Dwelling coverage is, quite simply, the part of your home insurance policy that protects the actual structure of your house. In insurance lingo, it’s often called Coverage A, and it serves as the financial backstop for everything from your foundation and walls to your roof. If it's a permanent part of your home—like an attached garage or a built-in deck—this is the coverage that protects it.

The Foundation of Your Home Insurance Policy

Think of your home insurance policy as the complete plan for protecting your biggest investment. Within that plan, dwelling coverage is the foundation. Everything else is built right on top of it.

Its purpose is straightforward: to pay for repairs or even a full rebuild if your home gets damaged by a covered event, like a fire, a severe windstorm, or an act of vandalism.

But it’s not just about the big, obvious stuff like the siding and shingles. Dwelling coverage also extends to the essential systems that make your house function, including:

- Plumbing and electrical systems

- Built-in appliances like your furnace and water heater

- Fixtures that are permanently installed, such as kitchen cabinets and countertops

- Attached structures, like a garage, porch, or deck

Replacement Cost vs. Market Value

Here’s where things can get a little confusing, but it’s one of the most important concepts to grasp. Your dwelling coverage isn't based on what you paid for your house, its market value. Market value is influenced by things like land value, location, and the quality of the local school district.

Insurers, on the other hand, are focused on a completely different number: replacement cost.

Replacement cost is the estimated price tag for labor and materials to rebuild your home exactly as it was, from the ground up, at today's prices. This is why your home’s insured value might be higher or lower than its market price.

To quickly recap this core idea, here's a simple summary:

Dwelling Coverage at a Glance

| Concept | Description |

|---|---|

| What It Is | The part of a home insurance policy (Coverage A) that protects the physical structure of your house and its attached components. |

| Primary Purpose | To provide funds to repair or rebuild your home after it's damaged by a covered event, such as fire, wind, or hail. |

| Key Valuation | Based on replacement cost, not market value. This is the estimated cost to reconstruct the home with similar materials today. |

Understanding replacement cost is key because it directly determines your policy's coverage limits. Insurers use sophisticated tools that factor in local construction costs to come up with this number, ensuring you have enough money to fully recover from a total loss.

The Financial Impact of Dwelling Limits

Your dwelling coverage limit is the most significant driver of your home insurance premium. The connection is direct and clear. For example, a home insured for $200,000 in dwelling coverage might carry an average annual premium around $1,442. Bump that coverage up to $400,000, and the premium could be closer to $2,481.

Getting this valuation right is a balancing act—you need enough coverage to be made whole after a catastrophe without overpaying for protection you don't need.

Many other protections in your policy, like coverage for other structures on your property, are often calculated as a percentage of your total dwelling limit. You can see how all these pieces fit together in our detailed guide to home insurance coverage types.

What Your Dwelling Coverage Actually Protects

Dwelling coverage draws a clear line between what’s part of your house and what’s simply in your house. I always tell my clients to think of it this way: if you could flip your home upside down and give it a good shake, pretty much everything that stays put is what your dwelling coverage is for.

This obviously includes the big things like your roof, walls, and foundation. But it also protects all the built-in systems that are permanently installed and make your house a home.

What Is Permanently Attached

Dwelling coverage is surprisingly broad, protecting all the elements that are truly integral to your home’s structure and function. It's not just about the shell of the building; it’s about the interconnected systems that make it a livable space.

Here’s a quick rundown of what’s typically covered:

- Structural Elements: The foundation, exterior and interior walls, framing, and roof.

- Essential Systems: All of your home's built-in electrical wiring, plumbing pipes, and the entire HVAC (heating, ventilation, and air conditioning) system.

- Attached Fixtures: Things like permanently installed cabinets, countertops, built-in appliances (like a wall oven or dishwasher), and flooring.

- Connected Structures: An attached garage, a front porch, or a back deck that's connected to the main house.

Understanding the Dividing Line

To really get a handle on dwelling coverage, it helps to know what it doesn't cover. Your policy specifically excludes personal belongings and any structures that aren’t physically attached to your home.

For instance, your furniture, clothes, electronics, and that new coffee maker are all protected under a different part of your policy called Personal Property Coverage. That shed out back? It falls under Other Structures Coverage. And the land your home sits on isn't covered by any part of a standard home policy.

Scenario Spotlight: A Kitchen Fire

Imagine a grease fire flares up on your stovetop. It scorches the custom-built cabinets above it and also melts your brand-new toaster. In this case, your dwelling coverage would pay to repair the burnt cabinets, but your personal property coverage would be what you use to replace the toaster.

This distinction is absolutely critical when you file a claim, as a single event can easily trigger several different coverage types within your policy.

If a major storm makes your home unlivable while repairs are underway, you'll also lean on Additional Living Expense coverage. You can learn more about how additional living expense coverage helps with temporary housing and other costs. This separation ensures every aspect of your loss, from the structural damage to the cost of being displaced, is handled by the right part of your insurance.

Dwelling Policies for Landlords and Vacation Homes

When you own a property you don't live in full-time, a standard homeowners policy just won't cut it. The risks tied to a rental property, a vacation getaway, or even a house sitting vacant are entirely different. This is precisely why Dwelling Property policies exist.

These specialized policies—often called DP-1, DP-2, and DP-3—are built from the ground up for non-owner-occupied homes. They provide the right kind of protection when someone else is living in your property, or when no one is there at all.

Understanding the Three Types of Dwelling Policies

Think of these policies as good, better, and best. Each form offers a different level of protection, and the one you choose will determine what gets covered, how you get paid after a claim, and what your premium looks like.

-

DP-1 (Basic Form): This is your no-frills, foundational coverage. It operates on a named peril basis, which means it only covers the specific risks listed in the policy—think fire, lightning, and little else. Importantly, claims are settled at Actual Cash Value (ACV), factoring in depreciation. It's the most affordable but also the most limited.

-

DP-2 (Broad Form): This is a solid middle-ground option. The DP-2 is also a named peril policy, but the list of covered perils is much longer and more practical than the DP-1. A huge plus is that claims for the structure are typically paid at Replacement Cost Value (RCV), which doesn’t deduct for depreciation.

-

DP-3 (Special Form): This is the gold standard for most landlords. The DP-3 provides open peril (or "all-risk") coverage for the dwelling itself. This flips the script: instead of listing what’s covered, it covers everything except for what's specifically excluded. It's the most comprehensive protection you can get for your investment property.

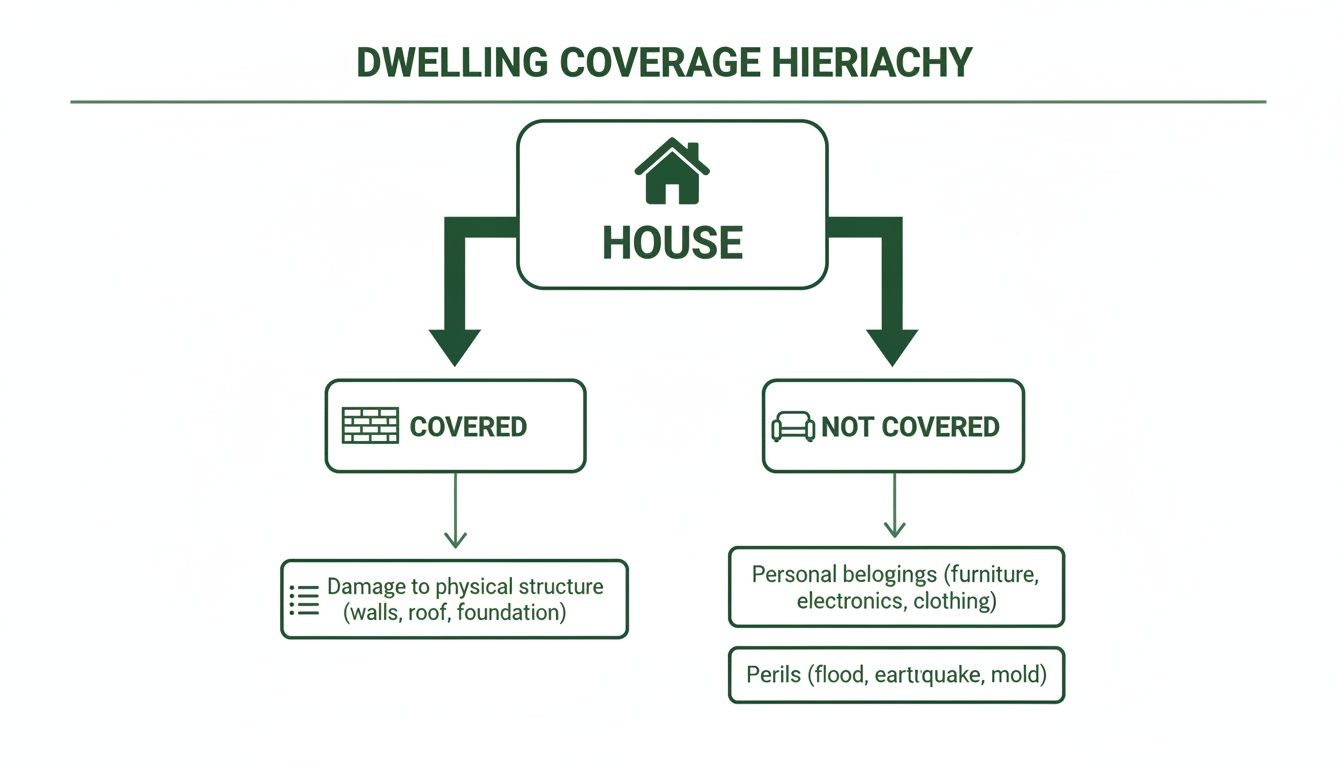

This flowchart breaks down the core idea: dwelling coverage is all about the house itself—the roof, walls, and foundation—not the personal items inside.

Comparing Dwelling Policy Forms DP-1 vs DP-2 vs DP-3

Choosing between a DP-1, DP-2, and DP-3 policy comes down to balancing cost against risk. To make it clearer, here’s a side-by-side look at what each form brings to the table.

| Feature | DP-1 (Basic) | DP-2 (Broad) | DP-3 (Special) |

|---|---|---|---|

| Peril Coverage | Named Peril (most limited list, e.g., fire, lightning) | Named Peril (longer list, adds perils like theft, falling objects) | Open Peril (covers all perils unless specifically excluded) |

| Valuation Method | Actual Cash Value (ACV) – Depreciated value | Replacement Cost (RCV) – Cost to rebuild new | Replacement Cost (RCV) – Cost to rebuild new |

| Ideal For | Vacant homes, low-value properties, budget-focused owners | Landlords wanting more than basic coverage without the highest cost | Landlords seeking the most comprehensive protection for their asset |

As you can see, moving from a DP-1 to a DP-3 significantly broadens your protection, ensuring you're better prepared for the unexpected.

Why Landlords and Vacation Homeowners Pay More

It's no secret that insuring a rental or vacation home costs more. Insurers often charge premiums that are 20–50% higher for these properties because the risks are elevated. A tenant may not spot a maintenance issue as quickly as you would, and a vacant property is a bigger target for vandalism or theft.

The difference between a basic DP-1 and a comprehensive DP-3 is all about aligning your premium with your risk tolerance. To see how this applies to seasonal properties, take a look at our guide on vacation home insurance.

The right dwelling policy aligns your coverage with your financial risk. A landlord might opt for a DP-3 to fully protect their income-generating asset, while someone holding a vacant property between sales might choose a basic DP-1 to simply cover the essentials.

Getting this choice right is crucial. For anyone owning rental properties, it's a smart move to explore specific landlord insurance options to make sure your investment is properly shielded. The cost of your policy directly reflects the level of protection you receive.

How to Calculate Your Dwelling Coverage Needs

Figuring out the right amount of dwelling coverage is probably the single most important decision you'll make when buying home insurance. If you get this number wrong, you could be left in a devastating financial hole after a disaster.

One of the most common mistakes homeowners make is confusing their home’s market value with its rebuilding cost. Your insurer doesn't care what you could sell the house for or how much you owe the bank.

The only number that truly matters is your home’s replacement cost. This is what it would cost to rebuild your entire home from the ground up, using today's labor and material prices, to the same quality it was before. It's purely about construction and has nothing to do with the value of your land.

Factors That Influence Rebuilding Costs

Pinpointing an accurate replacement cost is much more than a simple price-per-square-foot calculation. Insurance carriers use sophisticated tools that dig into a number of variables to get it right.

Here's what they're looking at:

- Local Construction Costs: A builder in coastal California charges a lot more than one in rural Ohio. Labor and material prices can swing wildly depending on your zip code.

- Home Size and Layout: It's not just about square footage. The number of stories and the complexity of your floor plan play a huge role in the final bill.

- Quality of Materials: Do you have custom kitchen cabinets, imported tile floors, or a slate roof? These high-end finishes cost significantly more to replace than standard, off-the-shelf options.

- Unique Architectural Features: Custom millwork, ornate masonry, or arched windows all add character to your home—and expense to the rebuild.

Creating a Financial Safety Net

Even with the most careful calculations, rebuilding costs can unexpectedly skyrocket. This is especially true after a widespread disaster like a hurricane or wildfire. Suddenly, everyone needs contractors and lumber, causing a "demand surge" that drives prices through the roof. To guard against this, you can add endorsements to your policy.

Think of an endorsement as a financial buffer. It automatically increases your dwelling coverage limit right when you need it most, protecting you from post-disaster inflation so you don't have to pay the difference out of pocket.

Two of the best safety nets you can add are:

- Extended Replacement Cost: This popular option adds a percentage—usually 25% to 50%—on top of your dwelling limit. If your home is insured for $400,000, a 25% extension gives you an extra $100,000 to work with if costs run high.

- Guaranteed Replacement Cost: This is the ultimate protection. It pays the full cost to rebuild your home exactly as it was, no matter how much it exceeds your policy limit. You can learn more about how this works in our guide on what is replacement cost coverage.

Economic factors like inflation and major catastrophe losses have a direct impact on these costs. It's not uncommon to see premiums and required coverage limits jump after a bad storm season. That’s why it's so important to review your dwelling coverage with your agent every single year. It’s the only way to make sure you aren't dangerously underinsured.

Securing the Right Coverage Without the Headaches

Knowing what dwelling coverage is and how to calculate it are the first big steps. But actually navigating the insurance market to lock in the right policy can feel like a whole other challenge. At Wexford Insurance Solutions, our entire focus is on making that process clear, straightforward, and centered around you.

We start by respecting your time. Our onboarding is completely paperless, cutting out the hassle so we can get right to the important part: building the right protection for your home.

Precision in Every Policy

Those quick online calculators are a decent starting point, but they often miss the details that make your home unique. We go deeper, providing personalized quotes that account for your home's specific characteristics, from the grade of its construction materials to its distinct architectural features. This ensures your dwelling coverage limit isn't just a ballpark guess—it's a reflection of your home's true replacement cost.

Our private-client expertise is especially critical for owners of high-value or custom-built properties. We specialize in:

- Unique Structures: Properly valuing the one-of-a-kind details and custom craftsmanship that standard policies frequently overlook.

- Higher Limits: Arranging coverage robust enough to fully rebuild a luxury home to its original standard.

- Specialized Endorsements: Identifying and recommending add-ons for things like valuable art collections, high-end custom fixtures, or elaborate landscaping.

Our goal isn't just to sell you a policy. We're here to be your partner, dedicated to protecting your most significant asset with the precision and care it deserves.

Of course, a solid policy is only one piece of the puzzle. It’s also smart to understand the ins and outs of filing homeowners insurance claims before you ever need to. Knowing the process ahead of time can make a stressful situation much more manageable.

We can help you connect all the dots, ensuring you’re not just insured, but truly protected. To get more comfortable with the fine print, take a look at our guide on how to read an insurance policy. We're here to bring clarity and peace of mind to your coverage.

Common Questions About Dwelling Coverage

Once you get a handle on the basics, the "what if" questions start popping up. That's a good thing! It means you're thinking like a smart homeowner. Let's walk through some of the most common questions and clear up any confusion.

Think of this as the practical, real-world guide to your home's protection. We'll get into the stuff that actually happens—from that kitchen remodel you're dreaming of to the major disasters you hope never occur.

Does Dwelling Coverage Affect Other Parts of My Policy?

Yes, it's the foundation of your entire policy. Your dwelling coverage limit, often called Coverage A, is the magic number that determines many of your other coverage amounts. Insurance companies do this intentionally to make sure your overall protection is balanced with the value of your home.

Here’s how it usually breaks down:

- Other Structures (Coverage B): This is for your detached garage, that new shed, or the fence around your yard. It’s typically set at 10% of your dwelling coverage.

- Personal Property (Coverage C): This covers everything inside your home—your furniture, clothes, and electronics. Expect this to be somewhere between 50% and 70% of your dwelling limit.

- Loss of Use (Coverage D): If a fire or other disaster forces you out of your home, this helps pay for a rental and other living expenses. It's often calculated around 30% of your dwelling limit.

So, if your home is insured for $400,000 in dwelling coverage, your policy might automatically give you $40,000 for your shed and $200,000 for your belongings. This is why getting your dwelling coverage number right is so crucial. If you underinsure the house itself, you're unintentionally underinsuring everything else, too.

What Happens if I Renovate or Add On to My Home?

This is a big one. Anytime you make a significant upgrade that increases what it would cost to rebuild your home, you need to have a conversation with your insurance agent. A gut-renovated kitchen, a new master suite, or an entire second-story addition all add serious value.

If you don't update your dwelling coverage, you're setting yourself up for a major financial shortfall. Let's say you invest $75,000 into a stunning kitchen remodel. If you don't adjust your policy and a fire later destroys your home, that $75,000 of added value simply doesn't exist in the eyes of your insurer. Your claim payout would be based on the old value, and you'd be on the hook for that difference when you rebuild.

Here's a simple rule of thumb: If the project requires a building permit, it's time to call your insurance agent. A quick call is all it takes to adjust your dwelling limit and make sure the new, improved value of your home is fully protected.

Are Floods and Earthquakes Covered by Dwelling Insurance?

No, and this is probably the most important exclusion for homeowners to understand. Standard homeowners policies, and the dwelling coverage within them, do not cover damage from floods or earthquakes. These are considered catastrophic events that fall outside the scope of a typical policy.

To be protected from these specific perils, you need to buy separate, dedicated policies:

- Flood Insurance: You can typically get this through the National Flood Insurance Program (NFIP) or from a private insurance company.

- Earthquake Insurance: In at-risk states like California, this is often available through state-managed programs or as a special add-on from certain carriers.

Skipping these policies can be financially devastating if your area is hit by one of these disasters. Your standard dwelling coverage won't pay a dime for repairs from rising floodwaters or damage from a tremor.

How Is Dwelling Coverage Paid After a Claim?

How you get paid after a disaster depends on one key detail in your policy: the valuation method. There are two main ways insurers calculate your payout.

-

Actual Cash Value (ACV): This pays for the cost to replace your damaged property, but subtracts depreciation for age and general wear-and-tear. So if your 15-year-old roof is destroyed, an ACV policy will only give you what a 15-year-old roof is worth, which is a fraction of the cost of a brand-new one.

-

Replacement Cost Value (RCV): This is the gold standard for homeowners and what you should look for in a policy. RCV pays the full amount needed to repair or replace the damaged part of your home with new materials of similar quality—with no deduction for depreciation. The goal is to make you whole again.

Thankfully, most modern homeowners policies use RCV for the structure of the home itself. But it never hurts to double-check your policy documents and confirm this, just to avoid any surprises when you need your coverage the most.

At Wexford Insurance Solutions, we believe clear answers are the cornerstone of great coverage. Our team is here to help you build a policy that truly protects your home and family, without the guesswork. Get in touch today for a personalized quote and the peace of mind you deserve.

Does Insurance Cover Water Damage? A Homeowner's Guide

Does Insurance Cover Water Damage? A Homeowner's Guide Business Owner Policy vs General Liability Comparison Guide

Business Owner Policy vs General Liability Comparison Guide