Figuring out how to choose the right homeowners insurance really boils down to three key things: getting an honest read on your home's value and specific risks, smartly comparing quotes from solid insurers, and checking out those companies to make sure they're financially stable and have a good service reputation. Follow that path, and you'll land on the right coverage without overpaying.

Getting Started with Homeowners Insurance

Let's be honest, diving into homeowners insurance can feel like a chore. It's a world filled with confusing jargon and what seems like a million different options. But getting this right is about so much more than just satisfying your mortgage lender. It’s about creating a financial backstop that can help you rebuild your life if the worst happens.

A great policy doesn’t just cover the sticks and bricks of your house. It protects your personal belongings, your financial well-being, and, frankly, your sanity. The key is to see it as a clear roadmap, not an intimidating maze. When you break it down into a few manageable steps, the whole process feels a lot less overwhelming.

A Clear Framework for Success

First things first: you need to understand what you're actually protecting. This isn't about your home's market value or what you paid for it. It's about the replacement cost—the actual dollar amount it would take to rebuild your home from scratch today. You’ll also want to take stock of your personal belongings and flag any unique risks, like a swimming pool, a trampoline, or even a home-based business, that might need extra coverage.

Once you have that needs-list, you can start shopping around. But a word of caution: the cheapest quote is almost never the best deal. Real value comes from a policy with comprehensive coverage, offered by a company that's financially sound and known for paying claims without a hassle. For a closer look at what goes into a policy, our guide on what home insurance explained breaks it all down.

Expert Insight: Your main objective should be to find a dependable insurer that matches your specific coverage needs. A rock-bottom premium means nothing if the company drags its feet—or worse, denies your claim—when you need them most.

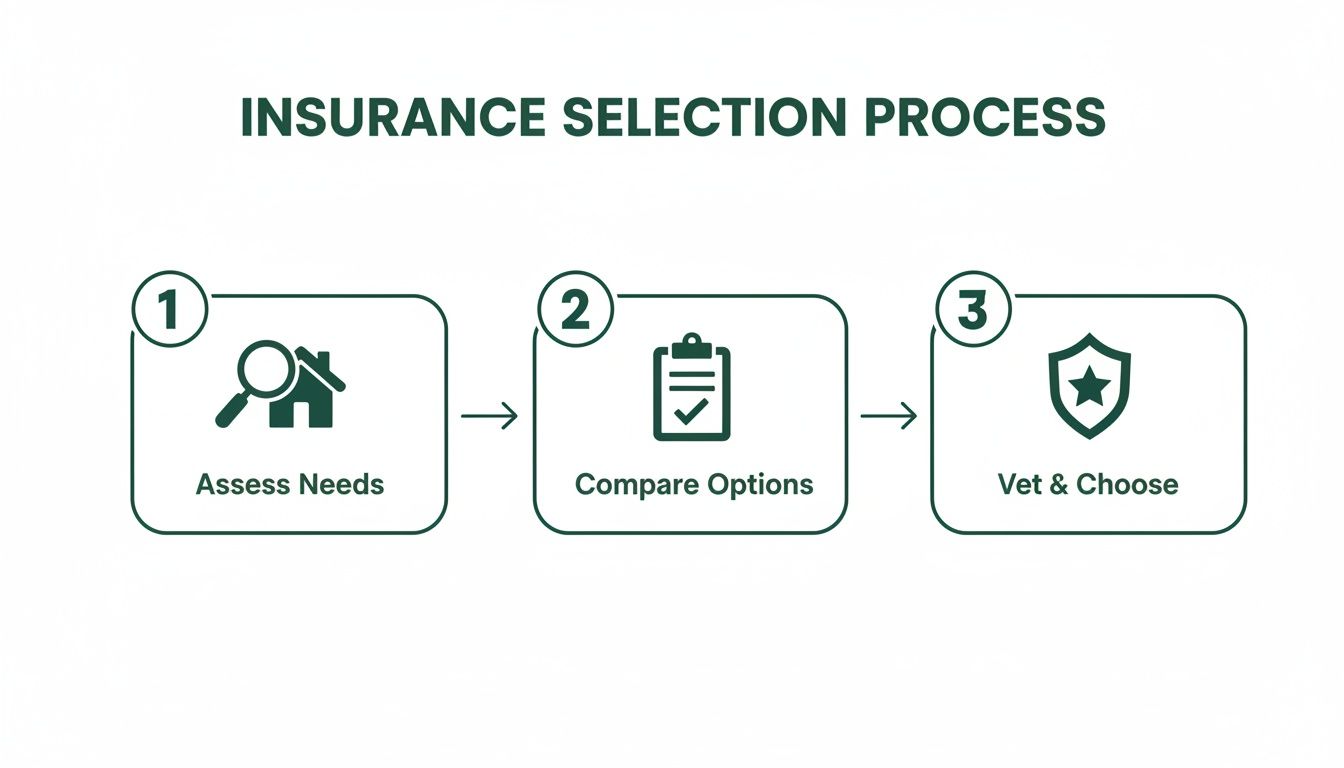

This simple visual breaks the selection process down into three logical stages.

As you can see, the process flows from figuring out what you need, to comparing your options, and finally to vetting the insurer before you make your final choice.

To keep everything straight, here’s a quick checklist to guide you through the process.

Your Homeowners Insurance Selection Checklist

| Action Step | Key Focus | Why It Matters |

|---|---|---|

| Assess Your Needs | Replacement Cost, Personal Property Value, Unique Risks | This ensures your coverage limits are high enough to fully rebuild and replace everything you own, preventing you from being underinsured after a total loss. |

| Compare Quotes & Policies | Coverage Types, Limits, Deductibles, Endorsements | Comparing apples-to-apples allows you to see the true value behind the price, focusing on protection rather than just the premium. |

| Vet the Insurer | Financial Ratings (e.g., A.M. Best), Customer Service, Claims Process | A company's ability to pay claims and provide good service is just as important as the policy itself. This step confirms you're choosing a reliable partner. |

Treating this like a project with clear steps—Assess, Compare, and Vet—is the best way to move from feeling uncertain to feeling confident you've made the right decision for your home and family.

Understanding Your Core Coverage Needs

Choosing homeowners insurance can feel like trying to decipher a foreign language, but it boils down to real-world protection for your home, your stuff, and your financial well-being. At its core, a standard policy rests on a few key pillars. Once you understand what each one does, you're well on your way to building a policy that actually has your back.

The main pieces of the puzzle are Dwelling Coverage, Personal Property Coverage, and Liability Coverage. Think of them as three different shields, each protecting a critical part of your life.

Protecting the Structure Itself: Dwelling Coverage

Dwelling coverage is what pays to rebuild or repair your house—the walls, the roof, the foundation, and anything attached, like a garage or a deck. The single most important thing to get right here is setting your coverage limit to your home's replacement cost, not its market value.

This is a crucial distinction. Market value is what a buyer would pay for your house, which includes the land. Replacement cost is what a contractor would charge to rebuild your home from scratch with similar materials at today's prices. Those two numbers are rarely the same.

Key Takeaway: Insuring your home for its market value is one of the most common and expensive mistakes I see. If your home is a total loss, the cost to rebuild could easily eclipse what you paid for it, leaving you to cover a massive gap out-of-pocket. Always, always focus on the cost to rebuild.

So how do you figure that out? A good estimate will account for:

- Local construction costs: Labor and material prices swing wildly from one zip code to another.

- Your home's features: Got custom cabinets, high-end flooring, or unique architectural details? Those all add to the rebuild cost.

- Square footage and layout: A larger, multi-story home is simply more expensive to put back together.

Covering Your Belongings: Personal Property

Picture this: a pipe bursts and soaks your entire living room, ruining your new sofa, TV, and that antique rug you inherited. This is exactly what personal property coverage is for. It protects everything inside your home—from furniture and clothes to electronics and kitchen gadgets.

When you're looking at this part of your policy, you'll face a critical choice between two ways of getting paid after a claim.

- Actual Cash Value (ACV): This pays you what your stuff was worth right before it was damaged, factoring in depreciation. That $1,500 laptop you bought five years ago? An ACV policy might only give you $300 for it today.

- Replacement Cost Value (RCV): This pays you enough to go out and buy a new, similar item. With RCV, you get the money for a brand-new laptop with comparable features. It puts you in a much better position to get back to normal.

RCV coverage does cost a little more, but in my experience, it's worth every penny. It allows you to actually replace what you lost without draining your savings. Our detailed guide to home insurance coverage types breaks all of this down even further.

Shielding You from Lawsuits: Liability Protection

Liability coverage is your financial backstop if someone gets hurt on your property and you're held responsible. For instance, if a delivery driver slips on your icy front steps, this coverage helps pay for their medical bills and your legal defense if they decide to sue. It’s a lifesaver.

Most standard policies come with between $100,000 and $500,000 in liability protection. Frankly, with the cost of healthcare and litigation these days, I advise most clients to carry at least $300,000 to $500,000. If you have significant assets to protect, a separate umbrella policy is an absolute must.

While your policy is there for when things go wrong, proactive steps like implementing home preparedness strategies for drought and storms can prevent a disaster in the first place. Taking the time to secure your property not only minimizes risk but also shows insurers you’re a responsible homeowner—which never hurts.

Customizing Your Policy With Deductibles and Endorsements

A standard homeowners policy is a fantastic starting point, but it's rarely a perfect, one-size-fits-all solution. I like to think of it as a quality suit off the rack—it provides the basic structure, but you need a tailor to get the fit just right. That’s exactly what deductibles and endorsements do for your insurance. They let you customize the coverage to match your life and financial reality.

This part of the process is all about striking a smart balance. You’re weighing your monthly premium against what you could comfortably pay out of pocket if something went wrong. It's a strategic decision that has a real impact on your budget and, just as importantly, your peace of mind.

Setting Your Deductible

Simply put, your deductible is the portion of a claim you cover before the insurance company steps in. Imagine a kitchen fire causes $15,000 in damage. If your deductible is $1,000, you pay that first $1,000, and your insurer handles the other $14,000. It’s your share of the risk.

The trade-off is straightforward: a higher deductible usually means a lower premium, and vice-versa. The trick is finding that sweet spot. You want a deductible high enough to bring down your monthly cost but low enough that you could write a check for it tomorrow without breaking a sweat. If you want to get into the nitty-gritty, you can learn more about how insurance deductibles work in our detailed guide.

This balancing act is more important than ever. Industry data shows that between 2024 and 2025, the average deductible on home policies jumped by a staggering 24.5%. We're seeing this a lot in high-risk areas where carriers are trying to manage the rising costs of severe weather. The 2025 Home Insurance Report has some eye-opening insights on this trend.

Pro Tip: Don't automatically default to the lowest deductible. A better approach is to ask yourself, "What's the most I could comfortably pay out-of-pocket without raiding my emergency savings?" That figure is often the perfect starting point for your deductible.

Adding Protection With Endorsements

Endorsements, which you might also hear called riders, are add-ons that patch up common gaps in a standard policy. No base policy covers absolutely everything, and these endorsements are designed to protect against specific risks that apply to your home and lifestyle.

Here are a few common ones I often recommend, along with real-world situations where they are absolute lifesavers:

- Water Backup Coverage: Picture this: a heavy storm overwhelms the city sewer system, and suddenly your beautifully finished basement is flooded. Standard policies almost always exclude this type of damage, but a water backup endorsement can cover the thousands of dollars needed for cleanup and repairs.

- Scheduled Personal Property: Do you own a $10,000 engagement ring or a valuable collection of antique firearms? Your base policy likely has surprisingly low limits for items like jewelry (often just $1,500). By "scheduling" these items, you insure them for their full, appraised value.

- Service Line Coverage: The main water pipe that runs from the street to your house cracks under your driveway. Most people don't realize that repairing this line is the homeowner's responsibility, and it can be a shockingly expensive job. This endorsement helps cover that unexpected cost.

- Home-Based Business Coverage: If you run an online shop from home and store $20,000 in inventory in the garage, you're underinsured. A standard policy offers minimal coverage for business property. This endorsement boosts those limits to protect your business assets.

By thoughtfully choosing your deductible and adding the right endorsements, you turn a generic policy into a personalized shield. It’s a critical step in building an insurance plan that truly has your back.

Shopping Around: How to Compare Home Insurance Quotes the Smart Way

Once you’ve nailed down the coverage you need, it's time to hit the market. Getting quotes is easier than ever, but the real art is in comparing them effectively. Let's be honest, it’s tempting to just grab the cheapest option, but that's one of the biggest mistakes you can make when trying to choose the right homeowners insurance.

True value isn't just about the premium; it's about finding bulletproof protection at a fair price. You have to look past that initial number and dig into the nitty-gritty of what each quote actually offers. I’ve seen it time and again: a policy that costs a little more upfront ends up being the better deal because it already includes critical endorsements you’d otherwise have to pay extra for.

Where to Start Getting Your Quotes

You've got a few different paths you can take to gather quotes, and knowing the pros and cons of each will make your shopping strategy much stronger.

- Independent Agents: Think of them as your personal insurance shopper. They work with a bunch of different insurance companies, which means they can bring you multiple options and help you weigh them against each other. It’s a huge time-saver.

- Captive Agents: These agents work for one specific insurance company. They know their company's products inside and out, so they’re a great choice if you’re already loyal to a particular brand.

- Direct Insurers: You can always go straight to the source by getting quotes from company websites or by calling them directly. This puts you in the driver's seat, but it also means you’re on your own when it comes to the heavy lifting of comparing everything.

My advice? Mix it up. An independent agent can give you a great baseline comparison, and you can round out your search by getting a quote from a big-name direct insurer they might not represent.

Making a True Apples-to-Apples Comparison

When the quotes start hitting your inbox, it's easy to feel a bit swamped. The trick is to get organized so you’re comparing more than just price tags. Even a simple spreadsheet can be a game-changer here.

Your main goal is to make sure every policy you're looking at is on a level playing field. It's not about what you pay; it's about what you get for what you pay. We go into even more detail in our guide on how to compare home insurance quotes.

Use this checklist to make sure you’re comparing fairly:

| Comparison Point | What to Look For |

|---|---|

| Dwelling Coverage (Coverage A) | Are the limits identical? Make sure all quotes are based on 100% of your home's replacement cost. |

| Personal Property (Coverage C) | Is it Replacement Cost (RCV) or Actual Cash Value (ACV)? RCV is what you want. No exceptions. |

| Liability Coverage | Are the limits the same? Check if they’re all quoting $300,000 or $500,000. |

| Deductibles | Look at the standard "All Other Perils" deductible and any special ones for wind or hurricanes. |

| Included Endorsements | Does one policy automatically include things like water backup coverage while others make it an add-on? |

Laying it all out like this will quickly show you which policy gives you the most bang for your buck, helping you make a decision based on value, not just price.

Must-Ask Questions for Your Agent

A good agent is your best asset in this process. They can translate the confusing jargon and offer insights you’ll never find on a website. Don't be shy—ask the tough questions to uncover any potential red flags or hidden gems.

Expert Takeaway: A great agent should welcome your questions. If they get dodgy or can’t give you a straight answer, that’s a major red flag. It tells you a lot about the kind of service you’ll get when it really matters.

Here are a few critical questions to have in your back pocket:

- What discounts are included in this quote, and are there any others I might be eligible for?

- What’s the claims process like with this company? If I have a claim, who is my point of contact?

- How have this company’s rates changed in my area over the past three years?

- Are there any special limits on valuables, electronics, or business equipment that I need to know about?

The answers you get will give you a much clearer picture of both the policy and the insurer behind it. That insight is vital, especially now. Over the past five years, global insurance premiums have grown by an average of 8% each year, mostly from rate hikes as carriers manage soaring claims costs. You can learn more about these market shifts from these global insurance report insights on mcksey.com. Asking about rate stability helps you see what your costs might look like down the road.

Evaluating an Insurer's Reliability and Financial Health

You've done the hard work of comparing quotes and tailoring policies, but don't skip the final, crucial step: vetting the company behind the numbers. A rock-bottom price from a shaky insurer is a terrible deal. When you're facing a crisis and need to file a claim, you're not just a policy number; you're a homeowner depending on that company to make good on its promise. You need a partner who will actually be there when it counts.

The insurance industry is always in flux, reacting to everything from global economic shifts to the unfortunate rise in severe weather events. This is why some insurers are tightening their belts while others are competing hard for your business. It’s a complex market, but a few key indicators can tell you a lot about an insurer’s true strength.

Decoding Financial Strength Ratings

Before you sign anything, you need to check an insurer’s financial report card. Independent rating agencies do this for you by digging into a company's financial records, business practices, and its real-world ability to pay claims today and tomorrow.

Think of these ratings as a stress test. A company with a top-tier rating has proven it can handle major catastrophes, like a widespread hurricane or wildfire, without crumbling.

Look for ratings from these trusted sources:

- A.M. Best: This is the gold standard for insurance. You're looking for companies with an “A” rating or better (like “A-,” “A,” or “A++”).

- Moody’s: An "A" rating or higher from Moody’s is another strong signal of financial security.

- Standard & Poor’s (S&P): Just like the others, an “A” or better from S&P shows an insurer is on solid ground.

Key Takeaway: Never settle for an insurer with a weak financial rating, no matter how tempting the premium. A company rated "B" or lower could struggle to pay claims after a large-scale disaster—exactly when you need them most.

Gauging Customer Satisfaction and Complaint History

Financial stability is only half the battle. The other half is how an insurer actually treats its customers. You want a company known for a smooth, fair, and responsive claims process, not one that gives you the runaround.

A great place to start is the National Association of Insurance Commissioners (NAIC) Complaint Index. This tool measures how many complaints an insurer gets relative to its size. A company with a complaint ratio above 1.0 receives more complaints than average, which is a definite red flag. A score below 1.0 is what you want to see.

Beyond that, consumer satisfaction surveys from organizations like J.D. Power offer fantastic insights into the real customer experience, from buying a policy to filing a claim. These reports reveal patterns in communication and payment speed that you’ll never find in a company's marketing materials.

Understanding Market Trends and Insurer Behavior

The overall health of the insurance market directly impacts your options and pricing. For example, as of Q3 2025, the global property insurance market has entered a 'soft' phase, with lots of competition driving down rates. But at the same time, insured losses from natural catastrophes topped $100 billion globally in the first half of 2025 alone, forcing some governments to expand mandatory coverage. You can dive deeper into these trends in Aon's global insurance market overview for Q3 2025.

This volatility is why insurers keep a close eye on their loss ratio—the ratio of claims they pay out versus the premiums they collect. A consistently high loss ratio can be a sign of financial trouble. To learn more about this crucial metric, check out our guide on what a loss ratio in insurance means.

By choosing an insurer that's financially sound and has a strong service record, you’re doing more than just buying a policy; you're securing a reliable financial partner for your home.

Finalizing Your Policy and Staying Protected

You’ve done the hard work of comparing quotes and have a great policy picked out. Now it's time to cross the finish line. These final steps aren't just about signing papers; they’re about making sure the protection you think you're getting is exactly what's on the page.

Your first move is to carefully read the policy declaration page. Think of this as the "cheat sheet" for your entire policy. It’s a one-page summary that lists all your coverage limits, deductibles, and any special endorsements you added. Double-check that every number and detail matches what you and your agent agreed upon. You don't want any last-minute surprises.

Making It Official and Staying Prepared

Once you've confirmed all the details are correct, the next step is getting your payment set up. Ask about discounts—many insurers will knock a bit off your premium if you pay the full year upfront or enroll in autopay. It’s an easy win.

While you're at it, take two minutes and save two numbers in your phone: your agent's direct line and the insurer's 24/7 claims hotline. When an emergency hits, the last thing you want to do is hunt for a phone number.

This is also the perfect time to create a quick home inventory. It sounds like a chore, but it's incredibly simple. Just walk through your house with your smartphone and take a video of everything you own—from the TV and sofa to the contents of your closets. If you ever have to file a major personal property claim, this video will be invaluable.

Key Takeaway: Your homeowners insurance is not a "set it and forget it" product. Life changes, and your policy must change with it. An annual review is essential for maintaining proper protection.

Why an Annual Review Isn't Optional

Life doesn't stand still, and neither should your insurance coverage. It's crucial to schedule a quick check-in on your policy at least once a year.

Think about what might have changed. Did you finally finish that kitchen remodel? Build a new deck? Inherit expensive jewelry? These kinds of updates almost always increase your home's replacement cost. Without adjusting your coverage, you could find yourself seriously underinsured after a major loss.

Knowing your policy is one thing, but it’s also smart to know what to do in a crisis. Having a plan for what to do in case of a burst pipe, for example, can help minimize the damage and make the claims process go much smoother. A yearly review keeps your coverage, and your emergency plan, up to date.

A Few Lingering Questions

Even with a solid game plan, a few questions almost always come up when you're zeroing in on the right homeowners policy. Getting these sorted out can give you the confidence to make a final decision. Let’s tackle a few common ones I hear from clients all the time.

How Often Should I Really Be Shopping for Home Insurance?

My rule of thumb is to give your policy a quick once-over every single year. Did you finish the basement? Buy a valuable piece of art? These are the kinds of life changes that demand a coverage check-in.

But when it comes to actively shopping the market and getting new quotes? Plan on doing that every two to three years. It's the best way to keep your current insurer honest and see what else is out there. Of course, if you get a renewal notice with a shocking rate hike that doesn't make sense, that’s your cue to start shopping immediately. Don't just auto-renew without seeing if you can do better.

A Pro's Take: In the insurance world, loyalty is a nice idea, but it doesn't always translate into savings. Insurers' rates and risk appetites are constantly shifting. Regularly testing the market is just smart financial hygiene to make sure you’re not leaving money on the table.

Is Filing a Claim Guaranteed to Raise My Premium?

It’s a definite "maybe." The answer really depends on the why and how often behind the claim. A single, major claim after a hurricane rolls through your town is viewed very differently than, say, three small water damage claims in two years. Multiple small claims can paint a picture of a high-risk property, which is a red flag for insurers.

Before you call in a claim for something minor, I always advise clients to do the math. How much is the repair going to cost versus your deductible? If the repair bill is only a few hundred dollars more than what you have to pay out-of-pocket, you might be better off handling it yourself. This keeps your claims history clean, which can save you a lot more on your premium in the long run.

What's the Real Difference Between Market Value and Replacement Cost?

This is probably the single most important concept to get right, and where I see the most confusion.

- Market Value: Think of this as the "Zillow" number. It’s what someone would pay for your house and the land it sits on in today's real estate market, factoring in things like location and school districts.

- Replacement Cost: This is purely about the structure. It’s the dollar amount needed to rebuild your home from scratch, using the same quality of materials, at today's labor and supply costs. It completely ignores the value of your land.

You must insure your home for its 100% replacement cost. No exceptions. Relying on market value is one of the biggest and most financially devastating mistakes a homeowner can make. If a fire levels your home, the cost to rebuild can easily exceed its market value, leaving you on the hook for a massive shortfall.

Choosing the right insurance isn't just a transaction; it's about securing your peace of mind for the long haul. At Wexford Insurance Solutions, we pair our hands-on experience with data-driven insights to build a policy that truly protects what you’ve worked so hard for. Explore your personalized insurance options today.

What Is a Premium Audit for Business Insurance

What Is a Premium Audit for Business Insurance What is waiver of subrogation and how it protects your contracts

What is waiver of subrogation and how it protects your contracts