Think of this guide as your roadmap to protecting the physical backbone of your business. At its core, commercial property insurance is the financial safety net for your building, your equipment, and your inventory when disaster strikes—whether it's a fire, a break-in, or a severe storm. It's what stands between a major setback and total financial collapse.

What Is Commercial Property Insurance?

Simply put, commercial property insurance is what allows your business to get back on its feet after physical damage or loss. Imagine having to pay out-of-pocket to rebuild your office or replace every piece of vital equipment after a fire—the cost could easily sink the entire business. The whole point of this insurance is to get you back to where you were financially just before the damage happened.

This coverage is absolutely essential for any company that owns, rents, or relies on physical assets to operate. That means just about everyone.

The Foundation of Your Business Protection

Your policy is built to cover the tangible things that make your business tick. This protection is usually broken down into a few core components:

- The Building: This is the physical structure itself, along with anything permanently attached to it, like built-in shelving, HVAC systems, or specialized machinery.

- Your Business Personal Property (BPP): This covers everything inside, like your computers, desks, inventory, and raw materials. It's all the "stuff" you need to do business.

- Property of Others: The policy can also cover items you don't own but are responsible for—think of a customer's laptop you're repairing or a client's equipment stored at your facility.

Getting this right is critical. If you lease your office, for example, your landlord’s insurance covers the building, but you're on the hook for everything inside it. Your BPP policy is what protects your investment. For those who own investment properties, it's also worth understanding the key differences between landlord insurance and homeowners insurance, as the protections are tailored differently. To dig deeper, our article on what commercial insurance covers breaks it down even further.

Here’s a simple way to think about it: If you could magically turn your building upside down and give it a good shake, everything that falls out is your Business Personal Property. What’s left standing is the building.

At Wexford Insurance Solutions, we help business owners across New York and Florida build this financial fortress from the ground up. Our team works with you to make sure your most important assets are valued correctly and fully protected, so there are no dangerous gaps in your coverage when you need it most.

Understanding Your Core Coverage Options

Every commercial property insurance policy stands on three essential pillars. Think of them as the legs of a stool—if one is weak or missing, your entire business is left unstable. Getting a handle on how each one works is the first step toward building a real financial safety net for your company.

These core coverages are designed to work in concert. One protects the physical shell of your business, another protects what's inside, and the third is a financial lifeline that keeps you going if you have to temporarily shut down.

Let's break them down.

Building Coverage: Your Business's Fortress

First up is the most straightforward piece of the puzzle: Building Coverage. This protects the physical structure of your property, from the foundation right up to the roof, along with anything permanently bolted down.

Imagine a severe hailstorm rolls through and wrecks the roof and windows of your retail shop. Building coverage is what steps in to pay for those repairs, getting your physical location back in one piece.

This coverage typically includes:

- The building itself and any completed additions.

- Permanently installed machinery like your HVAC system.

- Outdoor fixtures such as attached signs and awnings.

Getting the valuation right here is absolutely critical. A good insurance partner will help you set a coverage limit based on what it would cost to rebuild your property today—not what you paid for it or its current market value.

Business Personal Property: Everything Inside the Walls

While building coverage protects the shell, Business Personal Property (BPP) coverage protects everything you keep inside it. This is the operational heart of your company, and frankly, it's the part of a policy business owners most often undervalue.

A simple way to think about it is the "upside-down test." If you could magically flip your building over and shake it, whatever falls out is your Business Personal Property. What stays put is the building.

This coverage is all about replacing the movable assets you need to run your business—computers, inventory, furniture, equipment, you name it. If you rent your space, BPP is the main coverage you'll need, since your landlord's policy only covers the structure. For a complete picture, you might want to read our guide on the different types of commercial insurance coverage available.

Business Interruption: The Financial Lifeline

The third pillar is arguably the most important for long-term survival: Business Interruption Coverage. Sometimes called business income insurance, this replaces lost profits and covers your continuing expenses if a covered disaster forces you to close your doors for a while.

Physical repairs don't happen overnight. During that downtime, your revenue might flatline, but your bills—rent, payroll, loan payments—certainly won't. This is where business interruption coverage becomes a true game-changer.

To see how it all comes together, let’s look at a quick overview of these three core coverages.

| Key Commercial Property Coverages at a Glance |

| :— | :— | :— |

| Coverage Type | What It Protects | Example Scenario |

| Building Coverage | The physical structure and its permanent fixtures. | A heavy snowstorm causes your roof to collapse; this pays for the rebuild. |

| Business Personal Property (BPP) | Movable contents like inventory, equipment, and furniture. | A pipe bursts and ruins your entire stock of electronics; this pays to replace them. |

| Business Interruption | Lost income and ongoing expenses during a forced shutdown. | A fire forces a 3-month closure; this covers payroll and lost profits. |

As you can see, each coverage plays a distinct but connected role.

Let's put it all together with a restaurant example. A kitchen fire causes major damage, forcing a two-month closure for a complete overhaul. Here’s how a solid policy would respond:

- Building Coverage: Pays to repair the fire-damaged kitchen walls, ventilation systems, and flooring.

- Business Personal Property Coverage: Pays to replace the destroyed ovens, refrigerators, and ruined food supplies.

- Business Interruption Coverage: Covers the restaurant’s lost net income, employee salaries, and rent for the two months it can’t operate.

Without that business interruption piece, even a beautifully repaired restaurant might reopen only to face insurmountable debt. This single coverage often makes the difference between a successful recovery and having to shut down for good.

Choosing the Right Policy Structure for Your Risk

Picking the right commercial property insurance goes way beyond just setting a coverage amount. It's really about deciding on the core logic of your policy—how it's built and how it will respond when you need it most. This choice dictates which disasters are covered and how all the different pieces of your protection fit together.

Your first major decision is between a Named Perils and an Open Perils policy. I like to think of it like ordering at a restaurant. A named perils policy is like an à la carte menu; you're only covered for the specific risks listed in the policy. An open perils policy is more like the all-you-can-eat buffet—everything is covered unless it's specifically listed on the exclusions list.

Named Perils vs. Open Perils Coverage

A Named Perils policy does exactly what it sounds like: it explicitly names the causes of loss it will cover. If something damages your property and it's not on that list, you're out of luck.

Typically, you'll see things like this covered:

- Fire and lightning

- Windstorm and hail

- Explosions

- Vandalism

- Damage from vehicles or aircraft

This structure gives you predictable, solid protection against common threats, but it can leave you exposed. If some bizarre, unforeseen event happens, you might discover you have no coverage simply because it wasn't on the "approved" list of perils.

On the other hand, an Open Perils policy (you'll often hear it called a "special form" policy) offers far broader protection. It covers all direct physical losses except for those that are specifically excluded. This completely flips the script. Instead of you having to prove a loss was from a covered event, the insurance company has to prove it was caused by an excluded one. That's a huge advantage for a business owner.

An open perils policy starts from a position of "everything is covered" and then carves out specific exceptions. A named perils policy starts from "nothing is covered" and then adds specific protections. For most businesses, the former provides a much stronger safety net.

While they do cost a bit more, the comprehensive coverage of an open perils policy makes it the go-to recommendation for most businesses that want to be truly protected.

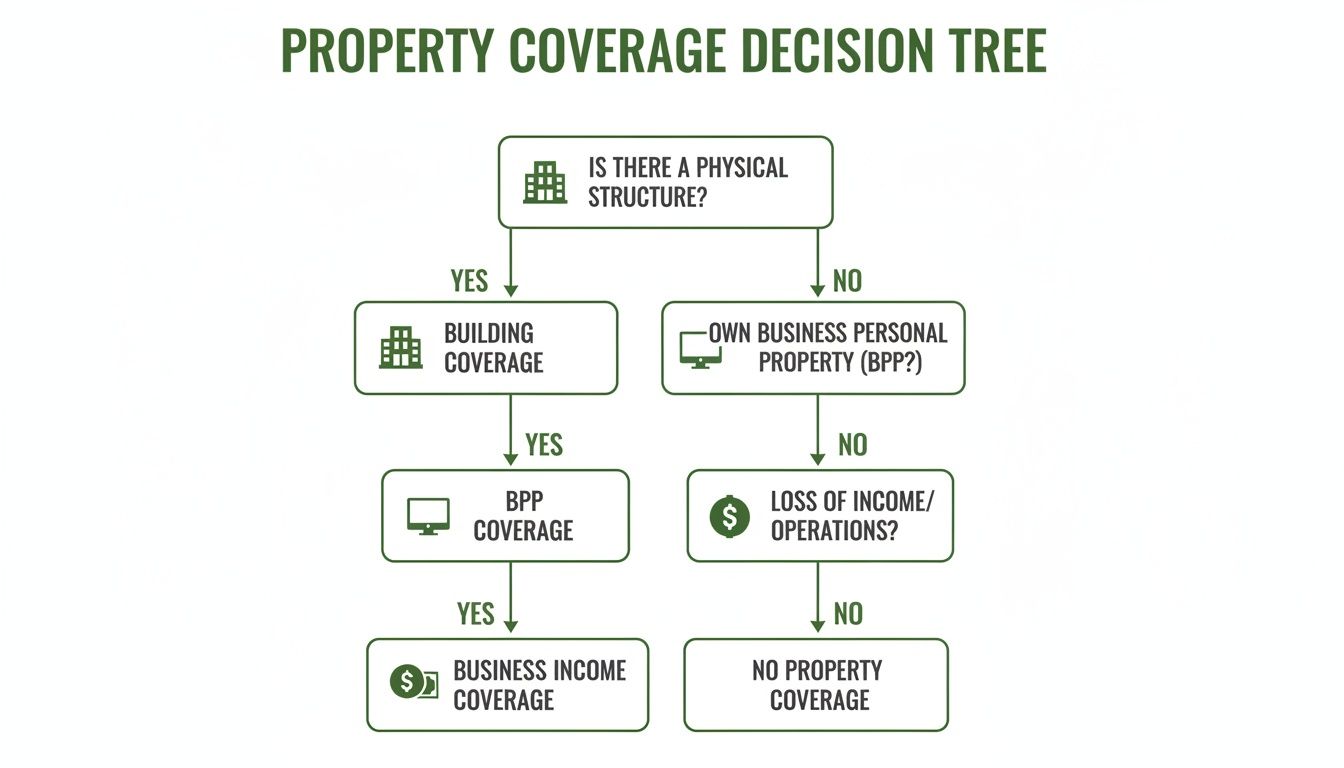

This decision tree gives you a great visual for mapping out your basic property coverage needs.

As you can see, building, property, and income coverages are the foundational pillars of a smart insurance strategy.

Business Owner's Policy vs. Standalone Policies

The next big choice is how you want to buy your insurance. You can either purchase individual, standalone policies for each risk, or you can bundle them into what's called a Business Owner's Policy (BOP).

A standalone commercial property policy is straightforward: it only covers your physical stuff. You would then need to go out and buy separate policies for general liability, commercial auto, and any other exposures your business has.

A BOP, however, is a handy package created specifically for small to medium-sized businesses. It bundles your commercial property and general liability insurance into one policy, which is usually more affordable. For a lot of companies, this is the most streamlined and cost-effective way to get covered. We've put together a full guide that explains in detail what is a Business Owner's Policy and how it works.

This isn't a small decision, especially in a growing market. The global commercial property insurance sector is expected to grow from $378.18 billion to $422.74 billion in direct premiums, driven by rising property values and a greater awareness of catastrophic risks.

So, how do you choose? It all comes down to your unique risk profile. A small retail shop, a local accounting firm, or a café would likely find a BOP to be a perfect fit—it provides great protection at an attractive price. But a business with more complex or specialized risks, like a manufacturing plant with custom machinery, will probably need the flexibility and tailored coverage that only standalone policies can offer. The best way to know for sure is to talk through your operations with an expert who can help you make the right strategic call for your company's future.

How Your Property Valuation Method Impacts Payouts

When you're looking at a commercial property policy, it's easy to get focused on what is covered. But the real make-or-break detail is how the policy pays out when you file a claim.

The valuation method is the financial engine of your insurance. It dictates the exact dollar amount you'll get after a disaster strikes. This single detail can be the difference between a smooth, full recovery and a devastating financial hole you're forced to dig yourself out of.

There are two fundamental ways your property can be valued: Replacement Cost Value (RCV) and Actual Cash Value (ACV). Getting a firm grip on what separates these two is probably one of the most important things you'll learn in this guide.

Replacement Cost Value: The Gold Standard

Think of Replacement Cost Value (RCV) as the "new for old" promise. This approach is designed to make you whole again by paying what it costs to repair or replace your damaged property with brand-new materials of a similar kind and quality. Crucially, there's no deduction for depreciation.

Let's imagine a power surge completely fries your five-year-old server system. You originally paid $10,000 for it, but a comparable new model today costs $12,000. With an RCV policy, your insurance would pay the full $12,000 (minus your deductible) to get that new server installed.

This is why RCV is the standard we recommend for most businesses. It ensures you have the actual funds needed to get your operations back on track with modern equipment, without reaching into your own pocket.

Actual Cash Value: The Budget-Friendly Alternative

Now, let's look at the other side of the coin. Actual Cash Value (ACV) works differently. It pays you for the replacement cost minus depreciation—the value your property lost over time due to age, use, and general wear and tear.

Essentially, ACV pays what your property was worth the moment before it was destroyed.

Let’s go back to that fried server. After five years of use, an adjuster might determine it had depreciated by 60%. That means its actual cash value is just $4,000 ($10,000 original cost – $6,000 depreciation). Under an ACV policy, that's all you'd get. You’d be on the hook for the remaining $8,000 to buy a new server.

To dive deeper into this math, our team has put together a detailed article explaining what is actual cash value and how it's calculated.

The core difference is simple: RCV pays what it costs to replace your property today. ACV pays what your old property was worth yesterday.

While ACV policies come with a lower price tag, the potential for huge out-of-pocket expenses makes them a risky choice for most operating businesses.

Replacement Cost (RCV) vs. Actual Cash Value (ACV)

To make the distinction crystal clear, here’s a side-by-side comparison of how these two valuation methods work in the real world.

| Feature | Replacement Cost Value (RCV) | Actual Cash Value (ACV) |

|---|---|---|

| Payout Calculation | Cost to replace with a new, similar item today. | Replacement cost minus accumulated depreciation. |

| Depreciation | Not deducted from the payout. | Deducted from the payout. |

| Financial Outcome | Provides enough funds for a full recovery. | Often leaves a significant financial gap to cover. |

| Premium Cost | Higher premium. | Lower premium. |

| Best For | Businesses seeking complete financial protection. | Businesses with tight budgets or much older assets. |

Choosing the right valuation method is a foundational step in building a policy that will actually perform when you need it most.

Filling the Gaps with Endorsements

No matter which valuation method you choose, a standard property policy isn't a silver bullet—it has built-in limitations. It almost always excludes common but major risks like floods, earthquakes, and equipment breakdowns. This is where endorsements come into play.

Think of an endorsement (also called a rider) as a small, specialized add-on that plugs a specific coverage gap in your main policy. It’s how you customize your insurance to match your unique risks. A restaurant in a historic district, for example, faces different challenges than a new warehouse in an industrial park.

Here are a few common endorsements business owners should consider:

- Flood Insurance: An absolute must-have for properties in flood zones, as water damage from flooding is a standard exclusion.

- Earthquake Coverage: Critical for any business located in a seismically active area.

- Ordinance or Law Coverage: This is a big one. It pays the extra costs to bring a damaged building up to current, stricter building codes during reconstruction—something a standard policy won't cover.

- Equipment Breakdown: Covers the cost to repair or replace vital machinery after a sudden mechanical or electrical failure.

Working with an experienced advisor is the best way to pinpoint which endorsements you truly need. At Wexford Insurance Solutions, we analyze your specific operations and location to recommend the right add-ons that turn a generic policy into a rock-solid shield.

Navigating a Commercial Property Claim Successfully

When disaster strikes, that commercial property policy you've been paying for suddenly becomes the most important document your business owns. It's your financial lifeline. How you handle the claims process from the very first moment will make all the difference in how quickly—and how fully—you recover.

The clock starts ticking the second you discover the damage. But before anything else, your first job is to ensure everyone's safety.

Your Immediate Post-Incident Checklist

Once the scene is safe and any immediate danger is gone, your focus needs to pivot to damage control and documentation. Think of yourself as a detective at a crime scene. The evidence you gather now will build the foundation for your entire claim.

Here’s what to do right away:

-

Stop the Bleeding: First, take reasonable steps to prevent the damage from getting worse. This might mean boarding up shattered windows, throwing a tarp over a gaping hole in the roof, or shutting off the main water valve. Your insurer expects you to protect what’s left of the property.

-

Document Everything: Before you touch a single thing, pull out your phone. Take photos and videos of everything from every conceivable angle. Get wide shots to show the scope of the disaster and then zoom in for close-ups of specific ruined equipment or structural damage. This visual proof is pure gold.

-

Call Your Insurer: Get on the phone with your insurance agent or carrier as soon as it's practical. Policies have strict rules about prompt notification, and waiting too long can create unnecessary headaches.

The steps for filing most property damage claims, including complex roof insurance claims, follow this same fundamental pattern of immediate action and thorough documentation.

Compiling and Submitting Your Claim

With the initial chaos under control, it’s time to get organized. The goal is to hand the insurance adjuster a clear, comprehensive, and well-supported file that makes their job easy.

Begin by creating an exhaustive inventory of every single item that was damaged or destroyed. List what it was, how many you had, roughly how old it was, and what it would cost to replace. Dig up any receipts, invoices, or financial statements you have to back up those values.

Key Takeaway: The quality of your documentation directly shapes the outcome of your settlement. An organized, detailed claim gets processed faster and paid more fairly than a messy, incomplete one.

Keep a dedicated claim file—digital or physical—for every email, photo, receipt, and note from your conversations with the adjuster. This creates an undeniable record of your claim from start to finish. For a more detailed walkthrough, our guide on how to file a property damage claim breaks it down even further.

The Advantage of Expert Advocacy

Let's be honest: trying to manage a major insurance claim while also trying to keep your business afloat is a nightmare. This is exactly when having a dedicated partner like Wexford Insurance Solutions in your corner becomes invaluable. We don't just sell you a policy; we stand by you when you need it most.

We step in as your advocate, handling the back-and-forth with the insurance company and ensuring your claim is presented in the most professional and effective way possible. Our team knows how to interpret confusing policy language and negotiate with adjusters to secure the full and fair settlement you are owed. We turn a stressful, all-consuming process into a managed recovery.

How Wexford Turns Insurance From a Chore Into a Strategy

Reading a guide like this is a great start. You now know the difference between RCV and ACV and what an open-peril policy covers. But the real challenge is turning that knowledge into a policy that actually works for your business—one that protects you without creating a mountain of paperwork.

That’s where we come in. At Wexford Insurance Solutions, we see ourselves as more than just brokers. We're your strategic partners, dedicated to making the entire insurance process straightforward and effective.

We've done away with the old, cumbersome way of doing things. Our onboarding is modern and paperless, and every client gets access to a 24/7 secure online portal. Need your policy documents at 10 PM on a Sunday? They’re right there. No more digging through filing cabinets.

We’re Your Advocate, Especially When It Matters Most

Getting you a policy is just the beginning of our relationship. Think of us as your in-house risk management team and, crucially, your claims advocate.

If the worst happens and you need to file a claim, you won't be on your own trying to decipher carrier requests. We step in immediately. We handle the back-and-forth with the insurance company, help you gather the right documentation, and fight to make sure your claim is settled fairly and quickly. It’s this hands-on support that helps businesses across New York and Florida not just get covered, but actually reduce their long-term cost of risk.

At Wexford Insurance Solutions, our goal is to blend expert, personal guidance with modern efficiency. We're here to build a more resilient financial foundation for your business, one policy at a time.

Let's Make the Most of Today's Market

The good news? The insurance market is currently in a great spot for business owners. According to the latest Marsh Global Insurance Market Index, composite commercial rates have dropped by 4%—the fifth quarter in a row we've seen a decrease.

What does this mean for you? Insurers are competing for your business, which leads to better coverage options and more favorable terms. It’s the perfect time to review your current policy. You can dig into the numbers yourself by reading the full Marsh Global Insurance Market Index report.

We stay on top of these trends so you don't have to. By combining this market insight with a genuine understanding of how your business operates, we find opportunities to strengthen your coverage, often while lowering your costs. Your business is unique, and it deserves more than a generic policy. It needs a shield built specifically for its risks and goals.

Ready to feel confident in your coverage? Connect with the Wexford Insurance Solutions team today. We’ll provide a custom review of your business’s protection and help you build a stronger plan for whatever comes next.

Got Questions? We've Got Answers

Even after going through all the details, you probably still have a few specific questions. That’s completely normal. Let's tackle some of the most common ones we hear from business owners every day.

How Much Commercial Property Insurance Do I Really Need?

Figuring out the right amount of coverage isn't a guessing game. It's a calculated decision based on the real-world value of your business.

You need enough to cover the full replacement cost of your building (if you own it), the total value of your Business Personal Property (think equipment, computers, inventory), and your potential lost income for at least six to twelve months. Skimping here is one of the biggest mistakes we see; it can leave you with a massive financial hole after a disaster.

Think of it this way: if a fire wiped out everything, your policy should give you the actual funds needed to rebuild, restock, and reopen—not just a portion of what it would cost. A thorough valuation is non-negotiable.

Does Commercial Property Insurance Cover Employee Theft?

No, and this is a critical point many business owners miss. Your standard property policy does not cover losses from an employee's dishonest acts.

To protect against things like embezzlement or employee theft, you need a separate policy called Crime Insurance or a Fidelity Bond. It’s specifically designed to cover these internal threats. It’s about protecting your business from the inside, while your property policy protects it from the outside.

What Happens If My Business Is Located In A Rented Space?

This is a great question. If you're a tenant, your landlord's insurance covers the building itself—the walls, the roof, the foundation. But everything inside that belongs to you is your responsibility.

Your policy needs to cover all of your Business Personal Property (BPP). This includes:

- Your inventory and stock

- All of your equipment and machinery

- Desks, chairs, and other furniture

- Any improvements or build-outs you paid for

Your commercial property policy focuses solely on your assets, ensuring you can get back on your feet without depending on your landlord's coverage.

Are Natural Disasters Like Floods And Earthquakes Covered?

Typically, no. Standard commercial property policies almost always exclude damage from floods and earthquakes. These are considered catastrophic events that require their own dedicated insurance.

You'll need to purchase separate, specialized policies or add specific endorsements to your main policy. Since Wexford Insurance Solutions works with businesses in high-risk coastal areas like Florida and New York, we make evaluating your need for flood insurance a top priority. A good agent will look at your specific location, assess the real risks, and make sure you're not left exposed to the very disaster that's most likely to happen.

Ready to build a policy that actually works for your business? The team at Wexford Insurance Solutions can give you a custom review of your needs and help you find the right coverage. Learn more and get started at https://www.wexfordis.com.

Umbrella Liability vs Excess Liability: A Comprehensive Guide

Umbrella Liability vs Excess Liability: A Comprehensive Guide What is an insurance premium: what is an insurance premium explained simply

What is an insurance premium: what is an insurance premium explained simply