If you've ever felt the sticker shock of a commercial auto insurance quote, you're not alone. Finding affordable coverage can feel like a maze, but it's far from impossible. The secret isn't just about shopping around; it's about understanding what drives those high premiums and then showing insurers that your business is a smart, low-risk investment.

Let's start by pulling back the curtain on the market forces that have everyone's rates on the rise.

Why Is Commercial Auto Insurance So Expensive?

Noticing your commercial auto premiums creep up—or even jump—is a common frustration for business owners. From independent contractors with a single van to companies managing a large fleet, the entire industry is navigating a perfect storm of factors pushing costs higher. Getting a grip on these pressures is the first real step toward finding more affordable coverage.

This isn't just about one bad year or a single accident. It's a mix of economic trends and on-the-ground realities that make insuring commercial vehicles a much riskier and more expensive business for the carriers themselves.

The Rising Cost of Everything

One of the biggest culprits is inflation, but it's more than just the price of gas. Today's commercial vehicles are technological marvels, packed with sensors, cameras, and onboard computers designed to improve safety. The downside? A simple fender bender that used to mean a new bumper can now involve recalibrating sensitive electronics, turning a minor repair into a multi-thousand-dollar job.

On top of that, medical costs continue to skyrocket. When an accident involves injuries, the resulting hospital bills, physical therapy, and long-term care expenses are drastically higher than they were a decade ago. Insurers have to account for these massive potential payouts, and that gets passed down to policyholders through higher premiums. For a full breakdown of the fundamentals, you can learn more about what is commercial auto insurance in our comprehensive guide.

The Impact of Widespread Industry Challenges

Looking beyond individual claims, several major trends are putting the squeeze on the insurance market. A persistent shortage of experienced drivers means many businesses are forced to hire newer, less-seasoned operators, which statistically elevates the risk of accidents. Insurers see this trend and price their policies more defensively.

Another major factor is the rise of "nuclear verdicts"—shockingly large jury awards in liability lawsuits that can soar into the tens of millions. The mere possibility of a single one of these verdicts forces insurers to raise rates across their entire book of business to build up the necessary financial reserves.

For years, many insurers have been operating at a loss in this sector, with combined loss ratios consistently over 100%. That means the money paid out in claims and expenses is more than the premiums they collect.

In fact, recent data shows commercial auto premiums have seen some of the steepest rate increases across all insurance lines, with average hikes between 9% and 9.8% in just the first half of a single year. This environment, fueled by everything from distracted driving to those massive legal verdicts, is precisely why finding affordable coverage requires a strategic approach.

Key Factors Driving Up Your Commercial Auto Premiums

Understanding these moving parts can help you see your policy through an underwriter's eyes. Here’s a quick summary of the primary reasons your insurance costs keep climbing and what they mean for your business.

| Driving Factor | Impact on Your Premiums | A Proactive Step You Can Take |

|---|---|---|

| Advanced Vehicle Technology | Minor accidents now lead to major repair bills due to expensive sensors and electronics. | Implement rigorous pre-trip and post-trip vehicle inspections to catch small issues early. |

| Soaring Medical Costs | Injury claims are more expensive than ever, increasing the liability risk for every policy. | Invest in driver safety training focused on defensive driving and accident avoidance. |

| Driver Shortages | Hiring less-experienced drivers is seen as a higher risk by insurance carriers. | Create a robust driver screening process, including MVR checks and road tests. |

| "Nuclear" Legal Verdicts | The threat of multi-million-dollar lawsuits forces insurers to increase rates for everyone. | Ensure you have adequate liability limits and consider an umbrella policy for extra protection. |

These factors create a challenging market, but they also highlight where you can make a real difference. By focusing on safety, driver quality, and proactive risk management, you can position your business to stand out from the crowd and earn the better rates you deserve.

Get Real About Your Business Risk—Here’s How

To get a handle on your commercial auto insurance costs, you have to start thinking like an underwriter. This isn't just about making a list of your trucks and drivers. It's about taking a hard, honest look at your day-to-day operations to pinpoint exactly where your risks are. This kind of internal audit does two things: it gives you the hard data you need to negotiate a better rate, and it shines a light on safety issues you can fix today.

This isn't just another pile of paperwork. You're building a story—a case that proves your business is a safer bet than the next one. The more you can show you're on top of your risk, the better your chances are of getting a premium that doesn't break the bank.

Your Drivers Are Your Biggest Risk (or Asset)

Let's be blunt: the people behind the wheel matter more than anything else to an insurer. You could have a fleet of brand-new, top-of-the-line vehicles, but if your drivers have spotty records, your rates will reflect that. That's why you have to start with their Motor Vehicle Records (MVRs).

But don't just collect the MVRs and file them away. Dig in and start sorting your drivers into tiers. It’s a simple system that tells a powerful story.

- Clean Records: These are your best drivers. No violations, no at-fault accidents in the last three to five years.

- A Few Bumps: Maybe they have one or two minor speeding tickets. Nothing major, but not a perfect record.

- High-Risk: This is where you find the serious stuff—a DUI, reckless driving, or a pattern of at-fault accidents.

This simple exercise instantly shows you where your risk is concentrated. Imagine walking into a negotiation and being able to say that 80% of your drivers have clean records. That’s a much more powerful position than if that number is only 50%. Presenting this kind of internal analysis shows you're proactive, not reactive.

Map It Out: Where Are Your Vehicles Going?

Where you drive is almost as important as who is driving. A local flower shop navigating chaotic city streets all day has a totally different risk profile than a regional sales manager who spends most of their time on open highways. Insurers get this, and they price for it.

So, start mapping out your typical routes. What hazards do your drivers face every day?

- Are they in high-traffic city centers with constant stop-and-go?

- Do they travel on poorly maintained or unlit rural roads?

- Are their routes known for high accident rates?

Think about a construction crew. Their trucks are constantly squeezing down tight residential streets and backing into busy, congested job sites. The risk of a minor fender bender or a bigger liability claim is pretty high. Now, compare that to an IT consultant who primarily drives a sedan between suburban office parks. The risk is worlds apart. When you document your actual routes and mileage, you prevent the insurer from just lumping you into a generic high-risk category.

An underwriter’s job is to predict the future by looking at the past. When you give them a clear, factual picture of your operations, you replace their assumptions with your reality. That gives them the confidence they need to offer you a better rate.

It’s Not Just the Truck, It’s What’s Inside

The final piece of the puzzle is understanding what your vehicles do and what they carry. You can't just say you have five "vans." The specific job and the cargo completely change the risk equation.

Let’s look at two businesses that both use identical cargo vans:

- A Local Florist: They're moving lightweight flowers. If there’s an accident, the financial loss on the cargo is pretty small.

- An HVAC Company: Their vans are loaded with expensive copper piping, heavy equipment, and hazardous materials like refrigerant. The potential for a costly claim, both for property and liability, is huge.

Get specific when describing your vehicle use. If your van has a permanently installed carpet cleaning system, that’s a key detail. It tells an insurer that you might need specialized coverage (like an equipment floater) and, more importantly, that you’ve actually thought through your operational risks. This detailed self-audit turns you from someone just asking for a price into a truly informed buyer, ready to secure the affordable coverage your business needs.

How to Shop for Quotes and Compare Policies

Once you've done the internal work of figuring out your business risks, it's time to take that knowledge to the market. But shopping for affordable commercial auto insurance isn't about getting the most quotes—it’s about getting the right ones.

You can't really compare policies apples-to-apples if every insurer is working with different or incomplete information. The goal is to see past the price tag and find the best overall value for your business. That means knowing who to talk to, what to tell them, and how to read the fine print. A cheap premium is great until you find out a critical gap in coverage leaves you exposed after an accident.

Your First Big Choice: Independent Agent vs. Direct Carrier

Before you start dialing, you need to decide how you'll approach the insurance marketplace. You can go straight to individual insurance companies or partner with an independent agent who represents many of them. Each path has its pros and cons, and the best route often comes down to your business's complexity and how much time you can personally sink into the process.

Going Direct to a Carrier

This means you contact insurance companies one by one. While it seems straightforward, it can eat up a lot of your time, and you’ll only ever get one company's perspective. This approach really only makes sense for super simple businesses, like a solo consultant who just uses a personal sedan for work.

Working with an Independent Agent

An independent agent is your advocate in the market. You give them your business info, and they shop it around to a bunch of different carriers to find the best fit. They know the ins and outs of what different insurers look for and can often find specialized programs you’d never stumble upon yourself. For most businesses—especially those with a fleet, unique operations, or a spotty claims history—this is by far the most efficient way to go.

My Two Cents: The real value of a good independent agent isn't just saving you a few phone calls. They're experts at translating your business operations into a risk profile that underwriters will actually like. That expertise often leads to better, more affordable commercial auto insurance in the long run.

The Quote Preparation Checklist

To get accurate quotes you can truly compare, you need to have your ducks in a row before you start the conversation. Showing up unprepared leads to vague estimates based on assumptions, not facts. Get these details ready to make sure every quote is built on solid ground.

- Business Basics: Your official business name, address, and Federal EIN.

- Vehicle Roster: A complete list of your vehicles, including the year, make, model, and VIN for each one.

- Driver Files: A list of every potential driver with their full name, date of birth, and driver's license number.

- How You Operate: A clear description of how your vehicles are used. What’s your typical radius of operation? What do you haul?

- Your Track Record: A record of any claims from the past three to five years. This is often called a "loss run" report, and you can get it from your current or past insurer.

Having this information ready not only makes the process smoother but also shows the agent or carrier that you're a serious, organized business owner. It also dramatically reduces the chance of a surprise premium hike down the road.

Look Deeper Than the Bottom-Line Price

Comparing quotes is about much more than just finding the lowest number. I've seen two policies with nearly identical prices that offered wildly different levels of protection. You have to scrutinize the details to understand what you're actually paying for. It's a methodical approach, much like you'd use for a home and auto insurance comparison for your personal stuff, just with your business assets on the line.

Here’s where to focus your attention:

- Liability Limits: Make sure the liability limits are identical on every quote you compare. A policy with a $500,000 limit is obviously going to be cheaper than one with a $1,000,000 limit, but is that lower amount really enough to protect your entire business?

- Deductible Amounts: Look closely at the deductibles for both collision and comprehensive coverage. A higher deductible means a lower premium, but you have to be sure it’s an amount your business can comfortably pay out-of-pocket on a moment's notice.

- Critical Exclusions: This is where you have to read the fine print. Does one policy exclude coverage for that expensive custom shelving you installed in your van? Does another stop coverage the second you cross state lines? These little exclusions can create massive, devastating gaps.

By digging into these specifics, you shift from simply price-shopping to making a smart, informed business decision. The cheapest policy is almost never the best one; the real goal is finding the most cost-effective coverage that provides rock-solid protection for the unique risks your business faces every day.

Optimizing Your Coverage Without Risking Your Business

When business owners look for affordable commercial auto insurance, they often make a classic mistake: they just pick the cheapest option. But the best policy isn’t the cheapest one—it’s the one with the right coverage for your specific operation. Finding that sweet spot is how you protect your business without overpaying.

Think of your insurance policy as a toolkit. You don't need every tool under the sun, but you absolutely have to have the right ones for the job. This means really understanding the core parts of your policy—liability, collision, and comprehensive—and tweaking them to fit your company's actual financial situation. It’s about being smart, not just cheap.

Strategic Deductible Adjustments

One of the fastest ways to lower your premium is to raise your deductible. This is the amount you agree to pay out-of-pocket on a claim before the insurance company steps in. By taking on a higher deductible, you're telling the insurer you're willing to share more of the upfront risk, and they'll reward you with a lower rate.

But don’t make this call lightly. You have to be brutally honest about your company's cash flow. Could you comfortably cut a check for $2,500 or $5,000 tomorrow if a vehicle gets into a wreck? If that would cause a major financial headache, a lower deductible is the smarter, safer bet, even if the premium is a bit higher.

A great rule of thumb is to set your deductible at the highest amount your business can easily afford to pay without disrupting your day-to-day operations. This single change can often knock 15% to 30% off your collision and comprehensive premiums.

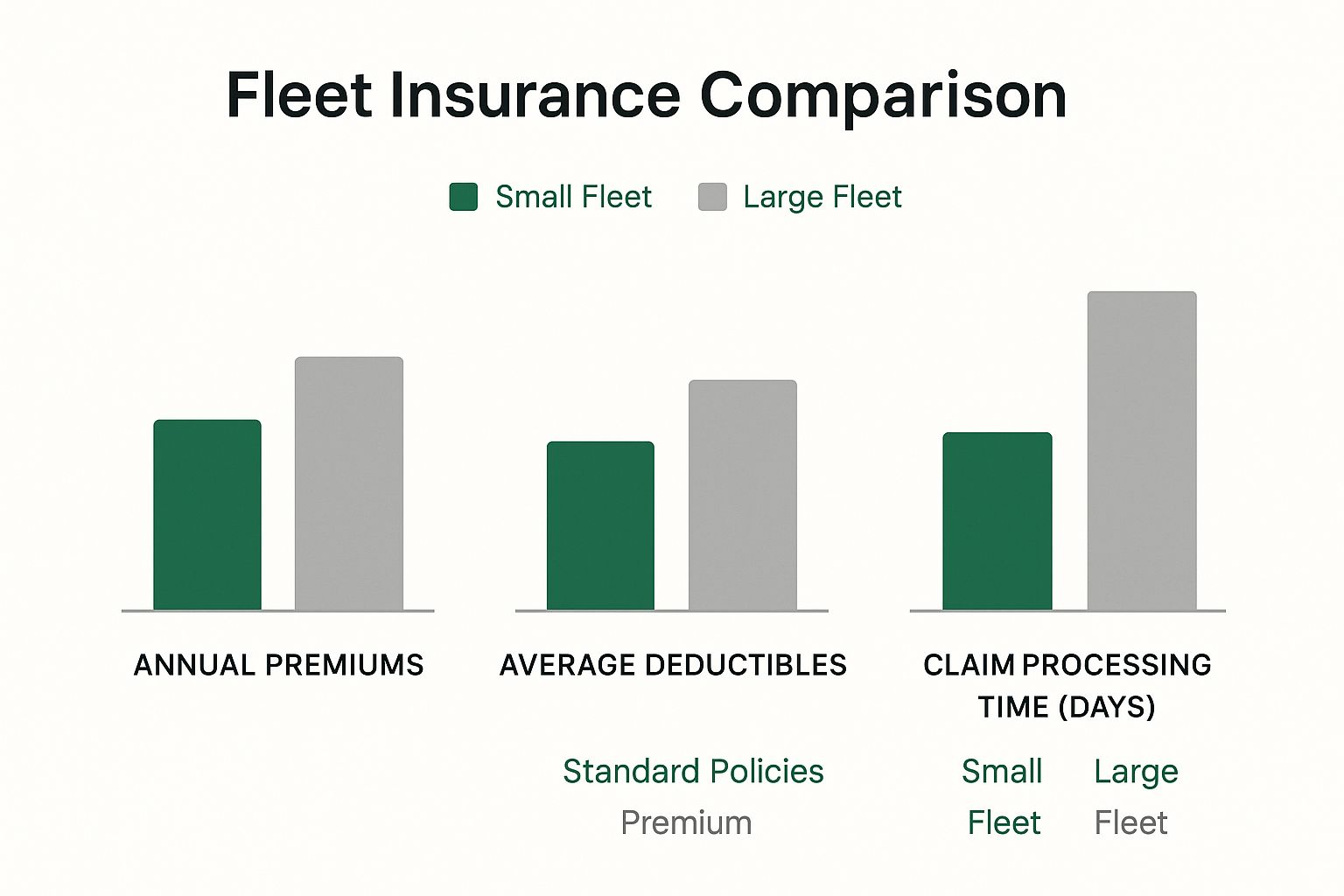

The image below gives a good overview of how different factors, from your fleet size to your policy choices, can directly affect your insurance costs.

As you can see, things like the number of vehicles you operate and the specific coverage you select have a direct, measurable impact on what you'll end up paying.

Getting Liability Limits Right

Your liability coverage is, without a doubt, the most important part of your policy. It’s what protects your entire business if you’re at fault in an accident that injures someone or damages their property. Opting for the state-minimum liability limits is a common—and potentially catastrophic—mistake.

A single bad accident can easily blow past those minimums, which are often just $25,000 or $50,000. Once a claim exceeds your limit, your business is on the hook for the rest. There's a reason commercial policies usually start with $1,000,000 in liability coverage—it’s a realistic shield against a lawsuit that could otherwise sink your company. For a closer look at the basics, our guide on what is commercial vehicle insurance breaks down these core protections.

How Policy Adjustments Impact Your Premiums

Making small changes to your policy can have a big impact on your annual costs. Here’s a quick look at how different adjustments play out in the real world.

| Policy Adjustment | Potential Premium Impact | Who It's Best For |

|---|---|---|

| Increase Deductible | Significant Decrease | Businesses with healthy cash flow that can cover a larger out-of-pocket cost. |

| Lower Liability Limits | Moderate Decrease | Not recommended. The risk of a major lawsuit far outweighs the small savings. |

| Drop Physical Damage Coverage | Significant Decrease | Owners of older, low-value vehicles where the premium costs more than the car is worth. |

| Add Hired & Non-Owned Auto | Slight Increase | Any business where employees use personal cars for work, even for small errands. |

Ultimately, each of these decisions is a trade-off between your monthly cost and your level of financial risk.

When to Add or Skip Extra Coverage

Beyond the big three, you can customize your policy with "endorsements"—add-ons for specific situations. Knowing which ones you truly need helps you build a policy that's both tough and lean.

-

Hired and Non-Owned Auto (HNOA) Coverage: This is non-negotiable if your employees ever use their own cars for work, whether it’s a quick bank run or a client lunch. If they cause an accident on company time, your business could be sued with zero protection without it.

-

Physical Damage Coverage (Collision & Comprehensive): For an old workhorse truck with a low Kelley Blue Book value, paying for full physical damage coverage might be throwing money away. If the truck is only worth $3,000 and your deductible is $1,000, you could easily pay more in premiums each year than you’d ever get from a claim.

-

Cargo Coverage: If you haul goods or expensive equipment, this is a must-have. A standard auto policy covers your vehicle, not what's inside. Picture a plumbing contractor's van getting stolen. Without cargo coverage, all those expensive copper fittings and power tools are just gone—a total loss for the business.

By carefully thinking through each of these components, you stop being a price-taker and become a strategic insurance buyer. You can build a policy that gives you strong protection where it matters most while cutting out the fat, striking that perfect balance between safety and savings.

Finding Savings Through Discounts and Safety Programs

Once you've got the right policy structure, the real work of lowering your premium begins. This is where you go from just buying insurance to actively managing your risk, which is exactly what underwriters love to see.

Insurers are in the business of rewarding safe behavior, and if you can prove you’re a safer-than-average risk, you’ll earn a better rate. It's a two-pronged attack: grabbing every available discount and, more importantly, building a safety-first culture that you can prove on paper.

Don't Leave Money on the Table: Ask for Discounts

Never assume your agent has found every single discount you're entitled to. You often have to ask. A few simple questions can knock a surprising amount off your premium and are a key part of landing more affordable commercial auto insurance.

Make it a point to specifically ask your agent or broker about these common, but sometimes missed, savings:

- Paid-in-Full Discount: This is often the easiest win. Paying your annual premium all at once instead of in monthly installments can often save you 5-10%.

- Continuous Coverage: Have you stuck with the same insurance company for a few years? Loyalty should be rewarded, so make sure you're getting credit for it.

- Bundling: If you have general liability or a Business Owner's Policy (BOP), ask what kind of discount you’d get for placing it all with the same insurer.

- Alternative Fuel: Running electric or hybrid vehicles? Many carriers offer a small break for fleets that are going green.

And don't stop there. The single best question you can ask is, "What else do you have?" You never know what other programs or discounts might be available.

Build a Rock-Solid Fleet Safety Program

A formal, written safety program is probably the most powerful tool you have for convincing an underwriter to give you a better rate. It demonstrates that you're proactive, not reactive, when it comes to risk. You aren't just hoping your drivers are safe—you're making it a core part of your operations.

Creating a documented safety culture isn't just about avoiding claims; it's about proving to your insurer that you're a partner in risk management. A strong program can be the deciding factor between a standard rate and a preferred one.

Implementing these kinds of programs has become essential for controlling costs in a tough market. Even as some parts of the commercial insurance market soften, underwriters remain cautious.

Put Technology to Work for You

Modern tech offers some fantastic ways to improve driver safety and, just as crucially, prove it to your insurer. Yes, there's an upfront cost, but the ROI from lower premiums and fewer accidents can be huge.

Telematics and GPS Tracking

These systems track a driver's real-world habits—things like speeding, hard braking, and sharp turns. This data is gold for coaching your team. Better yet, many insurers offer usage-based insurance (UBI) programs that give you direct discounts, often 15% or more, if your fleet data shows safe driving.

Dash Cams

I can't recommend dual-facing dash cams enough. When an accident happens, that video footage is your best friend. It can instantly clear your driver of fault, shutting down a costly "he said, she said" argument before it starts. Keeping your claims history clean is vital for getting good rates year after year, and it also makes it less likely you'll have to use your higher-level liability coverage. For a deeper dive, check out our guide on what is commercial umbrella insurance to see how that extra layer of protection works.

If You Don't Document It, It Didn't Happen

Here’s the bottom line: a great safety program that isn't documented might as well not exist in an underwriter's eyes. You have to be able to prove it.

Get in the habit of keeping meticulous records. When it's time for your insurance renewal, you should have a file ready to go with:

- Written Safety Policies: Your official company rules on cell phone use, pre-trip inspections, and how to report an accident.

- Driver Training Records: A simple log showing dates, topics covered, and which drivers attended each training session.

- Vehicle Maintenance Logs: Detailed records for every vehicle—oil changes, tire rotations, brake jobs, everything.

- Driver MVRs: Proof that you regularly review the Motor Vehicle Records for everyone who gets behind the wheel of a company vehicle.

When you can hand a comprehensive package like this to an insurer, you immediately stand out from the crowd. You're not just another applicant; you're a professional operation that takes safety seriously. That’s the kind of client who gets the best rates.

Common Questions About Commercial Auto Insurance

Let's face it, diving into commercial auto insurance can feel overwhelming. Business owners are always trying to make smart, cost-effective decisions, but the industry jargon doesn't make it easy.

I've heard these same questions come up time and time again from businesses looking for the right coverage without breaking the bank. Here are some straightforward answers to help you navigate the process with more confidence.

What Is the Single Biggest Mistake Businesses Make?

By far, the most common—and most expensive—mistake I see is businesses underestimating their liability needs. It's tempting to choose state-minimum liability limits just to shave a few dollars off the premium, but that's a massive gamble. In reality, those minimums are almost never enough to cover the costs of a serious accident involving injuries or major property damage.

Imagine a single major claim that blows past your policy limits. Suddenly, your business assets, and sometimes even your personal ones, are on the line to pay the difference.

Choosing a liability limit that truly protects your company from a devastating lawsuit is non-negotiable. The peace of mind that comes with a $1,000,000 liability limit is well worth the modest extra cost in your premium.

Can I Use My Personal Auto Policy for My Business Vehicle?

This is a huge point of confusion, and the answer is almost always a hard no. Personal auto policies are written for personal use, period. They have specific exclusions for most business-related activities, outside of your daily commute.

If you're using a vehicle to haul tools, make deliveries, drive clients around, or if it's registered in your company's name, a personal policy won't cover an accident. Trying to file a business-related claim on a personal policy is a surefire way to get it denied, leaving you holding the bag for all the damages.

How Much Can I Really Save with Telematics or Dash Cams?

The savings here are real and can be significant, often ranging from 5% to 25% on your premiums. The exact amount depends on the insurer and what data you're willing to share, but the benefits go way beyond just a simple discount.

- Telematics: These little devices track driving behavior—things like speed, hard braking, and mileage. This data fuels usage-based insurance (UBI), where safer driving habits are directly rewarded with lower rates. It’s that simple.

- Dash Cams: While you might get a small upfront discount for having them, their true value comes through during a claim. Video footage is your best friend for proving your driver wasn't at fault in an accident, which helps keep your claims history clean and stops future rates from skyrocketing.

Yes, there's an upfront cost for the hardware, but the long-term savings and risk management benefits are undeniable. A clean claims history is one of your most powerful tools for keeping commercial auto insurance affordable.

How Often Should I Review and Shop for My Policy?

As a best practice, you should do a full review of your commercial auto policy at least once a year. The sweet spot is about 60 to 90 days before your renewal date, which gives you plenty of time to shop around and make a switch without rushing.

But an annual check-in isn't the only time to take a look. You need to revisit your coverage anytime your business goes through a major change.

Think about triggers like:

- Adding or getting rid of vehicles

- Hiring new drivers (especially younger ones)

- Expanding your service area

- Changing the kinds of goods or equipment you transport

An annual review ensures your coverage is still a good fit and that your rate is still competitive. Your business is always changing, and your insurance should keep up. This same logic applies to other business risks; you can read more about evaluating the cost of cyber liability insurance to see how different business factors influence other types of policies. Never assume your current insurer is automatically your best option year after year.

Navigating the complexities of commercial insurance doesn't have to be a challenge. At Wexford Insurance Solutions, we specialize in finding the right coverage at the right price, tailored to your unique business needs. Let our expert team simplify the process and help you secure the protection your business deserves.

Essential Guide to General Liability Insurance for Sole Proprietorship

Essential Guide to General Liability Insurance for Sole Proprietorship How to Change Car Insurance Providers: Step-by-Step Guide

How to Change Car Insurance Providers: Step-by-Step Guide