Imagine you have a subscription service for professional protection. As long as you keep that subscription active, you're covered for any claims that pop up during that time. That's the simplest way to think about a claims-made policy. It's the standard for professional liability, including errors & omissions insurance.

What Is a Claims-Made Policy?

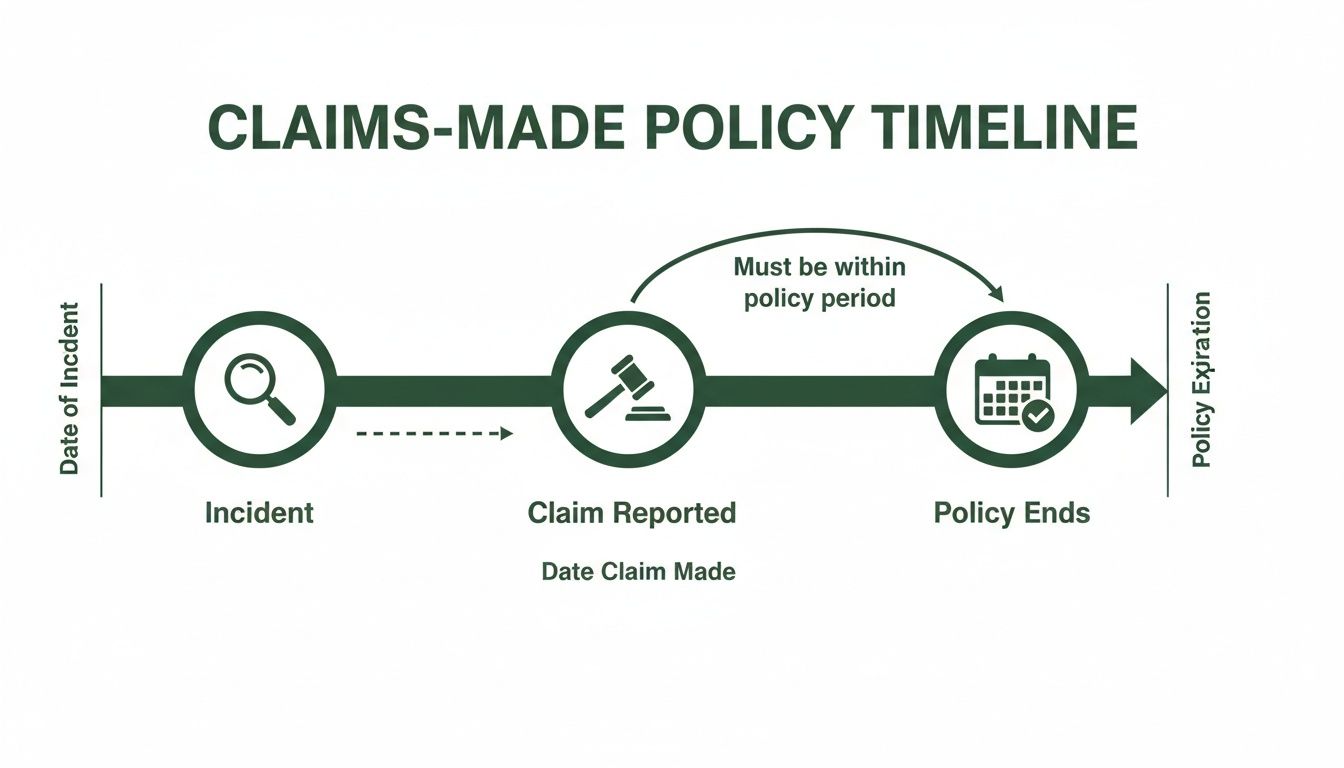

At its heart, a claims-made policy hinges entirely on timing. For a claim to be covered, it must be both made against you and reported to your insurance carrier while the policy is still active.

This is a huge departure from the other main type of policy, known as an "occurrence" policy. With occurrence policies, it only matters that the incident happened during the policy period; you could report the claim years later and still be covered. With a claims-made policy, the reporting date is everything.

This structure allows insurance carriers to better forecast their potential payouts for any given year, which is why the premiums often start out lower. But it puts the responsibility squarely on you to make sure you don't have any gaps in your coverage.

To really get a handle on this, let's look at the core pieces of a claims-made policy. Getting these fundamentals down is the key to managing your professional risk properly.

Claims-Made Policy At a Glance

Here’s a quick breakdown of the most important elements you need to know.

| Key Component | What It Means for Your Coverage |

|---|---|

| Coverage Trigger | A claim must be made against you and reported during the policy period. |

| Continuous Coverage | Absolutely essential. A lapse can leave your past work totally uninsured. |

| Initial Premiums | Often lower than occurrence policies, but they tend to increase over the first few years. |

| Common Use Cases | Standard for professional liability, D&O, and cyber insurance policies. |

Think of this table as your cheat sheet. These are the non-negotiable concepts that define how your policy will—or won't—protect you.

The Three Core Mechanics of a Claims-Made Policy

To really get your head around a claims-made policy, you need to understand its three key parts: the Policy Period, the Retroactive Date, and the Extended Reporting Period. These three components work together to draw the lines around what’s covered and what’s not. Think of them as the rules of the game—if you know them, you won't get caught off guard.

1. The Policy Period: Your Active Coverage Window

The most straightforward piece of the puzzle is the Policy Period. This is simply the block of time your policy is in force, which is almost always one year. For a claim to be covered, it has to be made against you and reported to your insurance company while the policy is active. This strict timing is what really separates claims-made from other types of insurance.

This timeline gives you a great visual of how these dates fit together.

As you can see, both the incident and the claim have to fall within the right timeframes. This is why having continuous, unbroken coverage is so important.

2. The Retroactive Date: Looking Back in Time

Next up is the Retroactive Date, and this one is a big deal. This date acts as the starting line for your coverage. Your policy will only respond to claims that stem from work you did on or after this specific date.

Let’s say you’re a consultant and you buy your first professional liability policy on January 1, 2024. The insurance company will set your retroactive date to that same day. Now, imagine a client sues you in June 2024 for a project you completed in 2023. Your new policy won’t cover it, because the work happened before your retroactive date.

Your retroactive date is like your policy's memory. The further back it goes, the more of your past work it remembers and protects. That's why keeping your original retroactive date when you switch insurers is absolutely critical for seamless protection.

Holding onto that date is one of the most important things you can do to manage your professional risk. You can get a deeper dive into the specifics by learning more about what a retroactive date in insurance really means for your long-term security.

3. The Extended Reporting Period (ERP): Protecting Your Past

The final piece is the Extended Reporting Period (ERP), but pretty much everyone in the industry just calls it tail coverage. This is an optional add-on you can buy when you cancel your claims-made policy or decide not to renew it.

So, why does it matter? The moment your policy expires, that coverage window slams shut. If a client from two years ago decides to sue you for a project you did back then, you'd be completely on your own without an ERP. Tail coverage buys you an extended window—often for several years—to report these kinds of "long-tail" claims that pop up after your policy has ended.

Here’s what you need to know about tail coverage:

- It’s essential, not optional. If you're retiring, selling your business, or even switching to a different type of policy, tail coverage is the only way to protect your past work from future claims.

- It's a one-time purchase. You buy it from the insurer you're leaving, and it comes with a single, upfront cost. Be prepared, though—it can be pricey, often costing 100% to 300% of what you paid for your last year's premium.

- It only covers past work. An ERP doesn't cover you for any new work you do. It only gives you extra time to report claims from incidents that happened before your original policy expired.

These three parts—the policy period, the retro date, and tail coverage—give you the complete picture of how a claims-made policy operates and defines exactly when and how you're protected.

Claims Made vs. Occurrence: A Practical Comparison

Getting a handle on how a claims-made policy works is the first step. But the real "aha!" moment comes when you see it side-by-side with an occurrence policy. This isn't just a matter of semantics; the choice you make can have major financial consequences years from now when an unexpected claim pops up.

It all boils down to what actually triggers your coverage.

An occurrence policy is straightforward: it's triggered by the date the incident happened. If a client slips in your office while your policy is active, you’re covered—even if they wait three years to file a lawsuit. That policy provides lifetime coverage for anything that went wrong on its watch.

A claims-made policy, on the other hand, is triggered when the claim is made and reported to the insurer. When the incident occurred is still important (thanks to the retroactive date), but the report date is what really gets the ball rolling. This single distinction is what makes it both more affordable and potentially riskier.

A Tale of Two Consultants

Let’s put this into a real-world context. Imagine two identical consulting firms, Firm A and Firm B.

- Firm A buys a claims-made professional liability policy, which they keep active from 2020 through 2024.

- Firm B opts for an occurrence professional liability policy for that same period.

In 2022, both firms finish a big project for the same client. Fast forward to 2025. Both firms have let their original policies expire, and that client from 2022 sues them, claiming a costly error was made during the project.

Firm B is covered. Since the mistake happened in 2022—when their occurrence policy was active—that policy is triggered and will respond to the claim.

Firm A, however, is in serious trouble. The claim was made in 2025, a full year after their claims-made policy expired. Without coverage in place when the claim was filed, they're left exposed. Their only saving grace would have been purchasing tail coverage.

This simple story is a perfect example of why continuous coverage is non-negotiable with a claims-made policy. Our in-depth guide offers a deeper look into the claims-made vs. occurrence coverage debate.

Claims Made vs Occurrence Policy Key Differences

To help you visualize the core distinctions, here’s a quick breakdown comparing the two policy structures. This table cuts through the noise and shows you what matters most when deciding which path is right for your business.

| Feature | Claims Made Policy | Occurrence Policy |

|---|---|---|

| Coverage Trigger | Claim is made and reported during the policy period. | Incident occurs during the policy period. |

| Initial Premiums | Lower, as risk is limited to the current year. | Higher, to account for future "long-tail" claims. |

| Premium Costs Over Time | "Steps up" for 5-7 years then matures and stabilizes. | Generally stable, adjusted for inflation and risk. |

| Coverage Continuity | Requires continuous coverage or "tail" coverage if canceled. | Provides lifetime coverage for incidents during the policy term. |

| Insurer's Risk | More predictable, easier to forecast claims. | Less predictable, must reserve for claims years away. |

| Common Use Cases | Professional Liability, D&O, Cyber, EPLI. | General Liability, Auto Liability, Workers' Comp. |

Ultimately, neither policy is universally "better"—they just serve different needs. Your decision should be based on your industry, risk tolerance, and long-term business plans.

Cost and Predictability

The difference in how these policies are built directly impacts your wallet. Occurrence policies start with higher premiums because the insurer is taking a bit of a gamble. They have to set aside money for claims that might not surface for years, a complex and expensive calculation.

Claims-made policies give insurers a huge advantage here. They can slash their "incurred but not reported" (IBNR) reserves—the funds set aside for future claims—by as much as 50%. This efficiency allows them to offer rates that are often 12-20% lower over the long run.

The numbers back this up. One major study found that claims-made forecasts were accurate 95% of the time, while occurrence policy forecasts were only 82% accurate over a five-year period. More accurate forecasting means less risk for the insurer and lower costs for you.

Of course, there’s a trade-off for those lower initial premiums. It's called the "step-up" in cost. For the first five to seven years, your claims-made premium will increase annually as the policy's potential exposure to your past work grows. Once the policy "matures," the price levels out.

Which Professions Rely on Claims-Made Policies?

While the inner workings of a claims-made policy might seem a little complicated at first, they are actually custom-built for certain professions. Specifically, they’re designed for careers where the fallout from a mistake might not show up for years. This structure is the key to protecting professionals from what we call "long-tail risks"—claims that pop up long after a project is finished and paid for.

The main reason claims-made has become the standard in these fields comes down to the nature of the risk itself. A slip-and-fall is immediate and obvious. But a professional error, a questionable decision by a board, or a hidden cyber vulnerability can sit quietly for a long, long time. A claims-made policy solves this problem by tying coverage to when the claim is reported, not when the mistake originally happened.

Professional Liability and Errors & Omissions (E&O)

This is the classic home for claims-made coverage. Think about doctors, lawyers, architects, and consultants. The advice they give or the work they perform today could easily turn into a lawsuit years from now.

For example, a financial advisor helps a client set up a retirement plan in 2022. It isn't until 2027 that the client discovers a costly oversight in the plan’s structure. As long as that advisor has kept their claims-made policy active the entire time, the policy in force in 2027 is the one that will respond. It covers the claim because it was made and reported during that policy period, even though the actual advice was given five years earlier. You can learn more in our guide on who needs professional liability insurance.

Directors and Officers (D&O) Liability

Company leaders face a similar kind of delayed-reaction risk. A major strategic decision made by a board of directors could be challenged by shareholders or regulators well into the future.

Scenario: A corporate board greenlights a major acquisition in 2023. Two years later, in 2025, a group of angry shareholders files a lawsuit, claiming the board didn't do its due diligence and overpaid. The D&O policy active in 2025 is the one that would kick in to defend the board members, protecting their personal assets from the legal battle.

Without this claims-made structure, insuring high-stakes corporate governance would be a nightmare. The full consequences of a decision often take years to unfold.

Cyber Liability Insurance

The digital world is another perfect match for the claims-made model. A hacker can sneak into a company’s network, plant some malicious code, and vanish. The damage might not be discovered for months, or even longer.

Picture this:

- A hacker exploits a software bug in January, but the company doesn't discover the data breach until the following year.

- The company would file a claim under the cyber liability policy it has at the time of discovery.

- That policy responds because the claim was made and reported while it was active.

This approach is essential because the timeline of a cyberattack is almost never clean and simple. There's the initial breach, the "dwell time" where the hacker goes unnoticed, and finally, the discovery and the ensuing claim. A claims-made policy lines up the coverage with the moment the financial and legal pain actually begins.

Smart Strategies for Managing Your Policy

Getting your head around a claims-made policy is the first step. The real trick is managing it year after year. This means paying close attention to the financial side of things—how your premiums evolve and what risks pop up when you decide to make a change. Smart management is what keeps your professional past safely under lock and key.

The first thing you'll likely notice is something called the "step-factor." For the first five to seven years, your premium will inch up annually. This isn't your insurer nickel-and-diming you; it’s just how these policies are built. In year one, the policy only has to cover one year's worth of your work. By year five, it's covering five years of potential liability, which is a much bigger risk for the insurance company. After this initial period, the policy "matures," the steps stop, and your premium should level out.

Avoiding Gaps When Switching Carriers

The single biggest headache with a claims-made policy is handling transitions. If you let your policy lapse or switch carriers the wrong way, you can create a massive coverage gap that leaves all your past work exposed to future lawsuits. It’s a costly—and entirely avoidable—mistake.

Let me be crystal clear: never let your coverage lapse. A gap of even one day can wipe out the protection for all your prior work. Your number one job as a policyholder is to maintain continuous coverage.

When you decide to move to a new insurance carrier, you have two main ways to make sure your past work stays protected. Both get you to the same place—unbroken coverage—but they work a bit differently.

- Nose Coverage: Think of this as an add-on to your new policy. Your new insurer agrees to look backward and cover your past work by adopting your original retroactive date. This is usually the easiest and most budget-friendly path, as everything is wrapped up neatly under one roof.

- Tail Coverage: Also called an Extended Reporting Period (ERP), this is a one-time purchase from your old insurer. It basically buys you a window of time (often several years) to report any claims that pop up from work you did while you were with them. Tail coverage is non-negotiable if your new carrier won't offer nose coverage. Want to dive deeper? Check out our complete guide on what is tail coverage insurance.

The Critical Need for Timely Reporting

Getting this transition wrong is a huge gamble. In fact, a staggering 40% of small businesses that switch carriers get hit with coverage denials for unreported "known circumstances" because they didn't follow the reporting rules to a T. Insurers need you to report any potential claim as soon as you're aware of it. Waiting until you have a new policy in hand to disclose an old issue is a recipe for disaster.

Your choice between nose and tail coverage isn't just a minor detail; it's a pivotal decision. Making the right move preserves the retroactive date you've worked so hard to establish, ensuring every project from your past remains securely insured, no matter what comes next.

Claims-Made Insurance: Your Questions Answered

When you're dealing with claims-made policies, a few "what-if" questions always seem to pop up. Let's tackle some of the most common scenarios that business owners and professionals run into.

What Happens if I Retire or Sell My Business?

This is a big one. If you retire or sell your business, your claims-made policy doesn't just ride off into the sunset with you. The moment you cancel that policy, your coverage for all your past work vanishes.

This is exactly where tail coverage becomes non-negotiable. By purchasing an Extended Reporting Period (ERP) from your last insurer, you're essentially buying a safety net. It gives you the ability to report claims that might surface years after you've hung up your hat. Without it, a lawsuit related to work you did ages ago could put your personal assets on the line.

How Much Does Tail Coverage Typically Cost?

There's no single price tag, but you can generally expect tail coverage to cost somewhere between 100% and 300% of your final year's premium. It’s a one-time payment, not an ongoing cost.

Several things influence the final number:

- Length of the ERP: A three-year tail will naturally cost less than a five-year or unlimited one.

- Your Profession: Higher-risk fields, like specialized medical practices or engineering, usually see higher costs.

- Claims History: A spotless track record often gets you a better price.

It's a significant expense, no doubt. But think of it as the final investment in protecting your life's work.

Can I Switch from a Claims-Made to an Occurrence Policy?

Absolutely, but you have to be careful to avoid leaving yourself exposed. Making this switch without creating a gap in your coverage is a two-step process.

First, you'll need to purchase tail coverage from your current claims-made provider. This locks in protection for all your past work. At the same time, you'll start your new occurrence policy, which will cover any incidents that happen from that day forward. This one-two punch—tail coverage for the past and an occurrence policy for the future—creates a perfect, seamless bridge of protection.

Navigating the ins and outs of claims-made insurance, from setting the right retroactive date to securing tail coverage, is what we live and breathe. Wexford Insurance Solutions is here to make sure you have continuous, gap-free protection. Let us help you safeguard your professional future.

Learn more about how we can help at Wexford Insurance Solutions.

Your Guide to Errors & Omissions Insurance

Your Guide to Errors & Omissions Insurance