The difference between actual cash value and replacement cost boils down to a simple, yet critical, concept: Actual Cash Value (ACV) pays for the current, depreciated value of your damaged property. In contrast, Replacement Cost (RC) gives you the funds to buy a brand-new, similar item at today's prices. This single distinction can mean the difference between a smooth recovery and a significant financial shortfall after a claim.

Understanding Your Insurance Payout Options

When you file a claim, the valuation method buried in your policy's fine print is what drives the final payout. It's not a trivial detail; it’s the engine that determines how much money you’ll actually receive to rebuild or replace your possessions. Deciding between ACV and RC is one of the most fundamental choices you'll make, impacting everything from the roof over your head to the couch in your living room.

Let's put this into a real-world context. Say a kitchen fire destroys your five-year-old refrigerator, which you originally purchased for $1,500.

- An ACV policy would have the adjuster calculate the fridge's current worth. After five years of use and depreciation, they might say its actual cash value is only $600. Your payout, after the deductible, is based on that lower number.

- An RC policy, on the other hand, gives you enough to go out and buy a new, comparable refrigerator, which might still cost around $1,500. This policy is designed to put you back in the same position you were in before the fire, minus your deductible.

ACV vs RC Quick Comparison

To help you see the differences at a glance, here’s a straightforward breakdown. This table cuts through the jargon to show you exactly how each type of coverage works in the real world.

| Feature | Actual Cash Value (ACV) | Replacement Cost (RC) |

|---|---|---|

| Payout Calculation | Cost to replace minus depreciation (age, wear and tear). | Cost to replace with a new, similar item (no depreciation deduction). |

| Claim Payout Amount | Lower; reflects the item's current market value. | Higher; covers the full cost of a new replacement. |

| Premium Cost | Generally lower. | Generally higher. |

| Best For | Policyholders seeking lower premiums who can afford potential out-of-pocket costs. | Policyholders wanting to fully restore or rebuild without a financial gap. |

This simple choice has profound financial implications. An ACV policy almost always has a lower premium because the insurer's maximum exposure is less. But that savings comes with a trade-off. An RC policy costs more upfront, but it delivers true peace of mind, ensuring you can restore your life to its pre-loss state without draining your savings.

The core promise of insurance is to make you whole again after a loss. Replacement Cost coverage is designed to fulfill that promise literally, while Actual Cash Value indemnifies you for the value of what you lost—which are two very different financial outcomes.

Ultimately, the choice comes down to one question: after a disaster, do you want a check for what your property was worth, or a check for what it will cost to replace it? Your answer is the key to building a policy that truly protects your financial future.

Understanding How Your Insurance Policy Values Your Property

When you file a claim, how much will you actually get paid? The answer to that critical question comes down to how your insurance policy values your property. It all hinges on two fundamental methods: Actual Cash Value (ACV) and Replacement Cost (RC). They might sound alike, but the difference in the final payout can be staggering.

Before we get into the nuts and bolts, it’s crucial to have a solid handle on what your property is truly worth. Getting this right from the start is the only way to ensure your coverage is adequate. For high-value or unique items, you may even need to assess authenticity, provenance, and worth before you even think about insurance. This groundwork is what prevents the painful discovery of being underinsured right when you need the coverage most.

What Is Actual Cash Value?

Think of Actual Cash Value (ACV) as the "fair market value" or "used" price of your property. It’s what your item was worth the moment before it was damaged, and that means one thing: depreciation. The insurance company starts with what it would cost to replace your item today and then subtracts value for its age and the wear-and-tear it’s seen over the years.

Depreciation is simply the loss of value over time. A 10-year-old roof, for instance, has protected your home through a decade of storms and sun. It’s not worth the same as a brand-new roof, and an ACV policy reflects that reality. The payout you receive is for the value of the old roof, not the cost of a new one.

Key Insight: The math is simple but its impact is huge: Replacement Cost – Depreciation = Actual Cash Value. This formula almost guarantees your insurance check won’t be enough to buy a brand-new replacement, leaving you to pay the difference yourself.

Because the insurer’s potential payout is lower, ACV policies come with a more budget-friendly premium. That can be appealing, but it’s a trade-off. You’re essentially betting that you’ll have the cash on hand to cover the gap if you ever have a major claim. To get a better feel for how this works in the real world, it helps to understand what is actual cash value in greater detail.

What Is Replacement Cost?

Replacement Cost (RC) coverage works on a much more straightforward principle: it pays what it costs to replace your damaged property with a new, similar item. Period. It completely ignores depreciation. The goal is to restore you to the same position you were in before the loss, using today's materials and prices.

Let’s go back to that 10-year-old roof. If it’s destroyed in a storm and you have an RC policy, your insurance will pay the full cost to have a new roof installed, less your deductible. You aren't penalized for the fact that the old roof had a decade of life behind it. This is the most direct route to getting back on your feet without having to drain your savings.

Here’s a quick breakdown of how they stack up:

- ACV Pays For: The item's value in its current, depreciated state.

- RC Pays For: The cost to replace the item with a brand-new one.

- ACV's Financial Hit: You'll likely face an out-of-pocket expense to cover the depreciation gap.

- RC's Financial Goal: To make you whole again by covering the full cost of a new item.

This greater level of protection is why Replacement Cost policies have higher premiums. The insurance company is shouldering a much larger financial risk. For most people, though, that higher premium is a small price to pay for the peace of mind knowing a catastrophe won't turn into a personal financial crisis.

How Insurance Payouts Work in the Real World

Knowing the dictionary definitions of Actual Cash Value (ACV) and Replacement Cost (RC) is one thing. Seeing how they play out when you actually file a claim is something else entirely. The valuation method on your policy doesn't just change the size of your insurance check—it dictates your entire financial path to recovery after a disaster.

Many homeowners don't grasp just how much depreciation can gut their payout until they're mid-claim, staring at a massive gap between what the insurance company paid and what it actually costs to fix things. Let's walk through a real-life example to make this crystal clear.

The ACV Payout: A Real-World Scenario

Imagine a hailstorm wrecks your 15-year-old roof. It has a typical 25-year lifespan, and the contractor’s quote to replace it is a firm $20,000. You have an Actual Cash Value policy with a $1,000 deductible.

Here’s a breakdown of how the adjuster will almost certainly calculate your settlement:

- Determine Replacement Cost: The cost to put a brand new, similar roof on your house today is $20,000.

- Calculate Depreciation: Your roof has been in service for 15 of its expected 25 years. That means it has lost 60% of its value (15 / 25 = 0.60). In dollar terms, the depreciation is $12,000 ($20,000 x 0.60).

- Find the Actual Cash Value: The ACV is simply the replacement cost minus all that depreciation: $20,000 – $12,000 = $8,000.

- Apply the Deductible: Finally, they subtract your deductible from the ACV: $8,000 – $1,000 = $7,000.

So, for a new $20,000 roof, you get a check for $7,000. You’re now on the hook for the remaining $13,000 out of your own pocket. This is the stark, often surprising, reality of an ACV policy.

The Replacement Cost Payout: A Two-Step Process

Now, let's run that exact same scenario, but this time you have a Replacement Cost policy. This is where people often get confused because the payout usually comes in two parts.

Step 1: The Initial ACV Payment

Right off the bat, the insurance company will cut you a check for the actual cash value of your damaged roof, just like in the first scenario. You’ll receive an initial payment of $7,000 ($8,000 ACV – $1,000 deductible). This first check is meant to get the ball rolling with your contractor.

Step 2: Recovering the Depreciation

Here’s the game-changer. Once you've actually replaced the roof and sent the insurance company the final invoice, they release the money they held back for depreciation—that $12,000. This is called recoverable depreciation. You get a second check, bringing your total payout to $19,000 ($20,000 – $1,000 deductible). For a deeper dive into this entire journey, check out our guide on the homeowner insurance claim process.

The Critical Differentiator: With Replacement Cost, your only out-of-pocket cost is your deductible. With Actual Cash Value, you’re paying your deductible plus the entire amount of depreciation.

This became painfully obvious to thousands of people after Superstorm Sandy caused $70 billion in damages. Many discovered their ACV policies, which often use formulas like ACV = Replacement Cost × (Useful Life Remaining / Total Useful Life), left them with checks that covered only 40-60% of what it took to rebuild.

Side-By-Side Claim Comparison: Personal Property

The same logic applies to your personal belongings, not just the structure of your home. Let's say a kitchen fire destroys your high-end refrigerator.

| Feature | ACV Claim Scenario | RC Claim Scenario |

|---|---|---|

| Item | 5-Year-Old Refrigerator | 5-Year-Old Refrigerator |

| Cost of New Replacement | $3,000 | $3,000 |

| Depreciation (50%) | -$1,500 | -$1,500 (Initially withheld) |

| Actual Cash Value | $1,500 | $1,500 (Initial payment) |

| Deductible | -$500 | -$500 |

| Initial Payout | $1,000 | $1,000 |

| Recoverable Depreciation | $0 | $1,500 (Paid after you buy a new one) |

| Total Payout | $1,000 | $2,500 |

| Your Out-of-Pocket Cost | $2,000 | $500 (Your deductible) |

The table makes it obvious. The RC policy makes you whole again, allowing you to buy a new fridge by covering its full cost minus your deductible. The ACV policy leaves you with a $2,000 hole in your budget. This is the practical, dollars-and-cents difference between these two types of coverage.

Choosing the Right Coverage for Your Situation

The theoretical difference between Actual Cash Value and Replacement Cost gets very real, very fast when you’re the one filing a claim. There’s no single "right" choice here; the best fit depends entirely on your financial picture, the kind of assets you're protecting, and frankly, your personal tolerance for risk. Let’s move past the definitions and dig into how these coverages actually play out for different people.

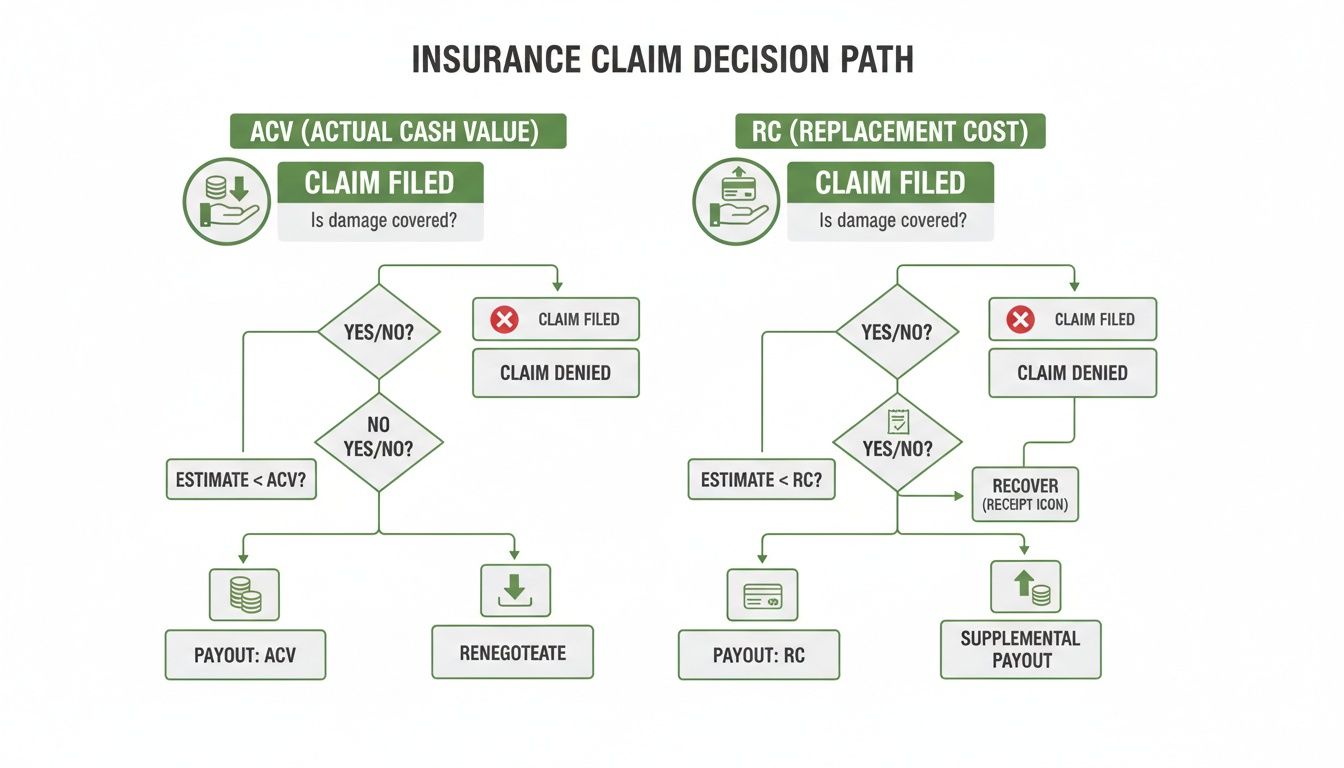

This decision tree clearly shows the fork in the road. An ACV claim path is a straight shot to a single payment. The RC path, however, often involves a second, crucial payment after you've actually done the repair or replacement work.

As you can see, Replacement Cost gives you the opportunity to recover the depreciation, which is the key to having enough cash in hand to be made whole again after paying your deductible.

The First-Time Homeowner in a High-Risk Area

For anyone buying their first home, especially if it's in a place vulnerable to disasters like hurricanes or wildfires, Replacement Cost (RC) coverage is non-negotiable for the house itself. Your home is almost certainly your biggest asset, and most new homeowners don’t have a massive cash reserve to bridge the gap if a claim payout falls short.

Think about it: after a catastrophe like Hurricane Irma, which caused over $50 billion in damages in 2017, the difference between these two policies becomes painfully clear. A $10,000 roof that’s 10 years old might only get you a $3,000 check from an ACV policy after factoring in a decade of depreciation and your deductible. That's a huge shortfall you'd have to cover out of pocket.

Our Recommendation: Always opt for Replacement Cost coverage for your home's structure and your most important personal belongings. The slightly higher premium is a small price to pay for the financial security you need to rebuild your life if the worst should happen.

The High-Net-Worth Family with Valuable Collections

High-net-worth families deal with a more complex risk landscape. Of course, their primary residence needs a top-tier RC policy—probably with guaranteed or extended endorsements—but their collections of fine art, jewelry, or antiques demand a different approach.

Your standard homeowner's policy has built-in sub-limits for these kinds of valuables. The real solution isn't just about choosing between ACV and RC; it's about securing a scheduled personal property floater on an "agreed value" basis. This strategy insures each specific item for a pre-negotiated amount, which completely removes any debate over its worth after a loss occurs.

- Primary Home: Guaranteed Replacement Cost is the only way to go.

- Valuable Collections: An "agreed value" policy is far superior to both standard ACV and RC.

- Secondary Properties: For an older vacation home, a carefully considered ACV policy might be a smart financial move, but only if you have the liquidity to absorb a potential coverage gap.

The Small Business Owner with Critical Equipment

For a small business, this choice can literally mean the difference between reopening after a fire and closing for good. Your equipment is the lifeblood of your operation, and every hour of downtime is lost revenue. When weighing your options, you have to consider major expenses like the average cost for roof replacement on your commercial building.

Imagine a restaurant owner whose specialized ovens are destroyed in a kitchen fire. An ACV policy would pay out the depreciated value of the old equipment, which might be next to nothing. This leaves the owner scrambling to come up with the cash to buy new, code-compliant ovens.

An RC policy, on the other hand, provides the funds to buy brand-new replacements, cutting down on business interruption and getting you back up and running. Saving a few dollars on an ACV premium introduces a massive operational risk—one most small businesses simply can’t afford to take. The ability to replace essential machinery without a huge capital outlay often determines whether a business survives a major loss. For a deeper look at this coverage, check out our guide on https://wexfordis.com/2025/09/11/what-is-replacement-cost-coverage/.

Building A Truly Resilient Insurance Policy

You might think a standard Replacement Cost policy is the best safety net you can get, but it has a crucial blind spot. Imagine a major wildfire or hurricane sweeps through your region. Suddenly, everyone needs the same building materials and the same skilled labor, causing prices to skyrocket. That policy limit you carefully calculated might not be enough anymore.

This is where your policy needs to be more than just standard—it needs to be resilient. Real protection doesn't just cover the expected; it anticipates the unexpected. This is achieved through specific add-ons, called endorsements, that build upon a standard RC policy to create a powerful buffer against worst-case scenarios.

Going Beyond Standard Replacement Cost

To truly protect yourself from post-disaster cost surges, you need to look at endorsements. These aren't typically included in a basic policy, but for homeowners in areas prone to natural disasters, they are absolutely essential. They are the key to making sure you can actually rebuild, no matter what happens to the local economy.

Two of the most powerful options you should know about are:

- Extended Replacement Cost: This adds a specific percentage of extra coverage on top of your dwelling limit—usually between 20% to 50%. So, if your home is insured for $500,000, a 25% extension gives you up to $625,000 to rebuild. That extra $125,000 can be a lifeline when construction costs spike.

- Guaranteed Replacement Cost: This is the gold standard of home protection. It’s a promise to pay the full amount to rebuild your home exactly as it was, even if the final bill exceeds your policy limit. This endorsement essentially removes the ceiling on your structural coverage.

Think of it this way: Extended RC gives you a fixed cushion, which is great. But Guaranteed RC offers an open-ended promise to make you whole. This top-tier coverage is often reserved for high-value properties, but it provides complete peace of mind.

Protecting Your Policy from Inflation

Even without a disaster, a more silent threat can weaken your coverage over time: inflation. The cost to rebuild a home ticks up a little every year. A policy limit that was perfectly fine five years ago could leave you dangerously underinsured today, creating a gap you’d have to pay out-of-pocket.

That's why the Inflation Guard endorsement is so important. It’s a simple feature that automatically increases your coverage limits each year, typically by 2% to 4%. This small, annual adjustment ensures your policy’s value keeps pace with rising construction and labor costs. You can learn more about all the factors involved when you find out how to calculate home replacement cost in our comprehensive guide.

By starting with a solid Replacement Cost foundation and adding these strategic endorsements, you elevate a standard policy into a truly resilient financial shield. You’re no longer just insuring your home for its value today; you’re protecting it against the unpredictable economic shocks of tomorrow. This proactive thinking is what separates basic coverage from a plan that will actually deliver when you need it most.

Making the Right Call with a Trusted Advisor

Deciding between actual cash value and replacement cost isn't just a box you check on a form. It's a critical decision that defines how you'll recover financially after a disaster. Your choice should come down to a hard look at your own situation—your savings, your comfort level with risk, and the kind of property you're insuring.

Think of it this way: choosing an ACV policy is a bet on yourself. You're accepting a lower premium today with the understanding that you'll have to cover the gap out-of-pocket if you ever file a claim. On the other hand, an RC policy is about peace of mind. You pay more upfront for the guarantee that you can get back on your feet without raiding your savings. There's no single "right" answer, but making the wrong choice for you can be a painful and expensive mistake.

Why You Shouldn't Go It Alone

This is exactly where an independent advisor proves their worth. A true expert doesn’t just quote a price; they dig into your financial life to see what makes sense. They help you realistically weigh the modest premium savings of an ACV policy against the thousands of dollars you might have to come up with after a fire or major storm.

Let’s put some real numbers to it. Say a fire ruins your family's 4-year-old couch, which you originally bought for $2,000. An ACV policy, after accounting for depreciation, might only cut you a check for $1,200, leaving you to find the other $800. An RC policy would give you the full $2,000 to buy a new one, minus your deductible.

Across the board, data shows ACV payouts are often 20-40% lower than RC. Furniture, for instance, can depreciate by 40% in just a few years. While upgrading to RC coverage might only add $25-$50 to your annual premium, we consistently see claim data showing ACV policyholders facing shortfalls of $2,500-$4,000 on personal belongings alone. You can see more on this in Experian's breakdown of insurance valuation.

Your insurance policy should be a financial safety net, not a source of unexpected debt. A professional policy review ensures your coverage is aligned with your ability to recover, providing true peace of mind.

An experienced advisor helps you see past the premium and build a strategy that truly protects your assets and lifestyle. They know how to spot the gaps, explain the fine print on endorsements, and find that sweet spot between cost and coverage that works for you. Ultimately, this isn't just about buying a policy—it's about making a smart investment in your financial security. The best first step is always a professional review to make sure the coverage you have is the coverage you actually need.

Frequently Asked Questions About Insurance Valuation

It's one thing to understand the textbook definitions, but it’s another to see how they play out in the real world. When it comes to actual cash value and replacement cost, the questions we hear most often are about the practical application. Let's dig into some of those common scenarios.

Is Replacement Cost Always the Better Option?

Not necessarily. While Replacement Cost (RC) offers the most robust financial safety net for a catastrophic loss, it isn't always the right fit for every person or every piece of property. Sometimes, Actual Cash Value (ACV) is a perfectly sensible, strategic choice, especially if you're trying to keep premiums manageable.

Think about a detached shed on your property or an old vacation cabin that you rarely use. If it were destroyed, would you really rebuild it to its original, brand-new state? Probably not. In a case like this, taking a lower ACV payout in exchange for a lower premium makes a lot of financial sense. The same logic applies to personal belongings that have little value or that you wouldn't bother replacing anyway—an ACV policy keeps you from overpaying for coverage you'll never use.

How Do Insurers Calculate Depreciation?

Depreciation is the key difference between an ACV and an RC payout, but it’s not just a number an adjuster pulls out of thin air. There's a method to it, based on estimating an item's remaining useful life.

Adjusters typically look at a few key factors:

- Original Cost and Age: What you paid for the item and how long you've had it.

- Item Condition: The amount of wear and tear on the property right before the damage occurred.

- Expected Lifespan: Insurers rely on standard industry data for this—for example, a typical asphalt shingle roof has a 25-year lifespan, while a refrigerator might have a 10-year lifespan.

A common formula they use is: Replacement Cost ÷ Expected Lifespan × Age = Total Depreciation.

Can You Mix ACV and RC Coverage in One Policy?

Yes, you absolutely can. In fact, this is a very common and smart way to build a policy that balances premium costs with solid protection where it counts most.

A popular and highly effective strategy is to insure the main dwelling structure with Replacement Cost coverage while opting for Actual Cash Value on personal property. This setup ensures you have the full funding to rebuild your home—your biggest asset—while saving premium dollars on belongings that you might not need to replace with brand-new versions.

This kind of flexibility lets you put your insurance dollars to work where you need them most. To get a better handle on how your belongings are covered, you can learn more about what is personal property insurance from our in-depth guide. An experienced advisor can help you fine-tune this mix-and-match approach to fit your budget and priorities perfectly.

Knowing the details is the first step, but the real value comes from applying that knowledge to your specific situation. At Wexford Insurance Solutions, our experts provide personalized reviews to make sure your policy gives you the protection you actually need, without you paying for what you don't. Get in touch today for a complimentary policy analysis.

What Is a Claims Made Policy and Why It Matters for Your Business

What Is a Claims Made Policy and Why It Matters for Your Business