Ever heard the term subrogation and wondered what it actually means? In the world of insurance, it’s a pretty important concept, but it's simpler than it sounds.

Think of it like this: subrogation is your insurance company’s right to stand in your shoes and go after the person who caused your loss. They get to pursue the at-fault party to recover the money they paid you for your claim.

A Simple Analogy to Make Sense of It All

Let's say your neighbor borrows your brand-new, top-of-the-line lawnmower and accidentally runs over a rock, completely wrecking it. You’re out a lawnmower, and things are now awkward with the neighbor.

But instead of you having to chase them down for the money, another friend steps in and buys you an identical replacement right away. Now, that helpful friend has the right to go to your neighbor and get reimbursed for the cost. That's subrogation in a nutshell.

Your insurance company is that helpful friend. When you file a claim for something covered—a car wreck, a busted pipe from a contractor's mistake—your insurer gets you back on your feet by paying the claim. Then, they turn around and use their right of subrogation to get that money back from the person (or company) that was actually responsible.

This whole process works behind the scenes to do two key things:

- It keeps the responsible party on the hook. The person who caused the damage should be the one to pay for it, not you or your insurer.

- It prevents you from getting paid twice. You can't collect money from your insurance company and then also collect the full amount from the at-fault party.

The very idea of subrogation is tied to how liability works in insurance. For example, knowing whether a state like Colorado is a no-fault state can make a huge difference in how and when subrogation comes into play after a car accident. At its core, the process is designed to maintain fairness and help keep insurance premiums in check for everyone.

By getting money back from the people who actually cause the losses, insurance companies can offset the massive amounts they pay out in claims. These successful recoveries help stabilize rates, which ultimately means your premiums stay lower than they otherwise would be.

To really get a handle on how this works, it helps to understand who's involved. Let's break down the cast of characters in a typical subrogation case.

Key Players in the Subrogation Process

The subrogation process involves a legal hand-off of rights from the policyholder to the insurer. Here’s a quick look at who’s involved and what their role is.

| Party | Role in the Claim | Goal in Subrogation |

|---|---|---|

| The Policyholder (You) | Suffers a loss, reports it, and files a claim with their own insurance company. | Get back to normal as quickly as possible and, hopefully, get their deductible back. |

| Your Insurer | Investigates the claim and pays you according to the terms of your policy. | Recover every dollar they paid out on the claim from the at-fault party's insurer. |

| The At-Fault Third Party | The individual or business whose negligence or actions caused the loss. | Let their own insurance company manage the claim and make the payment. |

Once your insurer pays your claim, they take over the financial recovery process, so you don't have to.

How the Subrogation Process Actually Works

Let's move past the technical jargon and walk through how subrogation plays out in the real world. Imagine a common scenario: a pipe bursts in your upstairs neighbor's condo, and water comes pouring down, ruining your ceiling, floors, and furniture. It's a disaster, but this is exactly what your insurance is for.

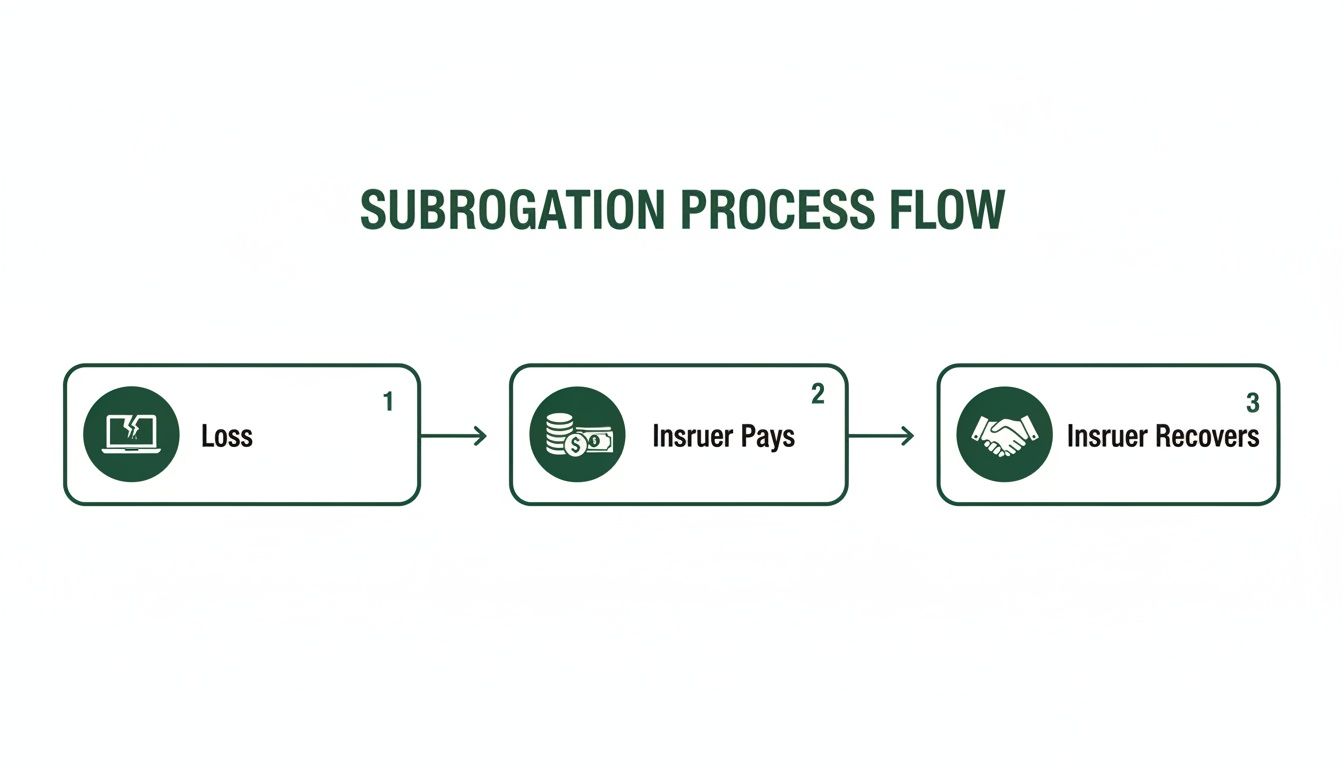

This simple flow shows the core steps your insurer takes to recover the costs.

The process is designed to make you whole first, then shift the final bill to the person who was actually at fault. The whole thing kicks off the moment you discover the damage and call your insurance company. You don't have to wait around for your neighbor to do the right thing; your policy is there to get the ball rolling immediately.

Step 1: You File a Claim

Your first move is to file a claim under your own homeowners or condo policy. You’ll need to document the damage, give your insurer the details, and pay your deductible. The goal here is simple: get the repairs started. Your insurer’s job is to make that happen, fast.

Step 2: Your Insurer Pays for Your Damages

Once your claim is approved, your insurance company cuts a check to cover the repairs and replace your damaged property, minus the deductible. This is the promise of your policy in action. It allows you to restore your home without having to personally chase down your neighbor or their insurance carrier for the money.

The subrogation process is a key part of how insurance companies manage recoveries, especially in complex situations involving handling commercial claims and coverage disputes. It allows them to systematically pursue reimbursement after they have already taken care of their policyholder.

Step 3: The Subrogation Phase Begins

Now, the behind-the-scenes work starts. With your immediate needs met, your insurer essentially "steps into your shoes." They take all the evidence—the plumber’s report, photos, repair invoices—and build a case showing your neighbor was responsible for the leak.

Their subrogation team then contacts your neighbor's insurance company directly and demands reimbursement for the money they paid out on your claim. This is the heart of subrogation. All the negotiation and legal wrangling are handled by them, saving you the stress.

Step 4: Recovery and Your Deductible Refund

If your insurer successfully recovers the full payment from the other party, they also get your deductible back. That money is then refunded directly to you. A successful subrogation means you end up paying nothing for a loss that wasn't your fault. You're made financially whole again.

How Subrogation Affects Your Premiums and Deductible

Subrogation might sound like just another piece of insurance jargon, but it has a real, direct impact on your wallet. When your insurance company successfully gets money back from the person who caused your loss, it’s not just a win for their bottom line. It’s a victory for all policyholders that helps keep insurance costs in check.

The scale of these recovery efforts is staggering. In 2021 alone, insurers clawed back an incredible $51.6 billion across auto-related claims. To put that in perspective, for every five dollars paid out for physical car damage, one dollar was recovered through subrogation. That’s a massive amount of money that directly offsets the billions paid out in claims.

Think of it this way: instead of spreading the cost of every claim across all policyholders by raising rates, insurers use subrogation to go after the responsible party. It’s a fundamental mechanism that keeps the system fair by making sure the person at fault foots the bill.

Getting Your Deductible Back

While stable premiums are a great long-term benefit, the most immediate reward for you is getting your deductible back. When you file a claim, you almost always have to pay your deductible first, even if the incident clearly wasn't your fault.

Let's say a distracted driver plows into your parked car, causing $5,000 in damage. To get the repairs started right away, you'll pay your $500 or $1,000 deductible to the auto body shop, and your insurer handles the rest.

A successful subrogation claim means your insurer recovers the money it paid for the repairs and the deductible you paid out of pocket. That deductible payment is then refunded directly to you.

This refund is what it means to be "made whole" after a loss. Without subrogation, you'd be out hundreds or even thousands of dollars for an accident you had nothing to do with. This process ensures the financial burden lands where it belongs—on the negligent party, not on you. Our guide on what a deductible in insurance is explains more about how that initial payment works.

The Bigger Picture: Keeping Costs Down for Everyone

The ripple effect of subrogation on the entire insurance market is huge. By holding at-fault parties financially accountable, insurers lower their total claim expenses. Those savings are then passed on to everyone in the form of more competitive premiums.

Here’s how it works:

- Lower Loss Ratios: Successful subrogation improves an insurer's loss ratio (the amount paid in claims versus the amount earned in premiums). A healthy loss ratio is a sign of a stable company, which leads to more stable rates for customers.

- Encourages Responsibility: Knowing that an insurance company has a legal team ready to pursue a claim can be a powerful motivator for people and businesses to act more carefully.

- Fairer Pricing: Subrogation helps ensure your premium is a reflection of your risk, not inflated to cover the cost of accidents caused by others.

At the end of the day, subrogation is a critical, behind-the-scenes process that protects your finances and promotes stability across the entire insurance system.

Real-World Subrogation Examples You Might Encounter

Definitions are one thing, but to really get a feel for subrogation, you need to see it in action. It’s a concept that clicks into place when you can imagine it happening to your own home or business. These real-world situations show how your insurer steps into your shoes to handle the financial recovery, saving you the headache of chasing down the at-fault party yourself.

Let's walk through three common scenarios where subrogation plays a starring role in the claims process.

Homeowners Insurance: A Faulty Appliance Installation

Picture this: you've just wrapped up a beautiful kitchen renovation, complete with a brand-new, high-end dishwasher installed by a professional. A week later, you walk in to find your hardwood floors are a buckled, warped mess. A shoddy connection on that new dishwasher caused a slow leak, leading to thousands of dollars in water damage.

Instead of getting into a drawn-out battle with the contractor, you file a claim with your homeowners insurance. They move quickly, covering the cost to repair the floors, less your deductible. Once you've been made whole, their subrogation unit takes the wheel. They go after the contractor’s general liability insurance, armed with evidence that the installer's mistake was the direct cause of the damage.

In a case like this, subrogation makes sure the financial buck stops where it should—with the contractor's business. If your insurer successfully recovers the full cost of the claim, they’ll also refund your deductible.

Commercial Auto Insurance: A Rear-End Collision

Now, let's shift to a business setting. One of your delivery drivers is sitting at a red light when another car, driven by someone who was clearly distracted, slams into them from behind. The collision puts your company van out of commission, causing significant damage and disrupting your daily operations.

Your commercial auto policy pays for the repairs right away, getting your vehicle back in service as soon as possible. But the story doesn't end there. Your insurer’s subrogation team immediately starts the recovery process, pursuing a claim against the at-fault driver's insurance. They manage all the back-and-forth, demanding full reimbursement for what they paid out.

For any business with a fleet of vehicles, this is absolutely critical. Successful recoveries, especially when dealing with different types of general liability claims examples, help keep your risk costs down and prevent your commercial premiums from spiking.

Workers' Compensation: An Injury on a Client Site

Finally, let’s look at how this works with workers' comp. An employee is on the job at a client’s facility when they slip on an unmarked hazard and get seriously injured. The property was just plain unsafe.

Your workers' compensation policy kicks in immediately, covering your employee’s medical bills and lost wages, just as it’s designed to. The key here, though, is that the injury was caused by the property owner's negligence, not yours.

This is a classic subrogation scenario:

- First, your workers' comp carrier pays all the required benefits to your injured employee.

- Next, the insurer turns around and subrogates against the property owner's general liability policy.

- Their goal is to recover every dollar they paid out for medical care and wages.

This isn’t just about the insurance company getting its money back. It’s essential for your business. A successful recovery helps keep your loss history clean, which is a huge factor in what you pay for workers' comp premiums down the road. By shifting the final cost to the truly responsible party, subrogation shields your company's bottom line.

What Is a Waiver of Subrogation

While subrogation is a powerful tool for insurance companies, sometimes it makes sense to willingly give up that right. This is accomplished through a waiver of subrogation—a specific clause in a contract where one party agrees to prevent their own insurance company from suing another party for damages.

Think of it as a pre-arranged peace treaty. In a big construction project, for example, a general contractor will almost always require every subcontractor on the job to have one. It’s a smart way to stop a single accident from spiraling into a tangled mess of lawsuits between multiple insurers.

Why Would You Waive This Right?

Giving up a right might sound strange at first. Why would you stop your insurer from getting money back, especially when it wasn't your fault? The answer comes down to risk management and protecting business relationships.

Without a waiver, a simple mistake could ignite a massive legal firefight. Imagine a plumber accidentally starts a small fire while soldering a pipe. The property owner's insurance pays to fix the damage, then immediately turns around and sues the plumber to get that money back. A waiver of subrogation stops that lawsuit before it can even start, preserving the working relationship and keeping the project moving forward.

A waiver of subrogation is essentially an agreement to let insurance policies do their job without the parties suing each other afterward. It simplifies claims by placing the ultimate responsibility for a loss on one party's insurer as agreed upon in the contract.

Where You’ll See Waivers in Action

Waivers aren’t just for construction sites. You'll find them in all sorts of business agreements where multiple parties are working together and want to keep things running smoothly.

Here are a few common places they pop up:

- Commercial Leases: Landlords often require tenants to have a waiver. This way, if a tenant's employee accidentally causes a fire, the landlord's insurer can't sue the tenant for the repair costs.

- Service Agreements: When a company hires a vendor for a major project, a waiver prevents a costly legal battle if something goes wrong.

- Construction Contracts: This is the classic example. It ensures that if one subcontractor’s mistake causes a major loss, their insurance company can't go after the general contractor or any of the other subs on the project.

It's crucial to understand what this clause means before you sign anything. Our detailed guide on what a waiver of subrogation is dives much deeper into how this works in the real world. Agreeing to a waiver without the right endorsement from your insurer can leave you exposed, so always run these contractual requirements by your agent first.

Your Rights and Responsibilities as a Policyholder

When you're dealing with a claim, the subrogation process can feel a bit out of your hands. But knowing your role—and your rights—can make a world of difference. It’s one thing to know the definition of subrogation, but it’s another to understand how you and your insurer can work together to get the best possible outcome.

This partnership is all about balance, and it’s designed to protect your financial interests while keeping things running smoothly.

After a loss, your insurance policy spells out a few key responsibilities you need to handle. Think of these not as chores, but as your contractual part of the deal that enables your insurer to go to bat for you.

Your Key Responsibilities

Your cooperation is the key that unlocks your insurer’s ability to recover the money they paid out. Without it, their efforts to pursue the at-fault party can stall out completely. You are the star witness in your own case.

Here’s what you need to do:

- Report the Incident Promptly: The sooner you let your insurer know what happened, the better. Time is of the essence, and delays can mean lost evidence and a weaker case.

- Provide Honest Information: Give your adjuster the full, unvarnished truth. Every detail matters, and accuracy is the foundation they’ll build their recovery case on.

- Cooperate Fully: This just means being available. Answer your adjuster’s questions, send over any documents they need, and generally help them with their investigation.

At its core, your main job is to avoid doing anything that could hurt your insurer's chances of getting the money back. This "duty to cooperate" is a standard part of almost every policy. Taking some time to learn how to read an insurance policy can help you spot these clauses ahead of time.

Understanding Your Rights

While you have responsibilities, you also have rights that protect you. Remember, your insurer is acting on your behalf, so you deserve to know what's going on and to share in any successful recovery.

Your most important right is the right to be "made whole." This legal principle means you must be fully compensated for all your losses—including getting your deductible back—before the insurance company can pocket the money it recovered.

This "made whole" doctrine gives you the right to:

- Be Kept in the Loop: Your insurer should give you periodic updates on how the subrogation effort is progressing.

- Get Your Deductible Back: If the recovery is successful, you are first in line to be reimbursed for the deductible you paid.

- Understand the Outcome: You're entitled to a clear breakdown showing how the recovered money was split between your deductible and the insurer's payout.

Common Questions About the Subrogation Process

Even after you grasp the basics, subrogation can still feel a little fuzzy around the edges. Let’s walk through some of the questions we hear most often from clients so you can feel more confident about the process.

Can I Sue the At-Fault Party Myself?

This one comes up a lot. Generally, the answer is no. Once you’ve accepted a claim payment from your insurance company, they effectively buy the right to go after the responsible person.

Think of it this way: it prevents a legal free-for-all where both you and your insurer are trying to get money from the same person for the same damage. Your insurer took on the financial hit, so they get to lead the charge to get it back.

Do I Still Have to Pay My Deductible?

Yes, you almost always need to pay your deductible to get the claim moving, even if you were 100% not at fault. Your deductible is simply your portion of the repair bill that you agree to pay upfront.

The whole point of subrogation is for your insurer to chase down the at-fault party to recover everything they paid out—plus your deductible.

A successful subrogation is what truly makes you whole again. It’s the mechanism that gets your out-of-pocket deductible back into your bank account.

What Happens If My Insurer Only Gets Some of the Money Back?

It’s not always an all-or-nothing situation. Sometimes, the at-fault party doesn't have enough insurance, or maybe both parties share some of the blame. In these cases, your insurer might only recover a portion of the total cost.

If that happens, you’ll typically get a proportional refund of your deductible. For example, if your insurer recovers 50% of the claim, you should expect to get 50% of your deductible back. Knowing this is crucial if you ever need to understand how to dispute an insurance claim and its outcome.

How Long Does This Whole Process Take?

There's no single answer here—it really depends. A simple, clear-cut car accident where fault is obvious might wrap up in a few months.

But if you’re dealing with a complex claim, like a major property loss with multiple parties involved, it could easily take a year or more. Patience is key.

Insurance claims can feel like a maze, especially with concepts like subrogation in the mix. But you don’t have to navigate it alone. The claims advocacy team at Wexford Insurance Solutions is here to be your guide, making sure your rights are protected and you get the best possible result.

Navigate Your roof damage insurance claim wind: Guide to a Fair Settlement

Navigate Your roof damage insurance claim wind: Guide to a Fair Settlement