It’s a classic mistake, and one that could cost you everything: thinking the Zillow estimate on your home is the number you need for insurance. The reality is, what your home might sell for and what it costs to rebuild it from the ground up are two completely different things. A homeowners insurance replacement cost estimator is built to calculate the rebuild cost, which is often much higher than you'd think.

Why Your Home's Market Value Isn't Your Rebuild Cost

Let's get one of the most dangerous myths in home insurance out of the way. Your home's market value has almost nothing to do with its replacement cost. They are calculated differently for entirely different reasons, and confusing them can leave you financially exposed if you ever have to file a major claim.

Think about it: market value is what a willing buyer would pay for your house and the land it sits on. It's driven by things like school districts, curb appeal, neighborhood comps, and the current real estate buzz. None of that matters when you're talking about the actual price of lumber and labor after a fire.

What Really Drives Rebuilding Expenses

A proper replacement cost estimate cuts through all the real estate market noise. It focuses on one thing: the cold, hard cash needed to reconstruct your home after a disaster.

This isn't just about putting up four walls. The calculation gets deep into the nitty-gritty of construction costs, including:

- Materials: The going rate for lumber, roofing, drywall, and copper wiring, which can swing wildly from year to year.

- Labor: What it costs to hire skilled carpenters, plumbers, and electricians in your specific zip code.

- Debris Removal: Before a single new nail is hammered, the rubble from your old home has to be hauled away, and that’s a hefty bill on its own.

- Building Codes: Your new home won't be rebuilt to the standards of 1985. It has to meet today’s codes, which often means expensive (but necessary) upgrades.

Here's the bottom line: your insurance policy covers the structure, not the dirt it sits on. Since a fire doesn't destroy the land, its value is completely ignored when calculating how much you need to rebuild the house.

If you own a home in Florida or New York, you've seen this in action at renewal time. The homeowners insurance replacement cost estimator is what your carrier uses to figure out the price tag for rebuilding with current local materials and labor—not what you paid for the house a decade ago. It's a big number. In fact, total U.S. replacement costs hit an eye-watering $31 billion last year, pushed by supply chain snags and labor shortages that have hiked structural costs by nearly 30% in just five years. This recent report on rebuilding costs paints a pretty stark picture.

Replacement Cost vs. Market Value at a Glance

Let's break this down side-by-side. Getting this distinction right is the first and most important step to making sure you're properly insured.

| Factor | Replacement Cost | Market Value |

|---|---|---|

| Primary Focus | Cost to rebuild the structure | Price a buyer would pay for the property |

| Key Influences | Labor, materials, building codes | Real estate trends, location, land value |

| Land Value | Excluded | Included and often a major component |

| Depreciation | Not a factor in the calculation | A factor, as older homes may sell for less |

The gap between these two figures widens even more when you factor in a different valuation method called Actual Cash Value (ACV). Unlike replacement cost, ACV policies subtract depreciation for age and wear, which can slash your payout dramatically. We break this down completely in our guide explaining what is actual cash value. This is a critical point—an ACV policy might only give you enough to rebuild a fraction of your home, whereas a replacement cost policy is designed to make you whole again.

Getting an Accurate Estimate for Your Home

Using a homeowners insurance replacement cost estimator seems simple enough, but the old saying "garbage in, garbage out" has never been more true. The quality of the estimate you get is only as good as the information you put in. So, before you start plugging in numbers, the first job is to gather the right details about your property.

This means you need to know more than just a ballpark idea of your home's size. You need the exact livable square footage. You can usually find this on your original appraisal, property tax records, or the home's blueprints. Getting this number wrong is probably the single most common mistake, and it can easily throw your final estimate off by tens of thousands of dollars.

Gathering Your Home’s Key Details

Once you've nailed down the square footage, it's time to build a detailed profile of your home. The more specifics you can provide, the more reliable that initial estimate will be.

Here are the essential details you’ll want to have ready:

- Year Built: This tells the estimator a lot about the original construction methods and materials.

- Construction Type: Is your home a standard wood frame? Or does it have brick veneer, vinyl siding, or stucco? Each material comes with a different price tag.

- Roofing Material and Age: An asphalt shingle roof costs far less to replace than architectural shingles, slate, or metal. The age is also a big factor.

- Number of Stories and Rooms: Be specific about the number of bedrooms and, just as important, the number of full and half bathrooms. Plumbing work isn't cheap.

- Foundation Type: Do you have a slab, a crawl space, or a full basement? If it's a basement, is it finished?

- Attached Structures: Don't forget to include things like attached garages, porches, or decks in your calculation.

It might take a little digging to find all this, but your closing documents or a recent property appraisal are your best friends here. They offer an objective record of your home’s features.

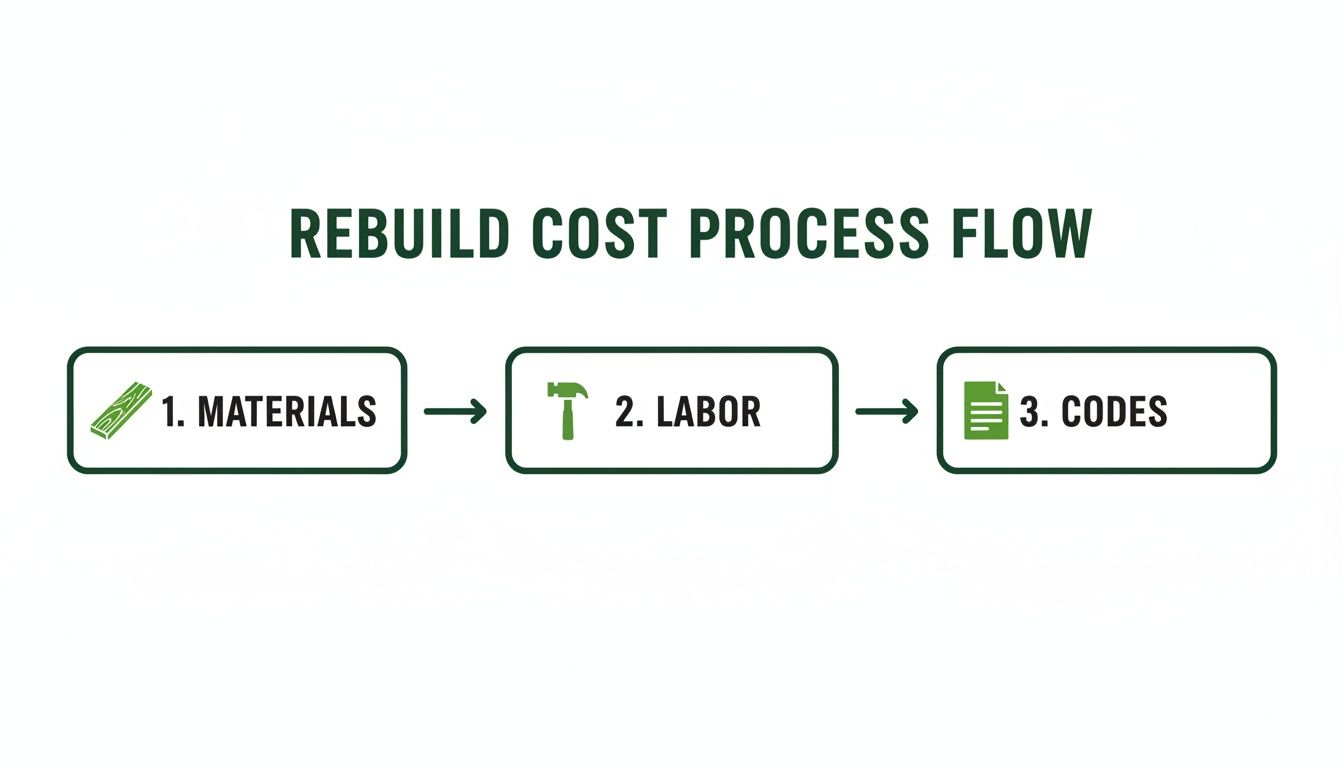

From a contractor's point of view, the rebuild cost is a mix of a few key components, as this flowchart shows.

As you can see, it’s not just about the cost of lumber and drywall. Labor costs and the need to comply with modern building codes are huge factors that drive the final price.

Special Features and Upgrades Matter

This is where many online estimators can fall short. They're great at pricing out a standard, builder-grade home, but they often struggle to account for the unique features and upgrades that make your house your home.

Think through any renovations you've done. Did you put in custom kitchen cabinets, granite countertops, or high-end hardwood floors? Those materials cost significantly more than the basic options, and you need to make sure they're included in the estimate.

Here's a real-world example: A basic estimator might value your kitchen replacement at $25,000. But if you've put $70,000 into a custom remodel, that $45,000 difference creates a massive coverage gap you’d be stuck paying for yourself after a disaster.

Make a list of other special features, such as:

- Fireplaces, especially if they involve custom stone or brickwork

- High-end, built-in appliances

- Specialized windows, like impact-resistant glass if you're in a coastal area

- Smart home technology or advanced security systems

To really understand how a single part of your home can affect the total cost, check out this ultimate guide to roof replacement cost estimators—it's a great deep dive into one of the most expensive components.

A Sanity Check with a Manual Calculation

While the online tools are convenient, I always recommend doing a quick manual calculation as a sanity check. It gives you a solid baseline to compare the estimator's results against and helps you spot if something is way off.

The formula is pretty straightforward:

Your Home's Square Footage x Local Cost Per Square Foot to Build = Estimated Replacement Cost

The only tricky part is finding a realistic "cost per square foot" for new construction in your specific area. A quick online search for "new construction cost per square foot in [Your City]" is a good start, but local home builder associations are often the best source for accurate, up-to-date numbers.

Let’s run a quick example. Say your home is 2,500 square feet, and the average building cost in your town is $175 per square foot:

2,500 sq. ft. x $175/sq. ft. = $437,500

This $437,500 is your rough baseline. If an online homeowners insurance replacement cost estimator spits out a number like $300,000, that’s a red flag that something important was probably missed.

For a more detailed walkthrough, our guide on how to calculate home replacement cost breaks it down even further. Just remember, both the online tools and this manual check are starting points—they're not a replacement for a professional review from an insurance expert.

What Really Drives Your Home's Rebuild Cost?

Getting an accurate number from a homeowners insurance replacement cost estimator is about much more than just square footage. It's a deep dive into dozens of variables, and each one can swing your final rebuild cost by thousands of dollars. If you don't get this right, you could be left with a massive financial gap when you need your coverage the most.

Here's something that catches a lot of homeowners off guard: local labor rates. You might be surprised to learn that costs can vary dramatically even between neighboring counties. A shortage of skilled electricians or roofers in your specific town will push reconstruction costs way up compared to a region with plenty of available labor. This is the kind of hyper-local detail a generic online calculator often misses.

Materials, Finishes, and Local Quirks

The quality and type of materials in your home are obviously huge cost drivers. A standard asphalt shingle roof is in a completely different price universe than a slate or copper roof. The same goes for siding—vinyl is affordable, but if you have brick veneer or stone, that premium expense has to be factored in.

Your specific location adds another layer of complexity. For instance:

- Coastal Homes: If you're in a hurricane-prone area, you likely have specialized high-impact windows and reinforced roofing. These aren't just nice-to-haves; they're often required by code and cost substantially more to replace.

- Historic Districts: Living in a historic district means you might be legally required to rebuild with period-specific materials and techniques. Sourcing these materials and finding artisans who can do the work can be incredibly expensive.

- High-End Finishes: That custom cabinetry in the kitchen, the marble countertops, the imported hardwood floors—all of these carry a much higher price tag than the builder-grade finishes found in many homes.

Details like these are exactly why your neighbor’s insurance premium might be climbing while yours stays put. The estimator ties your premium to the real cost of rebuilding your specific home today. Nationwide, the average dwelling coverage limit has hit $443,430. Older homes often feel the pinch the most; a 1955 house insured for $300,000 sees an average premium of $2,110, while a new build with modern safety features might only be $1,220.

To give you a better idea, let’s look at how specific materials can influence the final number.

How Home Features Impact Your Rebuild Estimate

This table shows how different material choices can really add up, impacting the total cost to rebuild your home.

| Home Feature | Standard Material (Cost per sq. ft.) | Premium Material (Cost per sq. ft.) | Estimated % Impact on Total Cost |

|---|---|---|---|

| Roofing | Asphalt Shingle ($5 – $8) | Standing Seam Metal ($14 – $22) | 5% – 15% |

| Exterior Siding | Vinyl ($4 – $7) | Brick Veneer ($15 – $28) | 8% – 18% |

| Flooring | Laminate ($3 – $7) | Genuine Hardwood ($10 – $18) | 4% – 10% |

| Windows | Double-Pane Vinyl ($25 – $50) | Hurricane-Impact Wood ($70 – $120) | 10% – 20% |

| Countertops | Laminate ($20 – $40) | Quartz or Marble ($75 – $150) | 2% – 7% |

As you can see, opting for premium materials in just a few key areas can easily add tens of thousands of dollars to your replacement cost, highlighting why a one-size-fits-all approach just doesn't work.

The Hidden Costs: Building Codes and Demand Surge

Two of the most frequently overlooked factors are modern building codes and post-disaster demand surge.

If your home was built 20 years ago, it will not be rebuilt to those old standards after a total loss. Today's codes demand major upgrades in electrical wiring, plumbing, insulation, and structural integrity.

These code-required upgrades aren't optional—they are legally required to get a certificate of occupancy. If your policy doesn't account for them, you could face a devastating financial shortfall.

This is where having the right kind of coverage becomes critical. Standard policies often have very limited payouts for these mandatory upgrades. You can learn more about how ordinance or law coverage fills this crucial gap, protecting you from paying for expensive, legally-required updates out of your own pocket.

Finally, there’s the unpredictable-but-powerful factor of demand surge. After a major event like a hurricane or wildfire, the demand for contractors, labor, and building materials skyrockets in the affected region. This can inflate local construction prices by 20-30% or more, practically overnight.

A properly calculated replacement cost should include a buffer for this potential inflation. An experienced insurance advisor will always factor in this surge pricing to make sure you aren't left underinsured right when you need your policy the most.

Common Mistakes That Lead to Underinsurance

Using a homeowners insurance replacement cost estimator is a great starting point, but I’ve seen firsthand how easy it is to make small missteps that create huge coverage gaps. These seemingly minor errors can leave you seriously underinsured, forcing you to pay tens of thousands out of pocket when you can least afford it. Knowing where homeowners typically go wrong is the key to making sure your policy will actually protect you.

One of the most frequent mistakes we see is completely forgetting about structures that aren't attached to the main house. It’s a classic case of focusing on the primary dwelling and overlooking other valuable parts of the property.

Forgetting Other Structures on Your Property

Your standard homeowners policy has a separate coverage limit for "Other Structures," which is often a default percentage, like 10% of your main dwelling coverage (Coverage A). This bucket of money is meant to protect things that aren’t physically connected to your home.

Commonly forgotten structures include:

- Detached Garages: These are expensive to rebuild, especially if you have a finished workshop or apartment above.

- Sheds and Outbuildings: Even a simple garden shed can cost thousands to replace once you add up materials and labor.

- Fences and Retaining Walls: The bill to replace hundreds of feet of fencing or a large retaining wall can be a real shock.

- In-ground Swimming Pools: After a fire, you’re not just replacing water. You’re rebuilding the concrete, liner, and all the equipment.

If that default 10% isn't enough to cover everything, you're underinsured from day one. You absolutely have to tally up the value of these structures and ask to increase your coverage if needed.

Underestimating Your Finishes and Upgrades

Another major pitfall is treating all finishes as equal. A generic homeowners insurance replacement cost estimator might assume you have standard, builder-grade materials, leading to a massive undervaluation if you’ve invested in premium upgrades.

Think about what it would really cost to replace what you have. Custom kitchen cabinets are worlds apart in cost from off-the-shelf options from a big-box store. The same goes for high-end flooring like imported Italian tile or wide-plank hardwood versus basic laminate.

A simple rule of thumb: If you've renovated or upgraded, your rebuild cost is higher than your neighbors' in a similar, non-renovated home. You must account for every dollar you've invested to avoid a coverage shortfall.

Make a detailed list of these premium features. This isn't just for getting an accurate estimate; that documentation becomes invaluable proof when you’re filing a claim.

Overlooking the "Soft Costs" of Rebuilding

So many homeowners focus entirely on the sticks and bricks, completely missing the substantial "soft costs" involved in a total rebuild. These are the necessary expenses that aren't materials or labor but are absolutely required to get the job done.

These hidden costs can add up fast and include things like:

- Debris Removal: Before a single nail is hammered, the remains of your old home have to be safely cleared and hauled away. For an average-sized home, this can easily cost $15,000 to $30,000 or more.

- Architectural and Engineering Fees: You'll need brand-new blueprints and plans drawn up to meet current building codes.

- Permits and Inspection Fees: Your local municipality will charge for building permits and the various inspections required throughout the process.

These expenses are almost never included in a basic per-square-foot calculation and have to be factored in to see the true cost. Identifying these potential shortfalls is a key part of a professional insurance gap analysis, which ensures every angle of a potential loss is covered. By getting ahead of these common mistakes, you can adjust your policy to reflect the actual cost of making you whole again after a disaster.

How Your Dwelling Coverage Shapes Your Premium

It's natural to wonder how the numbers from a replacement cost estimate translate into what you actually pay for insurance. The connection is quite direct: the more it would cost to rebuild your home from the ground up, the higher your annual premium will be.

From an insurer's perspective, this makes perfect sense. A more expensive home represents a greater financial risk they have to cover. The result of your replacement cost calculation sets the limit for your dwelling coverage—often called Coverage A—which is the absolute foundation of your homeowners policy.

Think of your dwelling coverage limit as the maximum amount the insurance company will pay to reconstruct your house. A homeowners insurance replacement cost estimator is the tool that lands on this all-important number. An accurate estimate ensures your Coverage A is sufficient, and that figure, in turn, has the biggest impact on your premium.

This isn't just about paying more for more protection. It's about paying the right amount for the protection you genuinely need. Trying to lower this number just to get a cheaper premium is a classic mistake. It's a gamble that could leave you underinsured by tens or even hundreds of thousands of dollars if you ever face a total loss.

The Direct Link Between Coverage and Cost

The math is pretty straightforward. A home with a rebuild cost of $500,000 will naturally have a higher premium than a similar home estimated at $300,000. The insurer's potential payout is much larger, and the premium has to reflect that increased risk. This is precisely why getting the replacement cost right is so critical—it's the main driver of what you pay.

Of course, your home's value isn't the only factor. Location plays a huge role. For example, a severe storm can flatten homes across Nebraska, where significant weather risks have driven average premiums to $5,203—a 10% increase in just one year.

On a national level, you might pay around $2,110 a year for a policy with $300,000 in dwelling coverage. But that figure jumps to an average of $3,210 for a $500,000 home, clearly showing how directly the replacement cost influences your rate.

Your premium isn't an arbitrary number. It's a carefully calculated reflection of risk, with the estimated cost to rebuild your home carrying the most weight. A higher premium for higher dwelling coverage is simply a necessary investment in your financial security.

Understanding this relationship is crucial. To get a better handle on what this specific part of your policy does, our guide explaining what is dwelling coverage breaks it all down. It really helps clarify why this figure is the cornerstone of your entire insurance plan.

Smart Strategies to Manage Your Premium

Just because a higher replacement cost means a higher premium doesn't mean you're stuck. You still have plenty of control over the final cost of your policy. The goal is always to find that sweet spot between rock-solid protection and a price that fits your budget—without ever cutting corners on your dwelling coverage limit.

Here are a few practical ways to dial in your policy's cost:

- Adjust Your Deductible: This is one of the most common levers. Choosing a higher deductible—the amount you pay out-of-pocket on a claim—can lower your annual premium. Moving from a $1,000 deductible to $2,500, for instance, could lead to significant savings.

- Bundle Your Policies: Insurance carriers love when you keep your business with them. Bundling your home and auto insurance almost always comes with a substantial discount and is one of the easiest ways to save.

- Install Protective Devices: Think smoke detectors, security systems, and water leak sensors. These devices reduce the odds of you filing a claim, and many insurers will reward you with a nice little discount for having them.

At the end of the day, using a homeowners insurance replacement cost estimator correctly sets the foundation. From there, these strategies help you build the smartest, most cost-effective policy for your specific needs, making sure you're fully protected without overpaying.

Ensuring Your Policy Is Accurate and Optimized

A good homeowners insurance replacement cost estimator is a fantastic starting point. It gives you a solid ballpark figure for your home's rebuild value, which is far better than guessing. But honestly, these online tools are just that—a starting point. They simply can’t account for all the unique details of your property or the specific market quirks that a seasoned insurance pro has seen time and time again.

This is where you build real peace of mind. It’s not about plugging numbers into a calculator; it's about getting a professional validation that turns a rough estimate into an ironclad policy.

Going Beyond the Basic Calculator

Think of an online estimator like a GPS mapping out a route. It's incredibly useful, but it has no idea that a local parade has shut down Main Street. An expert, on the other hand, is like a local who knows every back road and shortcut, making sure you get where you need to go without a hitch.

At Wexford Insurance Solutions, we take that initial estimate and sharpen it. We use sophisticated tools and, more importantly, our deep-rooted knowledge of local construction markets, especially in places like New York and Florida. We dig into the details that standard calculators almost always miss:

- Regional Material Sourcing: We know where local contractors get their lumber and drywall and how those supply chains affect pricing right now.

- Labor Rate Nuances: The cost of skilled labor in Miami-Dade County is worlds apart from the Hudson Valley. We adjust your estimate to reflect what’s actually happening on the ground in your specific area.

- Permitting and Code Specifics: We're intimately familiar with the building codes and permitting fees in your town, which can tack on significant, unexpected costs to a rebuild.

By layering this kind of granular, location-specific data onto the initial estimate, we transform a simple number into a truly reliable valuation.

The Professional Review Process

Once we've nailed down an accurate replacement cost, the next step is making sure it fits into your broader financial protection strategy. Having the right dwelling coverage is the foundation, but a truly great policy has other critical parts that all need to work together.

Our process is a comprehensive review, where we look at your policy from every angle to spot weak points and find opportunities for better, more efficient protection.

This isn't just about selling you a policy; it's about building a fortress around your most valuable asset. The goal is to ensure that if the worst happens, you have the exact resources needed to rebuild your life without compromise.

To really feel confident in your dwelling coverage, it helps to understand what your policy covers and have a practical guide to navigating property insurance claims handy for when you might need it. This knowledge empowers you to see exactly what your policy is designed to do.

A Policy That is Both Comprehensive and Cost-Effective

Our whole goal is to strike the perfect balance. Your policy needs to be robust enough to handle a total loss without forcing you to drain your savings. At the same time, it needs to be structured smartly to keep your premiums from breaking the bank.

Here’s how we do it:

- Validate Your Dwelling Coverage: First things first, we confirm your Coverage A is spot-on using our advanced tools and local know-how.

- Optimize Deductibles: We’ll walk you through selecting a deductible that gives you real savings on your premium without creating an unaffordable hurdle if you have to file a claim.

- Identify All Available Credits: From security system discounts to bundling savings, we hunt down every single credit you’re entitled to.

- Advise on Endorsements: We explain critical add-ons, like Ordinance or Law coverage, that protect you from the hidden costs of mandatory code upgrades during a rebuild.

What you're left with is more than just an insurance policy. It's a carefully crafted protection plan, validated by experts, and designed to give you absolute confidence that you’re ready for whatever comes your way.

Ready to move beyond a generic estimate and get a professionally validated insurance plan? The experts at Wexford Insurance Solutions are here to provide a complimentary review of your current coverage and ensure your home is protected with a policy that is both comprehensive and cost-effective.

Visit us to get started: https://www.wexfordis.com

Financial Planning for Small Business Owners A Practical Guide

Financial Planning for Small Business Owners A Practical Guide 8 Crucial General Liability Claims Examples for Business Owners in 2025

8 Crucial General Liability Claims Examples for Business Owners in 2025