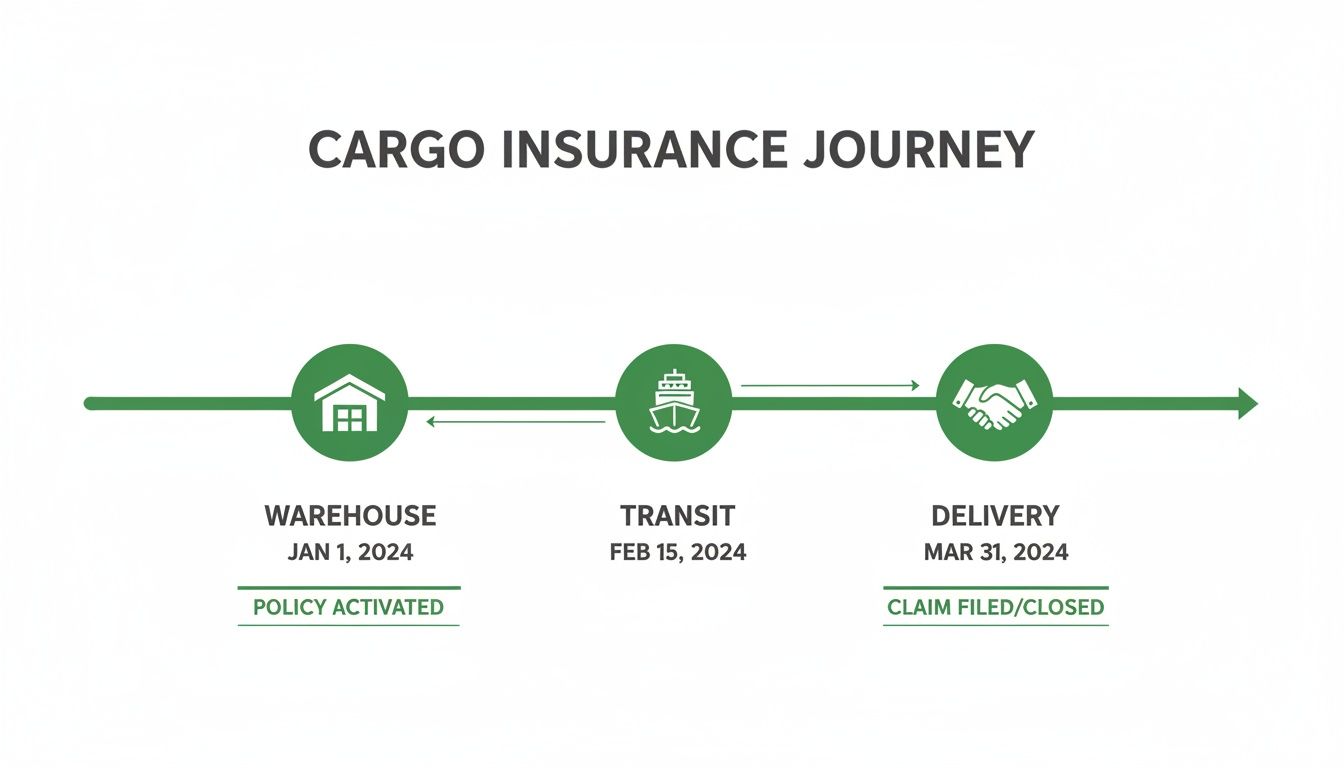

Picture this: a container packed with your best-selling product gets lost at sea or is damaged during a powerful storm. For any business involved in global trade, this isn't just a bad dream—it's a very real risk. This is where marine cargo insurance steps in, acting as your financial lifeline. It protects the value of your goods from the moment they leave your warehouse until they're safely in your customer's hands.

Why Marine Cargo Insurance Is Your Essential Safety Net

Think of global shipping as a long, unpredictable road trip. You can plan every detail meticulously, from production to packaging, but the journey itself introduces a ton of variables you simply can't control. We're talking about rough seas, chaotic port congestion, accidents, and even outright theft. Marine cargo insurance is designed specifically to shield you from the financial fallout of these unexpected events.

And it’s not just for massive corporations. Whether you're a small e-commerce business shipping handmade goods or a large manufacturer moving heavy equipment, a single uninsured loss can be devastating to your bottom line and your reputation. This coverage ensures a disaster on the water doesn't become a disaster for your business.

A Growing Necessity in Global Trade

The market numbers tell the story. Global marine cargo insurance premiums recently hit USD 22.64 billion, a 1.6% jump from the previous year, showing just how vital this protection has become for keeping international trade resilient. In fact, some forecasts suggest the market could nearly double by 2032.

At its core, marine cargo insurance transforms unpredictable shipping risks into a manageable, fixed cost. It provides the peace of mind needed to operate confidently in the international marketplace, knowing your assets are protected against the worst-case scenarios.

Beyond just safeguarding individual shipments, this insurance is a cornerstone of robust supply chain risk management strategies, especially in today's unpredictable world. It's a proactive move that bolsters your financial stability, letting you focus on growing your business instead of recovering from a crisis.

Proof of this coverage is often provided on a specific document, and you can learn more about it in our guide on what is a certificate of insurance. This guide will walk you through everything you need to know.

How to Read a Marine Cargo Insurance Policy

Cracking open a marine cargo insurance policy for the first time can feel like trying to read a foreign language. It's packed with dense clauses and jargon you won't hear anywhere else. But figuring out what your policy actually says isn't just a box-ticking exercise—it's one of the most important things you can do to protect your business.

Let’s break it down. Think of it like buying insurance for your car. You wouldn't just sign on the dotted line without knowing if you have basic liability or full comprehensive coverage, right? The same logic applies here. Knowing the details determines what happens when things go wrong on the water.

All Risks Versus Named Perils Coverage

The first and most important distinction you'll find is whether your policy offers "All Risks" or "Named Perils" coverage. This single choice defines the entire scope of your protection and is the foundation of your policy.

All Risks is the gold standard, the comprehensive, bumper-to-bumper warranty of the shipping world. It’s the broadest coverage you can get, protecting your goods against any physical loss or damage from any external cause. The only things it doesn't cover are the specific exclusions listed in the policy, like acts of war, employee sabotage, or "inherent vice" (the natural tendency of certain goods to spoil or break down on their own).

A Named Perils policy, on the other hand, is much more restrictive. It's like a powertrain warranty that only covers specific, listed parts of your car's engine. This type of insurance only protects your cargo from the exact risks, or "perils," that are explicitly spelled out in the policy. Common examples include fire, collision, sinking, or jettison (when cargo is intentionally thrown overboard to save the ship).

Here's the critical difference: With an All Risks policy, if something happens, the burden of proof is on the insurer to prove a specific exclusion applies. With a Named Perils policy, the burden is on you to prove that your loss was caused by one of the perils listed in your policy. For this reason alone, All Risks is almost always the better choice for most shippers.

Core Policy Types for Different Business Needs

Beyond the type of risk, policies are built to match how often you ship. It’s crucial to know which structure you have.

-

Voyage Policy: This is a one-and-done policy. It covers a single, specific shipment from its starting point to its final destination. It's perfect for businesses that only ship occasionally or have a one-off, high-value shipment that needs special attention.

-

Open Cover Policy: For frequent shippers, this is the way to go. It's an ongoing agreement where the insurer agrees to cover all your shipments over a set period, usually a year. This saves you from having to get a new policy for every single shipment; you just declare each one as it happens.

-

Stock Throughput Policy: This is the all-in-one solution. It bundles marine cargo insurance with coverage for your inventory while it's in storage, both before and after its journey. It protects your goods from the supplier’s warehouse all the way to the final customer's door, covering transit and storage under one seamless policy. This isn't the same as inland marine coverage, which is a separate product for goods moving over land. To get a better handle on that, you can check out our guide explaining what is inland marine coverage.

Decoding Key Clauses and Terminology

Every policy is full of specific clauses, but there are a few you absolutely need to understand.

The Warehouse to Warehouse clause is a big one. It confirms that your coverage starts the moment your goods leave the warehouse of origin and doesn't end until they arrive at the final destination warehouse. This provides crucial end-to-end protection, covering all the bits of the journey in between, like truck or rail transport.

General Average is a concept that has been around for centuries, and it’s a shock to many shippers when they first encounter it. Imagine a ship is caught in a terrible storm. To save the vessel and the rest of the cargo, the captain orders some containers to be jettisoned overboard. Under maritime law, the owners of the surviving cargo must all chip in to cover the loss of the sacrificed cargo. General Average is that shared financial obligation. Your cargo insurance covers this contribution, saving you from a surprise bill that could be catastrophic.

Finally, you’ll see references to the Institute Cargo Clauses (A, B, or C). These are standardized sets of terms that act as a shorthand for the level of coverage you're getting.

Comparing Institute Cargo Clauses (A, B, and C)

These standardized clauses from the International Underwriting Association of London are the bedrock of most marine policies. They provide a clear, industry-wide understanding of what’s covered. Here's a quick breakdown of what each one means for your cargo.

| Coverage Level | Clause A (All Risks) | Clause B (Named Perils) | Clause C (Named Perils – Basic) |

|---|---|---|---|

| Primary Coverage | Broadest coverage for physical loss or damage from any external cause, unless specifically excluded. | Covers specific major perils like fire, explosion, sinking, collision, and discharge of cargo at a port of distress. | The most limited coverage, typically protecting only against catastrophic events like fire, sinking, and collision. |

| General Average | Covered | Covered | Covered |

| Theft & Non-Delivery | Covered | Not Covered | Not Covered |

| Weather Damage | Covered | Covered only if water enters the vessel or container (e.g., washing overboard). | Not Covered |

| Best For | High-value goods, fragile items, and any shipper seeking the most complete protection available. | General cargo where budget is a key concern but catastrophic risk still needs to be managed. | Low-value, durable bulk cargo where only major vessel incidents are the primary concern. |

Understanding these clauses is key. Choosing Clause A gives you the most security, while Clauses B and C offer more limited, budget-friendly options for lower-risk goods. Make sure the clause in your policy aligns with the real-world risks your cargo faces.

How Incoterms Dictate Who's on the Hook for Insurance

Here’s a costly mistake I see all the time in global trade: shippers assume their carrier’s liability insurance has them fully covered. It doesn’t. Not even close.

A carrier's liability is severely restricted by international law, sometimes to just a few dollars per kilogram. This leaves a massive gap between what they’ll pay out and the real value of your lost or damaged goods. That's a financial hole you don't want to fall into.

This is where Incoterms come in. These aren't just shipping jargon; they are the official rules of the road for global trade. They clearly define who—the seller or the buyer—is responsible for what, and, most importantly, they pinpoint the exact moment the risk of loss or damage transfers from one party to the other.

The Great Handoff: Incoterms and Risk Transfer

Think of Incoterms like a pre-negotiated agreement for a relay race. Each rule specifies the precise point on the track where the first runner (the seller) hands off the baton (the risk and responsibility) to the second runner (the buyer). If the baton drops before the handoff, it's the seller's problem. If it drops after, it’s on the buyer to deal with the fallout.

Picking an Incoterm isn't a minor detail—it's a critical decision that directly shapes your financial exposure and insurance duties. Get it wrong, and you could be facing devastating uninsured losses, nasty legal battles, and soured business relationships.

The journey below highlights just how many stages there are where this risk transfer point is absolutely crucial.

From the moment goods leave the warehouse to the final leg of their journey, your choice of Incoterm determines who needs to have an active insurance policy in place.

A Look at Common Incoterms and What They Mean for Insurance

Let's break down two of the most common Incoterms to see how this plays out in the real world. Getting a handle on these will help you negotiate smarter and protect your shipments.

-

FOB (Free On Board): A very popular choice. With FOB, the seller covers all costs and risks until the goods are loaded "on board" the ship chosen by the buyer. The second that cargo crosses the ship's rail, the risk officially transfers to the buyer. From that point on, it's up to the buyer to arrange and pay for the main sea freight and the marine cargo insurance.

-

CIF (Cost, Insurance, and Freight): Under CIF, the seller’s responsibilities stretch much further. The seller pays for the goods, the freight to the destination port, and they have to get a minimum level of insurance to cover the buyer's risk during the voyage. Even though the seller buys the policy, the risk itself still transfers to the buyer once the goods are on board.

A critical point on CIF: the seller is only required to purchase the bare-minimum coverage (typically Institute Cargo Clauses C). If you're the buyer, that's probably not enough. A smart buyer will either negotiate for better coverage upfront or purchase their own supplementary policy to get the protection they actually need.

Negotiating these terms isn't just about cost; it's about controlling your risk. Your choice determines who has the right to file a claim and which insurer pays out. This gets even more layered if your insurer tries to recover costs from a negligent third party, which is why understanding the concept of a waiver of subrogation can be so valuable.

When you truly understand Incoterms, you stop hoping you're covered and start knowing you're protected.

Understanding Your Insurance Premiums and Costs

Figuring out the cost of marine cargo insurance isn't just pulling a number out of a hat. Think of insurance underwriters as seasoned risk analysts. They're meticulously piecing together a puzzle of your shipment's journey to predict the likelihood of something going wrong. The premium you pay is a direct reflection of the risk they're shouldering.

It all starts with the nature of your cargo. This is the single biggest piece of the puzzle. Shipping a container of rugged steel pipes is a world away from sending a pallet of delicate, high-value glassware. Insurers look closely at how prone your goods are to breakage, theft, or spoilage—the more fragile or desirable the item, the higher the premium.

Key Drivers of Your Premium

Once they’ve assessed your cargo, underwriters layer in several other critical factors. Each one adds a different dimension to your shipment’s overall risk profile.

- Shipping Routes and Destination: A journey across calm, well-policed waters is simply not the same risk as navigating through regions known for piracy or notorious for violent weather. High-risk zones will always command higher premiums.

- Mode of Transit: The carrier you choose matters. A modern, well-maintained vessel operated by a company with a stellar safety record presents a much lower risk than an older ship with a history of incidents.

- Claims History: Your track record speaks volumes. If your business has a history of frequent claims, insurers will see you as a higher risk and price your policy accordingly. A clean record, on the other hand, can lead to much better rates. A great way to understand this from an insurer's perspective is to get familiar with your loss ratio in insurance.

The wider insurance market also plays a part. After years of rising costs, the market has seen some shifts. Increased competition has led to some relief for shippers, with some reports from the 2025 marine insurance market outlook pointing to potential premium decreases between 7.5% and 10% for clients with good loss histories.

Calculating the Correct Insured Value

One of the most frequent—and painful—mistakes a shipper can make is underinsuring their cargo. To get it right, you need to calculate the total insured value, and that goes beyond the price on your commercial invoice. The goal is to cover your entire financial stake in the shipment.

The industry-standard formula looks like this:

Commercial Invoice Value + Freight Costs + 10-20%

That extra 10-20%, often called the "plus-up," is your safety net. It’s there to cover all the other costs you'd face if the shipment vanished, like customs duties, inspection fees, and, just as importantly, the profit you lost on the sale.

By correctly calculating your insured value, you ensure that a total loss of cargo doesn't also result in a loss of profit and additional recovery expenses. It’s the difference between simply replacing the goods and truly recovering your full financial position.

Balancing Deductibles and Coverage Limits

Finally, you can fine-tune your policy's cost by adjusting the deductible and coverage limits. These two levers let you strike a balance between what you pay upfront and how much protection you get.

A deductible is the amount you agree to pay out of your own pocket on a claim before the insurance kicks in. Choosing a higher deductible will lower your premium, but it also means you’re taking on more of the financial hit for smaller losses.

Your coverage limit is the absolute maximum an insurer will pay out for a single loss. It’s tempting to go with a lower limit to save a few dollars, but this can be a disastrous mistake. Your limit must be high enough to cover a worst-case scenario. Finding that sweet spot ensures your insurance is both affordable and actually does its job when you need it most.

Your Step-by-Step Guide to Filing a Cargo Claim

When your shipment arrives damaged—or not at all—it’s easy to feel a surge of panic. But in these crucial first moments, a calm, methodical approach will be your biggest ally. Navigating the claims process for your marine cargo insurance isn't about jumping through hoops; think of it as a clear action plan to document what happened and get you back on track.

The clock starts ticking the second you notice a problem. Acting immediately isn't just a good idea; it's almost always a policy requirement. Any delay can complicate your claim, or worse, put your entire financial recovery at risk. Your first job is to move quickly to protect your interests.

First Steps After Discovering a Loss

The moment you identify loss or damage, it's time to set the claims process in motion. These first moves are the foundation of your entire claim, giving your insurer everything they need to start working for you.

-

Notify Your Insurer Immediately: Your first call should be to your insurance broker or the insurer's claims department. Give them the essentials: what was shipped, what happened, and where. They’ll get the ball rolling and assign an adjuster to your case.

-

Inform the Carrier in Writing: At the same time, you must formally notify the shipping line, airline, or trucking company about the loss. This official notice, often called a "Letter of Protest," is a critical step that preserves your legal right to hold the carrier responsible for their part.

-

Mitigate Further Damage: Your policy expects you to act reasonably to prevent a bad situation from getting worse. If a pallet of goods gets wet, for example, your job is to move the undamaged items to a dry place. The good news is that any reasonable costs you incur doing this are usually recoverable.

Assembling Your Essential Claims Documents

A claim is only as solid as the evidence supporting it. An organized, complete set of documents is the secret to a smooth and successful settlement. Your goal is to create a crystal-clear story of the cargo’s value, its journey, and exactly what went wrong.

Think of yourself as building a case file. Each document plays a specific role, from proving you owned the goods to calculating the precise financial loss.

A well-documented claim leaves no room for doubt and speeds up the entire adjustment process. It shows you're serious and gives the adjuster the hard facts they need to approve a fair settlement without delay.

Here’s the core documentation you'll need to pull together:

- Bill of Lading: This is the contract with the carrier, proving they accepted your goods into their care.

- Commercial Invoice: It establishes the value of your cargo, which is the starting point for calculating your financial loss.

- Packing List: This document details the specific contents of the shipment, helping to pinpoint exactly what was lost or damaged.

- Photographic Evidence: Before anything is moved, take plenty of clear, detailed photos and videos of the damaged goods and their packaging.

- Survey Report: Your insurer will often appoint an independent surveyor to professionally assess the damage. This official report is a vital piece of evidence.

- Written Correspondence: Keep organized copies of your formal claim notice sent to the carrier and any other important communications.

Submitting a complete file from day one eliminates the frustrating back-and-forth and proves the validity of your claim from the start. Of course, it's also wise to understand that even with perfect paperwork, denials can happen. For a closer look at why, our guide explaining common insurance claim denial reasons offers some critical insights.

Avoiding Common Pitfalls and Choosing the Right Insurer

Navigating the world of marine cargo insurance isn’t just about knowing the policies; it's about sidestepping the common but incredibly costly mistakes that trip up even seasoned shippers. It's a hard lesson to learn, but even the most comprehensive-sounding policy can be riddled with exclusions that leave you exposed right when you need protection the most.

So many shippers get caught off guard by risks that have nothing to do with a dramatic collision at sea. We're talking about the real-world stuff: organized cargo theft in a chaotic port, slow-moving moisture damage from a container sitting in the sun, or losses that pile up from an unexpected delay in the supply chain.

For example, your policy might proudly state it covers spoilage "from any cause," but a tiny clause called a Delay Warranty buried in the fine print could completely void that coverage if the spoilage was due to a lengthy customs inspection. Knowing where these traps lie is the first step toward building a truly bulletproof shipping strategy.

Identifying Your Ideal Insurance Partner

Choosing the right insurer is every bit as important as choosing the right coverage. A rock-bottom price is always tempting, but it often comes at the cost of flimsy protection and a nightmare claims process. You're not just buying a piece of paper; you're looking for a partner.

Before you jump at the lowest premium, take a step back and really vet your options. Here’s what to look for:

- Financial Stability: Is the insurer on solid ground? Check their rating from a reputable agency like A.M. Best. This tells you if they have the cash reserves to pay out claims, especially if a major catastrophe hits.

- Claims Reputation: An insurer’s real character shows when you file a claim. Dig around. Ask for references. Find out if they have a reputation for being fair and efficient. Are they known for working with their clients or against them?

- Industry Expertise: A carrier that specializes in your industry—whether you ship fresh produce, heavy equipment, or high-end electronics—will have a much deeper understanding of the specific risks you face every day.

- Global Support Network: If you’re shipping internationally, you need an insurer with a solid global network. When something goes wrong in a foreign port, you need local surveyors and agents who can get on the ground and act fast.

Choosing an insurer based solely on cost is a classic pitfall. A slightly higher premium for a policy with a reputable, expert partner is an investment in certainty and peace of mind. It ensures you have a strong advocate in your corner when things go wrong.

The Shipper's Pre-Shipment Insurance Checklist

Let’s bring this all together. A simple checklist can be your final line of defense, helping you lock in the right coverage and manage risk before your goods even leave the warehouse. Think of it less as paperwork and more as a pre-flight check for your cargo.

Before every single shipment, run through these critical points:

- Review Your Incoterms: Pull up the sales contract and confirm the exact moment risk transfers from you to the buyer. Is your insurance policy active for the entire time the cargo is your responsibility?

- Verify Insured Value: Have you calculated the full, landed value? Don't forget the formula: Commercial Invoice + Freight Costs + 10-20% for lost profits and other incidental expenses.

- Document Cargo Condition: Take clear, time-stamped photos of your cargo before it's sealed in the container. Solid proof of its pre-shipment condition is your best weapon if you have to file a claim later.

- Confirm Packaging Adequacy: Most policies include a “Packing Warranty.” This is a big one. It means your claim can be flat-out denied if the damage was caused by poor or insufficient packaging. Make sure your goods are packed to survive the journey.

By making this a routine, you shift from just buying insurance to actively managing your shipping risk. This diligence is what protects your assets, keeps your customers happy, and builds a far more resilient supply chain.

Frequently Asked Questions

Even when you feel you have a handle on the basics, marine cargo insurance can throw some curveballs. Let's tackle a few of the most common questions we get from shippers to clear up some of the finer points.

My Freight Forwarder Offers Insurance. Do I Still Need My Own Policy?

Yes, it's almost always a better idea to have your own policy. While it seems convenient to just tick the box with your forwarder, their insurance is usually a generic, one-size-fits-all master policy. It wasn't designed with your specific cargo in mind.

That often means you're stuck with higher deductibles, surprisingly narrow coverage, or a messy claims process where you're not even the primary policyholder.

When you arrange your own marine cargo insurance, you're in the driver's seat. You get to set the terms and limits that match your cargo's true value and risks. Most importantly, you have a direct line to your insurer, which makes a world of difference if you ever need to file a claim. Always weigh what a forwarder is offering against a dedicated policy built for you.

What Exactly Is "General Average," and Why Should I Care?

General Average is one of those ancient maritime laws that can deliver a stunning financial hit to shippers who aren't prepared for it. Picture this: a ship is caught in a severe storm, and the captain has to jettison a few containers overboard to save the vessel and everyone else's cargo.

When the ship's operator declares a General Average, it means that every single party with a stake in that voyage—including the owners of the cargo that arrived perfectly safe—has to chip in to cover the cost of the sacrifice. Your goods could be sitting at the port, completely unharmed, but you won't be able to touch them until you pay your share of the loss.

This is a massive reason to have solid marine cargo insurance. A standard policy will cover your General Average contribution, saving you from a sudden and often crippling bill.

What's the Real Difference Between "All Risks" and "Named Perils"?

The difference boils down to how broad the coverage is and, critically, who has to prove what when you make a claim.

- All Risks Coverage: This is the best protection you can get (think Institute Cargo Clauses A). It covers any physical loss or damage from any external cause, unless that cause is specifically excluded in the policy, like war or intentional damage. With an All Risks policy, the insurance company has to prove the loss was caused by an exclusion to deny the claim.

- Named Perils Coverage: This is much more restrictive (like Clauses B and C). It only covers losses that result from a specific list of events, or "perils," written into the policy—things like fire, sinking, or collision. Here, the burden of proof is on you. You have to show that your loss was caused by one of those specific events on the list.

For peace of mind and a much stronger position at claim time, most shippers find that an All Risks policy is easily the better choice.

While this guide is all about protecting your shipments moving across the globe, it can be interesting to see how marine insurance applies in other areas. For instance, you can learn about insurance costs for living on a narrowboat.

At Wexford Insurance Solutions, our job is to cut through the jargon and complexities of commercial insurance. We build clear, effective coverage that truly protects your business. Contact us today for a personalized consultation and let our experts design a policy that keeps your assets safe, from the warehouse all the way to their final destination.

Best tips for cleaning business insurance: Coverage and Compliance

Best tips for cleaning business insurance: Coverage and Compliance What Is a Named Insured in an Insurance Policy?

What Is a Named Insured in an Insurance Policy?