Does insurance cover water damage? It’s one of the most common questions we get, and the answer is a classic: "It depends."

The short answer is yes, but it all comes down to the source of the water. Your standard homeowners policy is designed to protect you from sudden and accidental water damage that starts inside your home—think a burst pipe or a washing machine that suddenly overflows. What it almost never covers are gradual leaks, flooding from outside, or sewer backups. For those, you'll need extra protection.

What Water Damage Your Insurance Actually Covers

Think of your standard insurance policy like a firefighter. It's there for sudden, unexpected emergencies, not for slow, predictable problems that could have been prevented with routine maintenance. If you can wrap your head around that one concept, you're already halfway to understanding your coverage. To dig a little deeper, it helps to understand the fundamental home insurance coverage types that make up your policy.

Insurers really look at two things: where the water came from and how fast it happened.

Imagine a pipe freezes and bursts in your basement, unleashing a torrent of water. That’s a textbook covered claim. It was sudden, it was accidental, and it came from your home’s plumbing. But what if that same pipe had a tiny, slow drip for six months? The mold and rot that follows is almost always seen as a maintenance issue, meaning the damage won't be covered.

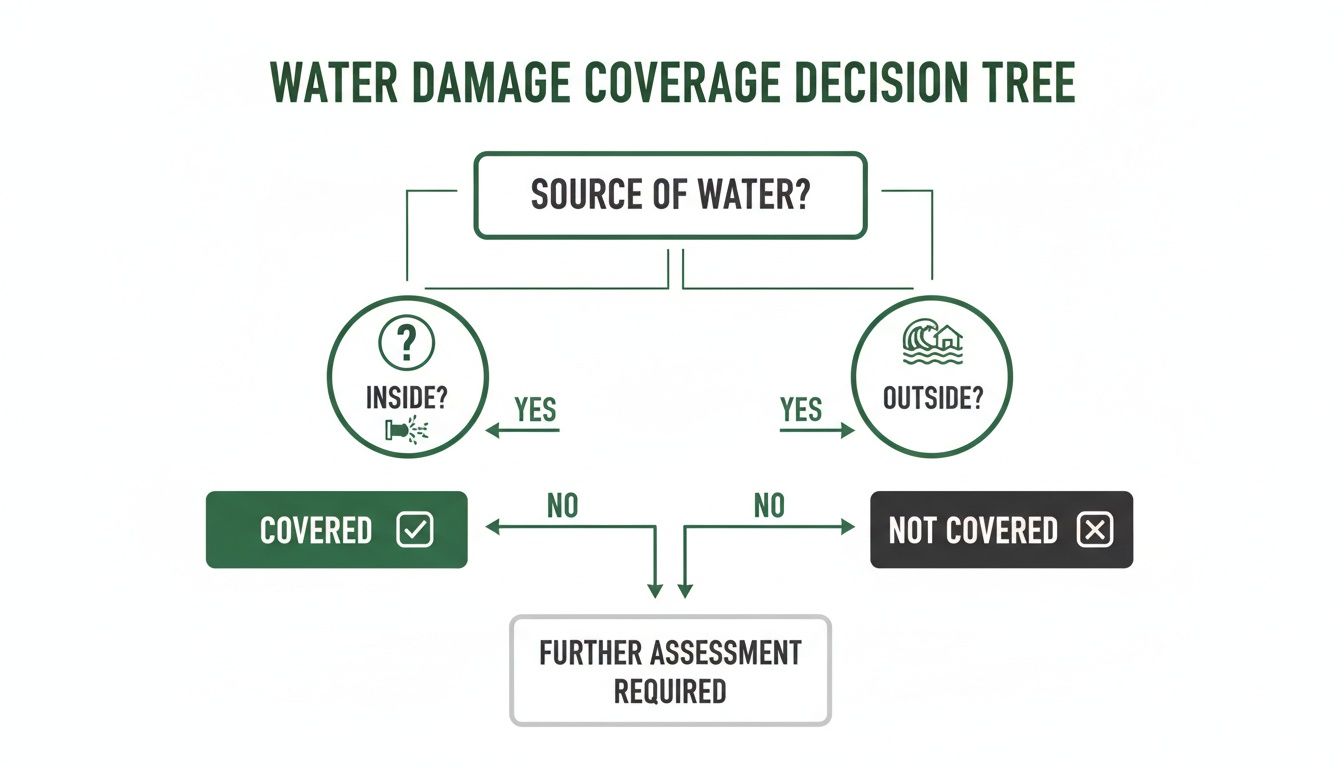

This decision tree gives you a great visual for that core logic. Did the water come from inside or outside?

As you can see, the origin of the water is the first and most important question your insurance company will ask.

Water Damage Coverage at a Glance

To make this crystal clear, here’s a quick table breaking down common water damage situations and how a standard policy typically views them. It’s a handy reference to see what’s usually covered, what requires an add-on (called an endorsement), and what needs a separate policy altogether.

And that last part is crucial. Standard policies explicitly exclude flood damage, yet a staggering 99% of U.S. counties have experienced a flooding event.

Key Takeaway: Your policy is not a catch-all. It's a specific tool for specific problems. Knowing its limits is the best way to make sure you're truly protected from any kind of water threat.

Here’s that quick breakdown:

| Type of Water Damage | Generally Covered? | Requires Special Coverage? |

|---|---|---|

| Sudden Burst Pipe | Yes | No |

| Appliance Overflow | Yes | No |

| Overland Flooding | No | Yes (Flood Insurance) |

| Sewer Backup | No | Yes (Endorsement) |

| Gradual Leaks | No | No (Considered Maintenance) |

| Storm-Driven Rain (Through a Damaged Roof) | Yes | No |

This table shows just how important it is to read the fine print and talk to your agent about adding endorsements or separate policies for risks like floods and sewer backups.

The Critical Difference: Sudden vs. Gradual Water Damage

If you want to understand how insurance handles water damage, there's one core principle you have to get right: the difference between sudden and accidental damage versus gradual damage. This single concept is the lens your insurance company uses to look at nearly every water-related claim.

Think of your policy as a safety net for unexpected catastrophes, not a maintenance contract. It’s there to catch you when something unforeseeable goes wrong, not to pay for problems that build up over time.

A "sudden and accidental" event is exactly what it sounds like—something that happens abruptly, without warning. The classic example is a pipe freezing and bursting, instantly flooding your kitchen. It was unexpected and the damage happened immediately. This is precisely what your policy is designed for.

What Is Sudden and Accidental Damage?

When an insurance adjuster looks at your claim, they're searching for the hallmarks of a "sudden and accidental" event. These are the incidents almost always covered by a standard homeowners or commercial property policy.

Here are a few real-world examples:

- Washing Machine Hose Blowout: The supply hose on your washing machine suddenly splits mid-cycle, sending water gushing across the laundry room.

- Water Heater Tank Failure: Your water heater tank gives way without any warning signs, emptying its entire contents into your basement or garage.

- Storm-Damaged Roof: A severe hailstorm blasts through, punching holes in your roof and letting rain pour directly into your attic.

- Appliance Malfunction: An icemaker line cracks or a dishwasher seal fails, causing an immediate and unexpected overflow.

In every one of these cases, the damage was immediate and tied to a single, identifiable event. The key is that the problem and the resulting damage happened at the same time. This is a critical point to remember when asking does insurance cover water damage. Our guide on what to do when homeowners insurance covers burst pipes explores this common scenario in much more detail.

A great way to think about it is like a broken window. If a stray baseball shatters the glass, that’s a sudden event your policy covers. But if the wooden frame slowly rots over 10 years and lets rain seep in, that's a maintenance issue you were expected to handle.

These sudden events can be devastatingly large. In fact, U.S. severe convective storms—which cause sudden water damage from hail and wind-driven rain—have become a massive liability. Losses in 2025 were estimated at $46 billion through September alone, marking the third straight year that losses topped $40 billion. This shows just how robustly the insurance industry responds to these acute disasters, even as rising costs become a major concern.

Why Gradual Damage Is Almost Never Covered

Now, let's flip the coin and look at gradual damage. This is any problem that develops slowly over weeks, months, or even years. From your insurer's point of view, this kind of damage is preventable and falls squarely under the property owner's responsibility for routine maintenance.

Your insurance policy isn't meant to pay for the consequences of neglect. The expectation is that you’ll keep an eye on your property, fix small issues before they become catastrophes, and generally keep things in good working order.

Common examples of gradual damage that are typically excluded:

- A Slow, Hidden Drip: A pipe behind a wall has a tiny, persistent leak that goes unnoticed for months, eventually causing wood rot, mold, and crumbling drywall.

- Foundation Seepage: Water consistently works its way through small cracks in your foundation over time, leading to a perpetually damp basement.

- Worn-Out Shingles: An old roof with cracked, curling shingles allows a little water into the attic every time it rains, causing slow-developing decay.

- Persistent Humidity: High humidity in a bathroom without proper ventilation causes paint to peel and mold to grow on the ceiling over many months.

In these situations, the damage didn't happen in a single moment. It was the result of a long-term condition that could have—and should have—been identified and repaired. The insurer’s stance is simple: covering this would be like paying for a new engine after you failed to get oil changes for years. It's a maintenance issue, not an insurable accident.

What About Major Disasters Like Floods and Sewer Backups?

While your policy is a great safety net for a sudden pipe burst, many homeowners are shocked to learn that some of the most destructive water events aren't covered at all. These major exclusions—floods, sewer backups, and often mold—are handled very differently, and it’s critical to know why.

These events aren't excluded because insurers are trying to get out of paying claims. It's because the risk is fundamentally different from an internal plumbing issue. We're talking about external, widespread, or gradual threats that require their own specialized coverage.

Why Floods Require a Separate Policy

The single biggest exclusion on any standard homeowners or commercial property policy is overland flooding. This is water that comes from outside your home—think rising rivers, torrential rain, or a storm surge. Your standard policy will not cover this. Period.

The reasoning is pretty straightforward: flood risk is massive and catastrophic. One major storm can damage thousands of homes at once, creating a financial tidal wave that would swamp any private insurer trying to cover it under a standard policy.

To fill this gap, the U.S. government created the National Flood Insurance Program (NFIP), which offers dedicated flood insurance policies you have to buy separately. You can dive deeper into the differences in our guide comparing flood insurance vs. homeowners insurance.

Flooding is a far more common threat than people realize. An astonishing 99% of U.S. counties experienced at least one flood between 1996 and 2019. Relying on your standard policy for this risk leaves you completely exposed.

Understanding Sewer and Drain Backups

Another major—and frankly, disgusting—exclusion is water that backs up through sewers or drains. Imagine the city sewer line on your street gets overwhelmed by a storm and forces raw sewage back up your pipes and into your basement. A standard policy won't touch it.

Insurers see this as a failure of external infrastructure, not a problem with your home’s plumbing. The damage started outside your property line, which puts it outside the scope of your policy.

Thankfully, there's a simple fix. You can add a water backup endorsement to your existing policy. It’s a relatively inexpensive add-on that provides coverage for the cleanup, repairs, and ruined property from a sewer or drain backup.

The Tricky Rules for Mold Coverage

Mold is the third big exclusion that trips people up all the time. Most insurance policies either severely limit or completely exclude coverage for mold damage and removal.

The logic here goes back to that "sudden and accidental" rule. Mold is a byproduct of lingering moisture. It usually grows slowly over time because of a slow leak, high humidity, or poor ventilation—all things that fall under the umbrella of home maintenance.

But there is a crucial exception. If the mold grew as a direct result of a covered water loss (like that burst pipe) and you acted immediately to dry everything out, your policy may cover the mold remediation as part of the original claim. The key is acting fast.

Recent global data shows just how vulnerable our infrastructure is, with floods causing 36% of damage to protection systems and 14% to drainage systems worldwide. These numbers highlight why events that start outside your home, like floods and sewer backups, demand their own kind of insurance.

To make this crystal clear, let's break down how a standard policy handles these perils versus what specialized coverage does.

Standard Policy vs. Special Coverage for Major Water Events

| Peril | Standard Homeowners Policy Coverage | Required Additional Coverage |

|---|---|---|

| Overland Flooding | Almost always excluded. Damage from rising rivers, heavy rain, or storm surge is not covered. | A separate Flood Insurance Policy, typically from the NFIP or a private carrier. |

| Sewer & Drain Backups | Almost always excluded. Damage from municipal sewer lines or drain clogs is not covered. | A Water Backup Endorsement added to your homeowners policy. |

| Mold Growth | Very limited or excluded. Generally not covered unless it's a direct result of a covered sudden leak that was promptly addressed. | Some insurers offer a limited Mold Endorsement, but prevention is the best strategy. |

As you can see, your standard policy is just one piece of the puzzle. Understanding its limits and knowing which add-ons you need is the only way to be truly protected.

Your Step-by-Step Guide to Filing a Water Damage Claim

There's nothing quite like that sinking feeling you get when you discover water damage. It's a moment of pure panic. But keeping a clear head and following a plan can make a world of difference in getting your life back on track.

Think of it as having two equally important jobs: first, immediate crisis control, and second, methodical claim management. What you do in the first few hours is just as critical as the paperwork you'll file later. The goal is simple: stop the water, save your stuff, and start building a rock-solid case for your claim.

Immediate Steps to Take After Discovering Water Damage

The second you spot the problem, your top priority is stopping it from getting any worse. This isn't just common sense—your insurance policy actually requires you to take reasonable steps to mitigate further damage. If you don't, you could put your entire claim at risk.

-

Stop the Water Source: This is job number one, no exceptions. If a pipe has burst or an appliance is overflowing, you have to shut the water off. Knowing how to turn off your water main is probably the most important thing you can learn before an emergency happens.

-

Protect Your Belongings: Get your furniture, electronics, rugs, and anything else of value out of the water, as long as it's safe to do so. Even lifting items onto wood blocks or pieces of aluminum foil can save them from soaking up more water and being ruined.

-

Document Everything (Before Cleanup): Before you move a single thing, grab your phone and play detective. Take tons of photos and videos of the damage from every conceivable angle. Get close-ups of warped floorboards, wide shots of the whole room, and clear evidence of where the water came from. This visual proof is gold.

Once you’ve got the immediate threat handled, it’s time to shift gears and officially start the claims process.

Filing and Managing Your Claim

Now that the chaos is under control, your focus needs to be on clear communication and meticulous record-keeping. This part of the process is all about working with your insurance company to reach a fair settlement.

Expert Tip: Start a "claim journal" right away. A simple notebook will do. Write down the name of every person you talk to, the date and time of the call, and a quick summary of the conversation. This log will be your best friend if any disagreements pop up down the road.

These next moves are crucial for keeping the process smooth.

-

Notify Your Insurer Promptly: Don't wait. Call your insurance agent or the company's claims hotline as soon as you can. Have your policy number handy and be ready to give a clear, simple explanation of what happened. They’ll give you a claim number and assign an adjuster to your case.

-

Arrange for Emergency Repairs: You’ll likely need to bring in a professional water mitigation company to start drying things out with industrial-grade fans and dehumidifiers. Make sure you keep every single receipt—these services are almost always covered.

-

Meet the Adjuster: The insurance company will send an adjuster to inspect the damage in person. You need to be there for that meeting. Walk them through the house, show them your photos and videos, and point out every single thing that was affected.

-

Get Repair Estimates: Don't just accept the first number you hear. Get detailed, itemized estimates from at least two reputable local contractors. This not only gives you a realistic benchmark for repair costs but also gives you leverage if the adjuster's initial offer seems too low.

I know this can all feel overwhelming, but taking it one step at a time will put you in the best possible position for a successful claim. For an even more detailed walkthrough, check out our complete guide on how to file a property damage claim.

Proactive Strategies to Prevent Water Damage

Knowing if your insurance covers water damage is one thing, but the best claim is always the one you never have to file. Taking a proactive approach doesn't just save you a world of stress; it can also bring down your insurance premiums over time. A little prevention now can save you a fortune later.

The financial case for staying ahead of problems has never been stronger. In the first half of 2025 alone, insured losses from natural catastrophes—many driven by water—rocketed to $100 billion globally. On top of that, construction costs have jumped 35.64% since 2020, which means every single repair hits your wallet harder than ever before. This growing "protection gap," as the World Economic Forum calls it, makes preventing damage a critical financial strategy.

Your Essential Maintenance Checklist

Your first line of defense is simple, routine maintenance. Catching small issues before they spiral out of control is the key to avoiding the very incidents that lead to expensive claims and major headaches.

Here are a few high-impact tasks you should tackle a couple of times a year:

- Inspect Appliance Hoses: Take a close look at the supply lines for your washing machine, dishwasher, and refrigerator icemaker. If you see any cracks, bulges, or signs of brittleness, replace them. As a rule of thumb, it’s smart to replace them every five to seven years anyway, even if they look fine.

- Test Your Sump Pump: You don't want to find out your sump pump is dead during a downpour. Test it by pouring a bucket of water into the pit—make sure it kicks on, runs properly, and shuts off like it's supposed to.

- Clear Gutters and Downspouts: Clogged gutters are a classic recipe for roof leaks and foundation damage. Keep them clear of leaves and debris so rainwater can be channeled safely away from your house.

For a comprehensive, room-by-room plan, check out our detailed home maintenance checklist to keep your property protected all year long.

Putting Smart Home Technology to Work

Today's technology gives us a powerful new toolkit for protecting our homes from water damage. Smart devices can keep an eye on your plumbing system 24/7, offering real peace of mind and stopping a disaster before it starts.

Think of smart leak detectors as smoke alarms for water. They're small, affordable sensors you can place in high-risk spots—like behind the toilet, under the sink, or in the basement. The moment they sense moisture, they send an alert straight to your phone.

For the ultimate safeguard, look into an automatic water shut-off valve. This device is installed on your main water line and can instantly cut off the flow to the entire house the second a leak is detected. It can turn a potential catastrophe into a minor cleanup job. Combining this with upgrades like installing waterproof and moisture-resistant flooring can make your home incredibly resilient.

Your Top Water Damage Questions Answered

Even when you think you have a handle on your policy, real-life situations can throw you for a loop. Let's walk through some of the most common questions I hear from homeowners and business owners to clear up the confusion.

Will My Insurance Cover a Leaking Roof?

This is a classic "it depends" scenario, and it all comes down to the why. If a sudden, covered event—like a nasty windstorm that tears off shingles—causes the leak, then yes, the water damage should be covered. The same goes for a tree branch crashing through your attic.

But if the leak is from old shingles that have been slowly failing for years? That claim is almost guaranteed to be denied. Insurance companies see that as a maintenance problem, not a sudden accident. The key takeaway is simple: sudden and accidental damage is covered, but gradual wear and tear is not.

What Can I Do if My Water Damage Claim Is Denied?

Getting that denial letter is a punch to the gut, but it doesn't have to be the end of the road. Your first move is to ask the insurance company for a formal written explanation. They are required to provide one, pointing to the exact language in your policy that justifies their decision.

Once you have that letter, read your policy very carefully. Do you agree with their reading of it? If not, you can start by filing an appeal directly with the insurer. If that doesn't get you anywhere, your next step might be to bring in a public adjuster to fight for you or to speak with an attorney who specializes in insurance law.

Is It Covered if My Neighbor’s Pipe Bursts and Floods My Place?

Yes, the damage to your property is covered—by your own homeowners policy. The most important thing is to get the ball rolling quickly, so you should file a claim with your own insurance company right away. Don’t wait on your neighbor.

What happens next is a process called subrogation. Your insurer will pay for your repairs to make you whole, and then they'll go after your neighbor's insurance company to get reimbursed. Because the problem started on their property, their policy is ultimately on the hook, but yours is the one that protects you first.

How Much Does Water Backup Coverage Cost?

This is one of the best bangs for your buck in the insurance world. For the incredible protection it provides, this endorsement is surprisingly affordable. Most homeowners can add sewer and water backup coverage for about $50 to $250 per year.

The exact price will hinge on where you live, your insurer, and how much coverage you want (say, $10,000 vs. $25,000). When you consider that a single sewer backup can easily cause tens of thousands in damage, that small annual cost buys a whole lot of peace of mind.

Figuring out the ins and outs of water damage can feel overwhelming, but you don't have to do it alone. The team at Wexford Insurance Solutions is here to provide clear, expert guidance and make sure you have the right protection long before you ever need it. Contact us today for a personalized policy review.

Your Guide to the Insurance Policy Rider

Your Guide to the Insurance Policy Rider What Is Dwelling Coverage and How Does It Protect Your Home?

What Is Dwelling Coverage and How Does It Protect Your Home?