Let's be blunt: confusing your home's sale price with what it costs to rebuild is the single biggest—and most expensive—mistake you can make with your insurance.

That Zillow estimate or recent tax assessment? It’s a real estate number, not a construction number. Relying on it to set your coverage is a recipe for disaster, and it could leave you hundreds of thousands of dollars short if you ever need to rebuild.

Why Your Home's Sale Price Is The Wrong Number For Insurance

When you start digging into home insurance, the very first thing you have to do is unlearn one massive assumption: that the price you paid for your house is the same number your policy should be based on.

It’s not. Not even close.

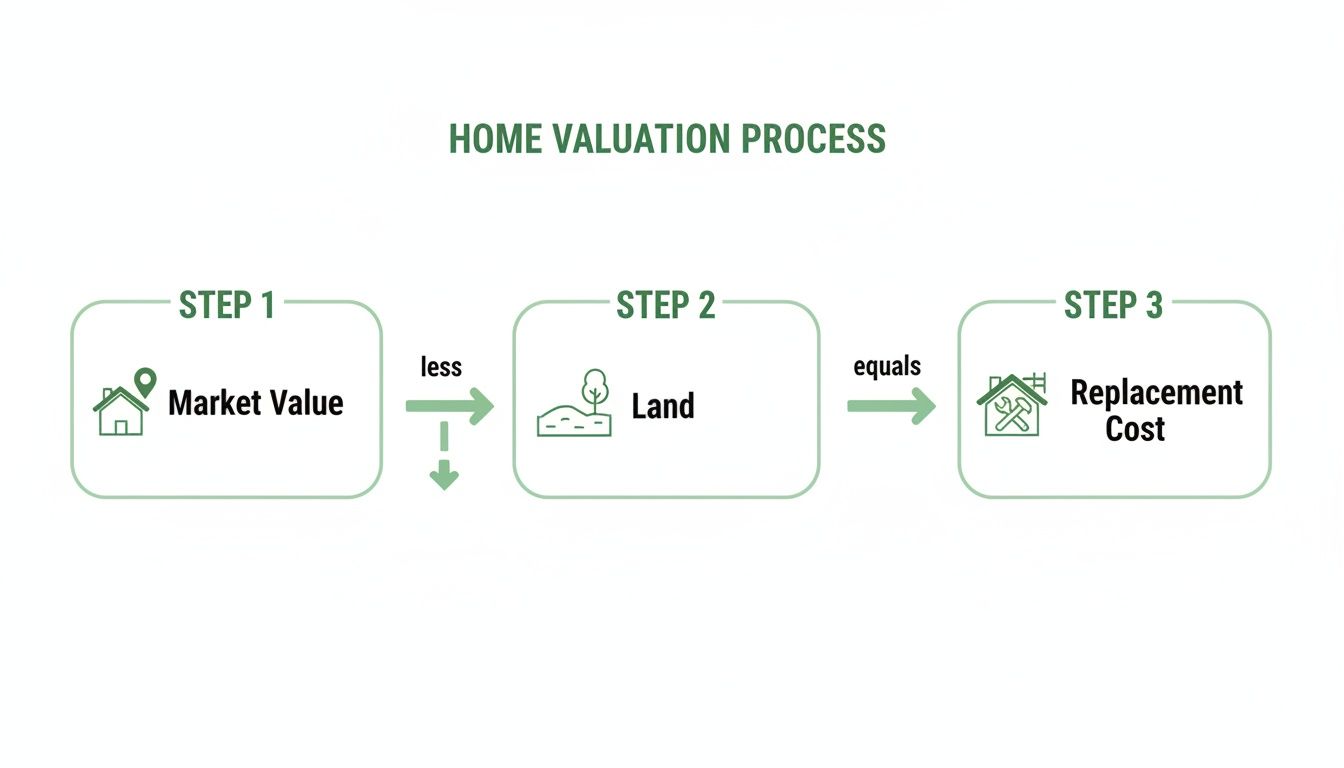

Think of it this way. Market value is what someone will pay for your house and the dirt it sits on. It's driven by curb appeal, school districts, and how hot the local market is. Replacement cost, on the other hand, is a purely practical, nuts-and-bolts calculation: what would a contractor charge for lumber, labor, and permits to rebuild your home from scratch after a fire?

Getting The Lingo Right: Replacement Cost vs. Market Value

To have a productive conversation with an agent or insurer, you need to speak their language. It all boils down to three core concepts that are often mixed up.

To make this crystal clear, let's break down the three main valuation types you'll encounter.

Replacement Cost vs Market Value vs Actual Cash Value

| Valuation Type | What It Covers | Primary Use | Key Factor |

|---|---|---|---|

| Replacement Cost | The full cost to rebuild your home with similar materials and quality at today's prices. | Home Insurance | Current construction costs (labor & materials) |

| Market Value | The price your home would sell for, including the land, location, and other intangibles. | Real Estate Sales | Supply and demand, location, economy |

| Actual Cash Value (ACV) | The replacement cost minus depreciation for age and wear-and-tear. | Cheaper insurance policies, personal property claims | Age and condition of property |

Each term serves a completely different purpose. Insuring your home based on its market value is like paying to insure the land, which is pointless—you can't burn down dirt.

In dense urban markets like New York, land can easily account for 50–70% or more of a property's market value. This means a $2 million townhouse might only need $800,000 to $1.1 million of structural replacement coverage. It’s a huge gap that trips up countless homeowners.

Here's a quick rundown of the key terms:

-

Market Value: This is the sale price. It’s a bundle of everything—the structure, the land, the neighborhood, even the view. To see how real estate appraisers arrive at this number, it helps to understand the general home appraisal process.

-

Replacement Cost: This is the insurance number. It’s a purely objective calculation of labor and materials needed to reconstruct your home on the same spot. It completely ignores the value of your land.

-

Actual Cash Value (ACV): Think of this as the "used" value. It's the replacement cost, but then the insurer subtracts for depreciation. An ACV policy is always cheaper, but it will only pay what your 15-year-old roof is worth today, not what a brand-new one costs. You can dive deeper into this with our guide on what is actual cash value.

The Dangers of the 80% Rule

So what happens if you get this number wrong? It's not just a minor oversight. Most insurance policies have something called the "80% rule," and it can turn a bad situation into a financial nightmare.

The rule states that your insurer will only fully cover a partial loss if your home is insured for at least 80% of its total replacement cost. If your coverage falls below that line, they can reduce your claim payout proportionately.

Let’s put that into real numbers. Say your home's true replacement cost is $500,000. To satisfy the 80% rule, you need at least $400,000 in dwelling coverage.

But maybe you insured it for $300,000 (only 60% of its value) to save on premiums. If a kitchen fire causes $50,000 in damage, the insurance company could invoke the rule and pay you a fraction of that, leaving you on the hook for the rest.

This is why getting the replacement cost right isn't just an academic exercise. It’s the absolute foundation of your financial safety net.

Practical Ways to Calculate Your Home's Replacement Cost

Figuring out your home's replacement cost can feel a bit like shooting at a moving target, especially with construction costs always in flux. But you don't need to be a contractor to get a solid estimate. The goal here is simple: find out what it would cost, using today's labor and material prices, to rebuild your home from scratch if it were completely destroyed.

Let's walk through a few reliable methods, from a quick back-of-the-napkin calculation to the more detailed approach professionals use.

The Per-Square-Foot Approach

The simplest starting point is the per-square-foot method. It's straightforward: you just multiply your home's total square footage by the average local construction cost for a house of similar quality. You can often get these local cost figures from a builder's association or a knowledgeable real estate agent who has a pulse on the market.

Be careful, though. A generic online search will give you a national average, which is almost useless. Construction costs vary wildly from one place to another. A home that costs $150 per square foot to build in one city might easily cost $350 per square foot in another, thanks to differences in labor wages, material transport, and local building codes.

To get a more realistic number, it helps to look at detailed breakdowns of the current cost to build a house in a specific region. This gives you a much better benchmark than a vague national average.

It's also crucial to remember that we're talking about rebuilding the structure, not what your home would sell for. The market value includes land, which doesn't need to be replaced.

A More Detailed Line-Item Estimate

If you want a more precise figure, you'll need to think like a general contractor. This is the line-item approach, where you break down the rebuild into its individual parts and tally up the costs.

Instead of one single multiplier, you’d consider everything separately:

- Foundation: Is it a simple concrete slab, a crawl space, or a full basement?

- Framing and Exterior: Are your walls standard wood-frame and vinyl siding, or something more expensive like brick veneer or stucco?

- Roofing: The material (asphalt shingle, metal, slate) and the complexity of your roof’s design make a huge difference.

- Interior Finishes: This is where costs can really add up. Think about the quality of your floors, cabinets, countertops, and light fixtures. Replacing custom cabinetry and granite countertops is a world away from replacing standard builder-grade materials.

- Major Systems: HVAC, electrical, and plumbing systems are big-ticket items, especially if you have high-efficiency units or smart home tech.

This level of detail really shows you where the money goes and how unique features can drive up your replacement cost. To make this easier, our detailed homeowners insurance replacement cost estimator can walk you through the process of documenting these features.

The Professional Approach Insurers Use

While DIY methods give you a good ballpark, insurance companies don't guess. They rely on sophisticated software and massive databases to get highly accurate estimates.

One of the most widely used ways to determine a home’s replacement cost is the comparative-unit method, which prices a house by dollars per square foot based on similar, recently built properties in the same region. In the United States, many insurers rely on cost-estimating software and regional construction data.

For instance, a tool like Verisk’s 360Value is an industry standard. It constantly pulls real-world data on material and labor costs from over 430 regions and analyzes more than 3 million actual repair estimates annually. This keeps their pricing razor-sharp.

Think about it this way: for a 2,400-square-foot home, being off by just $20 per square foot means you're underinsured by $48,000. That's a huge financial gap to cover out of pocket after a total loss. An independent insurance agent uses these professional tools to make sure that doesn't happen to you, ensuring your coverage truly reflects what it would cost to rebuild in the real world.

What About Older Homes and Unique Features?

The standard per-square-foot calculation works reasonably well for a typical modern home. But what if you own a 1920s Craftsman with original built-ins or a Victorian with intricate gingerbread trim? For these special properties, a simple multiplier isn't just inaccurate—it's a recipe for being dangerously underinsured.

When your home has historic or custom features, the math gets a lot trickier. The real challenge is accounting for materials and construction techniques that just aren't common anymore. Think about what it would take to replicate hand-carved millwork, true plaster walls, or custom masonry today. It requires specialized, and often very expensive, artisan labor.

Actual vs. Functional Replacement Cost: A Critical Choice

This is where you'll bump into a huge distinction in the insurance world: Actual Replacement Cost versus Functional Replacement Cost. Getting this right is everything for protecting your unique home without paying for coverage you don't need.

-

Actual Replacement Cost: This is the purist's approach. It aims to rebuild your home exactly as it was, using materials and craftsmanship of like kind and quality. If your house had plaster-and-lath walls, this policy covers the cost to rebuild them that way, even if modern drywall is far cheaper.

-

Functional Replacement Cost: This is the practical approach. It covers the cost of repairing or replacing your home with functionally equivalent, but modern, materials. So, instead of plaster, you’d get drywall. Instead of hand-milled hardwood floors, you might get high-quality engineered wood. It makes your home whole again but doesn't preserve its historical soul.

The difference between these two can create a massive coverage gap. For a historic home, the cost to replicate original features can easily be 20-40% higher than just using modern stuff. It’s a trade-off between preserving architectural integrity and keeping your premium in check.

This gets especially complicated when you realize that nearly 70% of U.S. housing stock was built before 1986. Many of those older homes, particularly pre-1920s builds, used labor-intensive techniques that are incredibly expensive to replicate now. To get around this, some insurers default to a functional replacement cost, which can swing the coverage amount by six figures on a larger older home. Verisk's analysis offers some great insight into how the industry is valuing older homes.

A Tale of Two Brownstones

Let's make this real. Imagine a classic 1910 brownstone in Brooklyn. To rebuild it with historical accuracy—custom millwork, period-correct materials, the whole nine yards—the true replacement cost might be $1.5 million.

But its functional replacement cost, using modern construction and off-the-shelf materials, could be closer to $1.1 million.

That $400,000 difference is the price of authenticity. If the owner has a standard policy, they might only get the functional value, leaving them with a huge shortfall if they want to restore their home's original character. This is exactly why a detailed conversation with an insurance pro is non-negotiable for owners of unique homes.

Don't Forget Modern Building Codes

Here's another wrinkle: today's building codes. When an older home is rebuilt, it has to be brought up to current standards. That could mean all-new electrical and plumbing systems, different structural supports, or updated fire safety measures that were never part of the original design.

These mandatory upgrades can add tens of thousands of dollars to the final bill.

This is why having the right policy endorsements is so important. Without specific coverage for these code-mandated upgrades, that cost comes straight out of your pocket. Our guide on ordinance or law coverage breaks down exactly how this protection works and why it’s a must-have, especially if your home has a bit of history to it.

Accounting for What's Beyond the Four Walls

It’s easy to get tunnel-vision when thinking about your home’s value. You calculate the cost to rebuild the main house and figure you’re done. But what about everything else? True financial protection means looking past the primary structure and accounting for everything from the detached garage to the complexities of modern building codes.

Thinking you’re fully covered just because the main house is insured is a common and costly mistake. Your policy is a bundle of different coverages, and each piece plays a specific role. If you ignore these other areas, you could be on the hook for major out-of-pocket expenses after a disaster.

Covering Detached Structures

Most standard homeowner policies automatically include coverage for "other structures" on your property—anything not attached to the main house. This is usually calculated as a percentage of your main dwelling coverage, typically 10%.

This bucket of coverage includes things like:

- Garages and carports

- Sheds or workshops

- Guest houses or pool houses

- Fences and gazebos

So, if your home is insured for $500,000, your policy might automatically give you $50,000 for these other structures. While that sounds fine for a simple shed, it could fall dangerously short if you have a large, finished workshop or a separate guest cottage. You really need to calculate the replacement cost of these structures individually to make sure your limit is high enough.

The Hidden Cost of Modern Building Codes

Here’s a big one almost everyone misses: Ordinance or Law coverage. Let's say your 50-year-old home burns to the ground. You can't just rebuild it exactly as it was. The new construction must comply with today's much stricter building codes.

These mandatory upgrades—like installing modern electrical systems, meeting new energy efficiency standards, or adding sprinkler systems—are not covered by a standard policy. The extra cost to bring your new home up to code comes directly out of your pocket unless you have this specific endorsement.

This coverage is absolutely critical for older homes. The cost to meet modern regulations can easily tack on tens of thousands of dollars to your rebuild, turning a difficult situation into a financial nightmare.

Protecting What's Inside Your Home

Your house is just the shell; your life is what's inside. Personal property coverage is what protects all your belongings—furniture, electronics, clothing, and so on. Much like the coverage for other structures, this is often set as a percentage of your dwelling coverage, typically between 50% and 70%.

The catch? There are crucial sub-limits, especially on high-value items. A standard policy might only cover $1,500 for jewelry or $2,500 for firearms, regardless of their actual worth. If you own expensive art, collectibles, or high-end electronics, you'll need a separate rider or endorsement to insure them for their full value. To properly safeguard these items, it’s worth learning more about the specifics of personal property coverage to avoid any nasty surprises.

Where Will You Live During the Rebuild?

Finally, if a disaster makes your home uninhabitable, where do you and your family go? A full rebuild can easily take a year or more. This is where Additional Living Expenses (ALE) coverage becomes an absolute lifeline.

Also known as Loss of Use coverage, ALE pays for the extra costs you rack up while you’re displaced. This isn't just for rent; it covers things like:

- Temporary Housing: Rent for a comparable apartment or house.

- Increased Food Costs: If your temporary rental doesn't have a kitchen, it can cover the extra cost of eating out.

- Other Expenses: Things you might not think of, like laundry services, storage unit fees, and increased transportation costs.

This coverage ensures you can maintain your standard of living without draining your savings during an incredibly stressful time. When you sit down to determine your home’s replacement cost, taking this kind of holistic view is the only way to be sure you're truly protected.

A Homeowner’s Checklist for Getting Your Valuation Right

Calculating your home’s replacement cost isn’t something you should leave entirely to your insurance agent. Think of it this way: you know your home’s quirks, upgrades, and unique features better than anyone. If you don't provide that information, you're asking someone to guess the value of your biggest asset.

The best way to get a truly accurate number is to be an active partner in the process.

This checklist will help you gather all the crucial details about your property. Walking into a conversation with your agent armed with this information ensures your final coverage amount isn't just a guess—it's a precise reflection of what it would actually cost to rebuild your home from the ground up.

Core Structural Details

Let's start with the big stuff—the foundational elements that make up the bulk of the rebuilding cost. Getting these right is the first step to an accurate valuation.

- Total Livable Square Footage: Be specific here. We're talking about the heated, finished areas of your home. Leave out the unfinished basement, garage, or screened-in porch unless they're fully finished and integrated into your living space.

- Foundation Type: What's your house built on? A concrete slab, a crawl space, or a full basement? If you have a basement, note whether it's finished or unfinished. A finished basement with a bedroom and bathroom costs a lot more to rebuild than a concrete box for storage.

- Exterior Wall Construction: Take a look at the outside. Is it vinyl siding, wood clapboard, brick veneer, or stucco? A home with full brick siding is significantly more expensive to reconstruct than one with standard vinyl.

Key Systems and Finishes

Now, let's move inside. The quality of your finishes can dramatically swing the final replacement cost, even between two homes with identical footprints.

The leap from standard builder-grade materials to custom finishes can easily add 25-50% or more to your home's replacement cost. These "small" details add up to a massive financial difference.

- Roofing Material and Age: What kind of roof do you have—basic asphalt shingles, higher-end architectural shingles, metal, or tile? The age matters, too, as it impacts both its current value and the likelihood of needing costly code upgrades during a rebuild.

- Kitchen Finishes: Get granular. Are your cabinets stock from a big-box store, semi-custom, or fully custom-built? Are the countertops laminate, granite, or quartz? A gourmet kitchen with high-end appliances can add tens of thousands to the valuation on its own.

- Bathroom Finishes: Same story here. Note the quality of the vanities, fixtures, and tile. Is it a simple fiberglass tub insert or a custom-tiled, walk-in shower with a frameless glass door?

Special and Unique Features

Finally, make a list of all the extras that make your house your home. These are the things that automated valuation tools almost always miss, but they add real rebuilding costs.

- Fireplaces or Wood Stoves: How many do you have? Are they traditional masonry fireplaces or more modern prefabricated inserts?

- Custom Built-Ins: Don't forget any custom shelving, cabinetry, or detailed millwork in your living room, home office, or closets.

- Decks, Patios, and Porches: Measure them and note what they're made of. Is it a simple pressure-treated wood deck, a high-end composite deck, or a custom stone paver patio?

Compiling this information is a core part of being a proactive homeowner. It not only prepares you for insurance reviews but also goes hand-in-hand with regular upkeep, like following a good home maintenance checklist. Be sure to revisit this list every few years—or after any major renovation—to make sure your coverage keeps up with your investment.

Working with an Expert to Avoid Costly Mistakes

While doing the math yourself gives you a decent ballpark figure, getting your home's replacement cost wrong can be a financially devastating mistake. Relying only on your own numbers is risky. It's so easy to underestimate what local labor really costs or completely forget about big-ticket items like debris removal after a disaster.

Those seemingly small oversights can leave you with a massive, unexpected bill when you're most vulnerable.

Think about it: even if you nail the price of lumber and shingles, what about the going rate for a skilled electrician in your zip code? Or the cost of pulling all the right permits just to start rebuilding? These are the kinds of moving targets that professional tools are built to handle.

Your Agent is More Than Just a Salesperson

This is exactly why a good independent insurance agent is such a valuable partner. They aren't just trying to sell you a policy; their job is to conduct a detailed risk analysis on what is likely your biggest asset.

An experienced agent has access to sophisticated valuation software that crunches hyper-local data on construction costs, building materials, and labor rates. That's a level of detail you just can't find with a quick Google search. Their goal is to make sure you aren't overpaying for coverage you don't need, but more importantly, that you aren't left dangerously underinsured.

An independent agent’s primary job is to prevent a financial catastrophe for you. Using industry-standard tools and insights from real-world claims, they can spot coverage gaps a homeowner would almost certainly miss.

Secure Your Financial Future with a Policy Review

Honestly, the single best thing you can do is schedule a professional policy review. This isn't a sales pitch; it's a strategic check-up for your financial well-being.

An agent will sit down with you, go through your current coverage line-by-line, and compare it against an accurate, up-to-date replacement cost estimate. They'll point out any vulnerabilities and explain your options in plain English.

Don’t leave the protection of your home to guesswork. A thorough review gives you the confidence that your policy will actually be there for you when you need it most. That’s real peace of mind.

Your Top Questions About Replacement Cost Answered

Figuring out your home's replacement cost is a huge step, but it’s not a “set it and forget it” number. It’s a living part of your financial protection that needs attention over time. Let's dig into some of the questions I hear most often from homeowners once they have their initial estimate.

How Often Should I Revisit My Replacement Cost?

Think of it as an annual financial check-up for your home. You should be reviewing your replacement cost calculation at least once a year. The costs for construction materials and skilled labor are constantly on the move, influenced by everything from inflation and supply chain snags to regional demand.

For example, a major hurricane season down south can cause lumber and roofing material prices to soar nationwide. Suddenly, the cost to rebuild your home could be significantly higher than it was just a year ago. A quick annual chat with your insurance agent is the best way to make sure your coverage is keeping up.

Do Renovations Change My Replacement Cost?

They sure do. Any time you make a significant improvement, you're increasing the amount of money it would take to rebuild your home to its new standard. Finishing a basement, adding a deck, or overhauling a kitchen can easily add tens of thousands of dollars to your replacement cost.

I see this all the time: a homeowner spends $75,000 on a beautiful new kitchen but forgets to tell their insurance agent. If a fire happens, their policy will only cover rebuilding the old kitchen, leaving them to pay the difference out of pocket.

The lesson? Call your agent the moment a big project is finished. Don't wait for your policy renewal.

What's the Deal with Extended Replacement Cost Coverage?

This is one of the most important endorsements you can add to your policy. Extended Replacement Cost is a safety net that adds a buffer—usually 25% to 50%—on top of your home's insured value.

Here’s a real-world scenario: Your home is insured for $500,000. A wildfire sweeps through your community, destroying hundreds of homes. This creates a massive surge in demand for contractors and materials, driving up prices. The actual cost to rebuild your home balloons to $600,000.

Without this coverage, you'd be $100,000 short. But with a 25% extended replacement cost endorsement, your policy would provide an extra $125,000, giving you more than enough to make you whole again. It's built for exactly these kinds of worst-case scenarios.

Why Did My Insurance Company Raise My Coverage Amount?

If you see your dwelling coverage and premium tick up at renewal time, it’s not a mistake. Most insurers include an inflation guard endorsement on their policies.

This feature automatically adjusts your coverage limit by a few percentage points each year to help it keep pace with the slow, steady rise of construction costs. It’s the insurance company’s way of proactively protecting you from becoming underinsured without you having to lift a finger.

Don't leave your home's protection to a rough guess. The expert independent agents at Wexford Insurance Solutions use industry-leading tools to provide a precise replacement cost valuation, ensuring you have the right coverage without overpaying. Schedule your complimentary policy review today at Wexford Insurance Solutions.

Homeowners Insurance Coverages Explained: A Complete Guide

Homeowners Insurance Coverages Explained: A Complete Guide