If you charge a fee for your professional advice, expertise, or services, you need professional liability insurance. It’s that simple. Think of it as a crucial safety net for your reputation and your bank account. Should your work or advice cause a client a financial loss, this is the policy that steps in to handle the aftermath.

Who Needs Protection For Their Professional Services?

I like to call professional liability insurance "brainpower insurance." Your general liability policy covers tangible risks, like a client slipping and falling in your office. But professional liability? That covers the intangible risks tied directly to the knowledge and skills you sell. A single, unintentional mistake—an error, an omission, or even just an allegation of negligence—can spark a lawsuit that could sink your business.

What many people don't realize is that clients can sue you even when you've done everything right. Defending your business against a baseless claim can be a nightmare, easily costing tens of thousands of dollars in legal fees alone. Professional liability insurance is what pays for those defense costs, along with any settlements or judgments, protecting your business assets and your hard-earned reputation.

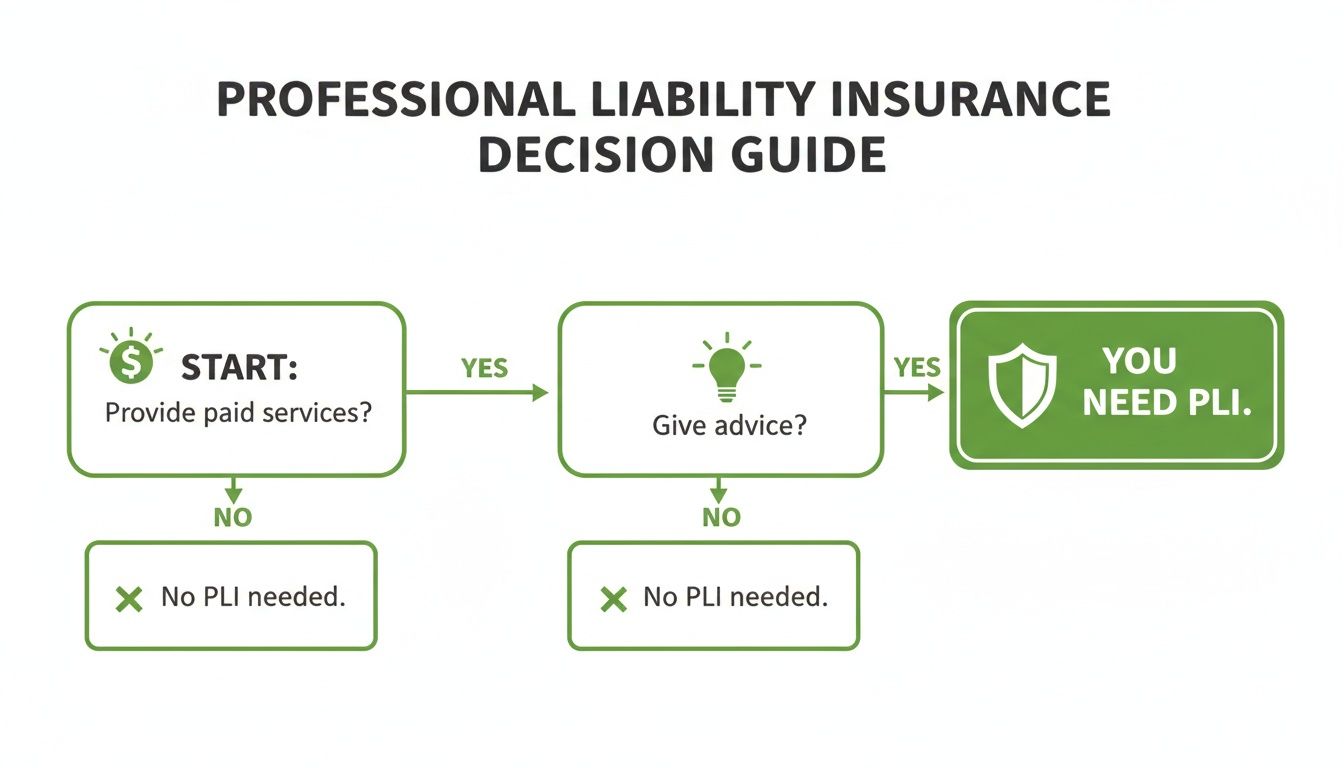

This decision guide makes it pretty clear.

The bottom line is straightforward: if people pay you for your specialized services or expert advice, you have a professional liability risk that needs to be covered.

Key Professions That Need This Coverage

The need for professional liability insurance has grown far beyond the traditional roles of doctors and lawyers. In our modern service-based economy, a whole new range of experts face this kind of risk every day.

The table below breaks down some of the most common industries where this coverage isn't just a good idea—it's essential.

Key Professions Requiring Professional Liability Insurance

| Industry Category | Examples of Professionals Who Need Coverage |

|---|---|

| Healthcare & Wellness | Doctors, Nurses, Therapists, Dentists, Counselors, Personal Trainers |

| Legal & Financial | Lawyers, Accountants, Financial Advisors, Notaries, Tax Preparers |

| Technology & IT | IT Consultants, Software Developers, Cybersecurity Analysts, Web Designers |

| Real Estate | Real Estate Agents, Property Managers, Appraisers, Home Inspectors |

| Creative & Marketing | Marketing Agencies, Graphic Designers, Writers, Photographers, Consultants |

| Consulting | Management Consultants, HR Consultants, Business Coaches, Strategists |

And that's just a starting point. The list is constantly growing. At the end of the day, if a client could lose money because of your professional guidance, you should have a policy. For anyone striking out on their own, having the right protection is non-negotiable. It's smart to explore the best insurance for self-employed professionals to make sure your independent venture is buttoned up.

The core principle is simple: where expertise is exchanged for a fee, a risk of liability exists. This insurance addresses that specific risk, making it a foundational element of modern professional practice.

If you want to get into the nitty-gritty of risks for advisory roles, our guide on professional liability insurance for consultants provides a much deeper look. Ultimately, getting this coverage is one of the smartest, most proactive things you can do to protect your livelihood from the chaos of client disputes.

Why Some Professions Simply Can’t Work Without It

For a lot of traditional professions, professional liability insurance isn't just a good idea—it’s the essential foundation of their practice. Think about doctors, lawyers, and financial advisors. The advice they give and the services they perform carry incredible weight. One single misstep can have life-altering consequences for a client, and in turn, for their own career. This isn't just a theoretical risk; it's a daily reality.

The stakes in these fields are just incredibly high. An architect’s small calculation error could lead to a major structural flaw, costing millions to fix. A financial advisor’s poorly timed recommendation might wipe out a family’s entire nest egg. In every one of these scenarios, the professional's expertise is directly tied to the client’s financial security or physical health, making the threat of a lawsuit a constant companion.

This is exactly why professional liability insurance is non-negotiable. You might hear it called malpractice insurance in the medical world or Errors and Omissions (E&O) coverage for other pros. Whatever the name, it acts as a critical shield against claims of negligence, professional error, or malpractice.

The High-Stakes World of Medical Professionals

Medical practitioners, whether they're surgeons or physical therapists, work in an environment where a person's health is literally on the line. A misdiagnosis, a mistake during a procedure, or even the perception of inadequate care can lead to devastating patient outcomes—and equally devastating malpractice lawsuits.

Take a physical therapist, for example. They might recommend an exercise that, despite their best intentions, accidentally makes a client's injury worse. Even if the therapist followed all standard procedures, the client could still sue, claiming the advice caused them more harm, lost wages, and extra medical bills. Without solid coverage, the cost of just defending that claim, let alone paying a settlement, could easily bankrupt the practice.

The financial pressure is massive. The global medical professional liability insurance market was valued at $12.5 billion and is expected to climb to $33.7 billion by 2031. This isn't just a random spike; it's driven by patients being more aware of their rights and claims systems getting faster, which means litigation is happening more often than ever.

Legal Experts Navigating a Minefield

The entire legal profession is built on giving accurate, timely, and effective advice. Lawyers and their teams are trusted with their clients' freedom, finances, and futures. Any error here can have profound, life-changing results.

Imagine a lawyer misses a critical filing deadline. It’s a simple oversight, but it could get their client's entire case thrown out, leading to a huge financial loss. That's a textbook example of professional negligence. The client would have very strong grounds for a legal malpractice suit to recover the damages they suffered because of that mistake.

Professional liability insurance is the safety net that allows legal professionals to advocate fiercely for their clients without being paralyzed by the fear that one unintentional mistake could bring their career crashing down. It covers defense costs, settlements, and judgments, which can be astronomical.

Financial Advisors and the Burden of Trust

Accountants, investment consultants, and financial advisors are the guardians of their clients' financial well-being. People place enormous trust in their expertise to grow wealth, handle taxes, and secure their retirement. A single piece of bad advice can unravel years of hard work.

Think about an accountant who makes a mistake on a corporate tax return. This could trigger a major IRS audit, resulting in hefty fines and penalties for the business. The company would, without a doubt, look to the accountant to cover those losses. This is a classic claim that falls right under the umbrella of professional liability insurance.

It’s also a perfect illustration of why this coverage is often called Errors & Omissions insurance—it covers both mistakes (errors) and things that were forgotten or left out (omissions). If you'd like to dive deeper, you can explore our guide on what is Errors and Omissions insurance.

For these cornerstone professions, going without this protection is like a surgeon operating without gloves. It's a completely unnecessary and reckless risk. This insurance is the one essential tool that protects not just their business assets, but their personal livelihood and professional reputation.

The New Wave of Professionals at Risk

The modern economy doesn't just run on things you can touch and see; it’s powered by expertise, data, and specialized services. This fundamental shift means the circle of professionals who need to worry about liability has grown far beyond the classic examples of doctors and lawyers. Today, a much wider range of experts can find themselves on the hook for claims of negligence.

If your business is built on providing specialized skills or advice for a fee, you're in the hot seat. The services you deliver—whether that's code, content, or consultation—create a direct professional liability exposure. All it takes is one unhappy client claiming your work caused them a financial loss to trigger a costly, time-consuming, and reputation-damaging lawsuit.

The Expanding Digital Frontier

Tech professionals are right on the front lines of this new risk landscape. Their work is often woven directly into a client's core operations, which raises the stakes dramatically if something goes wrong.

Just think about these all-too-common situations:

- IT Consultants and Managed Service Providers (MSPs): An IT consultant recommends and sets up a new cybersecurity system. A few weeks later, a data breach hits the client hard. The client could easily sue, claiming the consultant’s work was negligent and didn't provide the protection they paid for.

- Software Developers: A developer builds a custom e-commerce platform for a retailer. A hidden bug causes the site to crash during the Black Friday rush, resulting in thousands of dollars in lost sales. You can bet the client will look to hold the developer financially responsible for that failure.

- Web Designers: A designer builds a stunning new website, but accidentally uses a copyrighted photo without the right license. The owner of the photo sues the client for copyright infringement, and the client, in turn, sues the designer to cover their legal fees and settlement.

In every one of these cases, the professional wasn't trying to cause harm. They simply made a mistake—or were accused of making one. Professional liability insurance is built for exactly this: to cover the staggering costs of a legal defense and any potential settlement that follows.

Creative and Marketing Professionals Under the Microscope

The liability doesn't stop with tech, either. Creative and marketing agencies are facing more and more pressure. Their work is often directly tied to specific business goals, like generating leads or boosting sales. When those results don't quite hit the mark, clients sometimes start looking for someone to blame.

Imagine a marketing agency that launches a major ad campaign, promising the client a huge jump in website traffic and conversions. If the campaign metrics fall flat and the client feels they've thrown their money away, they might sue the agency for failing to deliver on their professional promise.

The real danger lies in the gap between a client's expectation and the final outcome. Professional liability insurance is the financial bridge over that gap when a client argues your service, not other market forces, was the reason for their loss.

Even a freelance graphic designer isn't safe. A designer could create a logo that the client absolutely loves, only for the client to get a cease-and-desist letter a month later because the design is too similar to an existing trademark. The client would then sue the designer to recoup the costs of a full rebrand, claiming negligence.

This all points to a critical modern reality: anyone who sells their expert work is vulnerable. The service economy has made it easier than ever to start a business, but it has also spread professional risk far and wide. From business coaches and HR consultants to freelance writers and project managers, this coverage is no longer a luxury—it’s a fundamental cost of doing business.

Without it, you're always just one unhappy client away from a potential financial catastrophe.

Professional Liability vs. General Liability Insurance

As a business owner, you’re often told you need insurance, but the alphabet soup of policies—CGL, E&O, D&O—can be overwhelming. Two of the most common and easily confused policies are professional liability and general liability. Getting them straight is vital, because assuming one covers the other can leave your business dangerously exposed.

Here's the simplest way I explain it to clients: General liability insurance is your "oops, I broke something" coverage. It handles tangible, physical risks you can see and touch, like a customer slipping on a wet floor or you accidentally damaging a client's property.

Professional liability insurance, in contrast, is your "oops, my advice broke something" coverage. It protects you from the intangible risks that come directly from your expertise—the financial fallout from an error in your work, a missed deadline, or advice that led to a client's loss.

A Tale of Two Claims

Let's make this real. Imagine you're a marketing consultant visiting a client's office. While presenting your brilliant new strategy, you gesture a bit too enthusiastically and knock a cup of coffee all over their server. The server is fried. That’s a clear case of physical property damage, and your general liability policy would kick in to cover the replacement costs.

Now, let's say a few months go by. The campaign you designed completely misses the mark. Your client, furious, claims your flawed advice cost them $100,000 in lost sales and sues you for professional negligence. This isn't about physical damage; it’s about the quality and outcome of your professional service. Here, your professional liability policy is what saves the day, covering your legal defense and any potential settlement.

Your work creates two distinct types of risk. General liability covers the risks of doing business anywhere (slips, falls, property damage), while professional liability covers the specific risks tied to the expert services you provide.

The need for both policies has never been greater. With the global liability insurance market already at $291.86 billion and projected to swell to $524.66 billion by 2034, it's clear that litigation is on the rise. North America alone represents a $134.26 billion slice of that market, driven by lawsuits over everything from service failures to data breaches. You can dig into more of the numbers in this liability insurance market research.

Breaking Down the Differences

While both policies are essential shields, they defend against entirely different attacks. For a clearer picture, let's put them side-by-side.

Comparing Professional Liability and General Liability

This table lays out the core distinctions between what these two critical policies cover.

| Coverage Aspect | Professional Liability (E&O) | General Liability (CGL) |

|---|---|---|

| Primary Focus | Financial loss due to your professional services, advice, or expertise. | Bodily injury, property damage, and advertising injury. |

| Common Claims | Negligence, errors, omissions, misrepresentation, violation of good faith. | Slips and falls, client property damage, libel, slander, copyright issues. |

| Example Scenario | An accountant makes a clerical error, leading to a major IRS fine for their client. | A client trips over a power cord in your office and breaks their wrist. |

Seeing them laid out like this makes the division of labor clear. Each policy has a specific job to do, and for nearly every service-based business, one without the other is a gamble you can’t afford to take.

To get a more detailed look at the physical risks your company faces, check out our complete guide on what is commercial general liability.

Choosing the Right Coverage Amount

Figuring out how much professional liability coverage you need can feel like a guessing game, but it's one of the most critical decisions you'll make for your business. There’s no magic number here. The right amount is always a calculated balance between your specific risks and what you can afford, making sure you're protected without overpaying.

Insurance carriers don’t just pull premiums out of thin air; they carefully assess your level of risk. They’ll look at everything from your profession and annual revenue to the size of your client contracts and any past claims. A freelance writer, for example, faces a completely different risk profile than a structural engineer overseeing a multi-million dollar construction project, and their coverage needs will absolutely reflect that.

Decoding Your Policy Limits

When you get a policy quote, you'll see two key numbers: the per-claim limit and the aggregate limit. It's crucial to understand what each one actually means for your protection.

- Per-Claim Limit: This is the maximum amount your insurance company will pay out for a single lawsuit or claim filed against you.

- Aggregate Limit: This is the total maximum amount your insurer will pay out for all claims combined during your policy period, which is typically one year.

Let’s say you have a policy with limits of $1 million / $2 million. This means the insurer will cover up to $1 million for any one claim but won't pay more than a grand total of $2 million for all the claims you might face that year. Choosing the right limits means taking a hard, honest look at the worst-case financial damage a single mistake could cause.

The Dangers of Being Underinsured

Trying to save a few dollars by skimping on coverage is a dangerous gamble. We live in a world where lawsuits are common, and jury awards can be shockingly high. Professionals from architects to IT consultants are navigating a minefield where one error can trigger a lawsuit that means financial ruin. In fact, court verdicts exceeding $10 million have doubled between 2015 and 2023, while average judgments have soared from $23 million to $40 million.

Being underinsured means that if a judgment exceeds your policy limit, you are personally on the hook for the difference. This could put your business assets, and even your personal assets like your home, at risk.

A single catastrophic claim could force you to sell your business, drain your savings, or even file for bankruptcy. This is precisely why a thorough risk assessment is non-negotiable. Think about the value of your largest projects, the potential financial fallout of a worst-case scenario, and any contracts you've signed that require specific coverage limits.

Figuring out the right coverage is a complex but essential step. To get a better handle on all the moving parts, our detailed guide takes a closer look at the key factors that drive professional liability insurance cost. At the end of the day, your policy limits should be a realistic financial shield against the unique risks that come with your professional services.

Partnering with an Insurance Expert

Realizing you need professional liability insurance is one thing. Actually finding the right policy is a whole different ballgame. If you’ve ever tried to go it alone, you know the market is a dizzying maze of jargon, fine print, and policies that all start to blur together. This is precisely where having a true insurance expert in your corner changes everything.

Think of an independent agent as your personal advocate, not just a salesperson tied to one company. At Wexford Insurance Solutions, our job is to dive into the broad insurance marketplace on your behalf. We shop around to find competitive prices, sure, but our real focus is on finding coverage that’s a perfect fit for the specific risks you face every day in your line of work.

We blend personal, one-on-one service with modern, efficient technology. That means you get a straightforward process—from the initial risk assessment to paperless onboarding—and you walk away with total clarity and confidence.

Your Advocate in a Complex World

Working with an expert isn't about a one-time transaction; it’s about building a solid, long-term risk management strategy. We invest the time to really get to know your business—whether you’re a consultant in New York or a tech startup in Florida—so we can spot potential blind spots in your protection.

This hands-on guidance becomes absolutely critical when a claim hits. Facing a lawsuit is stressful enough without having to navigate the claims process on your own. We’ll be right there with you, providing expert claims advocacy to ensure the resolution is fair and fast, protecting both your professional reputation and your finances.

Choosing an insurance partner is one of the most critical decisions you'll make for your business. It’s not about buying a product; it’s about finding an advisor who is genuinely committed to protecting your professional legacy.

Just as insurance requires a specialist, other parts of your business benefit from expert partnerships too. For more on this, a great guide to partnering with expert consulting firms offers solid advice on selecting the right advisors for various business functions.

Take Control of Your Professional Risk

At the end of the day, this is all about securing peace of mind. When you know you have a strong policy and an expert team watching your back, you can focus on what really matters: serving your clients and growing your business.

Finding the right advisor is the key. Learning how to choose an insurance broker is the perfect first step on your path to getting fully protected.

If you are a professional working in New York or Florida, don't leave your success to chance. Contact Wexford Insurance Solutions today for a complimentary risk assessment and see how much simpler and smarter protecting your business can be.

Frequently Asked Questions

Even after getting the basics down, you probably still have a few questions about professional liability insurance. That's completely normal. Let's tackle some of the most common ones we hear from professionals just like you.

I Have an LLC, So I’m Protected, Right?

Not quite, and this is a critical distinction that trips up a lot of business owners. An LLC is a great legal structure, but it’s designed to shield your personal assets—like your house or car—from business liabilities. It creates a firewall between you and your company.

However, it does nothing to protect the business itself. If a client sues your company for a professional error, the lawsuit is aimed directly at your business's bank accounts and assets. Professional liability insurance is what steps in to cover the legal bills and potential settlements. Without it, one big lawsuit could wipe out your company's finances, even if your personal savings are safe.

What’s the Deal with “Claims-Made” vs. “Occurrence” Policies?

Getting this difference is key, because most professional liability policies are claims-made, and they work differently than you might expect.

- Occurrence Policy: This is straightforward. It covers incidents that happen during the policy period, no matter when someone decides to file a claim. Your standard general liability policy usually works this way.

- Claims-Made Policy: This type only covers claims that are filed and reported while the policy is active. It's the go-to for professional liability.

So what does that mean for you? It means you need to keep your coverage continuous. If you let your policy lapse, retire, or sell your business, you’re exposed. To protect yourself from claims related to past work, you'll need to purchase an extension known as "tail coverage."

A claims-made policy is like a subscription service for protection. As long as it's active, you're covered. If you cancel, you lose protection for all your past work unless you secure tail coverage.

Can I Really Get Sued If I Didn’t Do Anything Wrong?

Yes, and it happens more often than you'd think. A client doesn't need a valid reason to file a lawsuit; they just need to believe you made a mistake that cost them money.

This is where your insurance truly proves its worth. A huge part of your professional liability policy is paying for your legal defense. Even if a lawsuit is completely frivolous and you win, the attorney's fees alone can easily climb into the tens or even hundreds of thousands of dollars. Your policy picks up that tab, ensuring a baseless claim doesn't become a real financial catastrophe.

I'm Just a Freelancer. Do I Actually Need This?

Absolutely. In many ways, freelancers and solo professionals need it more. You don't have the deep pockets of a larger corporation to absorb the financial shock of a lawsuit. A single claim could put your entire business—and potentially your personal finances—at risk.

Beyond just protection, it's quickly becoming a requirement to land bigger jobs. More and more clients, especially large companies, won't sign a contract unless their freelancers and independent contractors carry their own professional liability insurance. Having it shows you're a serious professional, making you a much more attractive partner for the high-value projects you want.

Navigating your professional risks is crucial for long-term success. The expert team at Wexford Insurance Solutions is ready to help you find the precise coverage your business needs to operate with confidence. Get started by visiting our website for a personalized risk assessment today.

8 Crucial General Liability Claims Examples for Business Owners in 2025

8 Crucial General Liability Claims Examples for Business Owners in 2025 How to Save on Homeowners Insurance A Practical Guide

How to Save on Homeowners Insurance A Practical Guide