Here’s the million-dollar question every homeowner asks at some point: Does my insurance actually cover mold?

The short answer is… it's complicated. The honest-to-goodness truth is sometimes. Whether or not you have a valid claim almost always comes down to what caused the mold to grow in the first place.

Your Quick Guide to Homeowners Insurance and Mold

Think of your homeowners policy as your financial protection against sudden and accidental disasters. It’s not a home warranty or a maintenance plan for problems that sneak up over time. This single concept is the most important thing to grasp when it comes to mold. Insurance companies are laser-focused on the why behind the fuzzy stuff growing on your wall.

Let's use a real-world example. Say a violent thunderstorm tears a hole in your roof, and rainwater soaks your attic insulation. If mold starts to grow a week later because of that water damage, the cleanup is likely covered. Why? Because the root cause—the storm—is a “covered peril” in your policy.

Now, flip that scenario. Imagine a tiny, slow leak from the wax ring on your toilet has been seeping into the subfloor for six months. When you finally discover a massive mold colony in the bathroom, your claim will almost certainly be denied. Insurers see that as a gradual maintenance issue you were responsible for, not a sudden accident.

Why The Cause Matters So Much

This distinction isn't just insurance companies being difficult; it's fundamental to how insurance works. Policies are designed and priced to cover the financial shock of unexpected events, not the predictable consequences of poor upkeep or wear and tear.

By excluding mold that results from neglect, carriers encourage us as homeowners to keep an eye on our property. It’s also what keeps premiums from skyrocketing for everyone. Catching problems early is key, so learning the unmistakable signs of mold in your house is a skill every homeowner should have.

And these issues are far from rare. In 2023, 5.3% of all insured homes had to file a claim. A staggering 97.3% of those claims were for property damage, often from the exact water-related issues that lead to mold.

The Golden Rule of Mold Coverage: If the mold is a symptom of a bigger, covered problem (like a burst pipe), you probably have a path to a claim. If the mold is the problem, stemming from neglect or a gradual leak, you're likely on your own.

To give you a better feel for this, here's a quick breakdown of common situations.

Mold Coverage Scenarios At a Glance

| Cause of Mold | Typically Covered? | Why or Why Not? |

|---|---|---|

| Sudden pipe burst | Yes | The cause was a sudden, accidental event covered by the policy. |

| Slow, long-term leak | No | This is considered a maintenance issue, not a sudden event. |

| Roof damage from a storm | Yes | The storm is a covered peril, and the mold is a direct result. |

| Flooding from heavy rain | No | Standard policies exclude flood damage; you need a separate flood policy. |

| High humidity/poor ventilation | No | This falls under homeowner maintenance and gradual damage. |

| Appliance overflow (e.g., dishwasher) | Yes | This is typically seen as a sudden and accidental discharge of water. |

Understanding this cause-and-effect logic is the first and most important step. In the rest of this guide, we'll get into the nitty-gritty of policy language, what to do if you find mold, and how to make sure you're properly protected. For a wider view, check out our guide that breaks down the key homeowners insurance coverages.

Understanding the “Covered Peril” Rule for Mold

When it comes to mold and your homeowners insurance, everything hinges on one simple but critical idea: the covered peril. Think of a peril as a specific, named disaster or accident that your policy agrees to cover—things like fire, lightning strikes, or a pipe suddenly bursting.

This "covered peril" rule is basically the gatekeeper for any mold-related claim. For your insurance company to even consider paying for mold cleanup, the mold has to be a direct result of one of these covered events. It's a strict cause-and-effect situation.

Imagine a line of dominoes. The first domino to fall must be a covered peril. That event then has to knock over the next domino (like water damage), which in turn knocks over the final one (mold growth). If the mold starts from something that isn't on that approved list of perils, the claim is a non-starter.

The Origin Story of a Mold Claim

Let's break this down by looking at how an insurance adjuster investigates. Their job is to play detective and trace the mold all the way back to its origin story. They're looking for that clear, undeniable link to a sudden and accidental event.

Here are a couple of real-world scenarios that show how this works:

Scenario A (Probably Covered): A grease fire starts in your kitchen. The fire department shows up and, thankfully, puts it out, but they soak the walls and cabinets in the process. A couple of weeks later, you find mold spreading inside the damp drywall. Here, the fire is the covered peril. The water damage was a necessary consequence of fighting the fire, and the mold was a direct result of the water. The chain of events is clear and connected.

Scenario B (Probably Denied): You keep noticing a musty smell in the basement. After some searching, you discover a huge patch of mold on a wall. It turns out a tiny, slow leak in the foundation has been seeping moisture in for months, maybe even years. In this case, there was no sudden or accidental event. It’s considered gradual damage stemming from a maintenance issue, which insurance policies almost always exclude.

This distinction is everything. Insurance is built to handle the risk of unexpected disasters, not the slow, predictable process of wear and tear. Figuring out if the initial water source is covered is the essential first step, which you can learn more about in our guide on how insurance handles water damage.

Key Takeaway: Your insurance policy is a shield against the financial shock of an accident. It's not a maintenance plan for problems that pop up over time from humidity, slow leaks, or general upkeep issues.

Why Insurers Draw This Hard Line

You might wonder why insurance companies are so strict about this. It's not just to be difficult; it's a fundamental part of how insurance works and is designed to encourage responsible homeownership.

If policies covered mold from any source imaginable, there would be no real incentive for homeowners to fix a dripping faucet, maintain their gutters, or run a dehumidifier in a damp basement.

By tying coverage directly to specific, accidental events, the system rewards proactive maintenance. It puts the responsibility for gradual deterioration where it belongs—with the homeowner—while still providing that crucial safety net for true, unforeseen catastrophes.

So, instead of asking, "Does my insurance cover mold?" the better first question is always, "What caused the mold?" If you can point to a covered peril as the culprit, you've got a solid basis for a claim. If not, the cleanup costs will likely be on you.

Decoding Mold Exclusions and Coverage Limits

If you've ever tried to read your homeowners policy from start to finish, you know how dense it can be. When it comes to mold, the really important details are buried in the fine print—specifically, in the exclusions and coverage limits. This is where most homeowners get surprised, and unfortunately, it's often not a good surprise.

These rules aren't just random. They’re a direct result of the insurance industry getting rocked by the "Mold Scare" back in the late 1990s. Vague policy wording led to a flood of massive claims. The real tipping point was a 2001 Texas Supreme Court case that awarded a staggering $32 million for a single mold claim. As you can imagine, insurers nationwide scrambled to rewrite their policies, adding the specific mold exclusions and financial caps that are standard today. For a bit more on this history, check out this deep dive on homeowners insurance and mold.

Common Mold Exclusions You Need to Know

Today, you’d be hard-pressed to find a standard homeowners policy that doesn't have specific language limiting or outright excluding mold coverage. Think of these exclusions as the insurance company drawing a very clear line in the sand.

Here are the most common reasons a mold claim gets denied:

- Flooding: This is the big one. Standard home insurance does not cover damage from natural floods, and that includes any mold that grows as a result. For that, you need a completely separate flood insurance policy.

- Poor Maintenance: If mold appears because you knew about a leaky pipe under the sink but never fixed it, the insurer will almost certainly deny the claim. They see it as preventable neglect on your part.

- High Humidity: Got mold in a bathroom with no fan? That’s on you. Mold that develops slowly over time from condensation, poor ventilation, or just living in a humid climate is considered a maintenance issue, not a sudden event your policy covers.

- Construction Defects: If mold is growing because of shoddy work by your builder—like improperly sealed windows—the responsibility falls on them, not your insurance company.

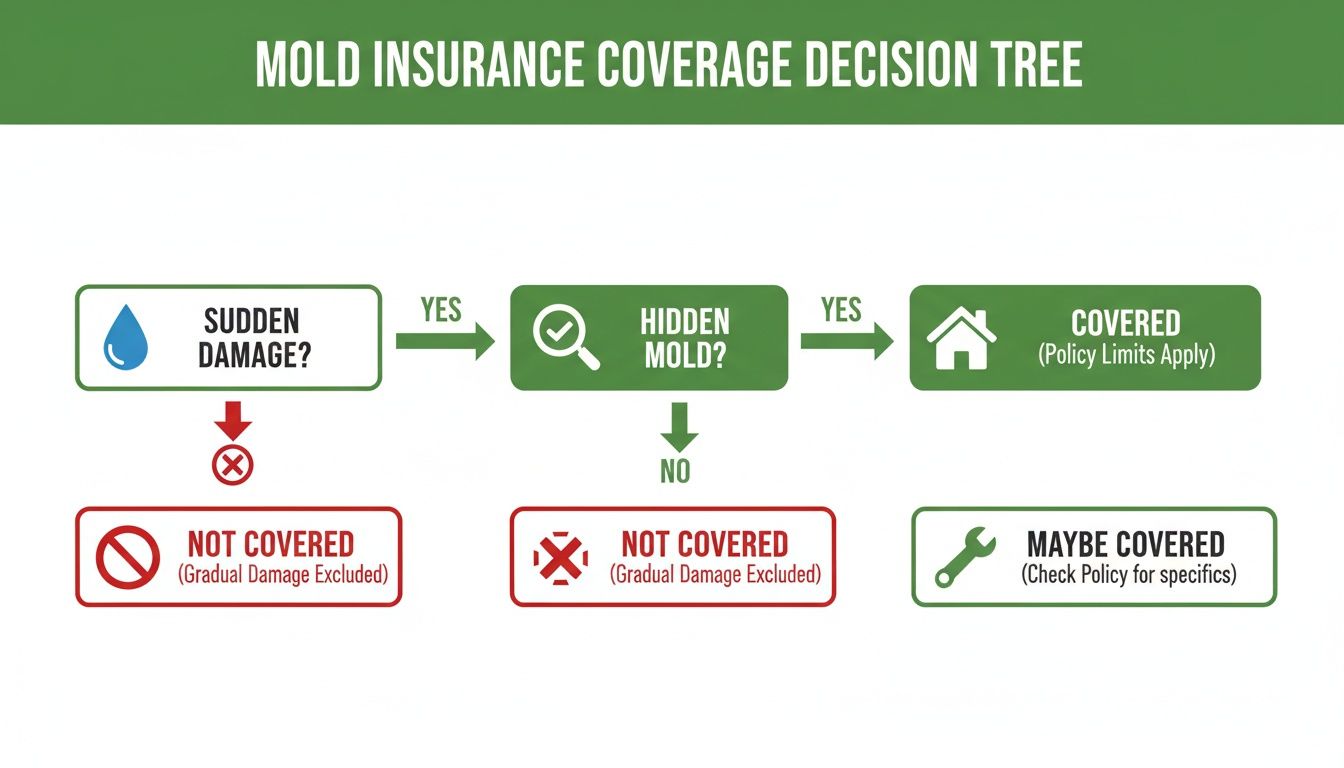

This decision tree gives you a good visual of how an insurance adjuster thinks about a mold claim.

As you can see, the path to getting a claim approved starts with a sudden, accidental water event. Anything gradual is a dead end.

Understanding Your Mold Coverage Sub-Limit

Now, here’s a crucial point: even when mold is covered, the payout is almost never unlimited. Your policy has a mold sub-limit, also called a mold limitation, and you need to know what it is.

A mold sub-limit is a hard cap on the maximum amount your insurer will pay for mold remediation and testing. This cap applies even if the cost to fix everything is much higher.

Let’s put that in real terms. Say your policy has $300,000 in dwelling coverage, but it has a specific mold sub-limit of $10,000. A pipe bursts in your wall, causing $25,000 in water damage and another $15,000 in mold cleanup. Your insurer would pay the full $25,000 for the water damage, but only $10,000 for the mold. That leaves you holding a $5,000 bill for the rest of the remediation.

These sub-limits vary, but they often fall between $5,000 and $10,000. That might sound like a lot, but a serious mold problem can easily blow past that figure, especially if it requires tearing out walls and floors. It is absolutely essential to find this number in your policy. If you discover your limit feels too low for comfort, you might want to look into how an insurance policy rider can add more protection.

How to Strengthen Your Mold Coverage Protection

Feeling a little uneasy about the standard policy limits for mold? That’s a common and completely valid concern. The good news is you don’t have to settle for the default coverage. You can take proactive steps to build a much stronger safety net.

This is where you can customize your policy with special add-ons, which in the insurance world we call endorsements or riders. Think of them like upgrading a new car; you pay a little extra for premium features that give you better performance and, more importantly, peace of mind.

These endorsements directly tackle those low sub-limits we talked about earlier, giving you the financial breathing room you’d need if a covered disaster ever leads to a serious mold problem.

What Mold Endorsements Typically Include

A mold endorsement isn't a blank check, but it does significantly raise the ceiling on what your insurance company will pay for remediation. Instead of being stuck with a base limit that might be just $5,000 or $10,000, you can often bump that protection up to a much more realistic figure.

Here’s what you can generally expect from a mold rider:

- Higher Coverage Limits: You might be able to increase your mold coverage to $25,000, $50,000, or even more, depending on your insurer. This provides a far more substantial cushion to handle extensive cleanup costs.

- Coverage for Testing: Some endorsements will even include a specific allowance for professional mold testing and air quality assessments—services that a base policy almost never covers.

- Increased Liability Protection: In certain situations, you can add an endorsement that provides limited liability coverage if, for instance, a guest in your home were to claim they got sick from mold exposure.

The need for this extra protection is far from rare. In 2022, water damage and mold were behind a staggering 27.6% of all homeowners' insurance losses. This statistic from uphelp.org highlights how mold coverage gaps affect homeowners, showing just how often these issues pop up while standard policies often leave homeowners under protected.

The Critical Role of Flood Insurance

Now, there’s one scenario where even the best mold endorsement won't help: a natural flood. It's absolutely crucial to remember that standard homeowners insurance never covers damage from floods. That includes any mold that grows as a result.

If your home is damaged by rising rivers, a storm surge, or torrential surface water, any and all resulting mold cleanup will be denied under your standard home policy. There are no exceptions.

To protect yourself from this, you need a completely separate flood insurance policy. These are typically sold through the National Flood Insurance Program (NFIP) or private insurance companies. A flood policy operates with its own set of rules, deductibles, and coverage limits for both your home’s structure and your personal belongings.

Don't make the mistake of thinking you're safe just because you don't live near the coast. Flooding is the most common and expensive natural disaster in the U.S., and many flood claims actually come from areas that are considered low to moderate risk. To make sure you're truly covered for a worst-case scenario, it’s a smart move to use a homeowners insurance replacement cost estimator to get an accurate picture of what it would take to rebuild.

By pairing a strong homeowners policy with the right endorsements and a separate flood policy, you create a comprehensive shield. This layered approach is the most effective way to ensure you're financially prepared for whatever nature throws your way.

Filing a Mold Damage Claim Step by Step

Finding mold in your home is stressful enough. The last thing you need is a complicated and confusing claims process. If you think the mold came from a covered event—like a pipe that suddenly burst—acting quickly and methodically is your best bet.

Let's walk through how to build a strong, credible claim. Think of yourself as a detective building a case. Your job is to clearly connect the mold you see (the effect) to the covered water event (the cause). The more organized you are from the start, the smoother this whole process will be.

Step 1: Take Immediate Action to Mitigate Damage

The very first thing you need to do is stop the problem from getting worse. This isn't just a good idea; it's something your insurance company expects. It shows you're acting in good faith to control the damage and keep costs from spiraling.

Don't worry, this doesn't mean you have to start a full-blown renovation. It’s simply about responsible damage control.

- Stop the Water Source: If a leak is the culprit, find your main water valve and shut it off immediately.

- Remove Excess Water: Get some towels or a mop for any standing water. Setting up fans or a dehumidifier will start the drying process.

- Secure the Area: If a storm punched a hole in your roof, get a tarp over it right away to keep more rain from pouring in.

And a crucial tip: keep every single receipt for anything you buy to help with this, like that tarp or those fans. These costs are often reimbursable as part of your claim.

Step 2: Document Everything Meticulously

Before you move or clean a single thing, pull out your phone and document everything. You cannot take too many photos or videos. This visual evidence is the bedrock of your claim, proving exactly what happened, how bad it is, and where it came from.

- Start Wide, Then Go Close: Take photos and videos of the entire room first to show the big picture. Then, zoom in for detailed, close-up shots of the mold, the source of the water (like that leaky pipe), and any personal items that were damaged.

- Create a Written Log: Grab a notebook or start a new note on your phone. Write down the date you found the mold, what you did to stop the water, and start a running list of every single damaged item.

- Keep All Communication: Document every conversation you have with your insurance company. Note the date, time, who you spoke with, and what was said.

Pro Tip: When you talk to your insurance agent, stick to the facts. Say something clear and direct like, "We had a pipe burst in our kitchen wall, which caused water and mold damage." Avoid guessing or saying things like, "We've had a weird smell for a few months." Focus on the sudden, covered event.

Step 3: Notify Your Insurance Company Promptly

Don't wait to call your insurance company. Most policies have a clause that requires you to report a claim "promptly" or "as soon as reasonably possible." If you wait too long, it could give the insurer a reason to question your claim.

When you call, have your policy number handy. The agent will open a claim file, give you a claim number (write this down!), and walk you through the next steps, which usually involves a visit from an adjuster. You can see a full breakdown of the process in our guide on how to file an insurance claim.

Once you've identified the source and the claim is moving forward, the next phase is proper cleanup. If the mold is lurking in your HVAC system, a specialized guide to air duct cleaning mold removal can be incredibly helpful. By following these steps, you put yourself in the driver's seat and seriously improve your chances of a fair and successful outcome.

Frequently Asked Questions About Mold and Home Insurance

When you're staring down a potential mold problem, the last thing you want is to get lost in the fine print of your insurance policy. You need straight answers, right now.

Let's cut through the confusion and tackle the most common questions and "what-if" scenarios we hear from homeowners every day.

Will My Insurance Company Pay for Mold Testing?

Probably not, but there's a key exception. Insurers generally see mold testing as part of regular home upkeep—something a homeowner does to stay on top of things. Think of it like a routine check-up.

The story changes if the testing is needed to figure out the extent of the damage after a covered claim, like a burst pipe that floods your basement. In that case, the cost to test might be rolled into the overall claim payment, but it would still fall under your policy’s mold limit. Some special mold endorsements also set aside a small amount specifically for testing.

What if Mold Develops After a Flood?

This is a critical distinction that trips up a lot of people. Your standard homeowners insurance policy does not cover damage from natural floods—we're talking about overflowing rivers, storm surge, or heavy rain that pools and seeps in from outside.

Because the initial flood isn't covered, any mold that grows as a result of it is also not covered. For that, you need a separate flood insurance policy. Flood policies operate with their own set of rules, deductibles, and limits for mold cleanup, so you'll want to be familiar with that specific coverage.

Important Takeaway: Think of your homeowners policy and your flood policy as two different shields. One doesn't block the attacks the other is designed for, especially when it comes to the mold damage that follows.

Does My Policy Cover Me if a Guest Gets Sick from Mold?

This is a liability question, and the answer is almost always no. Most homeowners policies have a specific exclusion for any bodily injury claims tied to mold.

If this coverage is available at all, it's usually as an optional add-on with a fairly low limit. It's meant to help with legal or medical bills if a visitor sues you for a mold-related illness, but the protection it offers is typically very limited.

Can My Insurer Drop Me for Filing a Mold Claim?

Filing one legitimate mold claim that's tied to a covered event is highly unlikely to get you dropped. Insurers know that accidents happen.

What can raise a red flag, however, is a pattern of multiple water damage claims. This can signal a higher risk to the insurance company and might lead them to not renew your policy down the road. It’s another reason why proactive maintenance is your best defense. If you do find yourself facing non-renewal, an independent agent can help you shop around for other options.

Knowing what your policy truly covers is the best way to protect your home and your wallet. At Wexford Insurance Solutions, our experts can review your current coverage, spot the gaps, and find the right solutions to give you peace of mind. Contact us today for a personalized insurance review.

A Practical Guide to Home and Auto Insurance Bundles

A Practical Guide to Home and Auto Insurance Bundles How much is engagement ring insurance: a clear guide to costs and coverage

How much is engagement ring insurance: a clear guide to costs and coverage