concepts, laying out a clear path to securing your financial future.

Mastering Wealth Preservation and Growth

For high-net-worth families, an investment strategy goes far beyond simply picking good stocks. It's about building a financial fortress—a meticulously engineered portfolio designed not only to generate strong returns but also to weather any economic storm. The mandate is always twofold: pursue ambitious growth while protecting the capital you've already built.

This means looking past the familiar landscape of public markets. While stocks and bonds are the bedrock of any portfolio, true resilience comes from including assets that don't move in lockstep with the S&P 500. This is where the world of alternative investments becomes so crucial for sophisticated financial planning.

The Power of Alternative Investments

Think of a conventional portfolio as a well-built ship. It’s seaworthy in calm waters, but what happens when a hurricane hits? Alternative investments act as the deep keel and stabilizers—specialized components that provide balance when the main sails are being thrashed by volatility.

These assets often have a low correlation to public markets, which is just a technical way of saying they march to the beat of their own drum. This creates a powerful diversification effect.

- Private Equity: This involves investing directly into private companies before they ever hit a public stock exchange. The goal is to capture significant growth before an IPO or acquisition.

- Hedge Funds: These funds use a wide array of complex strategies to find opportunities in both rising and falling markets, aiming to smooth out the bumps in your overall portfolio returns.

- Bespoke Real Estate: This isn't about buying a rental property. It’s about direct investment in commercial developments, specialized real estate funds, or unique land deals that aren't available to the average investor.

By weaving these kinds of assets into your strategy, you’re adding layers of defense and opportunity, making your entire financial structure far more durable.

Advanced Portfolio Construction Techniques

Once you have the right ingredients, the real art is in how you combine them. This is where we move from basic asset allocation to a dynamic, tax-aware approach that actively manages both risk and opportunity.

A common headache for many successful individuals is a concentrated stock position, often tied to a family business or years of executive compensation. Having too much of your net worth in a single company is a huge gamble. A smart plan might involve a carefully phased diversification schedule or using specific financial instruments to hedge against a sudden drop in that stock’s value.

Another critical piece of the puzzle is tax-aware rebalancing. Everyone knows they should rebalance—selling high and buying low to maintain their target asset mix. But if you do this without thinking about taxes, you can hand over a huge chunk of your gains to the IRS unnecessarily.

Tax-aware rebalancing is about being strategic. It means harvesting losses to offset gains and intentionally placing different assets in the most tax-friendly accounts. Over time, this can add a significant boost to your real, after-tax returns.

This kind of proactive management ensures your portfolio isn’t just growing, but growing as efficiently as possible. You can explore a more detailed breakdown of wealth preservation strategies to see how this defensive layer is built.

Building for Resilience and Long-Term Success

Ultimately, mastering your wealth is a continuous process. It's not a "set it and forget it" activity. It’s about building a portfolio that is both robust today and adaptable enough to handle whatever comes next, whether in the markets or in your own life.

This requires a disciplined, ongoing approach.

- Define Clear Goals: Start by getting specific about what you want to achieve with your wealth—growth, income, and legacy.

- Strategic Asset Allocation: Work with your team to create a target mix of traditional and alternative investments that fits your comfort level with risk and your timeline.

- Implement Tax-Efficiently: Use the right accounts and rebalancing tactics from day one to minimize the drag of taxes on your growth.

- Monitor and Adjust: The world changes, and so do your needs. Regularly review your portfolio to make sure it's still on track to meet your goals.

Following this playbook helps you construct a portfolio built for both impressive growth and lasting resilience, ensuring your financial legacy is secure for generations.

Mastering Advanced Tax Strategy

For anyone with significant wealth, tax planning isn’t just a once-a-year headache in April. It’s a year-round discipline and one of the most powerful levers you have for protecting and growing your assets. The goal is simple: legally reduce the slice of your wealth that goes to taxes, leaving more for you to grow, enjoy, and pass on. This means moving past standard deductions and embracing a much more proactive, strategic mindset.

Think of it like sailing. You could just point your boat toward the destination and let the wind and currents push you around. Or, you could have an expert captain who knows how to read the winds, anticipate the tides, and find the fastest, smoothest route. Advanced tax strategies are that expert navigation for your finances.

Moving Beyond the Basics

The real magic of financial planning for high net worth individuals happens when you get beyond the standard tax filing. This is where sophisticated techniques are layered together to create a powerful engine for tax efficiency that really starts to compound over time.

One of the most effective strategies is tax-loss harvesting. It sounds complicated, but the idea is simple. You sell investments that are down to intentionally realize a loss. That loss can then be used to cancel out capital gains taxes on your winning investments. It’s a smart way to find a silver lining in a market dip and turn a temporary setback into a tangible tax benefit.

Charitable giving is another area ripe for optimization. Instead of just writing checks, many successful families use smarter vehicles like Donor-Advised Funds (DAFs).

- Donor-Advised Funds (DAFs): With a DAF, you can donate appreciated assets—like stock that has grown in value—and get an immediate tax deduction for the stock's full market value. You completely avoid paying capital gains on its growth, and you can then decide which charities to support from the fund over time.

This approach not only stretches the impact of your philanthropy but also delivers tax advantages you’d never get from a simple cash donation.

It’s Not Just What You Own, But Where You Own It

Asset location is one of those concepts that’s incredibly simple but has a massive long-term impact on your returns. It’s the art of strategically placing your investments in the right type of account to minimize taxes.

The core principle is to shelter your least tax-efficient assets inside tax-deferred or tax-exempt accounts (like an IRA or Roth IRA). Meanwhile, more tax-efficient investments can sit comfortably in your standard taxable brokerage accounts.

Think of it this way: You wouldn't store ice cream in the pantry and crackers in the freezer. Each belongs in a specific environment. Similarly, investments that generate a lot of annual income or have high turnover belong in a tax-sheltered account where their growth won’t be constantly nickeled-and-dimed by taxes.

This strategic placement fights against "tax drag"—the slow, quiet erosion of your returns due to taxes. Over decades, getting this right can add a substantial amount to your net worth. For entrepreneurs, linking personal and corporate tax strategies is also a game-changer. You can dive deeper in our guide on financial planning for business owners.

Keeping an Eye on the Horizon

The tax code is never set in stone. Smart planning isn't just about winning today; it's about being prepared for what might come tomorrow. High-net-worth families are constantly watching for potential changes to income, capital gains, and estate tax laws.

For instance, the U.S. federal estate tax currently sits at a steep 40% for assets above the exemption amount. That makes forward-thinking estate planning an absolute must. As detailed in a review of the top issues facing HNWIs, staying ahead of these policy shifts is crucial.

This might mean using trusts to lock in today's more favorable exemption amounts or strategically accelerating gifts to family. A truly effective tax plan is a living, breathing document—one that’s flexible enough to adapt to new rules and protect your wealth no matter what Washington decides next.

Building Your Legacy Through Modern Estate Planning

For families with significant wealth, financial planning needs to look far beyond a single lifetime. This is where estate planning comes in, but it’s not just about what happens after you're gone. Think of it as the ultimate act of stewardship—a way to transform the wealth you’ve built into a lasting legacy for your family and the causes you believe in.

Instead of a grim task to be put off, see it for what it truly is: designing the blueprint for your family's future. A thoughtful plan ensures your vision is carried out exactly as you intend, protecting your heirs from avoidable taxes, legal headaches, and painful family disagreements. It’s one of the most meaningful gifts you can ever give.

The Essential Toolkit for Legacy Creation

At its core, estate planning relies on a few key legal documents to direct your assets. While most people are familiar with a will, a truly effective plan for a high-net-worth family uses a much broader and more sophisticated set of tools.

- Will: This is your foundational document. It outlines your basic wishes for who gets what and, just as importantly, names guardians for any minor children.

- Powers of Attorney: These are crucial. They grant a trusted person the authority to handle your financial and healthcare decisions if you're ever unable to make them yourself.

- Trusts: Here’s where the real power lies. Trusts are the workhorses of modern estate planning, offering a level of control and asset protection that other tools simply can't match.

Trusts aren’t just about passing things on. They are separate legal entities that hold assets for your beneficiaries, all managed by a trustee who must follow your specific instructions. This structure is what makes multi-generational planning and protection possible.

How Sophisticated Trusts Protect Your Heirs

Let’s say you want to leave a significant inheritance to a grandchild, but you're worried they might be too young to handle it wisely. A simple will can't solve that problem, but a trust can.

By placing those assets into a trust, you set the rules. You could specify that the funds can only be used for education until age 25, with distributions from the principal starting at age 30. The control is yours.

And that’s just one simple example. Trusts can be crafted to meet all sorts of specific goals.

Trusts are not just about transferring wealth; they are about transferring wealth with wisdom and intention. They allow you to shield assets from creditors, minimize estate tax exposure, and ensure your legacy is used to build up your family, not tear it apart.

For those with complex or international assets, getting professional guidance is non-negotiable. Part of this process involves Choosing the Right Trust Company in Hong Kong, as an expert fiduciary can be indispensable for navigating global asset management.

Advanced Strategies for Impactful Gifting

A great legacy plan doesn't wait until you're gone. Strategic gifting during your lifetime is a powerful way to reduce your future estate tax bill while also getting to see the positive impact of your wealth yourself. Techniques like establishing a family foundation or using specialized trusts can help you achieve your philanthropic goals in a very tax-smart way.

For family business owners, succession planning is just as critical. A well-structured plan ensures the business you poured your life into can transition smoothly to the next generation or be sold on favorable terms, preserving both its value and its legacy. To get a better handle on the tax side of things, our detailed guide on estate tax planning strategies is a must-read.

The Human Side of Estate Planning

You can have the most brilliant legal and financial strategy in the world, but it can all fall apart if the human element is ignored. The most critical—and often overlooked—part of this process is communication.

Preparing your heirs means transferring more than just money; it means passing on financial literacy and your family's core values. Having open conversations about your intentions, the responsibilities that come with wealth, and the purpose behind your plan can prevent future conflicts and create a sense of shared purpose. This is how you ensure your legacy not only survives but thrives for generations to come.

Protecting Your Assets from Modern Risks

Significant wealth doesn't just open doors to opportunity; it also paints a target on your back. For high-net-worth individuals and their families, the risks go well beyond a fluctuating stock market. We're talking about personal liability lawsuits, unforeseen life events that can hemorrhage cash, and a host of other modern threats capable of dismantling a lifetime of work. The only real defense is a proactive one—a carefully constructed shield designed to protect your assets from every possible angle.

Think of your wealth like a historic estate. You wouldn't just leave the gates wide open. Asset protection is the art of building legal and financial fortifications that make it incredibly difficult, if not impossible, for creditors or legal claims to penetrate your core wealth. This isn't about hiding money; it's about structuring it intelligently to guarantee its safety and longevity.

Fortifying Your Wealth with Advanced Insurance

Off-the-shelf insurance policies just don't cut it when you're dealing with the unique liabilities that come with affluence. This is where specialized insurance solutions become your first and most critical line of defense, acting as a powerful shock absorber against unexpected financial blows.

Two of the most important tools in this particular toolkit are high-limit umbrella policies and Private Placement Life Insurance (PPLI).

- High-Limit Umbrella Policies: Think of this as your personal bodyguard. An umbrella policy adds a massive layer of liability coverage that only kicks in after your standard home and auto policies have been maxed out. For high-net-worth individuals, a $1 million policy is the absolute floor; most clients we work with have policies of $10 million or more to safeguard against a major lawsuit.

- Private Placement Life Insurance (PPLI): PPLI is a much more sophisticated instrument, combining the tax benefits of life insurance with the flexibility of a customized investment portfolio. It creates a tax-sheltered environment for your assets to grow, and in many states, it's also protected from creditors.

These instruments are foundational to a solid defense. To see exactly how they slot into a bigger picture, you can read our detailed guide on insurance for high net worth individuals.

Legal Structures as Your Financial Fortress

Beyond insurance, the way you legally hold your assets is absolutely paramount. Here, we move from simple ownership to strategic containment, placing your wealth inside protective legal entities.

The objective is to create a legal firewall, separating your personal financial life from the assets themselves. If a lawsuit ever targets you personally, the assets held within these structures can be placed beyond the reach of a judgment. The most common structures we use are:

- Limited Liability Companies (LLCs): Perfect for holding real estate or business interests, an LLC shields your personal wealth from any liabilities that pop up within those specific ventures.

- Specialized Trusts: Certain irrevocable trusts can legally move assets completely out of your personal estate. This offers incredible protection from creditors and also serves as a cornerstone of sophisticated estate planning.

The core principle is beautifully simple: what you don't technically own can't be easily taken from you. By placing assets into these carefully designed legal entities, you create a formidable barrier against potential threats.

Planning for Life’s Certainties

A truly airtight risk management plan has to account for the inevitable curveballs life throws, especially the need for long-term care. The staggering cost of extended healthcare can drain a family's wealth faster than almost anything else, yet it's a risk that's so often ignored.

Recent studies show a fascinating disconnect: while high-net-worth individuals worry constantly about their wealth lasting, many have glaring gaps in their planning. For instance, only 57% of millionaires have a long-term care plan, and just 60% feel they have enough life insurance. These numbers point to a critical vulnerability in far too many financial plans. You can discover more insights about retirement planning for the wealthy.

By layering these defenses—advanced insurance, robust legal structures, and proactive life planning—you build a truly resilient shield around your wealth. This 360-degree approach doesn't just protect what you have; it ensures your wealth is secure enough to grow and thrive for generations.

Assembling Your Financial Advisory Team

Smart financial planning isn't a solo sport. Trying to manage every intricate detail of your finances on your own isn't just exhausting—it's risky. The best way to protect and grow significant wealth is to build a personal "board of directors," a dedicated team where each member brings a specific, high-level skill to the table.

The real magic happens when this team works together. A tax strategy that undermines your estate plan is a classic example of what happens when your experts don't communicate. The goal is to create a cohesive unit that talks, strategizes, and gives you complete confidence that nothing is falling through the cracks.

The Core Members of Your Financial Dream Team

To truly cover all your bases, you need a few key specialists. Each professional has a distinct role, but their work overlaps and influences the others. It's this synergy that turns simple financial management into sophisticated wealth stewardship.

Here’s who you need on your team:

- Wealth Manager or Financial Advisor: Think of this person as your quarterback. They see the entire field—from your investment portfolio to your family's legacy—and coordinate the other specialists to make sure every play works toward the same goal.

- Certified Public Accountant (CPA): This is your tax guru, and their job is so much more than just filing returns. A great CPA gives you forward-looking advice on how to structure your business, optimize for taxes, and understand the tax consequences of every major financial move before you make it.

- Estate Planning Attorney: Your legacy architect. This legal expert is the one who drafts the critical documents—wills, trusts, powers of attorney—that make sure your assets go exactly where you want them to, with as little friction and tax-related loss as possible.

- Insurance Specialist: This is your risk manager. They look at your life and business through the lens of liability, identifying potential weak spots. They then find the right solutions, like high-limit umbrella policies or specialized life insurance trusts, to build a protective wall around your assets.

Finding Professionals Who Align With Your Vision

Technical expertise is just the entry ticket. The real challenge is finding advisors who truly understand your family's values and what you want for the future. You have to go beyond the resume and ask the right questions to find a genuine fit.

An advisor's credentials prove they can do the job, but their philosophy determines if they are the right partner for your family's journey. Seek out professionals who listen more than they talk and who are committed to a long-term, collaborative relationship.

When you’re interviewing potential team members, be direct about how they get paid. Are they fee-only, meaning their only compensation comes directly from you? This is often the cleanest model. Or are they fee-based, a hybrid where they might also earn commissions from selling certain products? Knowing this from the start is fundamental to building a transparent and trusting relationship.

By carefully choosing each member and insisting they operate as a unified team, you build a powerful support system. This collaborative approach is the cornerstone of successful financial planning for high net worth individuals, turning a mountain of complexity into a clear, seamless strategy.

Answering Your Top Questions About HNWI Planning

Even after laying out the blueprint, I find that clients often have very specific, practical questions. It's one thing to understand the theory of wealth management, but quite another to apply it to your own life. Let's tackle some of the most common questions that pop up.

Think of this as the hands-on part of the discussion, where we translate the core ideas of wealth preservation and legacy planning into real-world scenarios you might be facing.

When Do I Actually Need Specialized Planning?

People often get hung up on the official definition of a "high net worth individual," which is typically someone with at least $1 million in liquid, investable assets. But honestly, that number is less important than the complexity of your financial life.

The real signal that you need a specialist isn't a dollar amount; it's when your finances start to feel like a puzzle with too many moving pieces. You should start looking for more advanced advice when you're dealing with things like:

- Juggling multiple income streams, especially from business ownership.

- Holding a large, concentrated stock position from your company.

- Wanting to use more sophisticated strategies to reduce your tax bill or plan your estate.

- Owning significant assets that need a serious risk management plan.

Simply put, when the standard, one-size-fits-all financial advice just doesn’t cut it anymore, it’s time to bring in the experts.

How Is This Different from Regular Financial Advice?

Most financial advice you see is geared toward one primary goal: accumulation. It's all about diligently saving for retirement in your 401(k) and IRAs. That's a crucial first step, but for HNWIs, it’s just the beginning. The focus has to shift from just growing wealth to a much bigger game of preserving, optimizing, and transferring it.

I like to use an analogy: it’s the difference between building a nice suburban house and constructing a fortress. The house gives you shelter, which is great. But the fortress is engineered from the ground up for defense, longevity, and to serve generations of your family.

HNWI planning isn't just about picking stocks. It’s about weaving together complex tax strategies, legal asset protection, detailed estate planning, and custom insurance solutions into a single, seamless financial strategy. That level of coordination is the real game-changer.

How Often Should I Revisit My Financial Plan?

Your financial plan should never be a "set it and forget it" document. It’s a living strategy that needs to adapt as your life changes. For anyone with significant assets, a deep-dive review with your entire team—your wealth manager, CPA, and attorney—should happen at least once a year. This keeps everyone on the same page and working toward the same goals.

That said, some life events are so significant they demand an immediate plan review, no matter how recently you had one. Be sure to call your team if you experience:

- A major change in your marital status.

- The sale or purchase of a business.

- A large inheritance or another major cash event.

- Significant changes to tax or estate laws.

Staying on top of your plan ensures it always reflects your current reality and is prepared for whatever the economic and legal climate throws your way.

At Wexford Insurance Solutions, our specialty is crafting the sophisticated insurance and risk management strategies that act as the protective foundation for your entire financial plan. Our team is dedicated to building a shield around what you’ve built, making sure your legacy is secure for generations. Find out how we can help at wexfordis.com.

What is scheduled personal property coverage: a quick guide

What is scheduled personal property coverage: a quick guide how to reduce homeowners insurance: Save on premiums today

how to reduce homeowners insurance: Save on premiums today