Think of scheduled personal property coverage as a special add-on—an endorsement in insurance terms—that you can attach to your homeowners or renters policy. It’s designed to provide specific, comprehensive protection for your most valuable belongings, like jewelry, fine art, or rare collectibles.

These are the kinds of items where the protection in a standard policy just doesn't cut it.

Understanding the Gaps in Your Standard Policy

Let's walk through a scenario I've seen play out too many times. Your home is burglarized. It's a horrible feeling, but you take some comfort in knowing you have homeowners insurance. When you go to file a claim for your stolen $10,000 engagement ring, you get a nasty surprise: your policy has a maximum payout of only $2,500 for all jewelry.

This is a classic example of a coverage sub-limit, and it's a critical gap in most standard insurance policies.

Insurers place strict caps on what they'll pay for certain categories of valuables. If you don't have extra protection, you're stuck paying the difference yourself. This is exactly the problem that scheduling your valuables is designed to solve. It allows you to individually list each high-value item at its full appraised value, making sure you’re covered for what it’s actually worth. This is a fundamental piece of understanding valuable personal property insurance and how it truly protects the things you care about most.

To really see the difference in action, a side-by-side comparison makes it crystal clear.

Standard vs Scheduled Coverage at a Glance

| Feature | Standard Homeowners Coverage | Scheduled Personal Property Coverage |

|---|---|---|

| Coverage Type | Blanket coverage for general belongings under a single limit. | Itemized coverage for specific, high-value articles. |

| Value Basis | Subject to low sub-limits (e.g., $2,500 for jewelry). | Based on the item's full, appraised "agreed value." |

| Deductible | A policy deductible usually applies to claims. | Often has a $0 deductible, meaning no out-of-pocket cost. |

| Covered Perils | Protects against named perils like fire and theft only. | Typically offers broader "open perils" protection, including accidental loss. |

By scheduling an item, you’re basically creating a mini-policy just for that piece. It provides superior protection that fills in all the holes left by your standard insurance.

You’re transforming your coverage from a one-size-fits-all safety net into a custom-fitted shield for your most important belongings.

Why Your Standard Insurance Policy Isn't Enough

It’s a common assumption: your homeowner's insurance is a safety net for everything you own. But that belief can be a costly mistake, all because of a detail buried deep in the policy fine print: coverage sub-limits.

Think of your personal property coverage like a big bucket. It seems like it can hold a lot, but your policy has separate, much smaller cups inside it for your most valuable items. This isn't a defect in your policy; it's how insurers keep standard premiums from skyrocketing for everyone.

The trouble starts when the value of your prized possessions spills over the top of those tiny cups.

Unpacking Coverage Sub-Limits

Let's say your policy gives you $200,000 in personal property coverage. That sounds like plenty, right? The problem is, that big number is a bit of a mirage. Tucked inside that overall limit, your insurer has placed strict caps on how much they’ll pay out for specific categories of valuables.

Here’s a real-world example of how this plays out. Imagine a house fire destroys your collection, including a $10,000 antique watch. When you file the claim, you discover your policy's sub-limit for all jewelry is just $2,500. Suddenly, you're facing a $7,500 out-of-pocket loss on that one watch alone, even though you thought you had plenty of coverage. The same logic applies to firearms, art, and other collections.

Key Takeaway: Sub-limits are the number one reason a standard policy fails to protect valuables. They create huge financial gaps that can leave you reeling from a loss, even when you thought you were fully covered.

The Financial Reality of Standard Caps

These limits aren't just a hypothetical problem—they are very real and often shockingly low. Many standard homeowners policies put a tight leash on what they'll pay for high-value items. Some common sub-limits you'll find are:

- Jewelry: Often capped between $2,000 and $2,500 for the entire collection.

- Firearms: Typically limited to around $2,000 to $3,000.

- Silverware and Goldware: Usually restricted to about $2,500.

These numbers make it painfully clear how exposed you are if you own heirloom jewelry, a nice engagement ring, or a small collection. You can see more examples of these typical limits in this handy guide to scheduled personal property coverage on policygenius.com.

This is precisely why getting a handle on sub-limits is so important. Standard policies are built to pay you for the depreciated value of everyday items, not their full worth. If you want to dive deeper into this, our guide explains what actual cash value is and how it affects what you get back after a claim.

Without specifically scheduling your valuables, you’re unintentionally gambling with their true value. Scheduled personal property coverage is the only way to close that gap and ensure your most important items are protected for what they're actually worth.

How Scheduled Property Coverage Actually Works

Think of your standard homeowners insurance policy like a big, sturdy tote bag. It's great for carrying most of your stuff, but you wouldn't just toss a priceless family heirloom or an expensive laptop inside and hope for the best. For those special items, you'd want a separate, padded case designed just for them. That's exactly how scheduled personal property coverage functions.

Instead of bundling your most valuable possessions under a broad, generic limit, scheduling them means you create a detailed inventory. This list, or “schedule,” is added as an endorsement to your main policy. Each item is listed one-by-one, right alongside its professionally appraised value.

This brings us to a critical term: "agreed value." Before a claim ever happens, you and the insurance company agree on the exact dollar value of each scheduled item. If your grandmother's diamond ring is appraised at $15,000, that's the number that goes on the policy. Should it get stolen, that's the amount you get—no haggling, no depreciation, no last-minute debates over its worth.

The Power of Broader Protection

Scheduling an item doesn't just guarantee you get its full value back; it fundamentally changes how it's insured. Your basic homeowners policy typically uses a "named perils" approach, which means it only covers losses from a specific list of events, like fire, theft, or a burst pipe. If the cause of the loss isn't on that list, you're out of luck.

Scheduled coverage flips that on its head. It provides "open perils" or "all-risk" protection, which is a massive upgrade. This means an item is covered for any type of loss, unless the cause is specifically excluded in the policy (like a flood or war).

Suddenly, those real-life accidents are covered. Accidentally drop your engagement ring down the sink? Covered. Leave your high-end camera on a train while traveling? Covered. These are precisely the kinds of mishaps a standard policy would never pay for. Getting a handle on these distinctions is a huge part of learning how to read an insurance policy and spotting potential gaps.

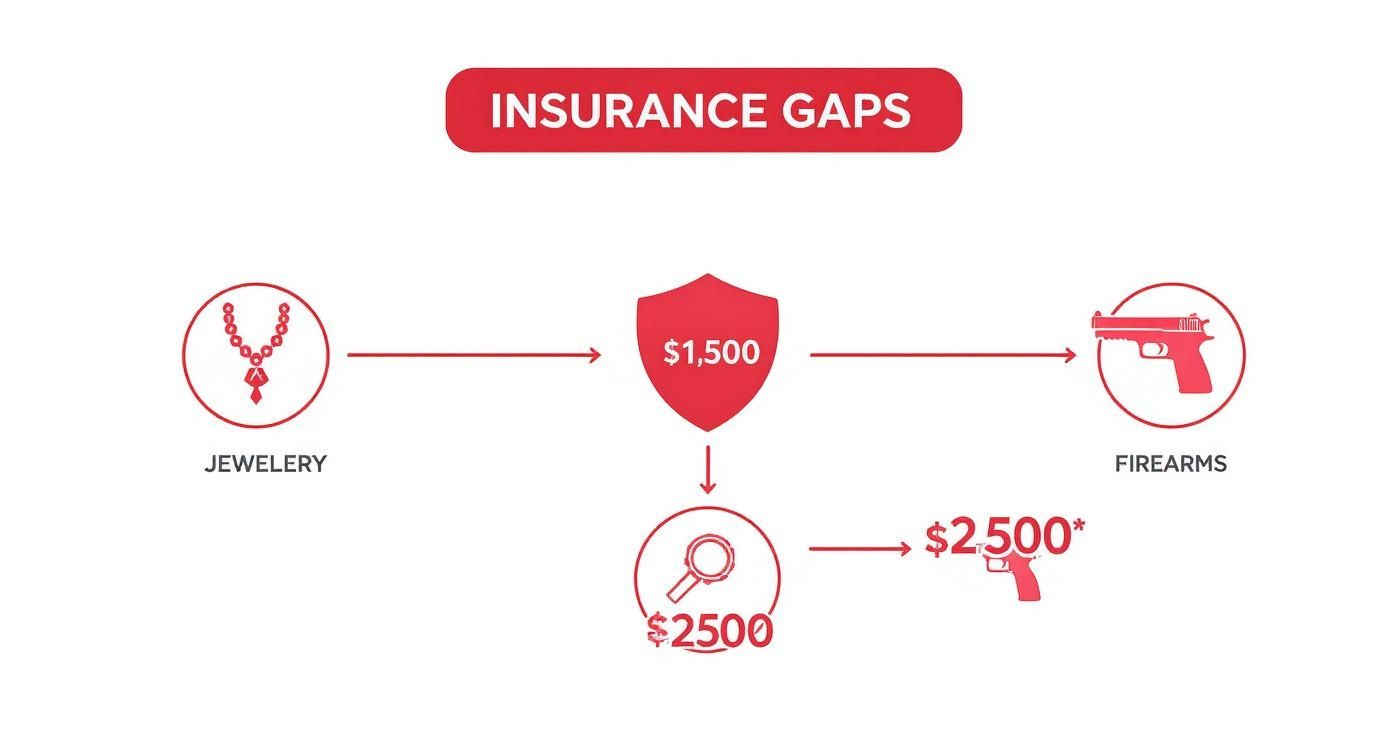

The infographic below really drives home the shortfalls of standard coverage that scheduling is designed to fix.

As you can see, the low sub-limits for things like jewelry or firearms can leave you seriously underinsured if you rely on the base policy alone.

The Nuts and Bolts

So, what does this look like in practice? Here are the core mechanics that make scheduled coverage so different from the blanket protection in a standard policy.

- Itemization is Key: You can't just say "my watch collection." Each individual piece you want to protect has to be listed separately.

- Proof of Value: You'll need to provide a professional appraisal or a very detailed receipt to lock in that "agreed value."

- No Deductible: This is a big one. The vast majority of scheduled item claims have a $0 deductible. If your $5,000 scheduled painting is damaged, you get the full $5,000.

By following this process, you’re essentially creating a set of VIP policies for your most important belongings, giving them the premium protection they need, wherever they happen to be in the world.

Common Items That Need Scheduled Coverage

Now that you've got a handle on how scheduled coverage works, you might be glancing around your own home, wondering what actually needs this extra layer of protection. It’s a great question. While any single item worth more than your policy’s built-in limits is a good starting point, some categories almost always need to be singled out.

Taking stock of these high-value possessions is the first real step to plugging coverage gaps you probably didn't even know you had. Let's walk through the usual suspects that benefit most from being scheduled.

Jewelry and Fine Art

These two are the classics, and for good reason. Your standard homeowners policy might cap jewelry theft at $2,500 total. That's often not enough to cover a single engagement ring, never mind a collection of heirloom pieces or a few luxury watches.

Fine art is in the same boat. Paintings, sculptures, or rare prints can easily blow past the typical personal property limits. Properly insuring fine art is about protecting both its financial and cultural worth from risks that a standard policy just wasn't designed to handle.

Key Insight: Don't just think about single big-ticket items. Scheduling is just as critical for collections where the combined value blows past your policy's sub-limit, even if each individual piece isn't wildly expensive on its own.

Collections and Unique Valuables

It’s easy to build a valuable collection over years without realizing its total worth has crept far beyond your insurance limits. These accumulated treasures often need an expert eye to appraise and insure correctly.

Here are a few common collections that you should seriously consider scheduling:

- High-End Camera Equipment: If you're a professional photographer or a serious hobbyist, you know that the value of cameras, lenses, and specialized gear adds up fast.

- Musical Instruments: That vintage guitar, concert-grade violin, or grand piano holds both sentimental and significant financial value that deserves specific protection.

- Collectible Firearms: Collections of antique or custom firearms almost always have a value that requires them to be scheduled individually.

- Antiques and Silverware: A sterling silver set passed down through generations or a piece of antique furniture are perfect examples of valuables not adequately covered by a standard policy.

- Stamp or Coin Collections: Philatelic (stamp) and numismatic (coin) collections can be surprisingly valuable. If you're a dedicated collector, resources like a Top Coin Insurance Guide 2025: Protect Your Numismatic Collection can be indispensable for protecting these unique assets.

At the end of the day, the rule of thumb is simple. If losing a specific item would be a true financial blow because its value is higher than your policy's built-in caps, it’s a prime candidate for scheduled personal property coverage.

Getting Your Valuables Scheduled Step by Step

Adding a floater or endorsement to your policy for your valuable items is a pretty straightforward process, but it does require some homework on your part. Think of it as creating a detailed file for each of your prized possessions. Putting in this effort upfront is exactly what guarantees you’ll get their full value back if you ever need to make a claim.

The whole idea boils down to a simple, powerful concept: proving an item's value before anything happens to it. This proactive approach prevents a lot of headaches and potential disagreements down the road for both you and your insurance company.

To get your items officially listed, just follow these simple steps.

Step 1: Start With a Home Inventory

First things first, you can't protect what you don't know you have. Take a walk through your home and make a list of all the high-value items that you suspect might be worth more than your policy's standard limits. We're talking about jewelry, art, collectibles, firearms, and high-end electronics.

If you have a lot of items, it might be a good idea to utilize home inventory management software to keep everything organized. It makes documenting everything much easier and can be a lifesaver if you ever need to file a claim. Once you've got your list, you're ready for the most important step.

Step 2: Get a Professional Appraisal

For most valuables, your insurance company is going to ask for a professional appraisal. This isn't just a casual estimate; it's a formal, detailed document from a certified expert that outlines an item's specific features and assigns it a retail replacement value. This is non-negotiable for most insurers.

Why is this so important? An appraisal establishes an agreed-upon value before a loss, which protects everyone involved. It might seem like an extra hoop to jump through, but it's what ensures a smooth claims process later.

Finding the right appraiser is crucial. You want someone with credentials from a recognized organization, like the American Society of Appraisers or the Gemological Institute of America (GIA) for jewelry. For a deeper dive, check out our guide on jewelry appraisal for insurance.

Step 3: Submit Your Documents and Lock It In

With your appraisal complete, the final step is to send everything over to your insurance agent. Along with the appraisal itself, they'll likely ask for:

- Detailed photos of the item from a few different angles.

- The original sales receipt, if you still have it.

- Any certificates of authenticity that came with the piece.

Once your insurer reviews and approves everything, they'll calculate the premium for adding the item to your policy. The cost is usually a set rate for every $100 of insured value. For instance, if the rate is $1.50 per $100 and you're scheduling a $10,000 watch, you'd pay an extra $150 a year for that item.

It's a small price to pay for the peace of mind that comes from knowing your most treasured assets are fully protected, no matter what.

So, Do You Actually Need Scheduled Property Coverage?

Figuring out if you need this extra protection isn't as complicated as it sounds. It really just boils down to taking a hard look at what you own and what it's worth.

First, make a quick list of your most valuable items. Think about your jewelry, any art you've collected, high-end electronics, or anything else that might be subject to a special limit on your standard policy. Now, add up their total value.

How does that number stack up against the built-in cap on your homeowner's or renter's policy? For categories like jewelry, that limit can be surprisingly low—sometimes just $2,500.

If the total value of your collection is way over that limit, you're looking at a serious coverage gap. That gap is precisely why people start looking for scheduled personal property coverage; it’s designed to fill that specific financial hole.

A Tale of Two Claims

Let's make this real. Imagine two neighbors who each own a $12,000 engagement ring. Unfortunately, a burglar hits both of their homes.

- Neighbor A decided to stick with their standard homeowner's policy, which had a $2,500 sub-limit for jewelry. After the theft, they file a claim and get a check for $2,500. They're left to cover the remaining $9,500 loss themselves.

- Neighbor B had the foresight to schedule their ring for its full $12,000 appraised value. When they file their claim, they receive a check for the full amount. And since many scheduled policies come with a $0 deductible, they can replace their ring without any financial stress.

The difference here is stark. The small annual premium Neighbor B paid to schedule their ring is nothing compared to the $9,500 loss Neighbor A suffered. It's a clear-cut case of a small investment providing massive financial security.

At the end of the day, it's your call. But you have to weigh the modest yearly cost of adding a rider against the risk of a huge, uninsured loss. If you do the math and find a significant gap, it's time to talk to your insurance agent. Getting a quote to schedule your valuables is a simple step that can buy you a whole lot of peace of mind.

A Few Common Questions

When you start digging into the details of insurance, a few questions always seem to pop up. This is especially true for something like scheduled personal property. Let's tackle some of the most common ones I hear from clients.

Getting these answers straight can make all the difference in deciding how to protect your most valuable items.

Does Scheduled Property Coverage Have a Deductible?

This is where one of the biggest benefits of scheduling really shines. For the most part, scheduled personal property coverage comes with a $0 deductible. It's a huge plus.

Think about it: if your scheduled $10,000 watch disappears, the insurance company cuts you a check for the full $10,000. You don't have to pay a dime out of pocket first. Compare that to your standard homeowners policy, where you’d likely have to eat a $500 or $1,000 deductible before seeing any money.

How Often Should I Get My Valuables Reappraised?

This is a crucial question. You want to make sure your coverage keeps up with the actual value of your items. The market for fine art, vintage watches, or even rare wine can change pretty dramatically. A good rule of thumb is to get your scheduled items reappraised every three to five years.

However, if you own things with a more volatile market value—think certain collectibles or hot-ticket designer jewelry—you might want to do it every two years just to be safe. You never want the "agreed value" on your policy to be less than what it would cost to replace the item today.

Pro Tip: I always tell my clients to set a calendar reminder for this. A simple alert every couple of years to check on your appraisals can save you from being seriously underinsured down the road.

Can I Get This Coverage with Renters Insurance?

Yes, absolutely. Don't think for a second this is just for homeowners. Scheduled personal property coverage is simply an endorsement, which is insurance-speak for an add-on. You can add it to most standard renters insurance policies without any issue.

This is so important for renters who might have a high-end camera, a valuable musical instrument, or an engagement ring. Remember, your landlord's policy covers the building, not your stuff. Scheduling your prized possessions gives you the exact same itemized, top-tier protection a homeowner gets.

Protecting your most cherished and valuable possessions shouldn't be a headache. At Wexford Insurance Solutions, we specialize in finding the right coverage to fit your unique needs, ensuring your valuables are protected for their true worth. Contact us today for a personalized review of your insurance needs.

A Guide to professional liability insurance for consultants

A Guide to professional liability insurance for consultants HNWI: financial planning for high net worth individuals

HNWI: financial planning for high net worth individuals